Can a felon buy a house in 2025? The straightforward answer is yes. Federal and state laws do not prohibit people with felony convictions from purchasing or owning property. This topic ranks among the most searched because homeownership represents stability and a fresh start for many Americans with criminal records.

With nearly 7 million Americans living with felony records, buying a home can play a crucial role in successful reintegration. Though myths persist, a felony does not legally block you from becoming a homeowner.

However, the journey can involve complex steps, especially regarding mortgages, lender risk assessments, and housing programs. This article breaks down the legal facts, real-world barriers, loan opportunities, and actionable strategies that can help felons become first-time homebuyers in 2025.

1. Can a felon buy a house?

Legally, felons have the right to buy real estate in every U.S. state. Neither federal nor state law bans homeownership due to a felony.

You can buy a house with cash or with financing, but mortgages can introduce complications.

Key facts:

-

Felons can legally purchase property with cash like any other buyer.

-

Mortgage approval is possible but varies by lender and felony type.

-

Certain housing programs (e.g., Section 8 rentals) may deny eligibility based on criminal history.

According to the U.S. Department of Housing and Urban Development (HUD), homeownership is a civil right that remains intact even after a felony conviction. Still, securing a loan can be the biggest hurdle.

2. Legal rights vs. real-world barriers

Though the law does not prohibit felons from owning homes, practical obstacles, especially around financing, often arise. Cash purchases are unrestricted, but not everyone has that luxury.

Mortgage lenders evaluate risk. A felony, especially a recent or financial-related one, can raise concern.

How different felonies may affect lender perception:

-

Financial crimes (e.g., fraud, identity theft): Often viewed as high risk; lenders may reject or request extensive documentation.

-

Violent crimes: May be scrutinized based on recency and severity.

-

Drug offenses: Case-by-case; recent drug-related felonies may be flagged.

-

Moral turpitude: Can disqualify depending on the loan type and lender policies.

-

Expunged or old records: May be forgiven or excluded from underwriting.

Pro tip: Some smaller banks or credit unions may focus more on your financial profile than your criminal history, always shop around.

View more:

- Powerful social media for small business marketing

- Best Telephone system for small business

- What’s the cheapest franchise to open

3. How a felony record impacts mortgage approval

Mortgage approvals depend on factors like credit score, income, employment history, and debt-to-income ratio.

A felony adds a risk variable during the underwriting process.

Mortgage background check checklist:

-

Felony type and severity

-

Time since conviction or release

-

Record status (e.g., closed case, pending charges)

-

Character references or proof of rehabilitation

-

Effect on credit behavior

-

Loan type: FHA, VA, USDA, or conventional

-

Lender-specific policies

-

Size of down payment

-

Availability of cosigners

Real example: In 2025, FHA loans allow certain felony records if borrowers prove rehabilitation and time has passed since conviction. VA and USDA loans assess background differently but apply case-by-case logic.

4. Home loans for felons: Mortgage and alternative financing options

Felons exploring homeownership in 2025 have multiple financing paths, including some programs built to provide second chances.

4.1. Common loan options

-

FHA loans for felons: Flexible credit requirements and consideration of rehabilitation.

-

VA loans: Available for qualified veterans; case-by-case for criminal history.

-

USDA loans: Target rural buyers with stricter criminal background filters.

-

Conventional loans: Strictest credit and background checks.

4.2. Alternative routes for financing

-

Community banks and credit unions: More personal review of felony cases.

-

Private lenders: Looser criteria but higher interest rates.

-

Seller financing: Buy directly from sellers to skip bank scrutiny.

-

Lease-to-own programs: Good for rebuilding credit while living in the home.

-

Cosigners: Trusted friends or relatives can increase lender confidence.

-

Larger down payments: Reduces risk and increases approval chances.

| Option | Pros | Cons |

|---|---|---|

| FHA Loan | Low credit required, flexible | Proof of rehab often needed |

| Private Lender | Fast approval | High interest, short terms |

| Seller Financing | No bank involved | Not always available |

| Lease-to-Own | Time to rebuild credit | Risk of losing investment |

5. Fair Housing Law, discrimination & criminal background

The Fair Housing Act (FHA) prohibits discrimination based on race, religion, or national origin, but not specifically criminal history.

That said, housing providers cannot apply blanket bans if doing so disproportionately affects protected groups.

Key legal protections

-

You cannot be denied for an old or sealed felony alone.

-

Lenders must give written reasons for denial upon request.

-

Discriminatory screening can be reported to HUD or local agencies.

-

Some state and city laws extend greater protections to ex-offenders.

-

Legal aid organizations help fight unjust denials.

Recent lawsuits in 2024–2025 have expanded awareness of unjust housing rejections. Know your rights before applying.

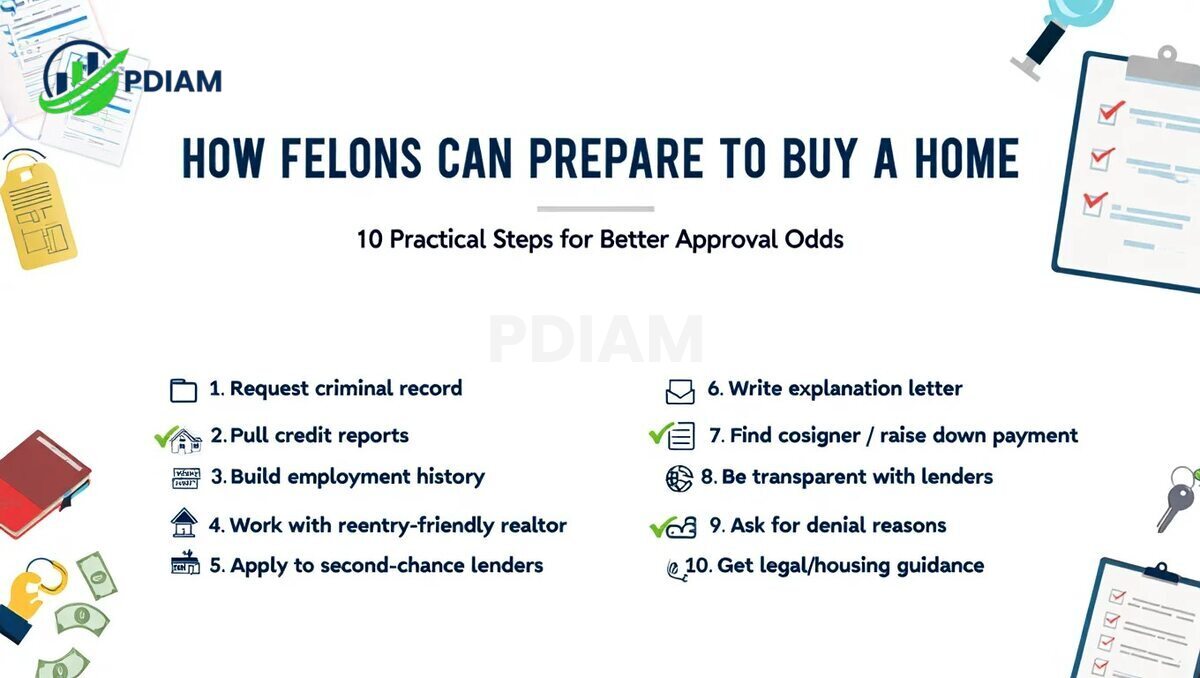

6. Step-by-step: How felons can prepare to buy a home

Taking control of the home buying process means preparation. Use this checklist to improve your approval odds:

-

Request your full criminal record to confirm accuracy.

-

Pull credit reports from all three bureaus and fix any errors.

-

Build stable employment history, document income thoroughly.

-

Work with realtors familiar with felony reentry housing.

-

Apply to second chance lenders or programs.

-

Write a letter of explanation for your felony and show rehabilitation.

-

Find a cosigner or increase your down payment, if needed.

-

Be upfront with lenders, transparency builds trust.

-

Request reasons if denied, then adjust before reapplying.

-

Consult housing counselors or legal professionals for guidance.

These steps help turn legal eligibility into actual homeownership success.

Want to learn more stuffs like this? Check out our related articles:

- How much is gap coverage insurance? Smart buyer tips [2025]

- What is Push and Pull marketing? A simple breakdown [2025]

- The ugly shocking truth: Can you pay DoorDash with Cash? [2025]

7. Frequently asked questions about felons and buying a home

Q1: Does a felony show up on a mortgage background check?

A: Yes. Most lenders run criminal background checks during the underwriting process.

Q2: Are there waiting periods before applying for a mortgage?

A: Some lenders prefer at least 3–7 years post-conviction, especially for serious offenses.

Q3: Does the type of felony matter?

A: Absolutely. Financial, violent, and recent offenses carry more risk in lender evaluations.

Q4: What if my felony was expunged or sealed?

A: Expunged records may not appear, but policies vary by lender and state.

Q5: Can felons buy a house in every U.S. state?

A: Yes. No state bans felons from purchasing or owning property.

Q6: Will banks explain why I was denied?

A: Yes. Under federal law, you can request the reasons in writing.

Q7: Are there first-time home buyer programs for felons?

A: Yes. FHA loans and community grants may support felon reentry into homeownership.

8. Conclusion

So, can a felon buy a house? Yes, egally, you can. But success depends on preparation, financial health, and knowing your rights.

Here’s a quick recap:

-

Felons can legally purchase homes in all states.

-

Mortgages are accessible but depend on the lender and offense type.

-

FHA, VA, and community-based programs may offer pathways.

-

Alternative financing can bridge the gap when traditional loans fail.

-

Understanding credit, background checks, and discrimination laws is crucial.

-

Preparation, including documentation and counseling, can greatly improve outcomes.

Whether you’re applying for FHA loans for felons, exploring home loans for felons with bad credit, or just starting your journey, homeownership is within reach in 2025.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.