How to build an emergency fund in 2025? Financial stability feels more uncertain than ever. Inflation pressures, shifting job markets, and unforeseen global events have highlighted the importance of having a financial safety net.

An emergency fund is money set aside to cover unexpected costs, such as sudden medical bills or job loss, helping you avoid debt and stress.

Having this fund offers peace of mind and greater control over your financial future. It protects you from disruptions and helps you make sound decisions under pressure.

This comprehensive guide covers all you need to know about how to build an emergency fund, from practical steps to motivation and common mistakes to avoid. Our aim is to give you clear, up-to-date strategies so you can take control of your future with confidence.

1. What is an emergency fund and why do you need one?

Before learning how to build an emergency fund, it’s essential to understand what it is and why it matters. An emergency fund is a separate stash of money set aside specifically for urgent, unexpected expenses. Its purpose is to provide quick, reliable access to cash during a crisis, without risking losses or going into debt.

Common emergencies that call for this fund include:

- Unexpected medical bills

- Loss of income or job

- Major car repairs

- Home repairs, like a broken furnace

- Urgent travel for family emergencies

These events are often costly and time-sensitive, making it crucial that the fund is easy to access but separate from everyday spending money. For example, if you suddenly lose your job, an emergency fund can cover your rent and groceries while you look for new work, no loans needed.

Real Example:

After a layoff in 2024, Anna from Texas relied on her emergency fund to cover six months of essentials while she found a new job. This safety net helped her avoid credit card debt and stay focused on her job search.

2. How much should you save for an emergency fund?

The next question in how to build an emergency fund is: How much is enough? Most financial experts recommend saving enough to cover three to six months of your essential living expenses. This range gives you a solid cushion for most emergencies.

If you’re just starting out, aim for a smaller starter goal between $500 and $1,000. This helps you handle smaller surprises while building momentum. The right amount depends on your lifestyle, stable jobs may need less, while freelancers or families need more.

2.1. Estimating your emergency fund target

Before you start saving, it’s important to know exactly how much you need in your emergency fund. Begin by calculating your essential monthly expenses. This figure forms the foundation of your savings goal and ensures you’re realistically prepared for unexpected events.

| Category | Monthly Amount |

|---|---|

| Housing (rent/mortgage) | $ |

| Utilities & bills | $ |

| Food & groceries | $ |

| Transportation | $ |

| Health insurance & medical | $ |

| Other essentials | $ |

| Total monthly essentials | $ |

Once you have your total, multiply it by 3 or 6 to set your personal emergency fund target. This approach gives you a clear, actionable goal that matches your unique financial needs and lifestyle. As your expenses change, revisit this calculation to keep your emergency fund up to date.

3. How to build an emergency fund: Step-by-step in 2025

Learning how to build an emergency fund is about taking small, steady steps.

Here’s a roadmap tailored for today’s economic realities.

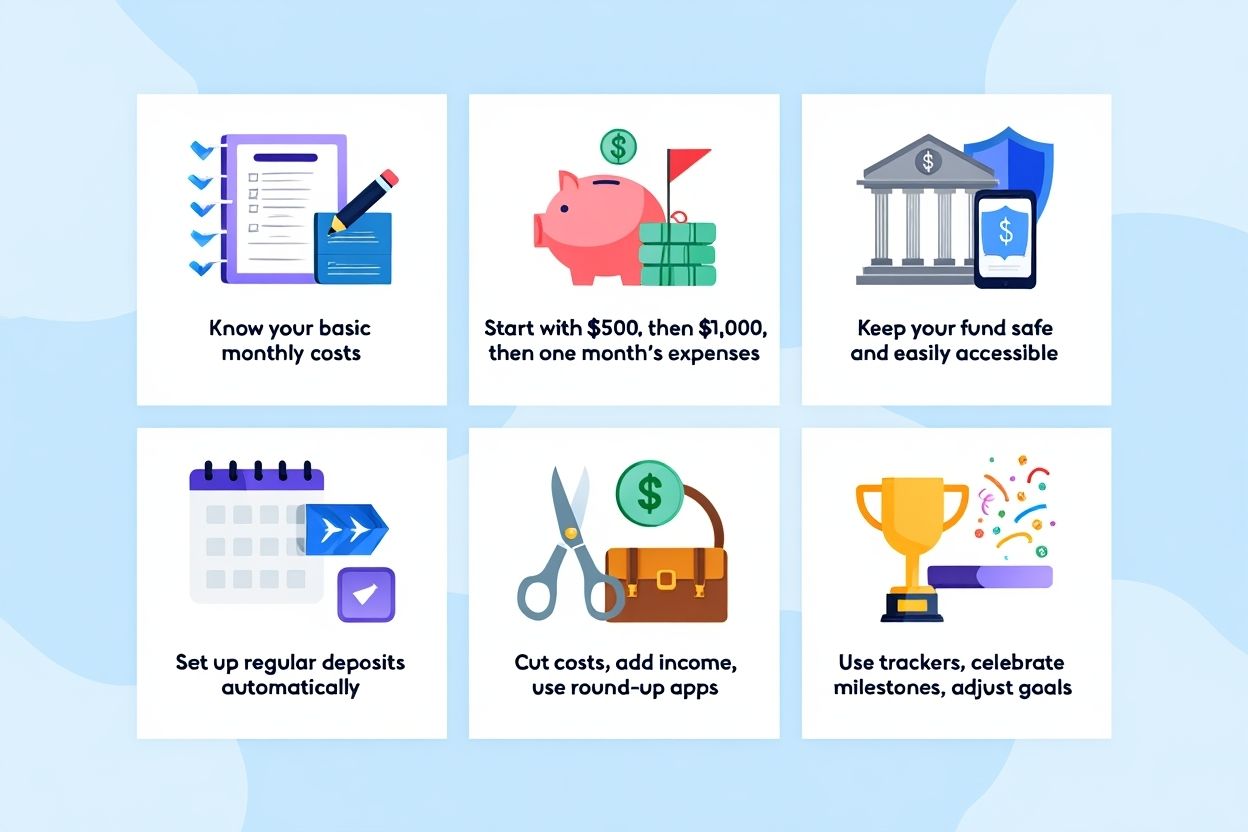

3.1. Assess your monthly essentials

Start by listing your fixed and variable monthly expenses. This gives a clear picture of how much you need to cover basic living costs.

- Include rent or mortgage, utilities, groceries, transportation, and insurance.

- Consider using a budget worksheet to organize these numbers.

After that move on to the next one

3.2. Set a realistic initial goal

Begin with a manageable goal, saving your first $500 is a milestone. Then increase gradually: $1,000, then enough for one month’s expenses, and so on.

- Focus on steady progress, not perfection.

- Celebrate small wins to stay motivated.

Don’t let a big savings target discourage you from getting started. Begin with a manageable, short-term milestone.

3.3. Open a Dedicated & Easily Accessible Savings Account

Keep your emergency fund separate from regular spending accounts to avoid accidental use.

- Choose a high-yield savings account or a credit union account with good interest rates.

- Ensure the account is FDIC or NCUA insured.

- Opt for easy online access without penalties for withdrawal.

Avoid tying your emergency fund to investment accounts or physical-only branches to ensure liquidity in a crisis.

3.4. Automate Your Savings

Set up automatic transfers from your paycheck or checking account to your emergency fund. Automation helps you save without thinking about it.

- If you have irregular income, use tools or budgeting apps to adjust amounts flexibly.

- Consider strategies like the envelope method or rules that save a percentage of windfalls or side income.

Pro Tip:

Automate your savings as soon as you get paid and treat your emergency fund like any must-pay bill. Consistency builds security over time.

3.5. Find ways to boost savings

Look for both ways to cut costs and increase income to grow your fund faster.

- Reduce recurring expenses by canceling unused subscriptions or renegotiating bills.

- Try side gigs or sell items you no longer need.

- Use apps that round up purchases to save small amounts automatically.

- Always pay yourself first by saving a portion of your income before spending.

Small changes, when compounded over time, can have a major impact on your emergency fund.

3.6. Track your progress and stay motivated

Use visual trackers or apps to see your progress. Join savings challenges or make the process social with family or friends.

- Celebrate when you hit milestones like $500, $1,000, or your full target.

- Adjust your goals as your financial situation changes.

Motivation is key in how to build an emergency fund. Use visual trackers, savings apps, or milestone celebrations (like a small treat at $500, $1,000, etc.) to keep going. Share your goals with friends or join a savings challenge group for extra accountability.

View more:

- Social media for small business marketing

- How much does the average american make in their lifetime

- Which country markets are highest growing market in the world

4. Where should you keep your emergency fund in 2025?

Choosing the right place is just as important as saving the money itself. Your emergency fund must be safe, liquid, and preferably earn some interest to counteract inflation.

| Account Type | Pros | Cons |

|---|---|---|

| High-yield savings | Good interest, FDIC insured, liquid | Rate may fluctuate |

| Money market accounts | Higher rates, check writing option | May require higher min. |

| Digital-only banks | Better rates, low fees, insured | No physical branches |

| Certificates of Deposit | Higher interest for part of fund | Limited access |

| Digital wallets | Convenient, instant transfer | Check security/liquidity |

Avoid risky assets like stocks or crypto for your emergency fund, as their value can drop when you need cash most.

5. Common mistakes people make with emergency funds (and how to avoid them)

Every journey has obstacles. Here are common errors and how to avoid them:

-

Mixing emergency savings with daily accounts leads to accidental spending. Keep funds separate!

-

Setting unrealistic goals can be discouraging. Start small, then scale up.

-

Using the fund for non-urgent expenses defeats its purpose, ask, Is this really an emergency?

-

Failing to replenish after use: Always rebuild after a withdrawal.

-

Over-saving at the cost of debt repayment or investing: Find balance in your financial plan.

By avoiding these common mistakes, you’ll keep your emergency fund effective, resilient, and truly ready to protect you in life’s uncertain moments. Regularly reviewing your habits and making small adjustments ensures your fund continues to work for you, not against you.

6. How to replenish your emergency fund after using it

If you do need to tap your fund, don’t panic. Replenishing is part of responsible money management.

-

Restart automated transfers as soon as possible.

-

Use windfalls or bonuses to rebuild faster.

-

Temporarily cut discretionary spending until your fund recovers.

Example: If you withdraw $1,200 and save $100 per month, you’ll replenish the fund in a year. Adjust the pace as your income allows.

7. Practical tips for building an emergency fund faster in 2025

Building an emergency fund can feel overwhelming, but small daily choices really do add up over time. By adopting smart habits and staying intentional, you’ll see your savings grow faster than expected.

Below are over 30 actionable tips, grouped by theme, to help you speed up the process and keep your momentum strong.

7.1. Spending smart

Taking control of your spending is the quickest way to free up cash for your emergency fund. Focus on what you truly need and look for everyday opportunities to cut costs without sacrificing your quality of life.

- Track every dollar to spot savings opportunities.

- Unsubscribe from unused services like streaming or gym memberships.

- Negotiate bills such as cable, internet, or insurance.

- Set a daily $1 savings challenge.

- Use cash envelopes for weekly spending to avoid overspending.

By making mindful choices in your daily spending, you’ll be amazed how quickly extra dollars appear in your savings account.

7.2. Boosting income

Sometimes cutting costs isn’t enough, so finding creative ways to earn extra money can accelerate your emergency fund even more.

- Pick up side gigs like freelancing, tutoring, or delivery services.

- Sell unused items online or at local markets.

- Save part of any bonuses, tax refunds, or gifts.

Adding even modest amounts of extra income can make a major difference over the course of a year.

7.3. Automation and apps

Leverage technology to take the guesswork out of saving and keep your progress on autopilot.

- Use roundup apps that save spare change from purchases.

- Set up automated transfers coinciding with payday.

- Try budgeting apps with goal tracking features.

Automating savings makes consistency easier, and consistency is the secret to success.

7.4. Mindset and motivation

Saving money is as much a mental game as a financial one. Keep your spirits up with practical motivation tools and celebrate your progress along the way.

- Visual progress charts keep motivation high.

- Join savings groups or communities for accountability.

- Reward yourself with small treats for hitting milestones.

Staying positive and recognizing your wins keeps your energy high and your goals within reach.

7.5. Community resources

Don’t forget to seek out help, many resources exist to support your savings journey, especially during tough times.

- Explore financial counseling or assistance programs locally.

- Tap into employer benefits that help with savings.

Taking advantage of local and employer resources can give you a critical boost and valuable support on your path to a healthy emergency fund.

By combining several of these tips, you can customize your savings strategy to fit your lifestyle and see real progress, fast. Remember, every little bit counts on your journey to financial peace of mind.

8. When and how to use your emergency fund

A critical part of how to build an emergency fund is knowing when it’s appropriate to use it. Knowing exactly when and how to access your emergency fund ensures that it remains a true safety net, not just another pool of spending money. Here’s how to make the right call when life throws you a curveball:

-

Only tap your fund for true emergencies: job loss, medical bills, major repairs, urgent travel, etc.

-

Avoid using it for wants, planned expenses, or anything you could postpone.

-

Before withdrawing, ask: Is this urgent and unavoidable? Are there other options?

-

Once used, plan to rebuild as soon as possible.

By setting clear boundaries and sticking to your rules, your emergency fund will always be there to protect you, no matter what comes your way.

9. Frequently asked questions about emergency funds

Q1: Should I build an emergency fund or pay off debt first?

A: Prioritize high-interest debt, but keep at least $500–$1,000 aside so emergencies don’t push you further into debt.

Q2: How often should I review my emergency fund amount?

A: Review yearly or whenever your expenses or income changes significantly.

Q3: Can I invest my emergency fund for higher returns?

A: No. Safety and liquidity are more important than returns; keep your fund in secure, accessible accounts.

Q4: What’s the difference between an emergency fund and a sinking fund?

A: An emergency fund covers unexpected expenses, while a sinking fund is for planned future costs (like car maintenance).

Q5: How big should my fund be if my income is irregular?

A: Aim for 6+ months of expenses, as unpredictable income means greater risk.

Q: Should couples have joint or separate emergency funds?

A: Joint funds are often simpler, but some prefer both for personal control. Communication is key.

Q: What if I can only save very small amounts?

A: Start with what you can, even $10 a month builds the habit. The key is consistency.

10. Conclusion

In summary, learning how to build an emergency fund is one of the smartest moves for your financial security in 2025 and beyond. With the right plan and steady habits, you can weather life’s storms, reduce money stress, and make decisions with confidence.

Key takeaways:

-

An emergency fund shields you from debt and stress.

-

Save 3–6 months of essentials, or start with $500–$1,000.

-

Use dedicated, insured accounts for safety.

-

Automate, track progress, and celebrate milestones.

-

Only use your fund for true emergencies and always replenish afterward.

For more smart money guides, visit the Finance section at Pdiam, your trusted resource for building financial resilience and success.

Start your emergency fund today, your future self will thank you!