Inflation affects everyone, from consumers to businesses and policymakers. Simply put, inflation is the general rise in prices over time, which lowers the purchasing power of money.

Understanding the types of inflation, especially demand pull vs cost push inflation, is essential for making informed financial decisions in 2025.

Whether you’re planning a business strategy, managing personal finances, or following economic policy, knowing what drives inflation helps you react wisely. This guide will explain the key differences between demand-pull and cost-push inflation, along with real-world examples and advice to stay ahead in a changing economy.

1. What is inflation?

Inflation is one of the most fundamental forces in economics, affecting nearly every aspect of financial life, from grocery bills to central bank policy.

It means that prices for goods and services rise over time, reducing the amount your money can buy. In other words, the same amount of cash buys less than it did before.

Inflation is a major concern for governments, businesses, and individuals because it directly influences interest rates, wage growth, and overall cost of living.

Managing inflation effectively helps stabilize the economy and protects consumers’ purchasing power over time.

Understanding its nature is the first step toward grasping more complex inflation dynamics like demand pull vs cost push inflation.

2. The types of inflation: broad overview

There are several common types of inflation. Each stems from different forces within the economy.

-

Demand-pull inflation: When demand for goods and services rises faster than supply, pushing prices up.

-

Cost-push inflation: When rising costs to produce goods, like higher wages or raw materials, lead to higher prices.

-

Structural inflation: Caused by ongoing changes in the economy’s structure, such as new technology or trade patterns.

-

Built-in inflation: Inflation that happens as workers demand higher wages to keep up with rising prices, creating a cycle.

-

Hyperinflation: Extremely rapid and uncontrollable inflation, usually due to severe economic problems.

This article focuses on demand pull vs cost push inflation because these two types explain most inflation patterns in 2025.

3. Demand pull vs cost push inflation: Definitions and key differences

Understanding the distinction between demand pull and cost push inflation is crucial to interpreting current economic trends. Though both lead to rising prices, they originate from different economic pressures.

Demand-pull inflation happens when more people want to buy goods and services than what the economy can supply. Think of it like a popular restaurant where too many customers compete for limited tables, so prices go up.

Cost-push inflation occurs when the cost of making goods or services goes up, and businesses pass those costs to customers by raising prices. Imagine the restaurant facing higher food and labor costs, forcing them to increase menu prices.

Key distinctions:

-

Main cause:

-

Demand-pull → Increased demand

-

Cost-push → Higher production costs

-

-

Trigger events:

-

Demand-pull → Strong consumer spending, government programs

-

Cost-push → Supply shortages, wage hikes, energy price spikes

-

-

Price movement:

-

Demand-pull → Buyers pushing prices up

-

Cost-push → Sellers raising prices to maintain margins

-

Both types raise prices but start from different pressures. In practice, they can occur together, leading to more complex inflation cycles.

3.1. What causes demand-pull inflation?

Several economic conditions can drive demand-pull inflation. Below are some of the most common:

-

Rising incomes: More disposable income increases consumer spending.

-

Government spending: Stimulus packages and public projects boost demand.

-

Strong economy: Low unemployment and robust business growth fuel consumption.

-

Increased exports: Growing overseas demand pushes domestic businesses to expand.

For example, between 2020 and 2022, many countries experienced a surge in consumer spending after pandemic lockdowns eased. This sudden demand led to shortages and pushed prices higher, classic demand-pull inflation.

These patterns are especially visible in industries like real estate, electronics, and travel during boom cycles.

3.2. What causes cost-push inflation?

Cost-push inflation originates from the supply side. When production becomes more expensive, businesses have little choice but to pass these costs on to consumers.

Common causes include:

-

Higher raw material costs: Oil, food, metals all impact base costs.

-

Wage increases: Labor shortages or union pressure drive up payroll.

-

Supply chain constraints: Port delays or factory shutdowns reduce availability.

-

Geopolitical events: Conflicts or sanctions restrict key imports.

A recent case was the energy price surge in 2022, where oil and gas disruptions drove up production costs globally, clear signs of cost-push inflation in action.

Pro Tip:

Watch sectors like energy, manufacturing, and transport. These are typically first hit by cost-push pressures during global disruptions.

View more:

- Best money management apps for iPhone: Complete guide in 2025

- Cheapest business to start from home in 2025: A complete guide for budget Entrepreneurs

- Understand what is meant by real GDP fast: Clear Breakdown in 2025

4. Comparison table: demand-pull vs cost-push inflation

This quick comparison helps highlight how each type of inflation functions in the economy.

| Factor | Demand-Pull Inflation | Cost-Push Inflation |

|---|---|---|

| Main Cause | Excess demand over supply | Rising production costs |

| Trigger Events | Income growth, govt. spending, exports surge | Raw material price hikes, wage rises, supply shocks |

| Supply/Demand Dynamics | Demand outpaces supply | Supply decreases or costs increase |

| Typical Economic Scenario | Booming economy, low unemployment | Supply shortages, cost shocks |

| GDP Gap Association | Positive output gap | Negative supply shock |

| Policy Responses | Raise interest rates, reduce spending | Supply-side reforms, energy policy, wage controls |

| Real-World Example | Post-pandemic consumer spending | 2022 energy price spikes |

Understanding these contrasts helps clarify why inflation behaves differently under various economic conditions.

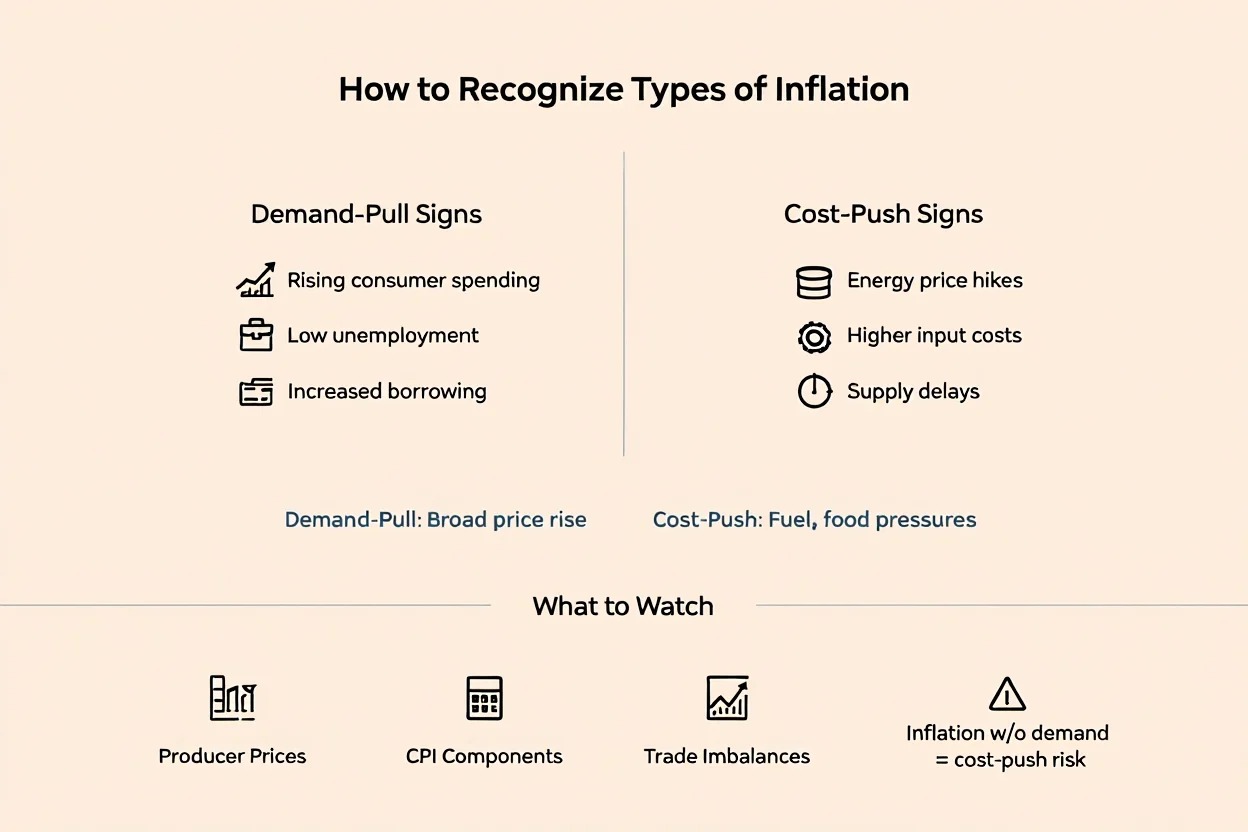

5. How to recognize each type of inflation in the real world

Both types of inflation leave clues. Here’s how to spot them in current data and news cycles.

-

Demand-pull signs: Rising consumer spending, low unemployment, strong GDP growth, increased borrowing

-

Cost-push signs: Input cost surges, union wage talks, supply delays, energy price hikes

-

Sector impact:

-

Demand-pull → Broad-based price increases

-

Cost-push → Sector-specific pressures (e.g., fuel, food)

-

-

Economic data to watch: Producer prices, wage growth, trade imbalances, CPI components

-

Red flags: Sudden inflation without demand growth may suggest cost-push dynamics

Pro Tip:

Track central bank language, terms like overheating often imply demand-pull concerns, while supply bottlenecks signal cost-push trouble.

Did this article attract you? Why don’t you check out our:

- What is risk free rate of interest: Things you must know [2025]

- What is the Dodd Frank Act? Discover Its role in Financial Stability [2025]

6. Effects of each inflation type: impact on business, policy, and people

Inflation doesn’t just affect prices, it changes how businesses operate, how governments make policy, and how people live. Let’s explore how demand-pull and cost-push inflation impact different stakeholders across the economy.

Inflation affects every part of the economy. Here’s how each type influences different stakeholders:

6.1. Businesses

For businesses, inflation influences input costs, pricing strategies, and profitability. Each type of inflation presents unique challenges and opportunities:

-

Demand-pull inflation can boost revenues as consumers spend more, but it may strain supply chains and increase delivery times. Companies may struggle to keep up with orders, risking customer dissatisfaction or operational inefficiency.

-

Cost-push inflation compresses profit margins as the cost of raw materials, labor, or logistics rises. Firms without pricing power may find it difficult to maintain profitability.

-

Typical responses include increasing product prices where possible, improving productivity, renegotiating supplier contracts, or shifting to lower-cost inputs.

Navigating inflation successfully requires both financial agility and supply chain adaptability.

6.2. Government and policy

Governments and central banks play a crucial role in responding to inflation. Their tools and priorities vary depending on the type of pressure facing the economy.

-

Demand-pull inflation often triggers interest rate hikes by central banks. The goal is to slow borrowing and spending to prevent overheating. Fiscal authorities may also reduce public spending or delay new stimulus plans.

-

Cost-push inflation is more complex. Policymakers must balance inflation control with the risk of slowing growth further. Traditional monetary tightening may not address root causes like oil shortages or supply bottlenecks.

-

Policy options include energy subsidies, supply chain investments, import diversification, or wage negotiation frameworks to ease tensions.

The challenge lies in targeting the source of inflation without stalling the broader economy.

6.3. Consumers and workers

The everyday impact of inflation is most visible at the household level, on paychecks, grocery bills, and living costs.

-

Demand-pull inflation may benefit workers in the short term by creating more jobs and prompting wage increases. However, if prices rise faster than incomes, purchasing power still erodes.

-

Cost-push inflation tends to hurt consumers more directly. When essential goods like fuel or food become more expensive, and wages don’t keep up, families face real income losses and budget stress.

-

Behavioral shifts include reducing discretionary spending, increasing debt reliance, or delaying major purchases.

Real-world example: In 2023, wage growth in many G7 countries averaged 4%, while inflation exceeded 6%, leading to a net decline in household purchasing power, a classic outcome of cost-push inflation.

Together, demand-pull and cost-push inflation reshape how businesses price, how governments react, and how households manage daily expenses.

Recognizing which force is driving inflation helps each stakeholder respond with the right strategy, whether that means adjusting interest rates, cutting costs, or planning your next career move.

7. Policy responses to demand-pull vs cost-push inflation

Different inflation types require different tools. Here’s how monetary and fiscal policymakers adapt:

-

Demand-pull:

-

Central banks raise interest rates

-

Governments reduce deficit spending

-

-

Cost-push:

-

Enhance energy infrastructure

-

Address supply chain bottlenecks

-

Support targeted subsidies

-

From 2021 to 2023, the U.S. Federal Reserve raised rates to tame demand-pull inflation. Meanwhile, Europe focused on energy subsidies to counter cost-push shocks from fuel prices.

Both approaches involve trade-offs. Tightening too fast can slow growth, while supply reforms take time to show impact.

8. Case studies: demand-pull and cost-push in action (2020–2025)

Here are real-world examples of each inflation type over the past five years:

-

Post-pandemic surge (2020–2022): Consumer demand soared after lockdowns eased, overwhelming supply chains and creating demand-pull inflation.

-

Energy crisis (2022): Global oil and gas supply shocks from geopolitical tension raised production costs worldwide, cost-push inflation intensified.

-

Logistics bottlenecks (2020–2023): Shortages in semiconductors and delayed shipping led to higher costs in auto, tech, and manufacturing sectors.

These events show that inflation types often overlap in real-world scenarios.

9. Summary table: at-a-glance takeaways

Here’s a quick reference to compare demand-pull and cost-push inflation at a glance. This table summarizes key distinctions in causes, context, and policy responses.

| Demand-Pull Inflation | Cost-Push Inflation | |

|---|---|---|

| Cause | Excess demand | Rising input costs |

| Economic Setting | Boom, recovery | Shocks, war, constraints |

| Policy Tool | Interest rate hikes | Supply support measures |

| Effect on Jobs | Can improve employment | May reduce real wages |

| Example | 2021 stimulus, post-COVID | 2022 oil price spikes |

This summary helps clarify which economic signals to watch, and how inflationary pressures may unfold in real time.

10. FAQs

Q1: Can both types of inflation occur together?

Yes. A growing economy with supply chain problems may experience both demand-pull and cost-push inflation simultaneously.

Q2: Which type is more common?

Demand-pull inflation is more frequent during booms. Cost-push usually appears during crises or supply disruptions.

Q3: How can I spot inflation in the news?

Follow reports on wages, input costs, commodity prices, and government stimulus announcements.

Q4: How should businesses respond?

By adjusting pricing strategies, renegotiating contracts, and watching interest rate trends.

Q5: Are there other inflation types?

Yes, built-in inflation (wage-price spiral) and hyperinflation, though the latter is rare in stable countries.

Q6: How does central bank policy differ by type?

Rate hikes target demand-pull, while supply-focused aid targets cost-push.

Q7: Which type affects consumers more directly?

Cost-push inflation typically hits harder, especially when energy or food prices rise faster than wages.

11. Conclusion

Understanding the difference between demand pull vs cost push inflation helps you better interpret economic news and make smarter financial decisions in 2025.

Key takeaways:

-

Demand-pull inflation results from too much spending chasing too few goods

-

Cost-push inflation stems from rising production costs or supply shocks

-

Each type requires different policy responses

-

Real-world inflation often includes elements of both

-

Awareness helps businesses, investors, and households prepare effectively

Inflation isn’t just a macroeconomic metric, it shapes your job, your grocery bill, and your financial future.

Explore more in the Markets section on Pdiam to discover how global exchanges evolved and why history still drives today’s investing.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys.