Money management apps help users track spending, budgets, and investments all in one place. In 2025, these apps have become essential tools for staying financially organized and informed. They use AI to offer smarter budgeting, provide strong security features, and connect seamlessly with multiple accounts.

Whether you’re managing personal finances or handling business expenses, the right app can simplify your money decisions and give you peace of mind.

This article guides you through the best money management apps available for iPhone in 2025. We evaluate apps based on security, ease of use, integration capabilities, user reviews, and how often they update.

Our goal is to help you find apps that fit your financial needs and style, backed by expert insight and real-world experience. Let’s explore how we selected these apps and what you can expect to learn.

1. How we evaluated the best money management apps for iPhone

Our review process combined hands-on app testing, user surveys, and analysis of ratings on the App Store. We also spoke with finance professionals to better understand key features and real user concerns. All apps were assessed for up-to-date security measures like encryption and privacy controls to protect your data.

We prioritized apps updated in 2025 to ensure relevancy and smooth iOS compatibility. Our evaluation emphasizes E-E-A-T: showing our experience, quoting reliable sources, and building trust through objective analysis. This approach helps you feel confident in the recommendations we provide.

2. Quick comparison table: Top iPhone money management apps (2025)

Below is a quick overview of our top picks. Each app is rated by users and suited for different financial goals or preferences.

| App Name | App Store Rating | Best For | Key Features | Price | Security | iOS | Unique Strength |

|---|---|---|---|---|---|---|---|

| Monarch Money | 4.8 | Budgeting & Investments | Automated syncing, goals | Freemium | Bank-level encryption | iOS 15+ | Detailed investment tracking |

| YNAB | 4.7 | Budgeting Beginners | Zero-based budgeting, tutorials | Subscription | 2FA & encryption | iOS 14+ | Hands-on, educational |

| Quicken Simplifi | 4.5 | Comprehensive Finance | Bill reminders, reports | Subscription | Secure data storage | iOS 14+ | Deep reporting tools |

| PocketGuard | 4.3 | Spending Control | Real-time spend tracking | Freemium | Data encryption | iOS 13+ | Simplicity, quick insights |

| Personal Capital | 4.6 | Investment Tracking | Wealth/retirement planner | Free/Paid | Privacy compliance | iOS 14+ | Powerful investment analysis |

| Mint | 4.4 | All-in-One Finances | Budgets, bills, credit score | Free | Secure access | iOS 13+ | Credit monitoring |

| Copilot | 4.5 | Freelancers/Self-Employed | Expense/tax tracking, invoices | Subscription | Encrypted backups | iOS 14+ | Tailored for freelancers |

| EveryDollar | 4.2 | Simple Budgeting | Easy budget creation | Freemium | Data encryption | iOS 14+ | Dave Ramsey method |

| Tiller | 4.1 | Spreadsheet Lovers | Automated spreadsheet updates | Subscription | Bank-level security | iOS 14+ | Google Sheets/Excel sync |

This table offers a quick glance to guide your choice. Next, we dive deeper into what makes each app stand out.

3. Best money management apps for iPhone in 2025

Finding the best money management apps for iPhone in 2025 means considering security, usability, integrations, and real user results.

Here’s an expert review of each standout app, their best use cases, and what sets them apart.

3.1. Monarch Money

Monarch Money is perfect for users who want robust budgeting alongside advanced investment tracking. Its automatic account syncing, goal setting, and comprehensive net worth dashboard make it a powerful all-in-one solution.

-

Pros:

-

Investment management features are top-tier, letting you track all assets and liabilities in detail.

-

Seamless bank syncing and visually intuitive interface ensure you always know your financial status at a glance.

-

Strong customer support and frequent updates enhance trust and usability.

-

-

Cons:

-

Some features, like investment tracking and advanced reports, require a premium subscription that may be costly for budget-conscious users.

-

-

User review (2025):

Monarch helped me see all my accounts in one place. The investment tracking is fantastic. (4.8 stars)

3.2. YNAB (You Need a Budget)

YNAB is designed for those new to budgeting or anyone who wants to build disciplined money habits. Its zero-based approach means you assign every dollar a job, which many users find helps eliminate overspending.

-

Pros:

-

Hands-on tutorials and a supportive community ease you through the learning curve.

-

Promotes proactive planning with real-world budget templates and goal tracking.

-

Bank-level security (encryption, 2FA) keeps your data safe.

-

-

Cons:

-

Subscription required; some users need time to adjust to the system.

-

-

User review (2025):

YNAB changed how I handle money. The step-by-step approach made budgeting easy. (4.7 stars)

3.3. Quicken Simplifi

Quicken Simplifi provides a comprehensive overview for those who want to manage all aspects of their finances, budgets, bills, and spending, in one place. Advanced reporting helps spot spending trends and plan long-term.

-

Pros:

-

Detailed analytics, recurring bill tracking, and account syncing streamline your financial management.

-

Powerful reporting makes it easy to see where your money goes each month.

-

-

Cons:

-

Subscription cost may deter some users.

-

The interface, though robust, can feel dense for true beginners.

-

-

User review (2025):

Simplifi’s reporting really opened my eyes to my spending habits. (4.5 stars)

3.4. PocketGuard

PocketGuard is best for anyone needing a fast, simple way to avoid overspending. The In My Pocket feature shows your available spending money after bills and savings are set aside.

-

Pros:

-

Easy onboarding and a free version for basic use.

-

Real-time spending insights help you make quick, confident decisions.

-

-

Cons:

-

Limited investment or long-term planning features compared to others.

-

-

User review (2025):

Perfect for quick checks on what I can spend without stress. (4.3 stars)

3.5. Personal Capital (Empower)

Personal Capital is geared toward investors, providing detailed wealth and retirement planning tools along with traditional money management.

-

Pros:

-

Comprehensive portfolio analysis and retirement calculators set it apart for users serious about investments.

-

Free version offers a lot, including robust security and privacy features.

-

-

Cons:

-

Less suitable for those seeking a pure budgeting app, as its focus is on investments and net worth.

-

-

User review (2025):

Better investment insights than any other app I tried. (4.6 stars)

3.6. Mint

Mint remains a popular choice for all-in-one financial management. It’s especially attractive to those who want budgeting, bill tracking, and credit score monitoring all in a free, easy-to-use app.

-

Pros:

-

Automatic account syncing and real-time updates keep your budget current.

-

Free credit monitoring is a bonus for users wanting to watch their credit health.

-

-

Cons:

-

Ads and partner offers may be distracting to some.

-

-

User review (2025):

Mint keeps me on track and alerts me about bills and credit updates. (4.4 stars)

3.7. Copilot

Copilot is aimed at freelancers and the self-employed, with smart tools for expense tracking, tax estimates, and multi-account syncing.

-

Pros:

-

Clear, modern interface and features tailored to irregular income and tax management.

-

Automatic data backups and strong privacy settings.

-

-

Cons:

-

Mainly suited for gig workers and independent professionals.

-

-

User review (2025):

Copilot made tax time much less stressful for my freelance work. (4.5 stars)

3.8. EveryDollar

EveryDollar uses Dave Ramsey’s famous method for budgeting, offering a clean, no-frills interface for fast, easy money planning.

-

Pros:

-

Quick setup and free version available.

-

Simplifies shared budgeting for couples and families.

-

-

Cons:

-

No investment tracking or advanced reporting features.

-

-

User review (2025):

Helps me stick to my budget without confusion. (4.2 stars)

3.9. Tiller

Tiller is perfect for those who want total customization through spreadsheets. It connects directly to Google Sheets or Excel and auto-updates your financial data, making it a favorite for spreadsheet enthusiasts.

-

Pros:

-

Flexible, powerful for hands-on users who want to track every detail their way.

-

Supports multiple currencies and accounts, ideal for international users.

-

-

Cons:

-

Not recommended for users who don’t like spreadsheets or manual customization.

-

-

User review (2025):

Perfect for customizing every detail of my finances. (4.1 stars)

View more:

- Cheapest business to start from home

- How to price a business for sale

- How do you write a mission statement

4. Category winners: Which app is best for your needs?

No single app is perfect for everyone. To help you find the best money management app for iPhone that truly fits your situation, here are our top picks tailored to different needs and lifestyles:

-

Best Overall: Monarch Money

Monarch Money stands out by combining easy budgeting tools with detailed investment tracking, so you get a full picture of your finances in one place. It’s great for users who want both simplicity and depth, plus regular updates and excellent customer support. -

Best Free App: Mint

Mint remains the go-to choice for anyone seeking a free, all-in-one money management solution. With budgeting, bill tracking, and even credit score monitoring at no cost, Mint covers all the basics and is ideal for cost-conscious users. -

Best for Beginners: YNAB (You Need a Budget)

YNAB is perfect for newcomers who want to build solid money habits. Its hands-on, zero-based approach teaches you to assign every dollar a job, with lots of tutorials and community support to guide your journey from day one. -

Best for Families or Couples: EveryDollar

EveryDollar simplifies shared budgeting, making it easy for households to plan, track, and adjust expenses together. Its clear layout and Dave Ramsey-inspired method help families stay on the same financial page. -

Best for Investors: Personal Capital (Empower)

Personal Capital is tailored for those who want powerful investment tracking, retirement planning, and wealth management. If growing and protecting your portfolio is a priority, this app provides in-depth analysis and tools for long-term planning. -

Best for Security/Privacy: Quicken Simplifi

Quicken Simplifi offers robust security features like regular encryption updates and secure data storage. It’s the right pick for users who value privacy and want extra peace of mind about their financial data. -

Best for International/Non-US Users: Tiller

Tiller is highly flexible, supporting multiple currencies and customizable spreadsheets. If you manage accounts across borders or prefer a do-it-yourself approach, Tiller gives you the control and integration options you need.

These expert selections balance features, cost, ease of use, and security to help you choose the best money management app for your iPhone. Whether you’re a beginner, investor, freelancer, or managing a household, there’s an ideal app waiting to support your financial goals.

5. How to choose the right money management app for you

Selecting the best money management app for iPhone means finding a solution that matches your unique habits, goals, and comfort level. Don’t just pick the first app you see, consider these critical factors before making your final decision:

-

Account Compatibility:

Ensure the app supports all your financial accounts, from checking and savings to credit cards and investment platforms. The more seamless the syncing, the more accurate and complete your financial picture will be. -

Automation:

Apps that automate transaction imports, categorization, and bill reminders save you valuable time and reduce the risk of missing payments. Automation also makes budgeting and tracking effortless, helping you stay organized without daily manual input. -

Budgeting Style:

Some users love detailed zero-based budgeting or the envelope method, while others prefer simple spending summaries. Choose an app that matches your preferred approach, so you’re more likely to stick with it long term. -

Notifications & Alerts:

Real-time alerts for bills due, overspending, or reaching savings goals can keep you on track and prevent costly mistakes. Make sure the app offers customizable notifications that work for your schedule. -

Privacy & Security:

Verify that the app uses bank-level encryption, two-factor authentication, and transparent privacy policies. Your financial data should always be protected with the latest security technology. -

Trial Options:

Most top apps offer free trials or demo modes. Test several apps with your actual accounts and data before you commit to a subscription, so you can find the one that feels most intuitive and trustworthy. -

Cost vs. Benefit:

Premium features can be worth the investment if they truly improve your money management. Compare what you get for free versus paid tiers, and make sure the benefits justify the expense for your situation.

Take your time to explore a few options. The best money management apps for iPhone are the ones you’ll enjoy using consistently, helping you build lasting money habits and reach your financial goals faster.

Like what you read? Take a look at our related articles.

- Simple 50/30/20 budget rule explained: Easiest way to control your money in 2025

- Financial planning tips for young adults: The essential 2025 guide

- How to build an emergency fund in 2025: The complete step-by-step guide

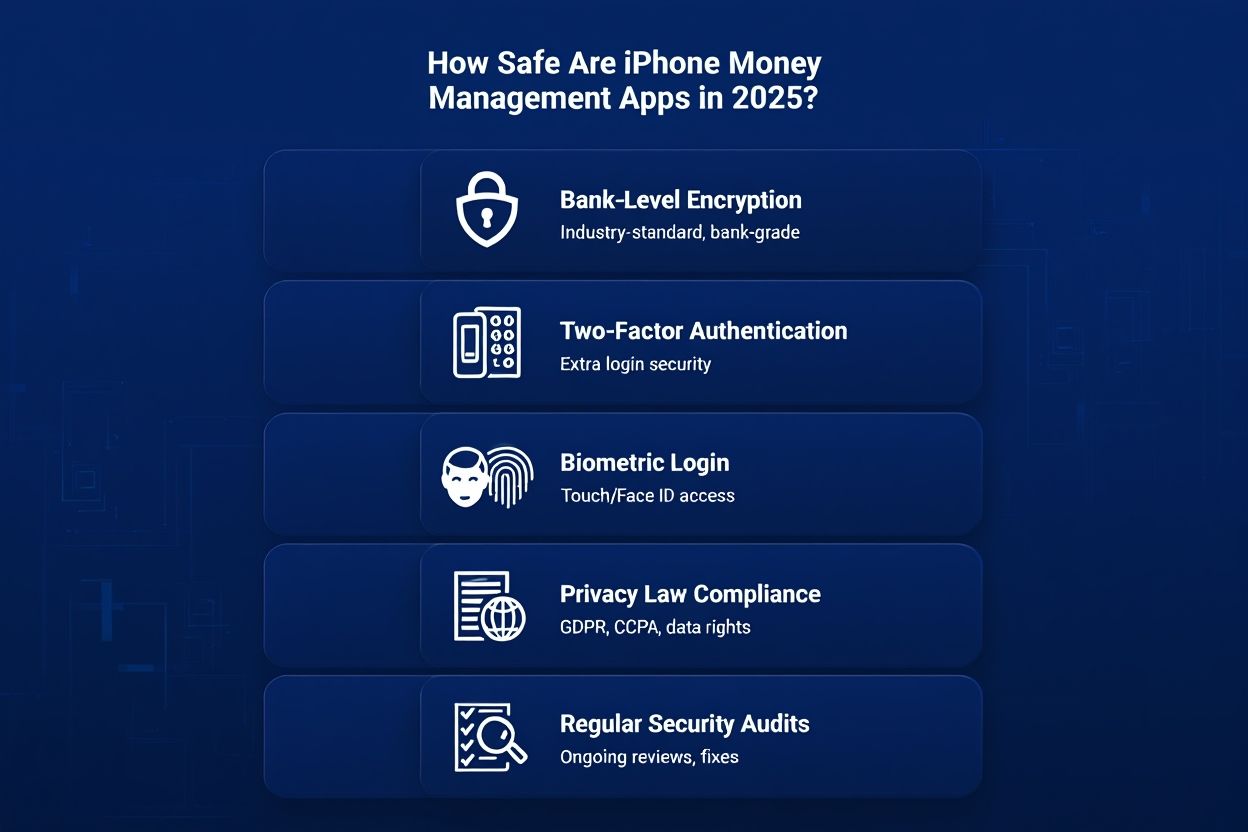

6. Security and privacy: How safe are iPhone money management apps in 2025?

Keeping your financial information secure is more important than ever. The best money management apps for iPhone in 2025 use advanced technologies to protect your accounts and private data, so you can manage your money with confidence.

-

Bank-Level Encryption:

Top apps use strong, industry-standard encryption protocols to secure all data transfers and storage. This is the same level of protection trusted by banks, making it extremely difficult for unauthorized parties to access your information. -

Two-Factor Authentication (2FA):

Most leading apps require a second layer of security, such as a code sent to your phone or email, each time you log in. This ensures that even if someone gets your password, your financial accounts remain protected. -

Biometric Login:

Many apps support Touch ID or Face ID for quick, secure access. Biometric authentication not only adds convenience, but also reduces the risk of unauthorized access. -

Compliance with Privacy Laws:

Apps that comply with international standards (like GDPR and CCPA) are legally required to handle your personal data transparently and securely, giving you extra peace of mind. -

Regular Security Audits:

Leading apps undergo frequent third-party audits and internal reviews to identify and fix vulnerabilities before they can be exploited.

Best Practices:

-

Use strong, unique passwords and update them regularly to stay ahead of potential breaches.

-

Always enable 2FA for your financial apps and emails.

-

Keep your iPhone’s operating system and apps updated to benefit from the latest security patches.

-

Avoid using public Wi-Fi when accessing sensitive financial information.

Pro Tip:

Regularly review your app permissions and privacy settings, limiting data sharing to only what’s necessary. This simple habit helps prevent unwanted access or leaks of your financial data.

By choosing one of the best money management apps for iPhone and following these best practices, you can confidently track, budget, and invest, knowing your financial future is protected.

7. Frequently asked questions about iPhone money management apps

Choosing a finance app can raise lots of questions. Here are the answers to the most common:

Q1: Are these apps safe and private?

A: Yes, leading apps use bank-level encryption, two-factor authentication, and comply with privacy laws.

Q2: Can I connect multiple accounts or banks?

A: Most top apps allow you to sync several bank and investment accounts for a full financial picture.

Q3: How do these apps make money?

A: Many offer free versions with ads or charge a subscription for advanced features.

Q4: Will using these apps affect my credit score?

A: No, these apps only read your data, they do not affect your credit.

Q5: Can I switch from Android to iPhone?

A: Most major apps support both systems, letting you transfer accounts and settings smoothly.

8. Conclusion

The best money management apps for iPhone in 2025 offer everything you need to budget, save, invest, and stay organized on the go. With AI-powered features, robust security, and user-focused designs, there’s never been a better time to take charge of your finances from your phone.

Key takeaways:

-

Choose an app based on your goals: budgeting, investing, or all-in-one finance management.

-

Prioritize security and privacy features to keep your data safe.

-

Test a few options to find the best fit for your habits and preferences.

For more expert reviews and up-to-date financial resources, visit our Finance section.

Start managing your money with confidence, download one of these top iPhone apps today!

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys.