Lifetime earnings refer to the total amount of pre-tax income an average American earns throughout their working years, typically between the ages of 20 and 65 or 69.

Understanding this figure is important for multiple reasons, such as planning for retirement, choosing a career path, assessing the return on education, and informing public policy decisions. Factors like gender, education, occupation, and where a person lives all influence these earnings.

This article draws on data from reliable sources such as the Social Security Administration (SSA), the Bureau of Labor Statistics (BLS), and the U.S. Census Bureau to provide a clear picture of how much does the average American make in their lifetimes.

We will break down lifetime earnings by key demographic factors and explain the calculation methods, offering useful insights you can apply to personal finance or policy discussions.

1. How much does the average American make in their lifetime?

The average American earns an estimated $1.5 to $1.7 million (in 2025 dollars) over a typical working lifetime. This range includes variations by gender and education. For example, men tend to earn between $1.7 million and $1.9 million, while women’s lifetime earnings typically range from $1.2 million to $1.4 million.

College graduates often see higher totals, around $2 million or more. These numbers represent broad averages and do not capture every individual’s experience, as many factors can influence personal earnings. This section answers the central question and sets the stage for a closer look at what shapes these earnings.

Pro tip: For a more accurate estimate, use the SSA’s Lifetime Earnings Calculator and input your own work history, education, and occupation.

2. Main factors that influence lifetime earnings

Several major factors explain why how much does the average American make in their lifetime can vary so much:

1. Education: Higher education levels usually lead to higher earnings. A bachelor’s degree can increase lifetime income significantly compared to only a high school diploma.

2. Gender: Wage gaps persist, with women earning less on average due to various causes such as occupational choices and caregiving responsibilities.

3. Occupation: Different jobs pay differently. For instance, doctors and engineers often earn more than teachers or tradespeople, even with similar education levels.

4. Race/Ethnicity: Studies show disparities in income across different racial and ethnic groups, influenced by structural and historical factors.

5. Region: Earnings vary by state and metro area, reflecting cost of living differences and dominant industries.

6. Career Longevity & Interruptions: Time out of work due to parental leave, illness, or unemployment affects total earnings.

7. Inflation & Time Period: Earnings are usually adjusted for inflation to compare value over time. Nominal wages alone don’t show true purchasing power.

Understanding these factors helps explain why average lifetime earnings vary so much among individuals. It also prepares us to explore how these averages are calculated.

3. How lifetime earnings are calculated

Understanding how much does the average American make in their lifetime starts with knowing the calculation method. Most estimates are based on a simple but powerful formula that takes into account real-world variables.

Calculation method:

Researchers multiply a person’s median or mean annual income by the number of years they work, adjusting for inflation, career breaks, and part-time versus full-time status. Longitudinal data from the SSA, Census Bureau, and BLS is commonly used to track income patterns over decades.

| Example Scenario | Average Annual Income | Years Worked | Lifetime Earnings (2025 dollars) |

|---|---|---|---|

| Full-time, 40 years | $50,000 | 40 | $2.0 million |

| 5 years part-time (half pay) | $30,000 | 5 | $150,000 |

| 35 years full-time | $55,000 | 35 | $1.925 million |

In practice, analysts account for job changes, salary growth, and gaps in employment to arrive at a realistic total. Calculations adjusted for inflation ensure that earnings reflect actual purchasing power over time, not just nominal salary.

This method allows for apples-to-apples comparisons between groups and helps you understand how different life choices (education, job, location) impact total career earnings.

View more:

- Cheapest business to start from home

- How to price a business for sale

- How do you write a mission statement

4. Lifetime earnings by category (In-Depth Breakdown)

Lifetime earnings vary greatly based on your education, gender, occupation, and where you live. Reviewing these differences can help you understand what to expect and identify ways to maximize your earning potential.

4.1. By education level

Education plays the largest role in determining lifetime earnings. The table below summarizes estimated lifetime earnings by highest degree attained:

| Education level | Estimated lifetime earnings (2025 dollars) |

|---|---|

| High school diploma | $1.2 million |

| Associate’s degree | $1.5 million |

| Bachelor’s degree | $2.0 million |

| Advanced degree (master’s or higher) | $2.6 million |

Higher education generally results in higher initial pay and faster wage growth. The investment in schooling tends to pay off over a career, thanks to better job opportunities and career progression. These gains, however, depend on the field of study and labor market conditions.

4.2. By gender

The lifetime earnings gap between men and women remains notable. The table below shows average earnings:

| Gender | Estimated lifetime earnings (2025 dollars) |

|---|---|

| Men | $1.8 million |

| Women | $1.3 million |

This difference stems from factors like occupational segregation, differences in hours worked, unpaid caregiving roles, and discrimination. While the gap has narrowed over decades, it still influences financial outlooks for many individuals.

4.3. By occupation

Lifetime earnings vary widely by profession, even among workers with similar education:

| Occupation | Estimated lifetime earnings (2025 dollars) |

|---|---|

| Teacher | $1.5 million |

| Engineer | $2.4 million |

| Doctor | $3.5 million |

| Skilled trades | $1.6 million |

| Information technology specialist | $2.2 million |

High-skill and licensed professions tend to have higher earnings. However, some skilled trades offer competitive pay without requiring extensive college education.

Real example:

A male engineer with a bachelor’s degree working in California may earn $2.5 million+ over 40 years, while a female high school graduate in retail in the South might earn less than $1.3 million.

4.4. By geography (State/Region)

Earnings also depend on where a person lives and works.

For example, median lifetime earnings can range from about $1.3 million in lower-wage states to over $2 million in high-cost metros. This variation reflects local wages, industry presence, and living costs.

States with strong tech or finance sectors typically see higher average earnings.

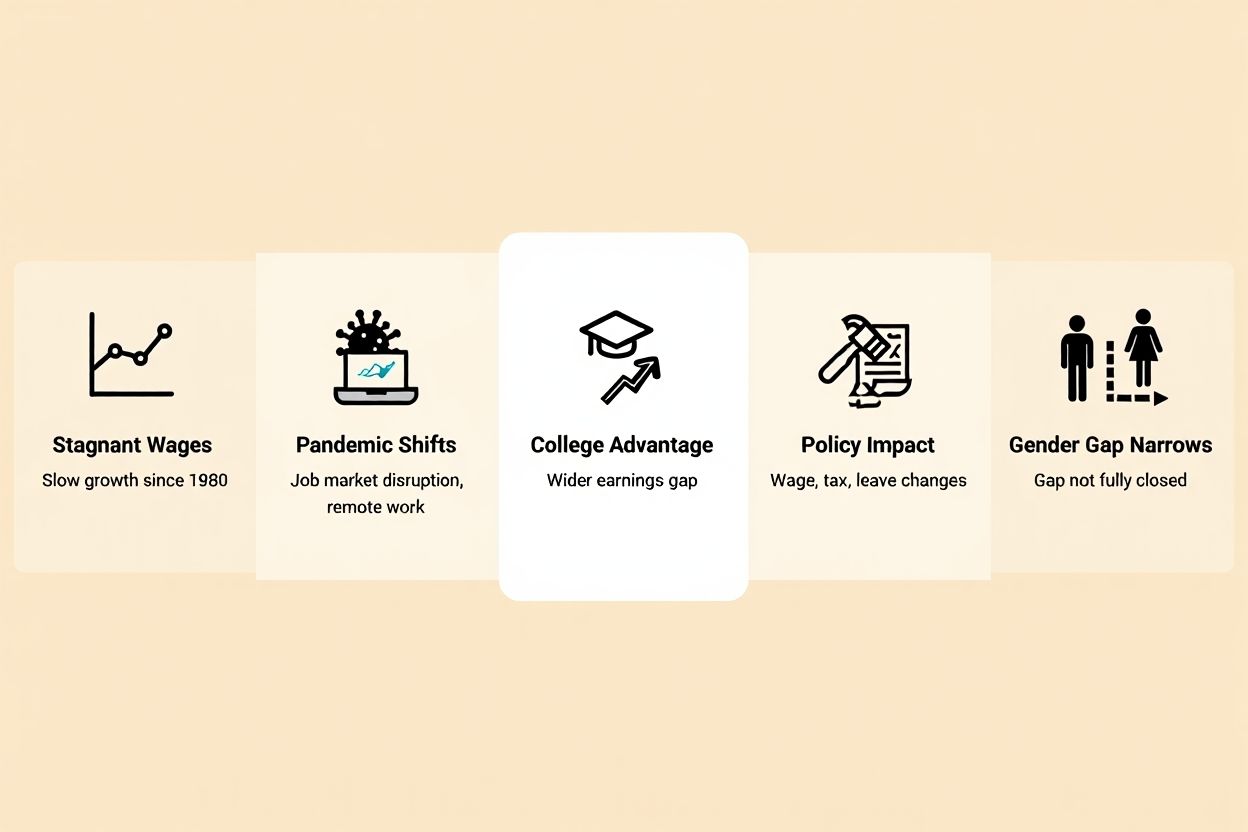

5. Trends and insights: How lifetime earnings change over time

Understanding trends in lifetime earnings is key to planning for your financial future. Over the past several decades, economic shifts and policy changes have shaped how much the average American can expect to earn in their lifetime. Here are the most important trends to watch:

Lifetime earnings estimates have evolved significantly.

-

Stagnant wage growth: Since 1980, many workers (especially those without college) have seen slow growth in real earnings.

-

Pandemic effects: COVID-19 caused short-term disruptions but also sped up remote work and changes in job markets.

-

College premium: The advantage of higher education for lifetime income has widened.

-

Policy changes: Minimum wage, taxes, and family leave all affect long-term earning trajectories.

-

Gender gap: The wage gap has narrowed but not closed.

Tracking these long-term trends helps put your own earning potential in context and highlights why planning, upskilling, and smart career decisions matter more than ever.

6. Estimating your own lifetime earnings

To estimate your lifetime earnings, multiply your expected annual income by your planned years of work, adjusting for potential career breaks and inflation. For example:

- A high school graduate earning $40,000 annually for 40 years with no breaks might earn about $1.6 million.

- A college graduate earning $60,000 annually for 40 years could reach $2.4 million in lifetime earnings.

- A professional who takes breaks for caregiving or schooling should subtract those years or adjust for lower earnings during those periods.

If you plan to take breaks for caregiving, unemployment, or returning to school, subtract those years or adjust your earnings for those periods accordingly.

Pro tip: Use online calculators from SSA and BLS, entering your field, degree, and career path for a tailored estimate.

7. Frequently Asked Questions (FAQ) on Lifetime Earnings

Q1: Are lifetime earnings before or after taxes?

A: The figures are generally pre-tax, focusing on gross income before deductions.

Q2: What exactly does lifetime earnings include?

A: It includes total wages and salaries earned over the working life, excluding benefits like pensions or Social Security.

Q3: Which careers offer the highest lifetime returns?

A: Medical professionals, engineers, and certain tech roles tend to have the highest averages.

Q4: How does the U.S. compare internationally?

A: The U.S. generally has higher average earnings than many countries but also greater income inequality.

Q5: Does student debt affect lifetime earnings?

A: Directly no, but it may delay wealth accumulation or influence career choices.

Q6: How do employment breaks affect totals?

A: Career interruptions lower lifetime earnings by reducing total working years or income during those periods.

Q7: Are the numbers averages or medians?

A: Most cited figures are averages (means), which can be skewed by very high earners.

Q8: Do these include bonuses or benefits?

A: Generally, only base wages and salaries are counted.

8. Conclusion

How much does the average American make in their lifetime depends on multiple factors: education, gender, career choice, and location. In 2025, the average range is $1.5–$1.7 million, but your actual outcome could be higher or lower.

-

Higher education and skilled jobs lead to higher earnings.

-

Location and industry matter significantly.

-

Gender and race gaps persist but are narrowing.

-

Planning and continuous learning help maximize your total.

Ready to calculate your own path?

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys.

Economy section is your trusted resource for understanding the complex world of personal and global finance. Here, you’ll find in-depth articles, practical guides, and expert insights designed to help readers make smarter decisions about income, savings, investing, and economic trends.

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.

very informative articles or reviews at this time.