Paystubs are more than just payment slips, they’re critical financial documents. They reflect your earnings, tax withholdings, and other payroll data for each pay period. But in 2025, a common question arises: do we need save previous companies paystubs?

The answer isn’t always simple. While you’re not always legally required to keep them, saving these documents can protect you in audits, support loan applications, and resolve disputes. This article from Pdiam helps you understand why, when, and how to store or dispose of paystubs from past employers to stay financially secure.

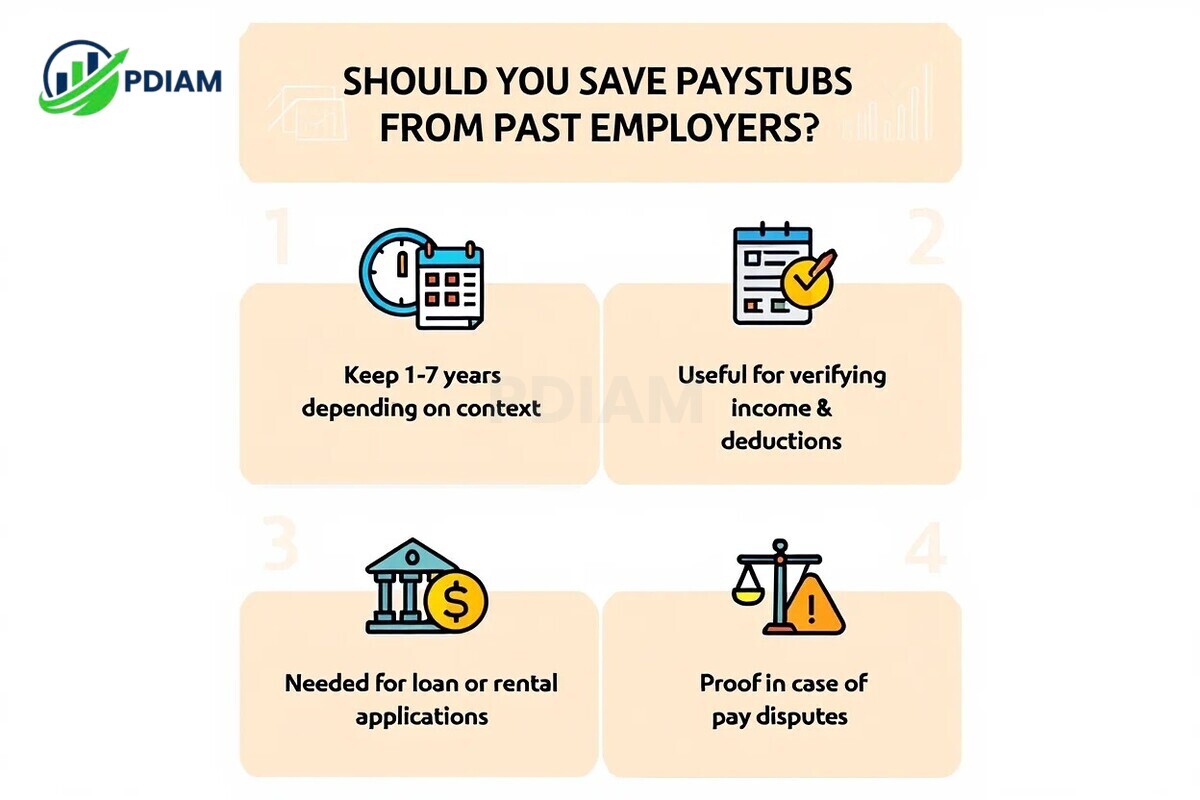

1. Quick summary: Should you save paystubs from past employers?

Before diving into the details, let’s address the main concern: do we need save previous companies paystubs?

The short answer is: yes. You should keep paystubs from former employers for at least one year after filing taxes. In many cases, it’s best to retain them for three to seven years, depending on your personal and legal circumstances.

These records are useful for tax filing, loan applications, income verification, and dispute resolution.

Here’s a quick reference table showing how long you should keep your paystubs based on common needs:

| Purpose | Recommended Retention Period |

|---|---|

| Tax filing | Minimum 1 year, ideally 3 years |

| Mortgage or loan applications | 3+ years |

| Proof of employment or income | As needed or indefinitely |

| Legal or wage disputes | Until fully resolved |

| Immigration or social services | Often 3–7 years |

Keeping old paystubs isn’t just good practice, it’s a proactive step to prevent unnecessary stress and complications down the road.

2. Do we need save previous companies paystubs?

This is one of the most frequently asked payroll-related questions in personal finance. The simple answer is: while you’re not legally required to keep past paystubs in most cases, it’s highly recommended that you do.

Employers have their own recordkeeping obligations. But employees, too, benefit greatly from keeping their own copies.

Why keeping paystubs helps employees:

Saving paystubs offers practical advantages across various financial and legal situations:

-

Supports tax filing: They serve as a personal record to verify W-2 or 1099 data and withholdings.

-

Strengthens dispute cases: In case of wage discrepancies or wrongful termination, paystubs act as vital proof.

-

Verifies income: Required for credit applications, apartment leases, or benefit eligibility.

-

Enables budgeting and planning: Paystubs reveal deductions, net income, and earnings trends.

Pro tip: If you’re a freelancer or frequently switch jobs, keeping all past paystubs can help bridge income verification gaps, especially during background checks or loan underwriting.

In essence, paystubs give you control over your income narrative, a critical asset in today’s financial landscape.

3. Over 30 practical reasons to save your paystubs

There are more reasons than you might think to keep your paystubs. Below is a comprehensive breakdown organized by common categories of use.

3.1. Tax purposes

Paystubs are an essential complement to your tax forms. They help you:

-

Verify income reported on W-2 or 1099 forms

-

Support IRS or state tax audits with precise documentation

-

Double-check federal and state withholdings for accuracy

-

Calculate deductions or credits more accurately

Real example: In 2022, a freelance graphic designer in Chicago used archived paystubs to prove underreported income on a 1099, leading to a corrected tax filing and avoidance of penalties.

3.2. Income and employment verification

Lenders, landlords, and government agencies frequently require proof of steady income. Paystubs help:

-

Demonstrate income during job or apartment applications

-

Support immigration filings with verifiable work history

-

Confirm income levels for Medicaid, SNAP, or housing aid

When trust and proof matter, your past paystubs speak louder than your word.

3.3. Legal and wage protection

When legal or labor issues arise, paystubs are often your best defense. They can:

-

Resolve unpaid overtime or wage disputes

-

Refute false claims about salary or hours worked

-

Back up employment claims in labor court or HR investigations

Paystubs serve as unbiased witnesses in any wage-related conflict, giving you legal leverage.

3.4. Loan and mortgage readiness

Before approving you for loans or credit, lenders want documentation of stable income. Paystubs help you:

-

Show consistent income across months or years

-

Strengthen loan or credit card applications

-

Prove job continuity and financial reliability

A well-maintained archive of paystubs can be the key to unlocking better financial opportunities.

3.5. Personal tracking and budgeting

Even if no third party ever sees them, paystubs are still valuable for personal planning. They help:

-

Track your earnings over time

-

Understand benefit deductions like health, retirement, or HSA contributions

-

Build realistic budgets based on take-home pay, not gross salary

Paystubs transform vague budgeting guesses into concrete financial planning.

3.6. Insurance and benefits

Applying for insurance or unemployment benefits? You’ll likely need proof of income. Paystubs can:

-

Verify previous earnings when applying for disability insurance

-

Support unemployment compensation claims

-

Document income changes for sliding-scale insurance premiums

Having past paystubs on hand accelerates claims and reduces the risk of rejection or delays.

3.7. Disputes and HR records

When confusion arises at work, or when transitioning between jobs, paystubs help:

-

Resolve discrepancies in final paycheck amounts

-

Reference timelines for PTO payouts, bonuses, or commissions

-

Support appeals for backpay or missed benefits

These reasons make a compelling case for keeping paystubs well beyond their pay period. Whether you’re defending your income, applying for support, or managing your own finances, they’re a valuable tool.

Final note for this section: Keeping your paystubs isn’t about paranoia, it’s about preparation. In a world where proof matters, paper trails protect.

View more:

- Financial planning tips for young adults

- Simple 50/30/20 budget rule explained

- Best money management apps for iPhone

4. How long should you keep paystubs?

Paystubs aren’t just temporary documents, they support your financial safety. The question of how long to retain them depends on your legal exposure, state law, and personal needs.

4.1. IRS and federal guidelines

The IRS recommends keeping tax-related documents, including paystubs, for at least three years after filing your tax return. This period covers the general statute of limitations for tax audits.

If you’ve underreported income by more than 25%, the IRS can audit up to six years. In cases of fraud or no filing, there’s no time limit, so document retention should be extended.

Pro tip: If you’re unsure about your tax situation or income accuracy, keep your paystubs for at least seven years to stay safe.

4.2. State law differences

Different states impose different recordkeeping obligations on employers. While employees are not always legally bound to retain records, it’s smart to align with your state’s recommendations.

Here’s a brief comparison:

| State | Employer retention | Suggested for employees |

|---|---|---|

| California | 3 years | 3–4 years |

| New York | 6 years | 3–6 years |

| Texas | 3 years | 3 years |

| Florida | 5 years | 3–5 years |

Matching both federal and state timelines gives you the best protection.

4.3. When to retain longer

There are scenarios where extended paystub retention becomes essential:

-

You are self-employed or an independent contractor

-

You’re involved in an IRS audit, legal dispute, or bankruptcy filing

-

You’re applying for immigration benefits or long-term government support

-

You work in a unionized sector or a public service job

The general rule? If in doubt, don’t throw it out.

5. Legal obligations vs. best practices

Legal requirements apply more strictly to employers than employees.

But from a risk-management perspective, employees benefit by following best practices.

5.1. Employers’ legal duties

Under federal and most state labor laws, employers must:

-

Provide paystubs upon request or by default

-

Retain payroll records for 3–7 years based on jurisdiction

-

Ensure transparency and access for compliance and disputes

5.2. Employees’ recommended approach

Here’s a simple guide to what’s recommended:

| Practice | Required? | Why it matters |

|---|---|---|

| Save paystubs for at least 3 years | ❌ No | Helps with IRS audits and loan verification |

| Store securely (paper or digital) | ❌ No | Prevents loss or identity theft |

| Keep paystubs related to disputes longer | ❌ No | Ensures legal protection |

| Retain longer if self-employed or audited | ❌ No | Supports irregular income documentation |

Even without legal mandates, maintaining a personal archive is a smart, low-effort way to avoid future stress.

6. Paper vs. digital: Best way to store paystubs in 2025

Choosing how to store your paystubs depends on your habits and tech comfort. Let’s compare options.

6.1. Paper storage

Pros:

-

Easy to retrieve without tech

-

Great for non-digital users

Cons:

-

Vulnerable to fire, water, or misplacement

-

Harder to search or organize chronologically

6.2. Digital storage

Pros:

-

Space-efficient and easily searchable

-

Backups can be automated and encrypted

Cons:

-

Needs proper digital security (passwords, 2FA)

-

Risk of hacking or deletion without backup

Recommended digital tools:

-

Google Drive with 2-factor authentication

-

Dropbox with encrypted folders

-

External encrypted hard drives (e.g., SSD with BitLocker)

-

Financial software like QuickBooks or Zoho with document uploads

Real example: A gig worker from Denver digitized all his paystubs using Google Drive. When applying for a car loan, he presented PDFs of his earnings from three clients, ensuring a smooth approval process.

7. How to digitize your paystubs effectively

Creating a digital backup of your paystubs isn’t complicated. Just follow these steps:

-

Scan with a smartphone or scanner

-

Apps: Adobe Scan, CamScanner, Microsoft Lens

-

-

Save as PDF files for universal access

-

Name files clearly:

Company_2025_03_March.pdf -

Organize by folders:

/Paystubs/2025/EmployerName -

Backup to both cloud storage and external drives

Privacy tips:

-

Use strong, unique passwords for cloud accounts

-

Enable two-factor authentication (2FA)

-

Avoid public Wi-Fi when accessing sensitive files

-

Update software and apps regularly

Following these guidelines ensures your digital archive stays safe and usable for years.

View more:

- What is a PPO health plan? Benefits you can’t ignore [2025]

- Do you get a severance package if you get fired? Know your rights [2025]

- Which statements about the accrual-based method of accounting are true? Must-Know in 2025

8. When and how to securely dispose of paystubs

You shouldn’t keep documents forever. Once your paystubs have served their purpose, it’s time to dispose of them safely.

8.1. Disposal timeline

Dispose of old paystubs when:

-

You’ve filed your taxes and cleared refund or liability

-

There are no ongoing legal or financial concerns

-

Documents are older than your retention policy

For most people, that means disposal after 3–7 years, depending on context.

8.2. Disposal method

| Format | Secure disposal method |

|---|---|

| Paper | Cross-cut shredder (not strip-cut) |

| Digital | Overwriting software (e.g., Eraser, CCleaner), or built-in secure delete |

Don’t forget to delete cloud backups and synced folders to prevent accidental retrieval or leaks.

Pro tip: Set an annual reminder to review and purge old paystub files securely.

9. What if you lose or never received old paystubs?

Paystubs may go missing for many reasons, lost documents, changing jobs, or employers using third-party payroll providers.

The good news is, even without original paystubs, you still have multiple ways to recover or reconstruct your income history.

9.1. Solutions if you don’t have them

If you didn’t receive a paystub or lost one, try these options to retrieve or replace the information:

-

Request from your former employer’s HR or payroll department

-

Most companies are legally required to retain records for several years and can provide a copy on request.

-

-

Access payroll platforms used by your previous employer

-

Platforms like ADP, Paychex, or Gusto often store historical paystubs that employees can log in and retrieve.

-

-

Use alternative supporting documents, such as:

-

Bank statements showing direct deposit amounts

-

W-2 or 1099 forms filed annually for tax purposes

-

Offer letters or employment contracts detailing agreed compensation

-

Pro tip: If you’re preparing for a loan, audit, or dispute, combine multiple alternative documents to build a strong case.

These solutions often provide enough proof of income, even when an actual paystub is unavailable.

9.2. Specific support based on employment type

Different job types may require different recovery methods. Here’s how to approach it based on your work arrangement:

-

Government employees: Contact your agency’s personnel or payroll office. Most agencies maintain detailed salary records.

-

Unionized workers: Reach out to your union representative or local payroll coordinator. Unions often keep duplicate payroll data or can help escalate requests.

-

Self-employed or freelancers:

-

Use invoices, client payment confirmations, or accounting software exports (like QuickBooks, FreshBooks, Wave).

-

Organize these by date and client to demonstrate consistent income.

-

No matter your employment background, there’s almost always a way to reconstruct your income documentation and fill in gaps left by missing paystubs.

10. FAQs

Q1: Do I need to keep paystubs if I already have my W-2?

A: Yes. W-2s summarize income, but paystubs provide detailed breakdowns useful for verification or disputes.

Q2: Can paystubs help me apply for a mortgage?

A: Definitely. Lenders often request recent paystubs to verify steady income.

Q3: Are digital copies valid for legal use?

A: Yes, if clear and unaltered. PDF scans are commonly accepted by banks and courts.

Q4: What if my employer never gave me a paystub?

A: You can request copies or ask for payroll summaries. Some states require employers to provide them.

Q5: Is it safe to discard paystubs after one year?

A: Only if you’ve filed taxes and don’t foresee legal or financial use. Safer to keep them for 3+ years.

Q6: How do freelancers handle paystub tracking?

A: Save all invoices, payment confirmations, and client correspondence for at least 7 years.

Q7: Are there apps to manage paystubs?

A: Yes. Tools like QuickBooks, Zoho, or Wave offer expense tracking and document uploads.

11. Conclusion

Do we need save previous companies paystubs? The answer is a clear yes.

Keeping your past paystubs empowers you to manage taxes, apply for loans, settle disputes, and prove income. While not legally mandatory for employees, the IRS, labor departments, and financial institutions recommend storing them for 3–7 years, or longer when needed.

Key takeaways:

-

Retain paystubs for at least 3 years

-

Use secure digital storage

-

Dispose safely after use

-

Replace lost stubs through employers or documents

-

Match federal + state guidelines for full coverage

By managing your paystubs properly, you gain peace of mind, avoid headaches, and stay ahead in your financial journey.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.