In today’s fast-paced business environment, understanding the difference between accounts payable and accounts receivable is essential for anyone managing finances, running a business, or studying accounting. These two terms are fundamental to tracking the movement of cash in and out of a company, and confusing them can lead to serious cash flow issues.

In fact, a 2023 survey by the Finance Professionals Network found that over 40% of mid-sized businesses experienced operational disruptions due to errors in managing AP and AR.

This guide breaks down the definitions, key differences, financial statement placement, and practical strategies to help you manage both effectively in 2025 and beyond.

1. What are accounts payable and accounts receivable?

Before diving into differences, it’s important to clearly define each term.

Though closely related, accounts payable (AP) and accounts receivable (AR) reflect opposite sides of a company’s financial activity.

1.1. What is accounts payable (AP)?

Accounts payable refers to the amount a business owes to its suppliers or vendors for goods and services received but not yet paid. It’s considered a current liability on the balance sheet and represents a future outflow of cash.

Example: A retailer purchases $5,000 of inventory on credit. Until paid, the $5,000 owed is recorded under accounts payable.

1.2. What is accounts receivable (AR)?

Accounts receivable is the amount a business is owed by customers for goods or services delivered on credit. It is categorized as a current asset because it represents expected incoming cash.

Example: A design agency completes a project and sends a $3,000 invoice to a client. Until paid, this amount is listed under accounts receivable.

2. Key feature comparison

The table below summarizes the foundational differences between AP and AR for quick reference:

| Feature | Accounts Payable | Accounts Receivable |

|---|---|---|

| Definition | What your business owes others | What others owe your business |

| Financial Statement | Current Liability | Current Asset |

| Cash Flow Direction | Outflow (payments) | Inflow (collections) |

| Typical Balance Type | Credit | Debit |

| Example | Supplier bill | Customer invoice |

These distinctions are foundational for understanding how money flows through a business.

2.1. Comparison by purpose and direction

Let’s break down the distinctions across five essential dimensions:

-

Who owes whom?

-

AP: You owe others (vendors, suppliers).

-

AR: Others owe you (clients, customers).

-

-

Balance sheet placement

-

AP: Listed under current liabilities, reflecting obligations.

-

AR: Listed under current assets, indicating expected inflows.

-

-

Accounting entry type

-

AP: Entered as a credit, increasing liabilities.

-

AR: Entered as a debit, increasing assets.

-

-

Cash flow direction

-

AP: Represents outgoing cash (payments to vendors).

-

AR: Reflects incoming cash (payments from customers).

-

-

Departmental responsibility

-

AP: Managed by the accounts payable or procurement team.

-

AR: Overseen by the accounts receivable or credit/collections team.

-

Pro Tip: Think of AP as your business’s outbox (cash going out) and AR as the inbox (cash coming in). This mental model helps reduce confusion.

2.2. Summary comparison table

Here’s a simplified side-by-side breakdown of the key attributes:

| Aspect | Accounts Payable (AP) | Accounts Receivable (AR) |

|---|---|---|

| Nature | Money owed by the business | Money owed to the business |

| Statement Classification | Current Liability | Current Asset |

| Cash Movement | Payment outflows | Collection inflows |

| Managed by | AP / Procurement team | Credit / AR team |

Both AP and AR are fundamental to working capital management. Monitoring them in tandem ensures businesses have the cash they need to operate smoothly and avoid shortfalls or missed opportunities.

3. How AP and AR work in real business cycles

To fully understand the difference between accounts payable and accounts receivable, it’s helpful to see how each functions within a real business workflow. AP and AR follow structured cycles that determine when and how money moves through an organization. Below, we walk through both processes step-by-step.

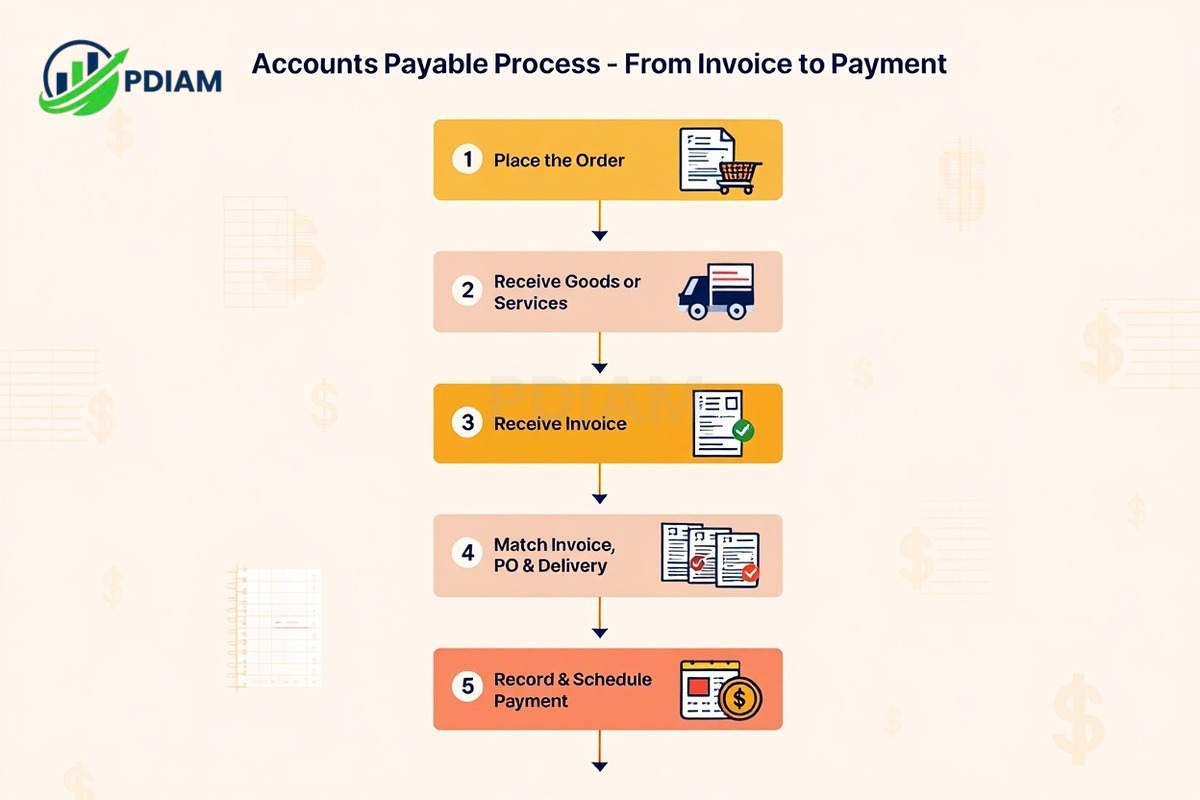

3.1. Accounts payable process (invoice to payment)

The accounts payable cycle involves recording and settling obligations to suppliers. Each step in the process ensures the business only pays for what it has received and approved.

-

Step 1: Place the order

The business initiates a purchase by submitting a purchase order to a supplier. -

Step 2: Receive goods or services

The vendor delivers the requested items or services to the business. -

Step 3: Receive invoice

The supplier sends an invoice referencing the delivered goods or services. -

Step 4: Match invoice with PO and delivery receipt

The AP team performs a three-way match to verify accuracy before payment. -

Step 5: Record and schedule payment

Once verified, the invoice is entered into the system and a payment date is assigned.

Key documents: Purchase order, supplier invoice, receiving report, and payment voucher.

This cycle ensures vendor obligations are fulfilled accurately and timely, preventing payment disputes and late fees.

View more:

- Financial goal setting examples: Practical strategies and actionable steps for success in 2025

- Saving money on a low income: A comprehensive 2025 Expert guide

- 2025’s Ten top Billionaires in the World ranked

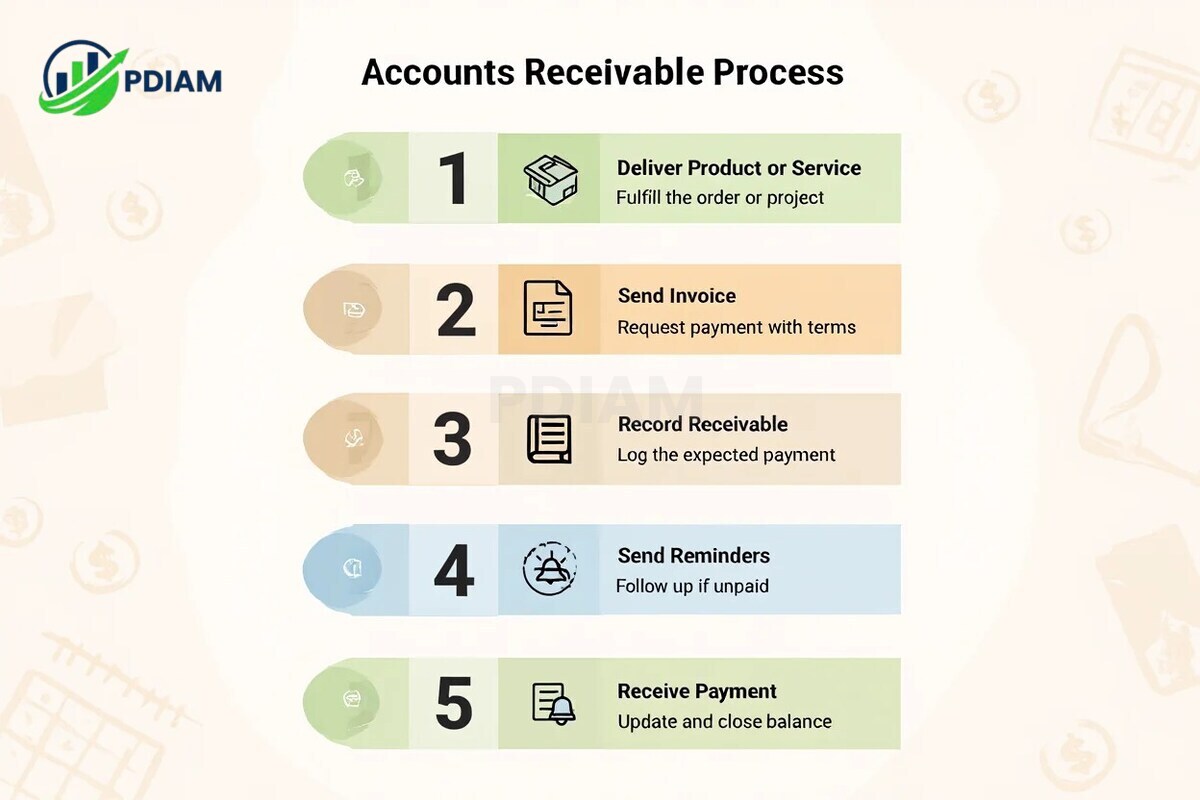

3.2. Accounts receivable process (sale to collection)

The accounts receivable cycle focuses on collecting payment for goods or services delivered. A well-managed AR process improves cash flow and reduces bad debt risk.

-

Step 1: Deliver product or service

After fulfilling an order or completing a project, the business initiates billing. -

Step 2: Send invoice to customer

The customer receives a formal request for payment, often including due date and terms. -

Step 3: Record the receivable

The AR team logs the outstanding amount into the system as an asset. -

Step 4: Issue reminders and follow-ups

As the due date approaches, automated or manual reminders are sent if unpaid. -

Step 5: Receive and record payment

Once the customer pays, the AR team updates the system and clears the outstanding balance.

Key documents: Sales order, customer invoice, payment receipt, and account statement.

This process ensures revenue is realized and recorded in a timely, trackable manner.

Real Example:

A wholesaler purchases components from a supplier on credit (AP), assembles them into products, and ships them to distributors who receive invoices (AR). Managing both sides ensures the company doesn’t overextend on purchases or miss opportunities to collect revenue.

4. Where do AP and AR appear on the financial statements?

On the balance sheet, these accounts are reported under different sections:

-

Accounts payable: Current liabilities → Indicates upcoming cash obligations.

-

Accounts receivable: Current assets → Indicates expected future cash inflows.

Their placement impacts liquidity ratios, such as:

-

Current ratio = Current assets ÷ Current liabilities

-

Working capital = Current assets − Current liabilities

A high AR balance may signal strong future income, or risk of overdue accounts. A high AP balance may mean cash is tight, or well-managed vendor terms.

5. Impact of AP and AR on financial strategy

Effective AP and AR management influences everything from vendor trust to expansion funding. Poor handling leads to:

-

Missed payments and late fees

-

Lost revenue due to bad debts

-

Damaged business relationships

-

Inaccurate reporting and budgeting

On the flip side, strong management contributes to financial agility, better borrowing terms, and improved forecasting.

6. Common pitfalls and best practices

Efficient management of accounts payable (AP) and accounts receivable (AR) is crucial to maintaining liquidity and strong business relationships. Yet, many companies still struggle with common operational errors.

This section outlines frequent pitfalls and offers practical, proven strategies to manage both functions effectively.

6.1. Common AP & AR mistakes

Even mature finance teams can fall into avoidable traps. Below are some of the most common issues:

-

Processing invoices late, resulting in penalties

Missed deadlines not only lead to fees but may damage relationships with key vendors. -

Not matching invoices with purchase orders

This increases the risk of paying incorrect or fraudulent invoices. -

Ignoring overdue receivables

Delayed collections affect cash flow and increase the chance of bad debt. -

Lacking payment terms clarity

Vague or inconsistent terms confuse customers and vendors, delaying transactions. -

Manual errors during entry or reconciliation

Data input mistakes can skew reports and delay month-end closing.

Understanding these mistakes is the first step in building a more resilient finance process.

6.2. Best practices for accounts payable

Strong AP practices help avoid late payments, improve vendor trust, and reduce fraud risk:

-

Process and approve invoices quickly

Delays in internal approvals can cause missed due dates and strained supplier relationships. -

Use automation and approval workflows

Digitized processes reduce bottlenecks and minimize manual handling. -

Match invoices with POs and receipts

This three-way match confirms that the goods or services were authorized and delivered. -

Maintain audit trails and approval logs

Every transaction should be traceable for internal reviews or external audits. -

Monitor for fraud or duplicate payments

Regular review and controls reduce exposure to errors and malicious activity.

These practices strengthen financial controls and reduce operational risk.

6.3. Best practices for accounts receivable

Effective AR processes speed up collections, enhance customer communication, and improve cash flow:

-

Send invoices immediately after delivery

Prompt invoicing signals professionalism and improves payment speed. -

Clearly define payment terms on all invoices

Setting expectations early minimizes disputes and delays. -

Use automated reminders and escalation workflows

Gentle follow-ups reduce the need for aggressive collections later. -

Assess credit risk before extending terms

Credit checks protect your business from overexposure to risky customers. -

Reconcile accounts regularly and follow up diligently

Staying current on account balances prevents issues from snowballing.

Pro Tip: Implementing AP/AR automation software drastically reduces manual errors, improves efficiency, and shortens the cash cycle, especially in multi-entity or high-volume environments.

View more:

- Definitive guide: Is net income and net profit the same? [2025]

- How does workers’ comp affect tax return: What’s legal in 2025?

- What is an audited financial statement? Full Breakdown [2025]

7. Glossary of related financial terms

Understanding the terminology behind accounts payable and accounts receivable is essential for interpreting financial reports and ensuring accurate communication with stakeholders. Below is a glossary of key terms frequently encountered in AP and AR management:

| Term | Definition |

|---|---|

| Invoice | A bill requesting payment from a buyer |

| Credit | An entry that increases liabilities or reduces assets |

| Debit | An entry that increases assets or reduces liabilities |

| Purchase Order | A formal request to a vendor for goods/services |

| Accrual | Recognition of revenue/expenses before cash is exchanged |

| Audit Trail | Chronological record of accounting transactions |

| Payment Terms | Contractual timing and method for paying an invoice |

| Current Asset | Expected to be converted into cash within 12 months (e.g., AR) |

| Current Liability | Obligations to be paid within 12 months (e.g., AP) |

| Reconciliation | The process of matching records to ensure accuracy and completeness |

These terms form the foundation of financial operations, and mastering them ensures clear communication between finance teams, vendors, and auditors alike.

8. Rapid reference: AP vs AR comparison table

For a quick comparison of the key characteristics between accounts payable and accounts receivable, use the table below. It’s designed as a rapid recap of the core differences outlined in earlier sections.

| Attribute | Accounts Payable | Accounts Receivable |

|---|---|---|

| Definition | Money owed to others | Money owed to you |

| Balance Sheet Line | Current Liability | Current Asset |

| Cash Flow Direction | Outflows (payments) | Inflows (collections) |

| Business Example | Supplier invoice | Customer invoice |

This table offers a quick reference to reinforce everything covered above.

9. Strategic importance of AP and AR in 2025

In today’s digital economy, managing AP and AR isn’t just about avoiding errors, it’s about enabling strategic growth. Timely payments build supplier trust; timely collections fund innovation.

With automation, AI, and smarter dashboards, finance teams now play a central role in:

-

Forecasting cash flow

-

Reducing working capital strain

-

Driving customer and vendor satisfaction

-

Minimizing financial risks

Ignoring AP/AR optimization means falling behind on both efficiency and competitiveness.

10. FAQs: Accounts payable vs. accounts receivable

10.1. Can one person manage both AP and AR?

Yes, especially in small businesses. But separation of duties is better for internal control.

10.2. What is a credit note?

A document issued to correct an invoice or refund part of a charge.

11.3. Which documents are essential for AP/AR?

-

AP: Purchase orders, supplier invoices, payment vouchers

-

AR: Sales orders, customer invoices, receipts

10.4. What’s the difference between AP and AR turnover?

-

AP turnover = How fast a business pays suppliers

-

AR turnover = How fast it collects from customers

10.5. What happens if records are incorrect?

Inaccurate AP/AR can lead to missed payments, cash shortages, or accounting errors.

10.6. Is AR more important than AP?

Both are vital. AP controls cash going out; AR ensures cash comes in. Balance is key.

11. Conclusion

Understanding the difference between accounts payable and accounts receivable is essential for financial health in 2025. AP tracks your business’s obligations; AR tracks what’s owed to you.

Summary:

-

AP = Money out | Liability | Managed by AP team

-

AR = Money in | Asset | Managed by AR/collections

-

Both affect cash flow, creditworthiness, and vendor/client relationships

-

Automation and best practices improve efficiency and accuracy

Mastering AP and AR helps protect liquidity, build trust, and support growth.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.