The simple 50/30/20 budget rule explained in this guide is one of the easiest ways to master personal finance. By dividing your after-tax income into three clear categories, needs, wants, and savings or debt payments, you get a roadmap for financial balance.

Popularized by Senator Elizabeth Warren’s book All Your Worth, this rule is ideal for beginners, young adults, or anyone who wants to start budgeting without feeling overwhelmed. Let’s break it down and see how you can make it work in your daily life.

Let’s explore this simple yet effective budgeting rule in more detail, breaking down each category and how to apply it in your financial life.

1. Simple 50/30/20 budget rule explained

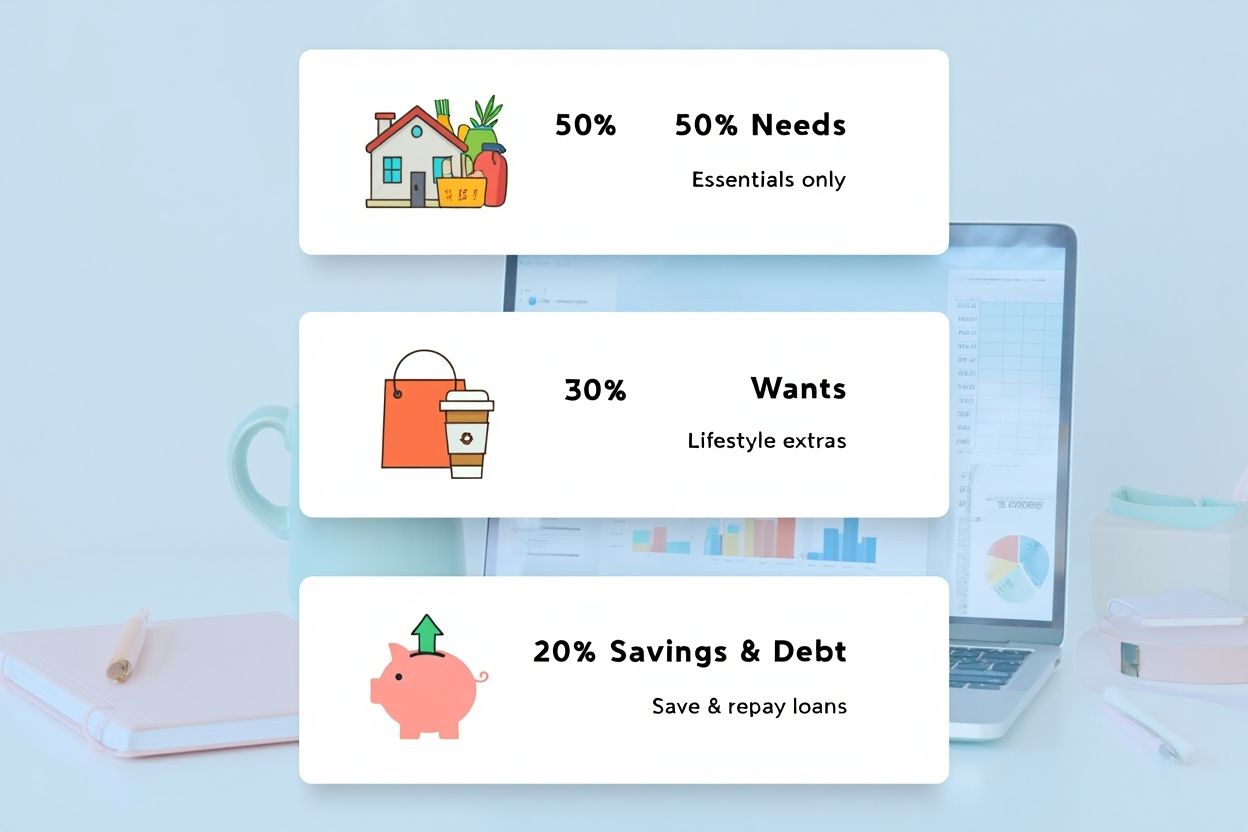

The simple 50/30/20 budget rule is a straightforward framework for managing your money. It splits your take-home pay into three categories:

-

50% for Needs: All the essentials you can’t live without.

-

30% for Wants: Enjoyable extras that improve your lifestyle.

-

20% for Savings & Debt Repayment: Building future security and paying down loans.

What makes this rule so simple? You don’t have to track every little purchase, just group your spending into broad, easy-to-understand categories. This approach helps you focus on the big picture and avoid getting lost in the details.

Pro Tip:

The 50/30/20 rule works best when you regularly review your categories and make adjustments as life changes. Flexibility is key!

2. Detailed breakdown: Needs (50%), Wants (30%), Savings & Debt (20%)

Understanding each category is essential for applying the simple 50/30/20 budget rule effectively. Here’s what counts in each section:

2.1. Needs: 50% of income

Needs are expenses essential for basic survival and day-to-day life. This 50% should cover all the bills and costs you can’t avoid.

- Housing (rent or mortgage)

- Utilities (electricity, water, heating)

- Food (groceries)

- Insurance (health, car, home)

- Minimum loan payments (credit card or student loans)

- Basic transportation

Real Example:

Sarah pays $1,000 on rent and $300 on groceries every month. John, supporting a family, budgets for utilities and health insurance as essential needs.

Remember, if your needs take up more than 50%, look for ways to reduce costs or adjust other categories for balance.

2.2. Wants: 30% of income

Wants are the nice-to-have expenses that improve your lifestyle but are not essential. These are the fun or luxury items you choose to spend on.

- Dining out or takeout meals

- Streaming subscriptions (Netflix, Spotify)

- Travel and vacations

- Shopping for clothes or gadgets beyond basics

- Hobbies and leisure activities

Pro Tip:

Don’t confuse wants with needs! Taking the bus to work is a need; choosing Uber for comfort is a want. Basic shoes are needs, but designer shoes are wants.

If you find your wants creeping higher, challenge yourself to cut back for a month and see how much you can save.

2.3. Savings & debt repayment: 20% of income

This category focuses on building financial security and reducing debt faster. It includes putting money aside and paying more than the minimum on debts.

- Building an emergency fund

- Contributing to retirement accounts

- Investing in stocks or bonds

- Paying extra on student loans or credit card debt

For best results, start by building a $1,000 emergency fund before aggressively paying down student loans. Prioritize savings while steadily reducing high-interest debt to improve financial health.

View more:

- Social media for small business marketing

- How much does the average american make in their lifetime

- Which country markets are highest growing market in the world

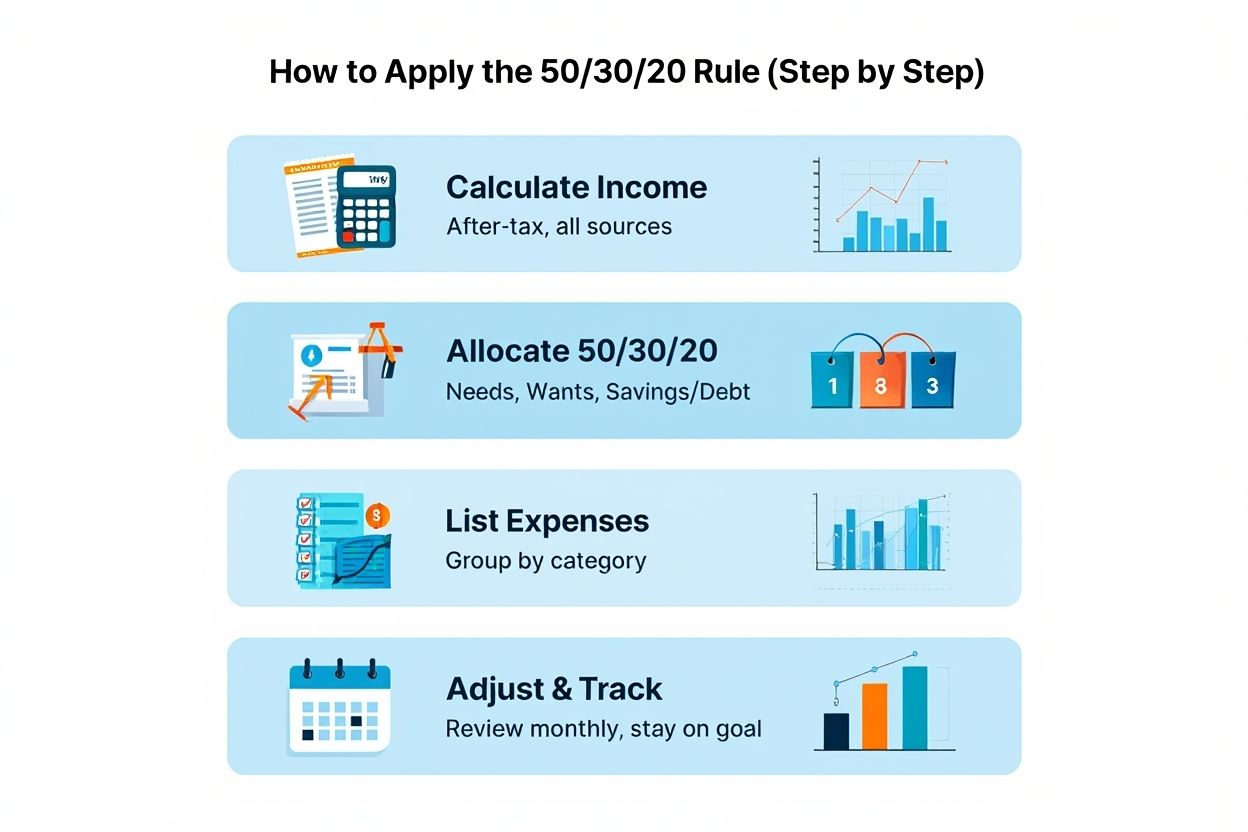

3. How to apply the 50/30/20 rule, step-by-step

Applying the 50/30/20 rule is simple when you follow these steps:

- Calculate your take-home income: This is your after-tax income, including salary and other income sources.

- Divide it into 50/30/20 buckets: Allocate 50% to needs, 30% to wants, and 20% to savings and debt.

- List your expenses: Group your expenses under these categories to see where your money goes.

- Adjust and track monthly: Review your spending each month, adjusting categories to stay on target and meet goals.

Here’s a checklist for quick reference:

| Checklist for quick reference |

|---|

| Know your after-tax income |

| Set budgets for needs, wants, savings/debt |

| Track spending honestly |

| Make adjustments as needed |

Sample budget table for $3,000 monthly post-tax income:

| Category | Percentage | Amount ($) | Example Expenses |

|---|---|---|---|

| Needs | 50% | $1,500 | Rent ($900), Groceries ($300), Utilities ($300) |

| Wants | 30% | $900 | Dining Out ($300), Streaming ($50), Shopping ($300), Travel ($250) |

| Savings & Debt | 20% | $600 | Emergency Fund ($200), Retirement ($250), Extra Loan Payment ($150) |

Adjust the categories to reflect your real-life priorities, especially if you live in a high-cost area or have variable income.

4. Practical example of the 50/30/20 budget rule

Seeing the simple 50/30/20 budget rule explained in action makes it easier to implement:

Imagine you have $3,000 take-home pay each month. Dividing it according to the rule means:

- Needs (50%) – $1,500: Rent ($900), groceries ($300), utilities ($300)

- Wants (30%) – $900: Dining out ($300), streaming ($50), travel savings ($250), shopping ($300)

- Savings & Debt (20%) – $600: Emergency fund contributions ($200), retirement account ($250), extra loan payments ($150)

If your needs exceed 50%, like paying higher rent in a big city, you might reduce wants or savings temporarily to maintain balance.

Want to learn more stuffs like these? Check out our related articles:

- Financial planning tips for young adults: The essential 2025 guide

- How to build an emergency fund in 2025: The complete step-by-step guide

5. Benefits of using the 50/30/20 budget rule

The simple 50/30/20 budget rule explained offers several advantages:

- Simplicity: Easy to calculate and reduces decision fatigue by focusing on broad categories.

- Balanced approach: Ensures you cover essentials while saving and enjoying life.

- Adaptability: Works for most income levels, from entry-level paychecks to higher salaries.

- Promotes awareness: Helps curb overspending by making you conscious of your habits.

Financial experts often recommend this approach because it combines discipline with flexibility, ideal for building strong money habits.

6. Limitations and considerations of the 50/30/20 rule

No budget system is perfect. Here are key considerations to keep in mind:

- Not a perfect fit in high cost-of-living (HCOL) areas, where needs often exceed 50%

- Irregular income earners or freelancers may find fixed percentages impractical

- Heavy debt loads may require more than 20% toward repayment

- Adjustments like 60/20/20 can better fit expensive cities or larger families

Pro Tip:

Customize the rule! If rent is 60% of your income, sharply limit wants or increase savings as your situation allows. The main goal is awareness and adaptation, not perfection.

Questions often arise about customization. For example, if rent is 60% of your income, you may limit wants sharply or increase savings gradually. The key is monitoring and adapting the rule to your unique situation.

7. 30+ Expert Tips for Successfully Using the 50/30/20 Rule

To make the 50/30/20 rule work best for you, consider these practical tips:

- Review and audit your current spending before budgeting.

- Use budgeting apps like Mint or YNAB for tracking.

- Automate savings to avoid missing goals.

- Set calendar reminders to review your budget monthly.

- Build buffer savings to cover unexpected expenses.

- Focus on paying off high-interest debt first.

- Limit subscription services to only those you actively use.

- Share budgeting goals with family to align efforts.

- Track receipts to catch small, overlooked expenses.

- Prioritize emergency fund before investing heavily.

- Revisit your budget after income changes.

- Use cash envelopes for wants to control discretionary spending.

- Cut back on dining out by meal prepping at home.

- Explore cheaper alternatives for utilities and insurance.

- Set realistic savings targets and increase gradually.

- Use windfalls like bonuses to boost savings or debt payoff.

- Compare prices and negotiate bills regularly.

- Limit impulse buys by waiting 24 hours before purchases.

- Adjust budget categories seasonally or based on life events.

- Set clear financial goals to stay motivated.

- Review credit reports regularly to manage debt smartly.

- Take advantage of employer retirement match programs.

- Consider side income to increase savings share.

- Maintain a financial journal to track progress and challenges.

- Cut back on recurring wants like rarely used subscriptions.

- Use visual charts to see your money flow clearly.

- Plan for irregular expenses like car maintenance in advance.

- Keep an eye on inflation and adjust budgets accordingly.

- Limit wants spending during tight cash flow periods.

- Consult a financial planner for personalized advice.

- Keep learning about money management through books and articles.

Experts stress that the 50/30/20 rule’s simplicity lets you stay flexible, adjusting as your life changes without losing control over your finances.

8. Frequently asked questions about the simple 50/30/20 budget rule explained

Before you start, here are answers to the most common questions about the simple 50/30/20 budget rule explained:

Q1: What counts as needs versus wants?

A: Needs are essential living costs like housing and groceries; wants are non-essentials like dining out or streaming subscriptions.

Q2: How should I handle irregular income?

A: Average your income over several months and prioritize needs and savings first each pay cycle.

Q3: Can the percentages be customized?

A: Yes, adapt the ratios to fit your lifestyle, especially if you have higher fixed expenses or live in a HCOL area.

Q4: What if I have significant debt?

A: Consider dedicating more than 20% to debt repayment, especially for high-interest loans.

Q5: How does 50/30/20 compare to envelope or zero-based budgets?

A: The 50/30/20 rule is simpler and focuses on broad categories, while envelope and zero-based budgets require tracking every dollar.

9. Conclusion

The simple 50/30/20 budget rule explained in this guide is truly one of the easiest and most effective ways to organize your finances and eliminate money stress in 2025. By dividing your income into needs, wants, and savings or debt, you gain both flexibility and control, two essentials for long-term financial success.

Key takeaways:

-

The simple 50/30/20 budget rule brings balance to daily spending and future planning, so you don’t have to choose between living well now and building security.

-

Its easy-to-follow structure makes it perfect for beginners, while its adaptable categories let anyone fine-tune their plan as life changes.

-

Regularly reviewing and adjusting your budget will help you avoid costly mistakes and reach your goals with less effort.

-

Using this proven budgeting method empowers you to avoid overwhelm and stay focused on what matters most.

For more expert budgeting tips, tools, and inspiring financial guides, visit our Finance section.

Start building your simple 50/30/20 budget today, take the first step toward a stress-free and confident financial future!

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys.

Great information shared.. really enjoyed reading this post thank you author for sharing this post .. appreciated