Understanding the difference between accrual and cash basis accounting is essential for businesses in 2025. These two methods determine when revenues and expenses are recorded, impacting financial clarity, tax reporting, and compliance.

Choosing the right method affects budgeting, forecasting, and decision-making. In this guide, we’ll explain each method, compare them side by side, and help you decide which approach fits your needs.

1. What Are Accrual and Cash Basis Accounting?

When it comes to tracking business finances, understanding the difference between accrual and cash basis accounting is critical.

These two fundamental accounting methods define how and when income and expenses are recorded, and ultimately shape how a business views its profitability, cash flow, and tax obligations.

1.1. Accrual Basis Accounting: Definition & Characteristics

Accrual accounting records revenues and expenses when they are earned or incurred, not necessarily when money is received or paid. This method aligns with the matching principle, ensuring that expenses are reported in the same period as the revenues they help generate.

Key characteristics:

-

Income is recorded when it is earned, even if not yet paid

-

Expenses are recorded when incurred, not when payment occurs

-

Provides a more accurate financial picture of business performance

-

Required for compliance with GAAP and IFRS standards (especially for larger or public companies)

Example:

A service completed in December but paid for in January would be recorded as income in December under the accrual method.

Why it matters: Accrual accounting helps reflect the true economic activity of a business, which is essential for forecasting, strategic planning, and attracting investors.

1.2. Cash Basis Accounting: Definition & Characteristics

Cash basis accounting, on the other hand, only records transactions when cash changes hands. It is simpler and commonly used by small businesses, freelancers, or sole proprietors who don’t carry inventory or face complex compliance needs.

Key characteristics:

-

Income is recorded when cash is received

-

Expenses are recorded when cash is paid

-

Minimal bookkeeping, easier to manage without advanced tools

-

Does not reflect outstanding invoices or unpaid liabilities

Example:

If a client pays in March for work done in January, the revenue is recorded in March under the cash method.

Why it matters: This method offers a clear view of actual cash on hand but may understate or overstate financial health, especially for growing businesses with delayed payments or payables.

While cash basis may be easier to implement, accrual accounting gives a clearer long-term view and is often mandatory for businesses meeting revenue or regulatory thresholds. Your choice of method affects everything from tax filings to investor reports, so understanding both is essential before choosing one.

2. Key difference between accrual and cash basis accounting

The primary difference between accrual and cash basis accounting lies in when revenues and expenses are recorded.

-

Accrual method: Recognizes income when earned and expenses when incurred, regardless of cash movement.

-

Cash method: Recognizes income and expenses only when money is actually received or paid.

Comparison by transaction type:

| Transaction Type | Accrual Basis | Cash Basis |

|---|---|---|

| Sale on credit | Income at time of sale | Income when payment is received |

| Expense incurred, paid later | Expense at time incurred | Expense when payment is made |

| Loan received | Recorded as liability | Recorded when cash is received |

Pro tip: Accrual accounting is mandatory for public companies and inventory-based businesses under GAAP/IFRS standards.

3. Side-by-side comparison table

To help visualize the difference between cash and accrual method, here is a direct comparison across five key aspects:

| Aspect | Accrual Basis | Cash Basis |

|---|---|---|

| Regulatory Compliance | GAAP/IFRS compliant | Allowed for small businesses only |

| Complexity | Requires trained accounting support | Easy for non-accountants |

| Financial Accuracy | More accurate and forward-looking | May omit liabilities or receivables |

| Typical Users | Corporations, inventory-heavy firms | Freelancers, sole proprietors |

| Tax Implications | Revenue and expenses match activity period | Based on timing of cash movement |

Each method serves a different business need. Accrual vs cash accounting is not about good vs bad, but fit for purpose.

Below articles might interested you:

- What is Fiduciary Liability insurance coverage? Must-know facts [2025]

- Can a felon buy a house? Rights, rules, and risks [2025]

- How much is gap coverage insurance? Smart buyer tips [2025]

4. Practical examples of accrual vs. cash basis

Real-world scenarios help clarify how accrual method vs cash method affects financial records.

Example 1 – Sale on credit

-

Scenario: A product is sold on December 15; payment is received in January.

-

Accrual: Records the income in December.

-

Cash: Records the income in January when payment arrives.

Example 2 – Expense incurred, paid later

-

Scenario: Supplies are received in March; payment is made in May.

-

Accrual: Records the expense in March.

-

Cash: Records the expense in May when payment is made.

These examples show how each method impacts reported profit and expense timing.

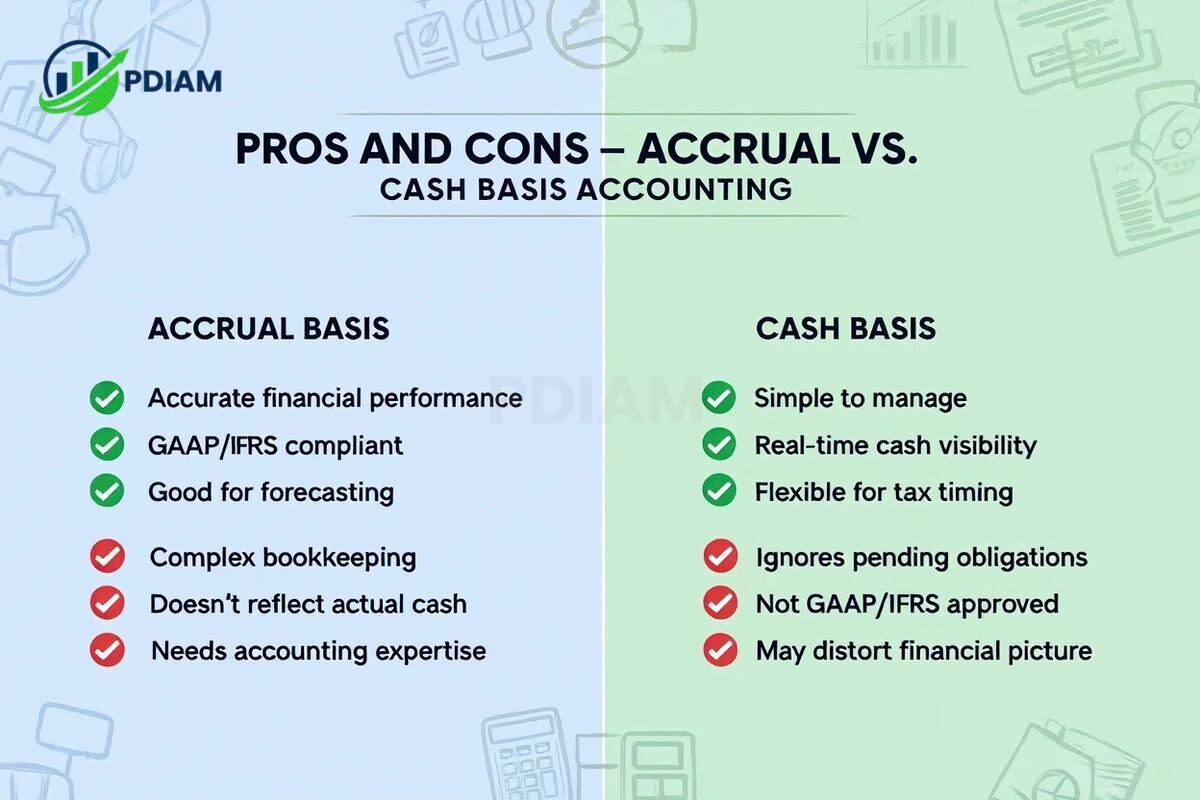

5. Pros and cons of each method

Let’s evaluate the benefits and limitations of both accounting methods.

Below are detailed comparision:

5.1. Accrual basis

Pros:

-

Provides accurate financial performance across periods

-

Complies with GAAP and IFRS

-

Better for long-term planning, forecasting, and budgeting

-

Captures full obligations and receivables

Cons:

-

Requires complex bookkeeping

-

May not clearly reflect available cash

-

Needs professional accounting tools or expertise

5.2. Cash basis

Pros:

-

Simple and easy to manage

-

Offers a clear view of actual cash on hand

-

Useful for managing tax timing by shifting payments

Cons:

-

Misses unpaid obligations or future receivables

-

Not accepted under GAAP or IFRS

-

Can mislead owners about profitability or liabilities

Real example: A tech startup using cash basis appeared profitable until switching to accrual, which revealed unpaid vendor bills and net losses.

6. Who Should Use Each Method & Regulatory Requirements

Choosing between the cash vs accrual method is not just about preference, it depends on your business’s structure, industry, and legal obligations. Understanding when each method applies is essential for compliance, clarity, and accurate tax reporting.

6.1. Suitability by Business Type

Here’s a quick guide to determine which method best fits different business types:

| Business Type | Recommended Method |

|---|---|

| Freelancer or contractor | Cash basis |

| Public company | Accrual basis |

| Inventory-based business | Accrual basis (required) |

| Startup under $25M in revenue | Either method permitted |

-

Small businesses: May benefit from the simplicity of cash basis, especially those with straightforward transactions and no inventory.

-

Larger firms or those seeking funding: Usually require accrual basis for credibility, reporting precision, and investor confidence.

Pro tip: If your business holds inventory or seeks loans or investment, choose accrual even if it’s not yet required. It sets the foundation for long-term financial health.

6.2. Legal & Tax Implications

Government agencies such as the IRS and global regulators have specific rules around who can use each method:

-

IRS Threshold (2025): Businesses with gross receipts over $25 million must use the accrual method for tax reporting.

-

IFRS/GAAP compliance: International Financial Reporting Standards and Generally Accepted Accounting Principles require accrual for public or large entities.

-

Switching methods:

-

Requires formal IRS approval

-

Must be documented consistently in financial statements and tax filings

-

-

Inconsistency risks:

-

Using both methods interchangeably can trigger audits

-

May result in penalties or misfiled taxes

-

Businesses planning to scale or cross international borders should proactively adopt the accrual method to stay compliant and investor-ready.

The accrual basis vs cash basis decision should be based on your business’s complexity, growth trajectory, and legal environment. Always review with a qualified CPA or tax professional to ensure you’re not only compliant but also strategically positioned.

7. How to decide: Choosing between accrual and cash basis

Ask yourself:

-

What is your annual revenue and complexity?

-

Do you carry inventory or have accounts payable/receivable?

-

Do investors or partners require financial statements?

-

Is accurate forecasting critical?

-

Do you prioritize ease of use or accuracy?

-

Are you prepared to scale and switch methods later?

Choosing between accrual method vs cash method depends on growth stage, reporting needs, and compliance expectations.

8. Impact on financial reporting and business decisions

Your chosen accounting method, accrual or cash basis, directly affects how your financial data is interpreted, both internally and externally.

-

Accrual accounting offers deeper insights into profitability, helping businesses plan, budget, and make informed decisions. It aligns revenues and expenses with the period in which they occur, giving a more realistic view of financial performance.

-

Cash basis accounting, by contrast, emphasizes liquidity, making it easier to track actual cash on hand. However, it may fail to reveal outstanding obligations or upcoming revenues.

Stakeholders such as lenders, investors, and auditors typically prefer accrual-based reports, as they offer consistency and comply with reporting standards.

In summary: If your goal is strategic growth, external funding, or regulatory compliance, accrual accounting provides a stronger foundation. For simplicity and short-term focus, cash basis may suffice, but comes with limitations.

View more:

- How do you write a mission statement

- Cheapest business to start from home

- Financial goal setting examples

9. Compliance and regulatory overview

Understanding the legal requirements for each accounting method is critical to avoid fines or audit triggers.

-

Accrual accounting is required under both GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards). Public companies and large private firms must use this method.

-

Cash basis accounting is permitted only for businesses under certain revenue thresholds, usually small firms or sole proprietors. In the U.S., the IRS allows cash basis for businesses with less than $25 million in gross receipts (as of 2025).

-

Using both methods inconsistently, or switching without approval, can raise red flags during audits.

Regulators verify your accounting method through tax returns and official financial statements. Switching methods typically requires IRS approval and adjustments to prior-year reporting.

Maintaining compliance isn’t just about avoiding penalties, it’s about building trust with investors, lenders, and authorities.

10. Quick reference table

To wrap up, here’s a concise comparison of the difference between accrual and cash basis accounting:

| Feature | Accrual Basis | Cash Basis |

|---|---|---|

| Timing | When income/expenses are earned/incurred | When cash is received/paid |

| Complexity | Higher – requires more bookkeeping | Lower – simple to maintain |

| Accuracy | High – reflects true financial health | Medium – may omit key data |

| Ideal for | Growing firms, corporations, public companies | Freelancers, sole proprietors |

| GAAP/IFRS Compliant | Yes | No |

This quick reference table reinforces the difference between accrual and cash basis accounting across key aspects like timing, complexity, and compliance.

While accrual basis offers a more complete and regulation-ready financial view, cash basis remains a practical choice for smaller, less complex operations.

Selecting the right method means balancing ease of use with financial accuracy and compliance needs. The table above can serve as a decision checkpoint for startups, growing firms, and advisors when evaluating accounting systems.

11. Frequently asked questions & misconceptions

Q1: Is one method always better?

No. It depends on the business type, size, and regulatory requirements.

Q2: Can a business change methods after starting?

Yes, with approval and proper documentation.

Q3: Which method is more accurate?

Accrual, as it reflects earned revenue and obligations.

Q4: Are there tax benefits to either?

Cash basis allows payment timing flexibility; accrual offers better long-term alignment.

Q5: Can I switch from cash to accrual if my business grows?

Yes, but prepare your systems and team in advance.

Q6: Is cash basis always easier?

It’s easier for bookkeeping, but not always best for planning or compliance.

12. Conclusion

So, what is the difference between accrual and cash basis account? Choosing between accrual and cash basis accounting is one of the earliest, and most impactful, financial decisions a business will make.

-

Accrual: Offers a detailed, forward-looking view aligned with regulatory standards like GAAP and IFRS. Ideal for growing businesses, companies with inventory, or those seeking outside funding.

-

Cash: Simple and cash-focused, suitable for freelancers, startups, or microbusinesses with limited complexity and no external reporting requirements.

Key decision factors include:

-

Your business size and sales volume

-

The presence of inventory or complex transactions

-

Investor or regulatory expectations

-

Your capacity for detailed bookkeeping and compliance

Always consult a tax or accounting professional before choosing, or switching, your accounting method to ensure compliance and avoid costly errors.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.