The average bank charge for a small business in 2025 typically ranges from $5 to $20 per month for maintenance, $0.15–$0.50 per transaction beyond free limits, and $10–$50 per wire transfer, depending on the provider.

Overdraft fees range from $15 to $35 per incident. Online banks often offer lower fees, while traditional banks may charge more for cash handling. Choosing the right account and monitoring usage are key to minimizing costs.

As businesses increasingly use digital tools and banks introduce more varied fee structures, small business owners need a clear picture of these costs. This guide breaks down what small business bank charges are, typical ranges for 2025, và practical advice to help startup founders, accountants, and entrepreneurs save money.

By knowing the average bank charge for a small business and how it works, you can better manage expenses and make smarter banking choices. We’ll cover key fees like monthly charges, transaction costs, wire transfer fees, and overdrafts.

1. Average bank charge for a small business in 2025: Key numbers at a glance

Bank charges for small businesses are the fees banks impose for services like maintaining accounts, handling transactions, and managing wires or overdrafts.

In 2025, staying informed is critical due to rising complexity in fee structures across traditional, online, and credit union providers.

Here’s a quick overview of typical small business bank charges in 2025, based on real fee schedules:

| Bank Fee Type | 2025 Typical Range |

|---|---|

| Monthly Maintenance Fee | $5–$20 |

| Transaction Fee | $0.15–$0.50 per transaction after free limit |

| Cash Deposit Fee | $0.10–$0.50 per $100 deposited above threshold |

| Wire Transfer Fee (Domestic) | $10–$25 per transfer |

| Wire Transfer Fee (International) | $25–$50 per transfer |

| Overdraft Fee | $15–$35 per incident |

| Check Fees | $0.10–$0.50 per excess check |

Online banks usually offer lower monthly and transaction fees, while traditional banks charge more for cash deposits. Credit unions offer competitive rates but may be limited in wire transfer functionality.

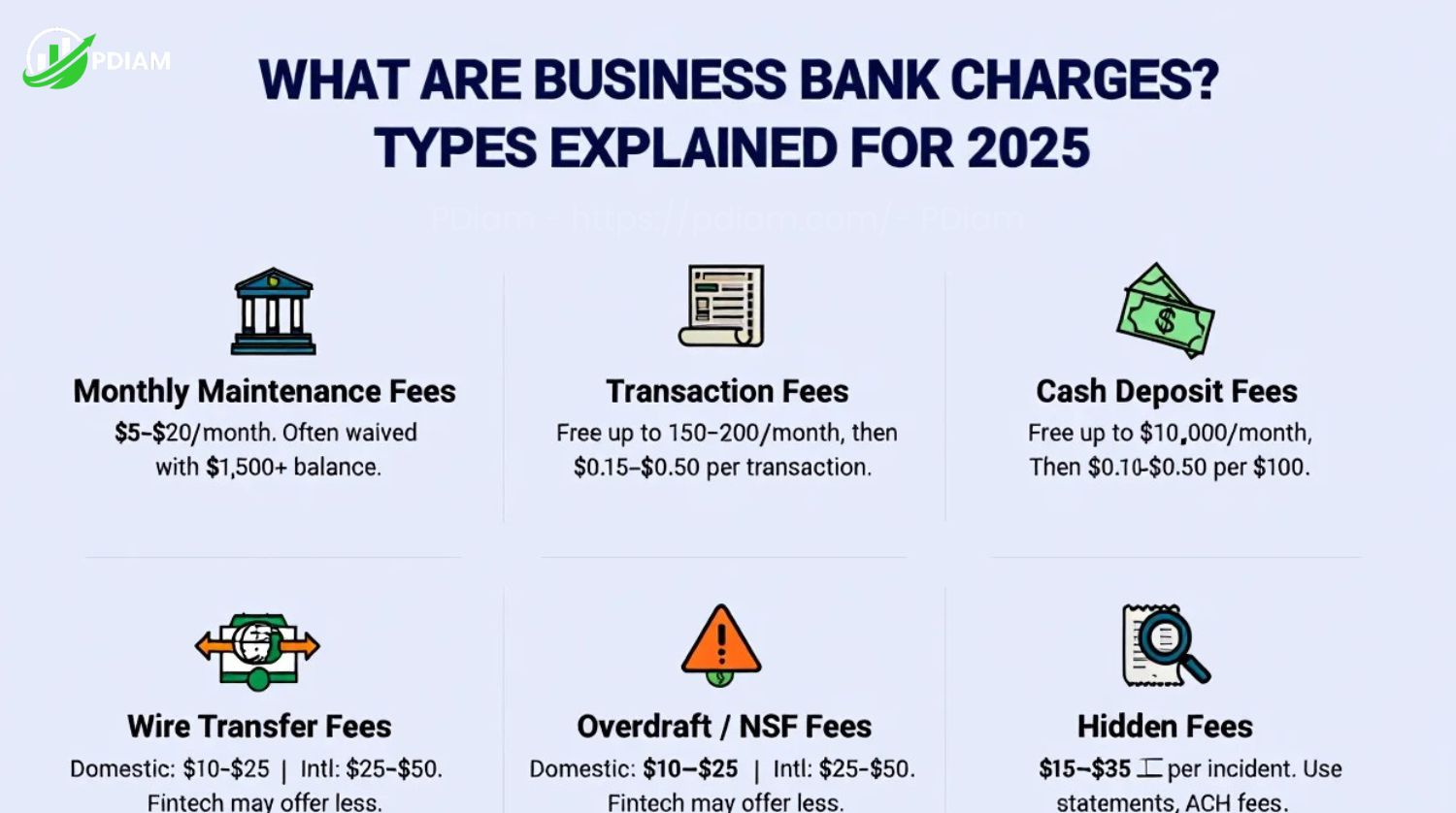

2. What are business bank charges? Types explained for 2025

Understanding the different types of business bank charges is essential for managing financial operations efficiently. Whether you’re launching a startup or running a growing company, bank fees can quietly erode your profits if not monitored carefully.

This section breaks down the most common types of fees that affect the average bank charge for a small business in 2025.

2.1. Monthly maintenance fees

These are flat-rate fees charged simply for keeping a business account open. In 2025, most banks charge between $5 and $20 per month, depending on the account tier.

Waiver options: Many banks will waive these fees if the business maintains a minimum balance (e.g., $1,500), processes recurring deposits, or links additional accounts.

Example: A business that keeps a $1,500 average balance may avoid the $15 monthly fee, saving $180 annually.

2.2. Transaction fees

Most business checking accounts include a limited number of free transactions per month, usually 100 to 200. After that, banks charge $0.15 to $0.50 per additional transaction.

| Monthly Transactions | Fee per Transaction |

|---|---|

| Up to 150 | $0.00 |

| 151–200 | $0.25 |

| 201+ | $0.40 |

To avoid overage fees, monitor your monthly volume and choose an account with appropriate limits.

2.3. Cash deposit fees

Cash-heavy businesses such as restaurants and retailers are especially impacted by deposit fees. Banks typically allow $5,000 to $10,000 in free monthly cash deposits. Beyond that, fees range from $0.10 to $0.50 per $100 deposited.

Tip: To avoid these charges, spread large deposits across multiple months or consider a bank with a higher free deposit threshold.

2.4. Wire transfer fees

Wire transfers are fast but costly. In 2025:

-

Domestic wires: $10–$25 per transfer

-

International wires: $25–$50 per transfer

-

Fintech platforms often offer discounted rates.

| Wire Type | Traditional Bank | Fintech Provider |

|---|---|---|

| Domestic | $20 | $10 |

| International | $40 | $25 |

Businesses that process frequent payments across borders should consider fee-friendly wire alternatives.

2.5. Overdraft and NSF fees

Overdraft fees occur when the account balance drops below zero, and the bank covers the difference. In 2025, the average overdraft fee ranges from $15 to $35 per incident.

Avoiding overdrafts: Link a backup account or apply for an overdraft protection service to avoid these high charges.

2.6. Additional and hidden fees

Besides standard charges, banks may apply lesser-known or hidden fees that can add up quickly:

-

Check-writing fees for exceeding monthly limits

-

Early account closure fees (within 90–180 days)

-

ACH processing fees for incoming or outgoing electronic transfers

-

Paper statement fees (often $2–$5 per month)

Always request and review the full business fee schedule when opening an account.

The average bank charge for a small business isn’t determined by one fee, it’s a combination of multiple small costs. Knowing how each fee works is the first step to minimizing them and choosing the right account for your operations.

Would you like me to revise Section 3 next (comparing traditional banks, online banks, and credit unions)?

View more:

- Financial planning tips for young adults: The essential 2025 guide

- How to price a business for Sale: The complete 2025 guide

- Cheapest business to start from home in 2025: A complete guide for budget Entrepreneurs

3. Comparing traditional banks, online banks, and credit unions in 2025

Different banking institutions offer varying costs and benefits.

| Bank Type | Monthly Fee | Transaction Cost | Wire Fees | Pros | Cons |

|---|---|---|---|---|---|

| Traditional Banks | $10–$20 | $0.30–$0.50 | $20–$40 | Strong branch presence | Higher costs |

| Online Banks | $0–$10 | $0–$0.25 | $10–$25 | Low fees, digital tools | No in-person service |

| Credit Unions | $5–$15 | $0.20–$0.40 | $15–$35 | Personalized support | Limited membership, fewer branches |

Traditional banks suit those needing face-to-face service. Online banks fit digital-native businesses. Credit unions serve locally-focused companies well.

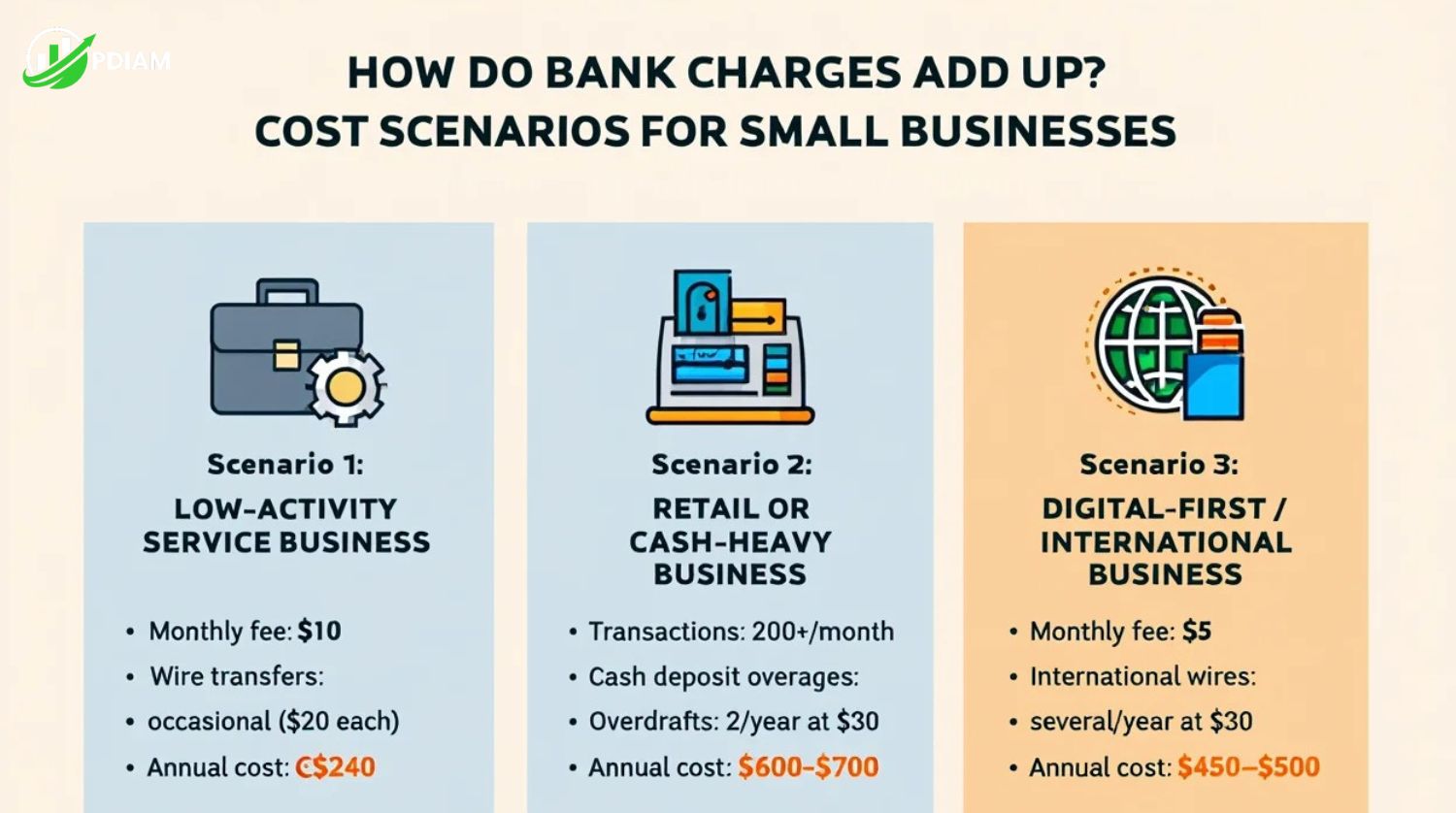

4. How do bank charges add up? Cost scenarios for small businesses

Understanding how bank charges accumulate over time is crucial for effective financial planning. Different types of small businesses face different banking costs depending on their transaction volume, cash handling, and banking behavior.

This section outlines three realistic annual cost scenarios for 2025, showing how small charges can add up quickly and impact your bottom line.

4.1. Low-activity service business

A service-based business with minimal banking activity pays fewer fees, but recurring charges still apply.

-

Monthly maintenance fee: $10

-

Transactions: 100/month (typically free)

-

Wire transfers: Occasional domestic wires at $20 each

-

Estimated annual cost: Around $240

While the fee load is relatively light, this business can still reduce costs by choosing a no-fee account or avoiding occasional wire charges.

4.2. Retail or cash-heavy business

Retail shops, restaurants, and other cash-intensive businesses incur higher fees due to transaction volume and frequent deposits.

-

Monthly maintenance fee: $15

-

Transactions: Over 200/month (some over-limit at $0.25–$0.40 each)

-

Cash deposit fees: ~$3/month for exceeding deposit thresholds

-

Overdraft incidents: Two per year at $30 each

-

Estimated annual cost: Between $600–$700

For such businesses, minimizing cash handling and tracking transaction volume can prevent excessive charges.

4.3. Digital-first or international business

Online or remote-based companies working across borders may pay lower basic fees but accumulate wire transfer costs.

-

Monthly maintenance fee: $5

-

Transactions: 150/month, mostly within free limit

-

International wire transfers: Multiple per year at ~$30 each

-

Estimated annual cost: Between $450–$500

These businesses benefit from choosing fintech banks or accounts with lower wire fees and no hidden charges.

Real Example: A small bakery was paying around $500 annually due to frequent overdrafts and excess cash deposit fees. After switching to an online business account with waived deposit limits and activating a linked credit line for overdraft protection, they eliminated most recurring charges.

This change directly improved their yearly profit margin without altering operations. As these examples show, bank fees can quickly erode profits if left unmanaged. By reviewing your usage patterns and switching to an account that fits your operational style, you can significantly reduce costs over the year.

5. Strategies to minimize or avoid bank charges

Minimizing the average bank charge for a small business in 2025 requires consistent oversight and smart financial planning. Many bank fees are avoidable with the right mix of account features, usage habits, and negotiation.

Reducing fees takes planning and regular review. Consider these actions:

-

Maintain required balances to waive monthly fees

-

Track transactions to stay within free limits

-

Stagger cash deposits to avoid crossing thresholds

-

Use fintech platforms with flat-fee models

-

Negotiate directly with your bank for better terms

-

Regularly check fee disclosures for updates

-

Use overdraft protection services

Pro Tip: Call your bank and ask, Are there options to waive fees if I maintain activity or move all business accounts here? You may be surprised by what they offer.

6. How to choose the best business account for your needs (2025)

Selecting the right business account isn’t just about finding the lowest fees, it’s about ensuring the account fits your operational style, payment volume, and future growth. In 2025, with banking fees and digital services evolving quickly, business owners must take a strategic approach when evaluating financial partners.

Here’s a comprehensive checklist to help you compare and choose the best account for your business:

-

Monthly fees and waiver conditions

Check whether there is a monthly maintenance charge and under what conditions it can be waived, such as maintaining a minimum balance or enrolling in paperless billing. -

Free vs. paid transactions

Many banks offer a set number of free transactions (usually 100–200). After that, you may pay $0.15 to $0.50 per transaction. Choose an account that aligns with your expected transaction volume. -

Cash deposit allowances

If your business handles cash, pay close attention to how much you can deposit for free each month. Depositing over the threshold (typically $5,000–$10,000) may trigger fees of $0.10–$0.50 per $100. -

Wire transfer costs

Domestic transfers typically cost $10–$25; international transfers can run $25–$50. If your business sends frequent wires, especially globally, look for fintech options with lower fees. -

Overdraft and NSF policies

Review the bank’s policy on overdraft and non-sufficient funds (NSF) charges. These fees can add up quickly, ranging from $15 to $35 per incident. Consider linking a backup account or using overdraft protection. -

Digital tools and integrations

Evaluate whether the account offers useful digital features like expense tracking, invoicing, integration with accounting software (e.g., QuickBooks), and mobile access. -

Support and accessibility

Do you need 24/7 customer service? Will you visit a branch regularly? Some banks offer live chat or phone support, while others rely on self-service portals. -

Security features

Look for two-factor authentication, real-time fraud alerts, and FDIC insurance. Cybersecurity is non-negotiable in 2025’s digital-first banking environment. -

Required documentation

Know what documents are needed to open the account based on your business structure (LLC, sole proprietorship, corporation). This prevents delays during onboarding. -

Reputation and customer reviews

Read recent reviews to learn about other business owners’ experiences. Watch for issues like unexpected fees, poor support, or platform reliability.

The best business account isn’t the one with the most features, it’s the one that fits your transaction habits, helps you avoid unnecessary fees, and grows with your company. Take the time to compare at least three providers before making your final decision.

Want to learn more stuffs like this, check out our:

- How many hours in working week? Full breakdown [2025]

- The Ultimate guide: What is A section 125 Cafeteria plans and benefits

- Critical guide: Is Boss firing someone for violating legal? [2025]

7. FAQs on average bank charge for a small business

Q1: What counts as a transaction?

Any credit or debit movement, including ACH, checks, and card activity.

Q2: How are international wires handled?

Banks charge higher rates and may include intermediary bank fees. Expect $25–$50 total.

Q3: Are fintech banks safe for business?

Yes, if they are FDIC-insured and use secure systems. Always verify credentials.

Q4: Can I negotiate or get fees waived?

Yes. Many banks waive fees for loyal or new business customers.

Q5: Are there legal caps on bank fees?

No federal cap exists, but transparency laws require clear disclosures.

Q6: What happens during an overdraft?

A fee of $15–$35 is charged. Some banks also charge interest until it’s resolved.

Q7: Can I be charged for paper statements?

Yes. Many banks charge $2–$5/month unless you opt for e-delivery.

8. Conclusion: Average bank charge for a small business

Understanding the average bank charge for a small business allows entrepreneurs to make smarter financial decisions, improve cost control, and avoid unnecessary banking expenses.

Key takeaways:

-

Monthly maintenance fees typically range from $5–$20, but many can be waived with minimum balances.

-

Transaction and wire transfer fees often drive up total costs if unmanaged.

-

Cash-heavy businesses face higher deposit fees; choosing the right bank matters.

-

Online banks offer lower fees but have fewer in-person services.

-

Proactive management and reviewing statements regularly can prevent fee surprises.

As the banking landscape evolves in 2025, small businesses that actively monitor their bank usage and optimize account features will gain a measurable financial advantage.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.