Saving money on a low income means setting aside even small amounts despite limited earnings. It’s a challenge many face when daily expenses like rent, bills, and food take most of their budget. Choosing between covering essentials and saving can feel impossible. Yet, even modest savings help build financial security over time.

Research shows that in the US and UK, only about 40% of low-income households manage to save regularly. This guide aims to provide practical, proven methods that anyone can use. Backed by real-world examples, it offers motivation and clear steps to help make saving achievable, no matter your income level.

We’ll start by exploring how to understand your finances, then creating realistic goals and budgets, followed by actionable saving strategies. With this knowledge, you’ll be better equipped to control your money and grow your savings gradually.

1. Understanding your financial situation to save wisely

Before you can save, you need to know exactly where your money goes. Understanding your financial situation is the first step to saving money on a low income, and it’s more empowering than you might expect.

Knowing exactly how much money comes in and goes out is the first step to saving wisely on a low income. It means tracking every source of income and every expense, honestly and consistently. This creates a clear picture to identify where cuts or changes can happen.

Here are key steps to get started:

- Write down all sources of income, including wages, benefits, or side earnings.

- Track all expenses daily, such as rent, groceries, transportation, and small purchases.

- Be honest, include even minor spending to avoid surprises.

- Review your records weekly to see spending habits and trends.

Various tools can help you track finances. Here’s a simple comparison:

-

Paper Journal: Free, fully customizable, but needs discipline.

-

Spreadsheet: Great for analysis and easy updates, but requires some computer skill.

-

Mobile Apps (Mint, YNAB, EveryDollar): Automatic tracking, reminders, and insights, ideal for quick check-ins.

Understanding Needs vs. Wants can guide smarter choices. Needs include essentials like housing, utilities, and food. Wants are non-essential items such as dining out, new clothes, or entertainment subscriptions. For example, a need might be paying for electricity, while a want could be streaming service fees.

This financial awareness lays the foundation for smart saving. Without it, budgeting remains guesswork and savings goals can seem unreachable.

2. How to set realistic savings goals on a low income

On a low income, small but steady savings add up. This is called micro-saving. Instead of waiting for a large sum, saving $5 a week can create an emergency fund over time.

When setting savings goals, consider both short-term (e.g., fixing a broken appliance) and long-term needs (e.g., a security deposit or retirement). Clear goals help keep you focused.

Use the SMART goal structure to increase success:

- Specific: Define exactly what you’re saving for (e.g., $200 emergency fund).

- Measurable: Track progress (e.g., $5 saved weekly).

- Achievable: Set realistic amounts based on income and expenses.

- Relevant: Make sure goals match urgent needs.

- Time-bound: Set a deadline (e.g., save $200 in 40 weeks).

Real Example:

Maria, a single mom in Texas, started saving $3 per week using a round-up app. In 10 months, she built her first-ever $120 emergency fund, enough to handle a car repair and avoid payday loans.

View more:

- How much does the average American make in their lifetime

- Powerful social media for small business marketing

- How to price a business for Sale

3. Building a practical budget when money is tight

A budget is your roadmap for saving money on a low income. The right method keeps you in control without feeling deprived.

Here are three proven approaches:

3.1. Envelope method

This traditional method involves assigning a specific amount of cash (or digital equivalent) to different spending categories, like food, rent, and transport. Once the envelope for a category is empty, you stop spending in that category until the next cycle.

This method creates strong boundaries and builds awareness of spending habits. It’s especially useful for those trying to control discretionary spending.

Pro Tip:

Try using physical envelopes for 30 days, you’ll quickly learn where your money goes and which categories need better control.

This approach forces you to plan each dollar and curb leakage from small, impulsive spending.

3.2. Zero-based budget

In a zero-based budget, every dollar has a purpose. That means your income minus expenses (including savings) equals zero. Nothing is left unassigned.

This method helps prevent small, impulsive purchases from adding up over time. It also promotes accountability and ensures every dollar contributes toward a goal, whether it’s groceries or an emergency fund.

It takes discipline, but the zero-based budget gives you full control over your financial choices.

3.3. Modified 50/30/20 rule

Adjust this rule to fit low income: 50% for needs, 30% for wants, and 20% for savings (but don’t stress, flex as needed).

Even $1 saved counts.

Whichever method you choose, be sure to:

-

List your monthly income clearly.

-

Assign amounts to each category based on past tracking.

-

Use a printable template or app.

-

Track actual spending and adjust weekly.

-

Correct mistakes quickly to stay on track.

You can modify the ratio, for example, 60% needs, 25% wants, 15% savings, or even reduce the savings portion temporarily. The important thing is to start where you can. Even setting aside just $1 builds consistency and confidence.

Pro Tip:

Don’t worry if you can’t hit the full 20% savings target. The habit of saving, even a little, matters more than the amount.

4. Proven strategies for saving money on a low income

Even the smallest changes can have a big impact over time.

Let’s break down tactics by category, with a quick intro and a closing tip after each group.

4.1. Groceries & meals: Top 5 money-saving tactics

Groceries are often a significant expense. Small changes in shopping and meal planning can create substantial savings over time.

- Plan meals weekly: A shopping list avoids impulse buys.

- Buy store brands: They cost less but offer good quality.

- Use coupons and apps: Digital discounts can add up.

- Cook in bulk: Preparing meals for several days saves time and money.

- Avoid food waste: Freeze leftovers and track expiration dates.

Smart meal planning not only saves money but also supports healthier eating habits and less food stress throughout the week.

4.2. Housing & utilities: Cutting costs without sacrificing comfort

Housing is usually the largest expense for low-income households. The good news is there are actionable ways to reduce housing-related costs without compromising comfort.

- Negotiate rent or seek assistance: Local programs may offer subsidies.

- Reduce energy use: Turn off lights, unplug devices, use energy-efficient bulbs.

- Bundle utilities: Combining services can reduce bills.

- Insulate your home: Simple fixes stop heat loss, cutting heating costs.

- Apply for utility discounts: Many providers offer low-income plans.

Tip:

Some utility providers have hardship programs, ask them directly!

4.3. Transportation: Saving while getting around

Whether for work or errands, transportation is a recurring cost. Fortunately, several affordable options exist without sacrificing mobility.

- Use public transport or carpool: Cheaper than driving alone.

- Walk or bike when possible: Saves money and improves health.

- Maintain your vehicle: Prevent expensive repairs by regular checks.

- Use fuel-efficient routes or apps: Reduces fuel costs.

- Shop for better insurance: Compare quotes for savings.

Reducing transportation expenses frees up room in your budget for essentials and makes saving more feasible, even with a tight income.

4.4. Bills & subscriptions: Stopping money leaks

Recurring bills and forgotten subscriptions can quietly drain your income. Tackling these expenses is one of the fastest ways to save.

- Review monthly bills: Identify unnecessary services to cancel.

- Switch providers: Shop around for cheaper phone or internet plans.

- Set reminders to avoid late fees: Automate payments where possible.

- Share subscriptions: Split costs with family or friends.

- Use metered billing: Monitor usage to avoid overcharges.

Treat subscriptions like luxury items, review them every quarter and cut anything that doesn’t bring real value.

4.5. Shopping & Everyday Spending: Frugal Hacks That Work

Everyday spending is where many budgets leak. With a few frugal strategies, you can reduce this category without sacrificing too much.

- Wait before buying: Give yourself 24 hours to consider.

- Buy secondhand: Thrift stores and online markets offer bargains.

- Use cash instead of cards: Helps control spending.

- Apply price comparison apps: Find the best deals.

- Shop seasonal sales: Stock up on valuables then.

Keep a wish list instead of making impulse buys, if the item still feels necessary after a month, it’s probably worth purchasing.

4.6. Bonus: Lifestyle, Health, and Free Entertainment

Saving money doesn’t mean sacrificing joy, health, or hobbies. In fact, many low-cost or free options can be even more rewarding.

- Use community resources: Libraries, parks, and free events.

- Practice healthy habits: Prevent costly medical bills with simple exercises and good diet.

- DIY cleaning and repairs: Saves service costs.

- Swap or borrow items: Tools and clothes can be shared.

- Limit expensive hobbies: Explore low-cost alternatives like walking or crafting.

A fulfilling lifestyle doesn’t have to cost much. Creativity and community can enrich your daily experience, often for free.

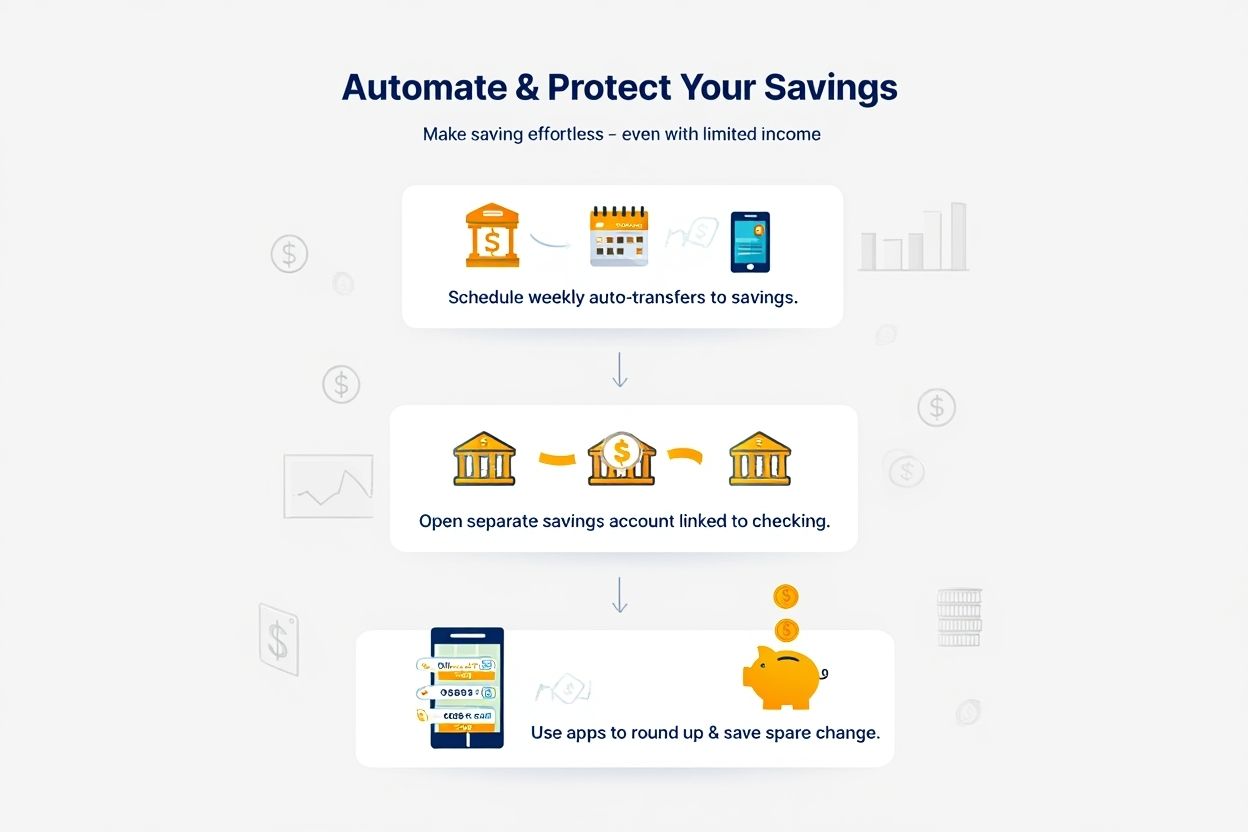

5. Automating and protecting your savings, even on a low income

Setting up automatic savings helps build habits without constant effort. Here’s how:

- Automatic transfers: Schedule weekly transfers from checking to savings accounts.

- Use piggyback accounts: Open separate savings accounts linked to your main bank.

- Micro-automations: Apps that round up purchases and save spare change.

Separating savings accounts helps prevent accidental spending. Choose banks or apps offering no-minimum balance and free transfers.

If you have nothing saved yet, start a safety buffer with even $1 or less weekly. The goal is building momentum.

Wanna learn more stuffs like these? Check out our related articles:

- Best money management apps for iPhone: Complete guide in 2025

- Simple 50/30/20 budget rule explained: Easiest way to control your money in 2025

- Financial planning tips for young adults: The essential 2025 guide

6. Can I grow my savings by increasing my income?

Increasing income can help saving but is often challenging due to time, skills, and stress. Here are practical options:

| Method | How to Start | Timeframe/Requirements |

|---|---|---|

| Online micro-tasks | Sign up on platforms like Amazon Mechanical Turk or Clickworker | Immediate start, flexible hours, low skills required |

| Part-time flexible gigs | Look for local delivery or retail roles with short shifts | Requires more time, some training |

| Government benefits & grants | Check eligibility using official online directories | Varies by program but often quick processing |

| Skill-building courses | Free or low-cost classes on sites like Coursera or local centers | Weeks to months, improves income potential |

Using community resources can ease barriers and provide support. Remember, growth is gradual, and every effort counts.

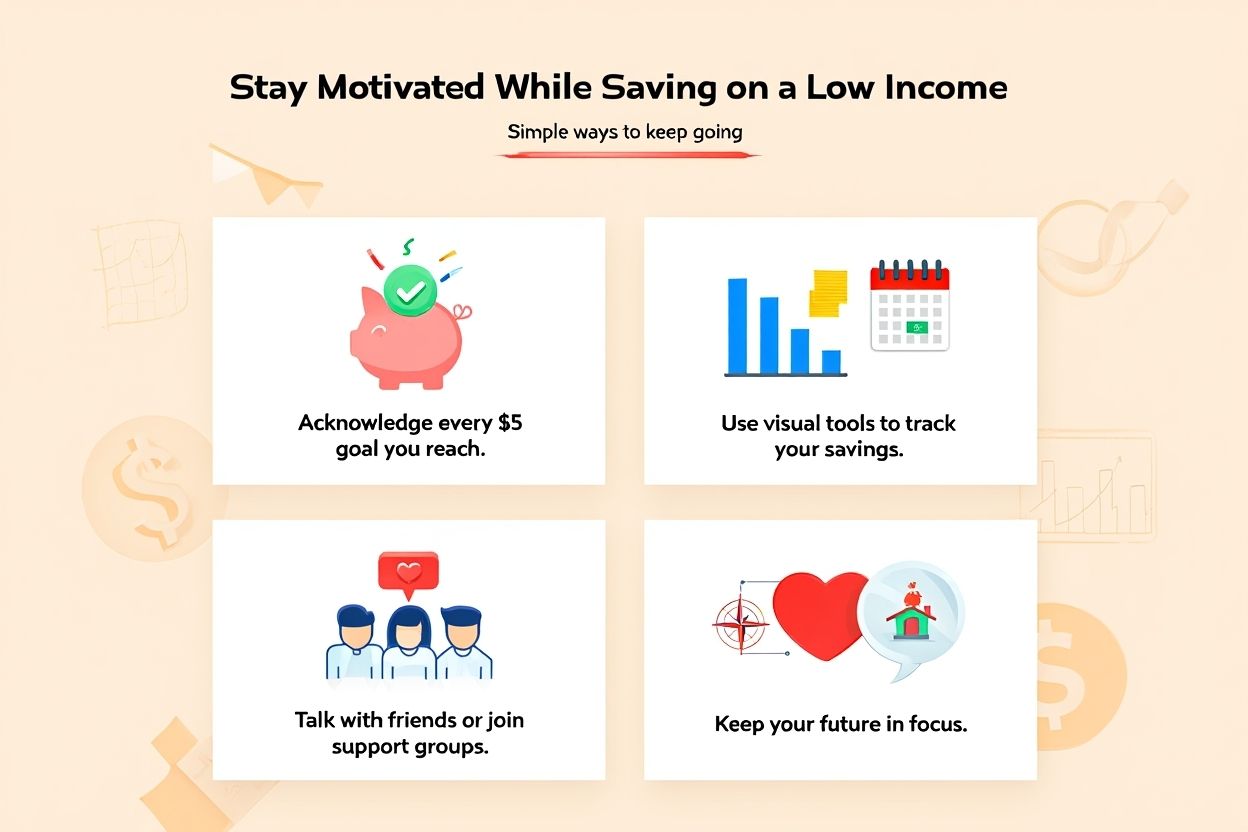

7. How to stay motivated and overcome setbacks on a low income

Saving on a low income is not always smooth. Here are tips to stay motivated:

- Celebrate small wins like hitting a weekly savings target.

- Visualize progress with charts or notes.

- Share goals with supportive friends or groups.

- Remind yourself why saving matters for your future.

If setbacks occur, such as unexpected expenses or job loss, try these actions:

- Pause savings temporarily without giving up.

- Adjust your budget to cover urgent needs.

- Seek emergency aid or community support.

- Return to savings as soon as possible.

Stories of others who saved successfully despite challenges can inspire and show that persistence pays off.

8. Essential tools, templates, and resources for low-income savers

Helpful tools make saving easier. Here are recommended resources:

| Tool | Description | Cost |

|---|---|---|

| Budget Templates | Downloadable sheets for tracking income and expenses | Free |

| Mint App | Automatic expense tracking with alerts | Free |

| You Need a Budget (YNAB) | Structured budgeting, 34-day free trial | Subscription after trial |

| Cash App | Supports instant transfers and savings | Free |

| Local Nonprofit Directories | Provides links to financial counseling and aid | Free |

Many apps require no credit check and minimal setups, ideal for low-income users. Searching [your country] free budgeting tools can reveal more options tailored to your region.

9. FAQs

Q1: Can I save if I’m already in debt?

A: Yes. Even $5 weekly while repaying debt builds momentum and security.

Q2: Will I have to give up all non-essentials?

A: No. Balance essential spending with low-cost alternatives.

Q3: What if there’s nothing left at month’s end?

A: Adjust your budget and seek community or government aid.

Q4: Are there free support resources for bills and emergencies?

A: Yes. Many nonprofits and official sites list grant or utility support.

Q5: What’s better, saving or paying off debt first?

A: Do both: pay down high-interest debt while saving small amounts.

Q6: How can I stay consistent with saving?

A: Automate transfers, track progress, and review goals monthly.

Q7: Are round-up savings apps safe to use?

A: Most major apps are secure. Use those with strong reviews and no hidden fees.

10. Conclusion

Saving money on a low income is difficult but doable with clear understanding, practical planning, and realistic goals. Tracking your finances honestly lays a strong foundation. Setting small, achievable savings targets helps build momentum. Using beginner-friendly budgets tailored to your situation keeps you on course.

Here’s a quick recap:

-

Track all income and expenses honestly.

-

Use SMART goals to build momentum.

-

Try envelope, zero-based, or 50/30/20 budgeting.

-

Apply savings tactics across food, housing, and bills.

-

Automate and protect your savings.

-

Explore ways to earn extra income over time.

-

Stay motivated and seek help when needed.

Saving even small amounts leads to long-term financial peace of mind.

For more expert budgeting tips, tools, and inspiring financial guides, visit our Finance section.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys.

I am truly thankful to the owner of this web site who has shared this fantastic piece of writing at at this place.