Entering your 20s in 2025 brings exciting opportunities, and plenty of financial questions. If you’re searching for the best financial planning tips for young adults, you’re already on the right track.

Whether you’re moving out for the first time, starting a new job, or juggling student loans, having a smart money plan will set you up for success and peace of mind.

Pdiam’s expert guidance draws from years of experience helping young adults navigate this journey. In this guide, you’ll find practical tips to manage budgeting, saving, investing, credit, and more, all designed to fit your busy, changing life. Let’s take a clear, easy-to-follow path toward financial confidence and independence.

1. What is financial planning for young adults?

Before diving into actionable financial planning tips for young adults, it’s important to know what financial planning really means and why it matters so much in your 20s.

Let’s talk about the basic first.

1.1. Understanding the basics

Financial planning means organizing your money so you can meet both your current needs and future goals. For young adults, it focuses on earning income, controlling spending, making budgets, saving regularly, investing early, and building good credit.

- Earning: Knowing your income sources.

- Spending: Tracking where money goes.

- Budgeting: Planning how to use money wisely.

- Saving: Setting money aside for emergencies and goals.

- Investing: Growing money for future needs.

- Credit building: Establishing and maintaining a good credit history.

Real Example:

Think of two friends, one who plans and budgets, the other who does not. The planner builds an emergency fund and invests even small amounts, making their money work for them. The other struggles with debt and missed opportunities. Starting early helps your financial foundation grow stronger through every stage of life.

2. Assessing your current financial situation

Before you can plan for the future, it’s important to understand exactly where you stand financially right now. Taking an honest look at your income, expenses, and assets lays the groundwork for smarter budgeting and successful saving. Let’s walk through the key steps to assess your finances and set yourself up for progress.

2.1. How to evaluate where you stand right now

Know where you are before planning where you want to go. Follow these steps to assess your finances:

- List all income: Include wages, part-time jobs, family support, or freelance work.

- Identify expenses: Separate fixed costs (rent, subscriptions) and variable costs (groceries, entertainment).

- Calculate net worth: Add up your assets (savings, valuables) and subtract liabilities (debts, loans).

Example budget snapshot:

| Income | Amount | Expense | Amount |

|---|---|---|---|

| Salary | $2,000 | Rent | $700 |

| Freelance | $300 | Food | $300 |

| Family Support | $200 | Transportation | $100 |

Calculating net worth: If assets total $5,000 and debts are $2,000, your net worth is $3,000. Honest evaluation like this lays the foundation for better budgeting and saving.

3. Financial planning tips for young adults

To help you take control of your money and build a secure future, here are the most effective financial planning tips for young adults in 2025.

Apply them step by step, your confidence and financial health will grow with each new habit you master.

3.1. Smart budgeting and saving

Setting up a simple, realistic budget is the first key step. Plan your monthly income and expenses, and use tools or even a notebook to stay on track. Set clear short-term and long-term goals, save for a trip or a home while thinking ahead to retirement.

-

Build an emergency fund: Aim for at least three months’ worth of expenses saved, starting with a small target if needed.

-

Track every expense for a month: Know exactly where your money goes to spot areas for easy cuts.

-

Automate your savings: Set up automatic transfers so saving happens without effort.

-

Open the right bank and savings accounts: Choose accounts with no fees and good interest rates.

Pro Tip:

Use technology to your advantage, set up recurring transfers and try apps that round up spare change to save painlessly.

Sticking to your budget, even when it’s hard, sets the tone for the rest of your financial journey.

3.2. Investing and using tech

Investing early, even small amounts, can yield big rewards over time thanks to compound growth. Get comfortable with basic investing concepts and don’t be afraid to start small.

-

Start investing: Use beginner-friendly platforms with low fees, like robo-advisors or ETFs.

-

Learn the 50/30/20 rule: Allocate 50% of income to needs, 30% to wants, and 20% to savings or debt payments.

-

Use the best budgeting & investing apps: Try Mint, Acorns, or other highly rated tools to track spending and investing automatically.

Embracing technology makes it easier to stay consistent, monitor your progress, and reach your goals faster.

3.3. Managing credit and debt

Building good credit opens doors to better rates on loans, apartments, and even some jobs. Avoid high-interest debt and always pay bills on time.

-

Understand and monitor your credit score: Check regularly using free tools, and spot errors or fraud early.

-

Pay bills on time, always! Late fees and dings on your credit report can hurt you for years.

-

Avoid high-interest debt: Steer clear of payday loans and high-rate credit cards.

-

Never ignore student loans: Know your repayment options and don’t delay communication with lenders.

Handling credit and debt proactively keeps your options open and reduces long-term stress.

3.4. Spending wisely and avoiding lifestyle creep

Living below your means and being intentional with spending gives you more options in the future.

-

Limit lifestyle creep: As your income grows, resist the urge to spend more; increase savings instead.

-

Cook more, eat out less: Save money and build a healthier routine.

-

Use student benefits/discounts: Always check for available savings on products and services.

-

Shop with a list and compare prices: Avoid impulse purchases and make smarter spending decisions.

Making wise spending decisions early on helps you reach your financial goals faster.

3.5. Making the most of benefits and resources

Take full advantage of what’s available to you at work, in your community, and online.

-

Employer benefits: Use 401(k), HSA, or other workplace plans to boost long-term savings.

-

Regular financial check-ins: Set a monthly or quarterly appointment with yourself to review goals and budgets.

-

Free financial courses/workshops: Continue learning to improve your decision-making.

-

Protect yourself from scams: Monitor your accounts and be cautious online.

Taking initiative with available resources gives you a major advantage over those who go it alone.

3.6. Mindset, motivation, and seeking help

Your attitude toward money is just as important as your actions. Stay positive, build good habits, and reach out for help when you need it.

-

Set up financial goals with friends: Accountability makes it easier to stick with good habits.

-

Celebrate progress: Reward yourself for hitting milestones, no matter how small.

-

Ask for help when needed: Seek trusted advice from mentors, family, or professionals if you feel stuck.

By maintaining a positive mindset and reaching out for help, you’ll find it easier to stick with your goals, and enjoy the journey along the way.

View more:

- Social media for small business marketing

- How much does the average american make in their lifetime

- Which country markets are highest growing market in the world

4. Building a strong financial foundation: Key pillars explained

A solid foundation sets you up for financial success at every stage of life. Each pillar below represents a core skill every young adult should master.

4.1. Budgeting: How to stay in control

Budgeting means balancing your income and expenses so your money lasts until next payday. Avoid mistakes like forgetting variable costs or setting unrealistic expectations.

Real Example:

Lisa tracked her spending weekly, adjusted categories, and avoided wishful budgeting, helping her build savings and avoid debt.

Mastering budgeting early makes it much easier to achieve your financial goals and avoid unnecessary stress.

4.2. Saving: Making compound interest work for you

Saving is more powerful the earlier you start, thanks to compound interest. Even modest, regular contributions can add up quickly over time, especially when left untouched to grow.

-

Setting aside $100 a month in your early 20s can result in a substantial savings cushion by your 30s.

-

Keep your savings separate from spending accounts to avoid temptation.

The discipline to save regularly, even small amounts, will serve you well for decades to come.

4.3. Credit: Build it, protect it

Building good credit opens doors to better loan rates, apartment rentals, and even some jobs. Establish responsible credit habits as early as possible:

-

Always pay bills on time, even if it’s just the minimum due.

-

Keep credit card balances low and monitor your credit score regularly.

-

Avoid maxing out cards or missing payments, as these can lower your score for years.

Good credit is an asset that pays off in many areas of life, so start protecting it now.

4.4. Debt: Smart strategies for management and avoidance

Not all debt is bad, but unmanaged debt can quickly become a burden. Focus on paying off high-interest debts first, and consider using the snowball method to tackle smaller balances for a motivational boost.

-

Make more than the minimum payment whenever possible.

-

Avoid taking on new high-interest debt and always read the fine print before borrowing.

Smart debt management helps you stay financially flexible and avoid unnecessary stress.

4.5. Investing: How to start early, step by step

Investing grows wealth over the long haul. Beginners should focus on low-cost index funds or ETFs and build a portfolio gradually.

Real Example:

Emma started investing $50 a month at 23 and saw her portfolio grow slowly but steadily.

The sooner you start investing, even in small amounts, the more you’ll benefit from compound growth and market experience.

5. Mastering your money mindset and forming habits

Building strong financial habits starts with the right mindset. The way you think about money, your beliefs, attitudes, and emotions, can either support or sabotage your goals. In your 20s, you’ll face peer pressure, social media FOMO, and the temptation to spend for instant gratification.

Fortunately, with a few mindful practices, you can set yourself up for lifelong financial well-being.

-

Recognize emotional triggers that lead to impulsive spending:

Pay attention to what situations, feelings, or social influences make you want to spend without thinking. When you spot these triggers, pause and ask yourself if the purchase is really necessary. Over time, this awareness can help you break costly habits. -

Practice habit stacking by linking financial tasks to daily routines:

Combine new money habits with activities you already do, like checking your savings balance when you make your morning coffee, or scheduling a weekly budget review before Sunday brunch. This makes it easier to stay consistent and integrate smart habits seamlessly into your life. -

Celebrate small wins to build confidence and motivation:

Progress might feel slow at first, but every positive step counts. Mark milestones such as saving your first $500, paying off a credit card, or sticking to your budget for a month. Reward yourself (within reason) to reinforce good behavior and stay motivated.

By focusing on your mindset and celebrating progress, you’ll create a positive feedback loop that keeps you moving forward, even when challenges arise. The habits you form now will build a foundation for financial success that lasts a lifetime.

Like what you read? Take a look at our related article. How to build an emergency fund in 2025: The complete step-by-step guide

6. Navigating major life transitions

Major milestones like moving out, landing your first job, or graduating from college can bring excitement, and plenty of new financial questions. Planning ahead and understanding what to expect will help you avoid common pitfalls and reduce money-related stress as your life changes.

6.1. Moving out, first job, or graduation

Taking the step into independence or starting your career often comes with brand new expenses and budgeting challenges. Here are key actions to help you start strong:

-

Set up a realistic budget:

Account for all essentials, including rent, utilities, groceries, and internet. Don’t forget to factor in security deposits and upfront costs when moving out for the first time. -

Understand your paycheck deductions and benefits:

Review your paystub to understand taxes, health insurance, retirement contributions, and other deductions. Knowing your take-home pay helps you budget accurately. -

Plan for new expenses:

Budget for transportation (public transit or car expenses), work clothing, and other job-related needs. Adjust your spending categories as your circumstances change.

By establishing these habits early, you’ll make the transition smoother and set the foundation for smart money management as your responsibilities grow.

6.2. Basic insurance you need

Insurance is an important tool for protecting yourself against unexpected financial shocks. Make sure you have coverage that fits your current situation:

-

Health insurance:

Protect yourself from costly medical bills by exploring your options through employers, parents, or government plans. Make sure your coverage matches your needs. -

Renters insurance:

Even if you’re just starting out, renters insurance can safeguard your belongings against theft, fire, or other losses, often for just a few dollars a month. -

Auto insurance:

If you drive, make sure you meet your state’s insurance requirements and shop around for the best rates.

Having the right insurance means you’ll be better prepared for whatever life throws your way, giving you peace of mind as you take on new adventures.

6.3. Understanding taxes and filing tips

Taxes can seem intimidating at first, but a little preparation goes a long way. Follow these tips to keep your filings stress-free and avoid common mistakes:

-

Track income and deductible expenses:

Throughout the year, keep organized records of all income and any deductible expenses, especially if you freelance or have side gigs. -

Use tax software or community resources:

Filing for the first time? Many communities offer free tax help for young adults. Tax software can also walk you through the process step by step. -

File on time:

Avoid late fees and stress by marking tax deadlines on your calendar and submitting your return before the due date.

With good habits and a bit of research, you’ll gain confidence in handling your taxes and can maximize potential refunds or credits.

6.4. When to get professional help

Sometimes, your financial situation can get complex or overwhelming. Don’t hesitate to reach out for support when you need expert advice or a second opinion:

-

If overwhelmed by debt or taxes:

Don’t wait until things spiral, seek support from certified credit counselors, nonprofit organizations, or tax professionals. -

For big investment or insurance decisions:

When your finances become more complex, getting guidance from a qualified advisor can help you make confident, informed choices.

Knowing when to ask for professional help is a sign of wisdom, not weakness, and can save you money, time, and stress down the road.

7. Trusted tools, apps, and resources for young adults

Choosing the right digital resources can simplify your financial journey and help you implement financial planning tips for young adults effectively. These trusted apps and platforms make managing money, building credit, and learning new skills much easier:

| Tool | Benefit | Cost |

|---|---|---|

| Mint | Budget tracking and bill reminders | Free |

| Acorns | Automatic micro-investing | Low monthly fee |

| Credit Karma | Free credit score monitoring | Free |

| Khan Academy Finance Courses | Free, beginner-friendly lessons | Free |

Pro Tip:

Be cautious of apps that promise quick riches or charge hidden fees. Always read reviews, check for security features, and verify legitimacy before linking your accounts or sharing personal information.

With the right tools and a little research, you’ll have everything you need to manage your money with confidence.

8. Common mistakes young adults make, and how to avoid them

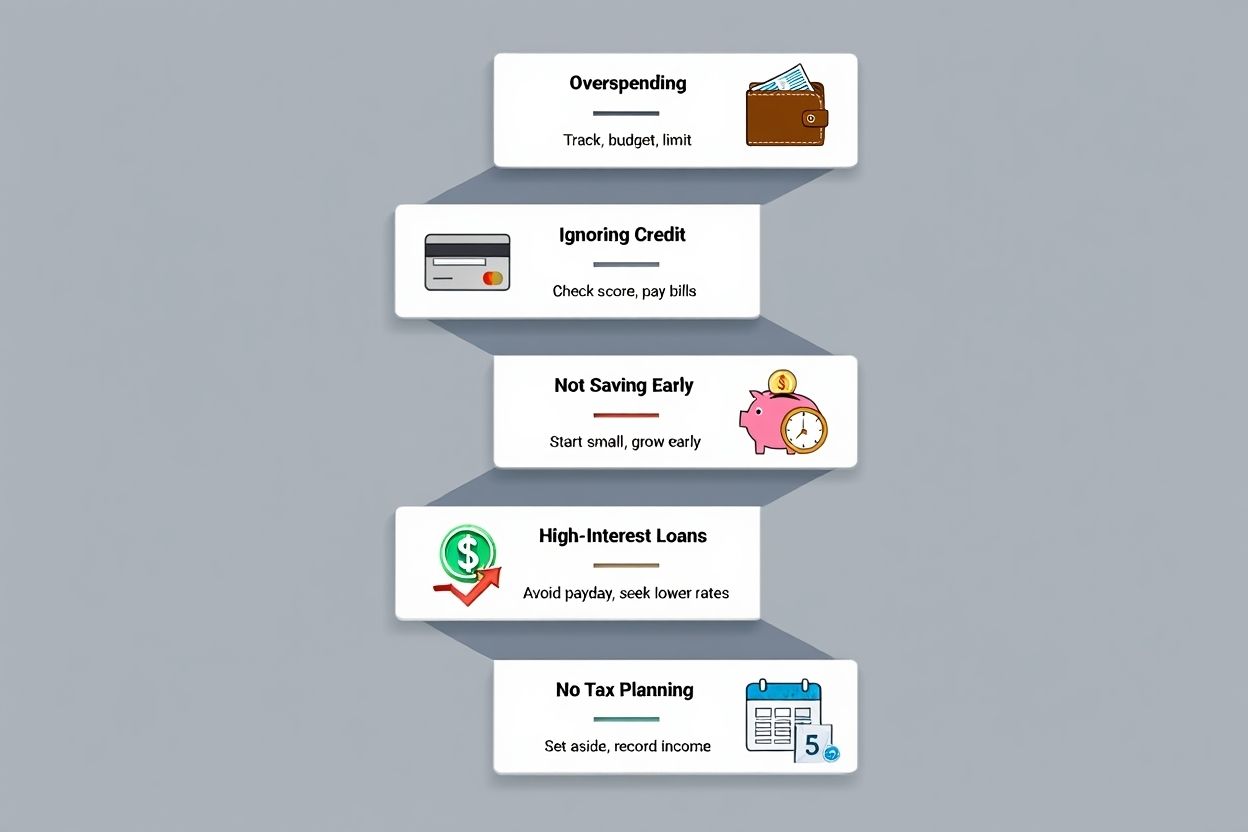

Everyone makes financial mistakes at some point, but recognizing the most common pitfalls early can help you build stronger money habits and avoid setbacks. Here are key errors young adults often face, and the best ways to avoid them:

-

Overspending:

It’s easy to lose track of expenses, especially with digital payments and impulse buys. Creating and sticking to a realistic budget helps you understand your limits and make better spending choices. Consider tracking every purchase for a month to see where your money really goes. -

Ignoring credit:

Building a good credit history is vital for future loans, renting apartments, and even some jobs. Check your credit score regularly, pay bills on time, and use credit cards responsibly, never borrow more than you can afford to pay back each month. -

Not saving early:

Many young adults delay saving, thinking small amounts won’t matter. But even modest, regular contributions to a savings or investment account grow significantly over time, thanks to compound interest. The earlier you start, the more you’ll benefit in the future. -

Using high-interest loans:

Payday loans, cash advances, or high-interest credit cards can quickly lead to overwhelming debt. Always explore safer borrowing options first, such as credit unions or low-rate personal loans, and build an emergency fund to reduce reliance on credit. -

Not planning for taxes:

Failing to plan for taxes can result in unpleasant surprises at tax time. Understand your withholdings, keep accurate records of income and expenses, and set aside money for taxes if you have freelance or side income.

By proactively addressing these common mistakes, you’ll build confidence and momentum as you master your finances and work toward your long-term goals.

9. Real stories and actionable case studies

Learning from real experiences can make financial planning tips for young adults feel more achievable and relatable. Here are inspiring stories from peers who took practical steps and saw positive changes in their financial lives:

Anna, 24:

After struggling with impulse spending, Anna began tracking every dollar she spent using a simple spreadsheet.

Within a year, she had saved enough to buy a used car without taking out a loan. Anna shares, I wish I learned budgeting sooner, it’s like gaining control over stress. Her story shows that small changes and consistency can lead to major rewards.

Mark, 26:

Mark faced $5,000 in credit card debt after college. By setting up automatic payments and preparing more meals at home, he gradually reduced his balance and avoided late fees.

Automating payments saved me from late fees, Mark notes, emphasizing how even busy professionals can stay on top of their bills with a bit of planning.

Sara, 23:

With no investing experience, Sara started by contributing $50 a month to a beginner-friendly investing app. As she learned about index funds and tracked her progress, she watched her portfolio grow, however slowly.

Seeing my investments grow slowly motivates me to keep going, she shares. Sara’s approach highlights the power of starting small and being consistent.

These case studies prove that with the right habits and a willingness to learn, anyone can take charge of their finances, no matter where they start.

10. Frequently asked questions about financial planning tips for young adults

Financial planning in your 20s can feel overwhelming, but the answers to these common questions will help you feel more confident as you build healthy money habits and a secure future.

Q1: Should I prioritize saving or paying down debt first?

A: Most experts recommend starting with a small emergency fund, $500 to $1,000, to handle unexpected expenses. After that, focus on paying down high-interest debt such as credit cards or payday loans. This approach keeps you safe from emergencies while reducing expensive interest costs.

Q2: How much should I have in my emergency fund?

A: Aim to save at least three to six months’ worth of essential living expenses. If that feels overwhelming, start with a smaller goal and build up gradually as your income grows or your situation changes. Your emergency fund will help protect you from job loss, unexpected bills, or other surprises.

Q3: Is it too early to start investing, and how do I begin?

A: It’s never too early! The sooner you start, the more you benefit from compound growth. Begin with small amounts using low-cost index funds, ETFs, or robo-advisors. Even $25 or $50 a month can make a difference over time.

Q4: What’s the first step if I have zero credit history?

A: Consider applying for a secured credit card or becoming an authorized user on a family member’s credit card. Make small, regular purchases and pay the balance off each month. This builds your credit history and helps you qualify for better rates in the future.

Q5: How do I talk to family or friends about finances?

A: Choose people you trust and approach the conversation honestly and positively. Share your goals and ask for advice or accountability, rather than just focusing on problems. Talking openly about money can help you stay motivated and learn new strategies.

11. Conclusion

Applying these financial planning tips for young adults is one of the smartest investments you can make in your 20s. By starting early, building good habits, and leveraging expert tools, you’ll gain the confidence and financial security needed to handle any challenge or opportunity that comes your way.

Key takeaways:

-

Build a realistic budget, track your expenses, and save consistently.

-

Start investing, even with small amounts, and focus on building credit responsibly.

-

Avoid high-interest debt, use technology to automate your finances, and seek out free resources.

-

Adjust your plan as your life changes and don’t hesitate to ask for advice.

Remember, consistent small steps today lead to significant gains tomorrow. Your financial journey is unique, but with the right strategies and support, your goals are within reach.

For more expert guidance and practical resources, visit the Finance section at Pdiam, your trusted partner in mastering money and building wealth.

Start your financial planning journey now, your future self will thank you!