In today’s economy, understanding financial terms like underbanked is more important than ever. What does it mean to be underbanked? It refers to having limited use of traditional banking services despite having access to them.

As we move through 2025, many people still rely on alternatives outside mainstream banks for their everyday money needs.

This guide aims to explain what underbanked means clearly and simply, helping you grasp why it matters. We’ll also look at how underbanked differs from unbanked (people without any bank accounts) and underserved groups, using the latest data from the Federal Reserve and FDIC.

Knowing these terms can help you see where you or others fit in the financial landscape and why bridging these gaps is critical for economic inclusion.

1. What does it mean to be underbanked?

Being underbanked means a person has at least one bank account but often depends on other financial services outside traditional banks. According to financial experts, underbanked individuals frequently use alternatives like check-cashing services, money orders, payday loans, or remittance providers.

These people may find regular banking either too costly, inconvenient, or untrustworthy.

For instance, someone might hold a savings account but still cash paychecks at a check-cashing store to avoid monthly fees or overdraft risks. This status often highlights a gap where banking services are accessed but not fully utilized for everyday money management.

Key characteristics of the underbanked:

Underbanked individuals share a set of behaviors and patterns that distinguish them from fully banked consumers. Below are the most common characteristics seen in 2025:

- Bank Account Access: They have access to traditional bank accounts but often avoid using them as the main tool for money management.

- Frequent Use of Alternative Services: They commonly rely on services such as check cashing, payday lending, or money orders, which usually come with extra fees.

- Higher Costs and Limited Credit: Underbanked individuals often pay more in service fees and may struggle to get loans or credit from mainstream banks.

In simple terms, underbanked individuals straddle the line between full banking participation and financial exclusion, creating unique challenges and risks.

2. Underbanked vs. unbanked vs. fully banked: Understanding the differences

To better understand where being underbanked fits, it helps to compare it alongside unbanked and fully banked statuses.

| Status | Has Bank Account | Uses Alternative Services | Main Challenges |

|---|---|---|---|

| Fully Banked | Yes | Rarely | Minimal |

| Underbanked | Yes | Frequently | Higher fees, limited access |

| Unbanked | No | Always | No bank access, financial risks |

Fully banked individuals use banks as their main financial resource with minimal need for alternatives. Underbanked people have accounts but often turn to alternative services due to cost, convenience, or trust issues.

Unbanked individuals have no bank accounts at all and rely entirely on outside services. These distinctions matter because each group faces different barriers and risks. For example, unbanked people may struggle with storing money safely, while underbanked may pay high fees unnecessarily.

Understanding these categories helps individuals and policymakers tailor solutions that improve financial security and inclusion.

3. Why do people become underbanked?

There are several personal and systemic reasons why people become underbanked in 2025:

- Distrust of Banks: Past negative experiences or fears of fees make people wary of fully relying on banks. For example, someone burned by hidden overdraft fees might avoid checking accounts.

- High Fees and Minimums: Monthly charges and minimum balance requirements deter people from using banking fully. A person earning irregular income may find it hard to keep minimum balances.

- Geographic Barriers: Living in rural or remote areas can limit access to physical bank branches, pushing people towards local check-cashing stores.

- Language and Cultural Gaps: Non-native speakers or new immigrants might find bank policies confusing or feel excluded.

- Poor Credit History: Lack of credit or previous issues can restrict access to bank credit products, making payday lenders more attractive.

- Digital Divide: Limited access to smartphones or the internet prevents the use of mobile banking apps.

Each cause contributes to whether or not a person fully uses banking services, often based on personal circumstances or systemic challenges reported by Pew Charitable Trusts and others.

Want to learn more? Explore our related articles:

- What are the biggest corporations in the World? [2025]

- When was the New York stock exchange founded? [2025]

- Financial planning tips for young adults

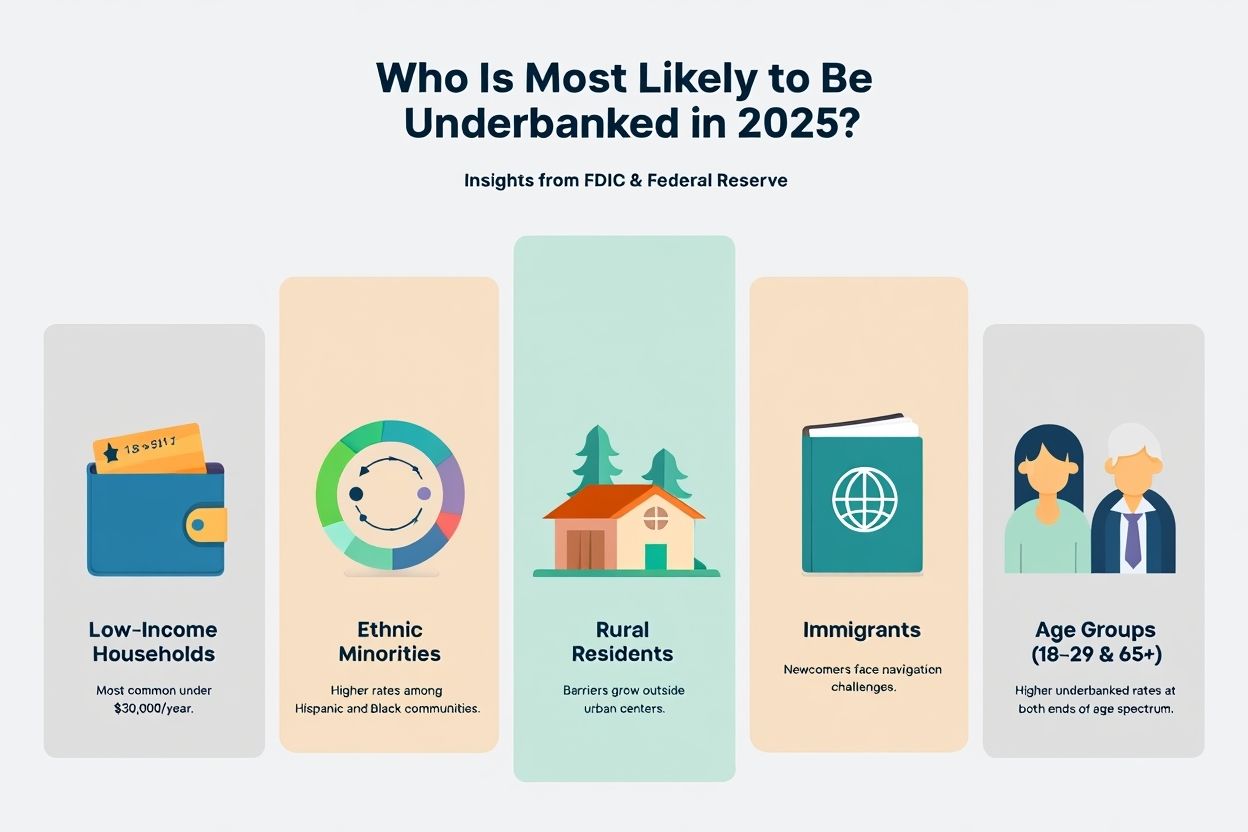

4. Who is most at risk? (Demographics and data)

Recent data from the FDIC and Federal Reserve shows clear trends in underbanked populations:

- Low-Income Households: Underbanked status is most common among families with incomes under $30,000 annually.

- Ethnic Minorities: Hispanic and Black communities have higher underbanked rates compared to other groups.

- Rural Residents: People living far from urban centers face more barriers to banking access.

- Immigrants: Recent immigrants often have difficulty navigating financial systems.

- Age Groups: Both younger adults (18–29) and older adults (65+) experience underbanked status at higher rates.

These findings highlight who may need the most support in financial inclusion efforts. Recognizing these groups helps direct resources and programs where they matter most.

5. Common alternative financial services used by the underbanked

Here are the most common financial services used by underbanked individuals in 2025:

- Check-Cashing Services: Useful for quick cash but often charge 1–5% fees.

- Payday Loans: Provide fast cash but carry very high interest rates, sometimes exceeding 300% APR.

- Pawn Shops: Offer loans against personal items but risk losing possessions if unpaid.

- Money Orders: A way to pay bills without a bank account, with fixed fees per order.

- Remittance Services: Used by immigrants sending money abroad, often with significant service fees and exchange rate costs.

While these services serve immediate needs, they often cost more and lack consumer protections compared to traditional banking. This can trap underbanked consumers in cycles of debt and financial stress.

6. Consequences and challenges of being underbanked

The consequences of underbanked status go beyond inconvenience, they directly affect long-term financial health:

Higher costs and fees: Using alternative services regularly adds expenses that build up over time. For example, check-cashing fees reduce funds for essentials.

Greater exposure to predatory loans: Payday loans and similar products can lead to debt traps.

Barriers to saving and credit-building: Without regular banking use, it’s harder to build credit history or access loans like mortgages.

Long-term financial impact: Being underbanked limits wealth growth and affects financial stability across generations.

Real Example: A gig worker earning weekly may choose to cash checks at a store to avoid overdraft risks, even while holding a bank account, effectively staying underbanked despite digital tools being available.

These challenges underline why many consumers find it difficult to improve their financial situation without support.

7. Pathways and solutions: How to transition from being underbanked

While being underbanked creates limitations, there are practical steps individuals can take to move toward full banking participation:

- Use Digital and Mobile Banking: Many banks now offer low-fee or no-fee accounts accessible via smartphones, making banking easier and cheaper.

- Explore Community and Government Programs: Initiatives exist to help people open accounts, improve credit, and access financial counseling.

- Find Fee-Free Accounts: Look for banks or credit unions offering accounts without minimum balance requirements or monthly fees.

- Improve Digital Access and Literacy: Gaining basic skills in online banking can open new opportunities for managing money.

- Seek Financial Counseling: Professional advice can guide people on budgeting, credit building, and avoiding costly alternatives.

Pro Tip: Ask your local credit union about second-chance banking programs, these are tailored for people recovering from past financial missteps.

Tracking progress and using trustworthy resources greatly improves the chance of escaping the underbanked cycle.

8. Supplement: Frequently asked questions about underbanked status

Q1: What’s the difference between underbanked and unbanked?

A: The underbanked have bank accounts but rely on alternatives; the unbanked have no accounts at all.

Q2: Can you be underbanked if you have a bank account?

A: Yes. Having a bank account doesn’t mean you fully use it for daily financial needs.

Q3: How do I know if I am underbanked?

A: If you regularly use check-cashing, payday loans, or money orders despite having a bank account, you may be underbanked.

Q4: What groups are most underbanked in the U.S.?

A: Low-income, minority, immigrant, rural, and young adults are most affected.

Q5: What’s the impact of being underbanked?

A: It limits credit access, increases service costs, and slows long-term financial progress.

Q6: Are there safe alternatives to payday loans?

A: Yes. Credit unions, online lenders, or community assistance programs offer safer options.

Q7: How can I start banking if I’ve had past problems?

A: Look into second-chance or low-fee accounts, and seek financial counseling for support.

9. Conclusion: Why underbanked status still matters in 2025

Understanding what does it mean to be underbanked is key to addressing financial inequality in the modern economy. Millions of people still rely on high-cost services simply because banking feels out of reach.

-

Underbanked people have bank access but still depend on expensive financial tools.

-

Common causes include trust issues, high fees, digital gaps, and geography.

-

Minorities and low-income groups are most affected, according to Federal Reserve data.

-

Solutions exist: digital banking, counseling, and policy outreach can close the gap.

The more we understand the underbanked experience, the better we can design tools for inclusion.

Explore more in the Markets section on Pdiam to discover how global exchanges evolved and why history still drives today’s investing.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys.

![What does it mean to be underbanked? Better options [2025]](https://pdiam.com/wp-content/uploads/2025/07/what-does-it-mean-to-be-underbanked-thumbnail-750x375.jpg)