When was the New York Stock Exchange founded? The answer takes us back to May 17, 1792, when 24 stockbrokers signed the Buttonwood Agreement just outside New York City. This moment laid the foundation for what would become the world’s largest stock exchange, the NYSE.

For over two centuries, the NYSE has influenced global finance, shaping how businesses raise capital and investors build wealth.

This article explores the NYSE’s origin, early growth, and lasting impact on financial markets worldwide.

1. When was the New York Stock Exchange founded?

The New York Stock Exchange was officially founded on May 17, 1792, when 24 brokers signed the Buttonwood Agreement at 68 Wall Street, New York City. This moment is considered the true founding date of the NYSE, as it marked the start of formal, organized securities trading in America.

The agreement was signed under a buttonwood tree, symbolizing the modest origins of what would become a pillar of modern finance.

1.1. The Buttonwood Agreement and its significance

The Buttonwood Agreement was a deal among 24 brokers to create a basic framework for securities trading in New York. Prior to this, trading was informal and based on word of mouth or trust, with little oversight.

Main provisions of the Buttonwood Agreement:

-

Fixed commission rates to avoid undercutting

-

Brokers only trade among signatories

-

Agreed system for tracking transactions

This laid the groundwork for a transparent, regulated stock market, establishing when the New York Stock Exchange was founded in its earliest form.

1.2. Who were the founding brokers?

The founding brokers who signed the Buttonwood Agreement played a critical role in establishing the NYSE and formalizing securities trading in early America.

These 24 original signatories were merchants and financiers based in New York City, driven by the need to replace chaotic, trust-based deals with standardized rules.

Common traits among the founding members:

-

Actively involved in New York commerce and early finance

-

Sought transparent, commission-based trading instead of undercutting practices

-

Contributed to regional economic structure and credibility

Though small in number, these individuals laid the groundwork for a market that still thrives over two centuries later. Their action on May 17, 1792, answers the historic question: when was the New York Stock Exchange founded, and who made it happen?

2. The NYSE in its early years

The early years of the New York Stock Exchange were marked by informal, open-air trading. Brokers operated outdoors or met in coffeehouses before formalizing the exchange.

In 1817, the NYSE adopted a formal constitution, becoming the New York Stock & Exchange Board. This marked the beginning of modern trading protocols, member seats, and governance rules.

2.1. Securities traded after the NYSE was founded

After its founding in 1792, the NYSE began by listing key securities such as:

-

U.S. government bonds (used to support infrastructure and war debts)

-

Shares of the Bank of New York

-

Other early American corporations

These assets were critical to building public trust in early financial markets.

2.2. Evolution of trading practices

Trading moved from the street to structured locations. Early innovations included:

-

Transition from shouting bids on sidewalks to floor trading

-

Introduction of membership seats

-

Development of internal rules, such as broker behavior and commissions

By standardizing operations, the NYSE helped increase confidence in American finance.

3. NYSE expansion during the 19th and 20th centuries

As the U.S. economy boomed, so did the NYSE. In 1903, the exchange moved into its iconic Broad Street building, where it still operates today.

The NYSE added thousands of domestic and international companies, increasing its influence over global capital markets.

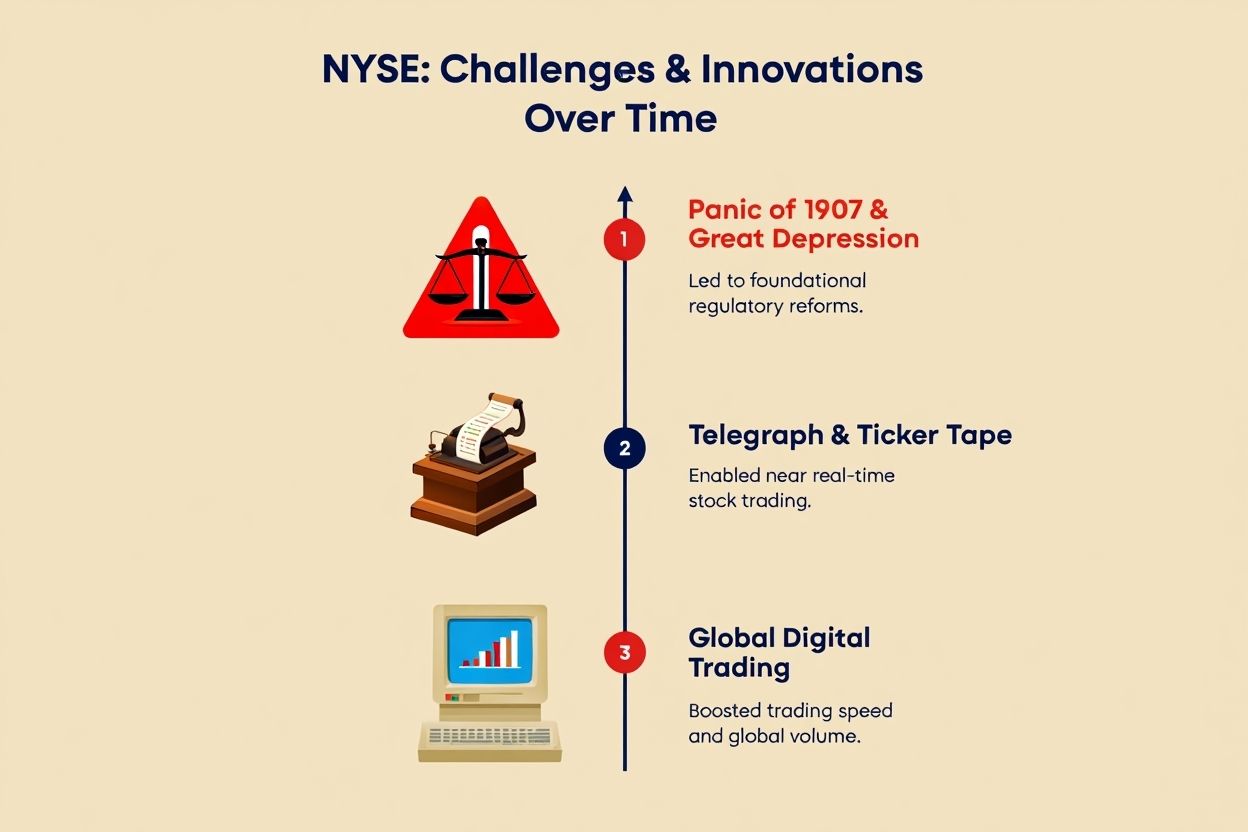

Challenges and innovations:

-

Panic of 1907 and Great Depression triggered regulatory reform

-

Telegraph and ticker tape enabled real-time trading

-

Computerization in the late 20th century accelerated global trading volumes

The NYSE demonstrated remarkable adaptability from the day it was founded through modern financial evolution.

View more:

4. The NYSE today: Legacy of the 1792 founding

The legacy of when the New York Stock Exchange was founded continues to shape today’s global financial markets. The NYSE has evolved into the world’s largest stock exchange by total market capitalization.

It remains at the heart of global investing, driving innovation and setting high standards for market transparency and stability.

Key modern milestones include:

-

2007: Merged with Euronext, forming the first transatlantic stock exchange group

-

2013: Acquired by Intercontinental Exchange (ICE), integrating advanced market infrastructure

-

Technology: Adopted AI-powered trading tools, ultra-low latency systems, and high-frequency infrastructure

These developments show how the NYSE has embraced modernization while upholding the core principles first set in 1792. It continues to act as a benchmark for financial exchanges around the world.

The founding values of fairness and trust established in the Buttonwood Agreement still guide the NYSE’s global leadership today.

4.1. Why the founding still resonates

Knowing when the New York Stock Exchange was founded helps us understand why it remains relevant.

Why it matters:

-

Introduced structured and fair securities trading

-

Set a blueprint for other financial exchanges globally

-

Symbol of stability, innovation, and trust in the finance world

Its founding principles, trust, transparency, and structure, continue to guide how capital flows today.

5. FAQ: Quick answers about when the NYSE was founded

Q1: Why is it called the Buttonwood Agreement?

A: Because the agreement was signed under a buttonwood (sycamore) tree at 68 Wall Street.

Q2: Did other stock exchanges exist at the time?

A: Some informal markets existed, like in Philadelphia, but none had a formal agreement like the NYSE’s Buttonwood pact.

Q3: Where is the NYSE located today?

A: At 11 Wall Street, after relocating to Broad Street in 1903.

Q4: What made the Buttonwood Agreement unique?

A: It set fixed commission rates and allowed trading only among signers, fostering reliability.

Q5: How has NYSE governance changed since its founding?

A: It now operates under a formal constitution and is owned by a public corporation under strict regulatory oversight.

Q6: How is the NYSE different from NASDAQ?

A: The NYSE has a physical trading floor, while NASDAQ is an electronic exchange. NYSE focuses more on legacy corporations.

Q7: What was traded on the NYSE at its founding?

A: Mostly U.S. government bonds and early bank stocks like Bank of New York.

6. Conclusion

When was the New York Stock Exchange founded? On May 17, 1792, 24 brokers signed the Buttonwood Agreement, giving birth to what would become the world’s most powerful stock exchange.

From a meeting under a tree to becoming a global financial force, the NYSE has shaped how capital moves, how companies grow, and how investors build wealth for more than two centuries.

Key takeaways:

-

Founded: May 17, 1792, through the Buttonwood Agreement

-

Historical significance: First formal securities market in the U.S.

-

Evolution: From trading government bonds to listing global corporations

-

Legacy: A model of transparency, regulation, and trust in financial markets

Understanding when the New York Stock Exchange was founded helps explain how modern finance was born, and why trust, structure, and long-term vision remain essential.

Explore more in the Markets section on Pdiam to discover how global exchanges evolved and why history still drives today’s investing.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys.