Does PayPal charge a fee for credit cards? Yes in 2025, PayPal charges fees when you use a credit card to make payments. These fees cover payment processing, risk management, and service operations. Whether you’re paying a friend, buying goods, or managing business sales, knowing these fees is critical to avoid surprises.

In this guide, we’ll break down PayPal’s credit card fee structure, compare it with other processors, explain ways to minimize costs, and answer common questions so you know exactly what to expect.

1. PayPal credit card fee structure 2025 (overview table)

PayPal’s fee structure varies based on the type of transaction, location, and currency. The table below summarizes the main credit card fees for 2025.

| Transaction Type | Domestic/International | Fee Rate | Fixed Fee | Notes |

|---|---|---|---|---|

| Friends & Family (Personal) | Domestic | 2.99% | $0.49 USD | Credit card payments only; no fee for bank/PayPal balance. |

| Goods & Services (Business) | Domestic | 2.59%–3.49% | $0.49 USD | Varies by monthly sales volume. |

| International Payments | Cross-border | +0.5%–2.0% on top of domestic fees | $0.49 USD | Extra fee for currency conversion. |

| In-Person Payments | Domestic | 2.29% | $0.09 USD | Available in select countries. |

| Currency Conversion | Cross-border | 3.00% | N/A | Charged on converted transaction amount. |

Fees vary by region and payment type, so always check PayPal’s official fee page for the most current rates.

2. Friends & Family vs. Goods & Services explained

When sending money through PayPal, it’s important to understand the difference between Friends & Family and Goods & Services transactions. Each type has its own fee structure and purpose, which directly impacts the cost and protections you receive.

Friends & Family transactions are meant for sending money to people you know. If you fund the payment using your PayPal balance or linked bank account, there’s no fee. But if you use a credit card, PayPal charges 2.99% + $0.49.

Example: Sending $100 via credit card to a friend:

2.99% of $100 = $2.99 + $0.49 fixed fee = $3.48 total. The sender pays $103.48, and the recipient gets $100.

Goods & Services transactions are for business payments. The seller pays between 2.59%–3.49% + $0.49, depending on monthly volume. Buyers don’t pay directly, but sellers may adjust prices to cover fees.

Knowing the difference between these two transaction types helps avoid unnecessary fees.

Check out our:

- What happens When you decline a Cash App payment in 2025

- Understanding what Is a hold harmless agreement clearly [2025]

- Learn What are the Branches of quantitative management easily [2025]

3. How much does PayPal charge a fee for credit cards? (by transaction type)

PayPal’s credit card fees vary based on the transaction type, funding source, and whether the payment is domestic or international.

Understanding these differences will help you plan and manage your payment costs effectively.

3.1. Domestic personal payments

Using a credit card for Friends & Family: 2.99% + $0.49.

Example: $100 from US → $3.48 in fees.

Pro Tip: Use PayPal balance or bank account to avoid this.

3.2. Business (Goods & Services) transactions

Sellers pay 2.59%–3.49% + $0.49. Larger sellers may get reduced rates. Fees fund dispute resolution and fraud protection.

3.3. In-person or point-of-sale

In select countries: 2.29% + $0.09.

Example: $100 transaction → $2.38 fee.

3.4. International payments & currency conversion

Extra 0.5%–2.0% for cross-border + 3% currency conversion.

Example: $100 US → Europe could incur ~$5–$6 total fees.Credit card fees vary greatly; funding method and transaction type make a big difference.

4. PayPal vs. other payment processors (2025 comparison)

Choosing the right payment processor depends not only on fees but also on features, payment types, and your sales volume. Comparing PayPal with other major platforms can help you decide which option best suits your needs.

| Processor | Fee Rate | Fixed Fee | Notes |

|---|---|---|---|

| PayPal | 2.59%–3.49% | $0.49 | Flexible, global reach, but higher for small sales. |

| Stripe | 2.9% | $0.30 | Simple pricing, great API. |

| Square | 2.6% | $0.10 | Best for in-person sales. |

| Venmo | 3.0% | $0.25 | Primarily peer-to-peer. |

Real Example:

A $10 payment via PayPal costs more in % terms due to the $0.49 fixed fee, while Square’s lower fixed fee benefits microtransactions.Your choice should depend on sales volume, transaction size, and preferred features.

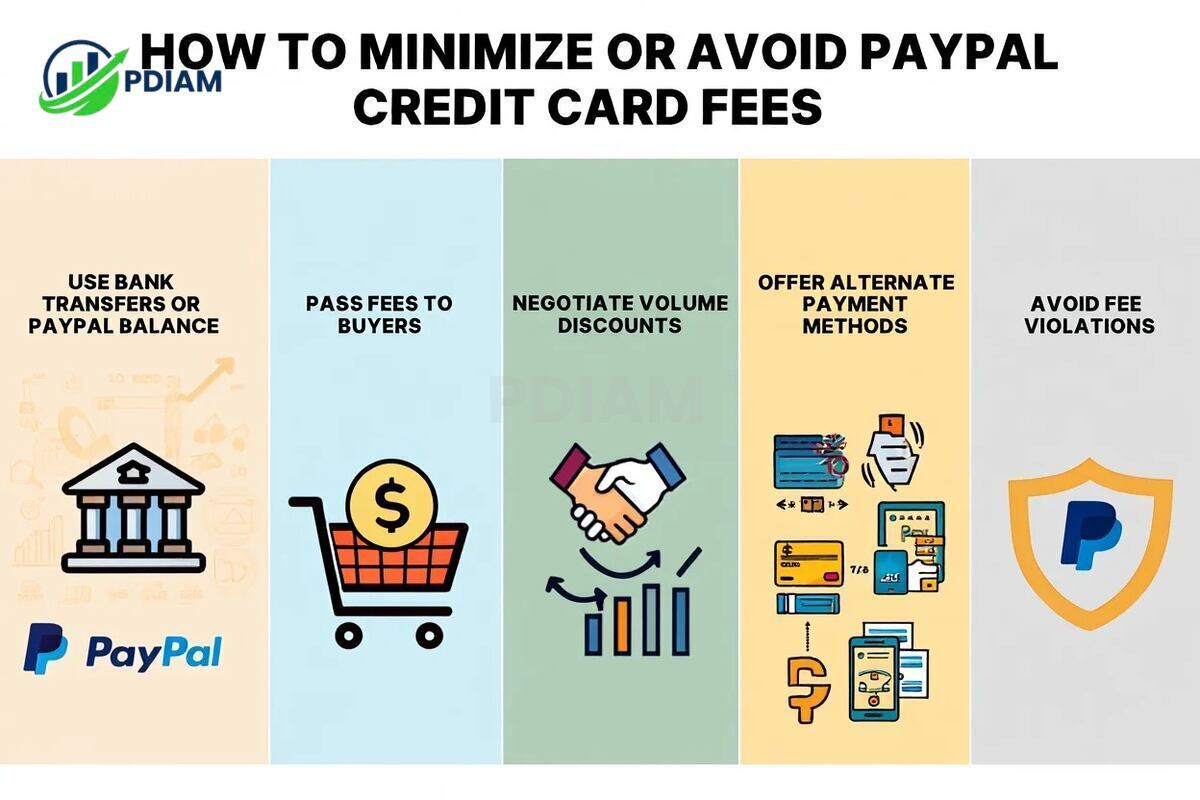

5. How to minimize or avoid PayPal credit card fees

Reducing PayPal credit card fees is possible if you understand how they’re applied and plan your transactions accordingly. While some fees are unavoidable, strategic payment methods can help you save significantly over time.

Ways to save:

-

Use bank transfers or PayPal balance – Friends & Family payments funded by a linked bank account or PayPal balance are often fee-free, unlike credit card payments which incur a percentage plus a fixed fee.

-

Pass fees to buyers – In regions where it is legal, sellers can include transaction fees in product pricing or add surcharges, ensuring the business doesn’t absorb the full cost.

-

Negotiate volume discounts – High-volume sellers can approach PayPal for reduced rates, especially if monthly transaction totals meet certain thresholds.

-

Offer alternate payment methods – Providing options like direct bank transfers, debit cards, or other platforms can help customers choose cheaper payment channels.

-

Avoid fee violations – Do not attempt to bypass PayPal’s fee structure through prohibited practices, as this could result in account suspension or termination.

Pro Tip:

If you make frequent small transactions, consider batching payments into fewer, larger amounts to minimize the impact of fixed per-transaction fees.

A proactive approach to fee management not only saves money but also ensures smoother transactions and better customer relationships.

6. PayPal fee examples & real-world scenarios (2025)

Seeing real numbers can make it easier to understand the true impact of PayPal credit card fees on your transactions.

Examples:

-

Personal transfer: Sending $100 to a friend via credit card under Friends & Family incurs a $3.48 fee to the sender.

-

Business sale: A $100 domestic sale through Goods & Services results in a $3.08–$3.98 fee for the seller, depending on their rate tier.

-

International payment: Sending $100 from the US to Europe could cost around $6 after adding cross-border and currency conversion fees.

Real Example:

A small business processing 500 monthly transactions of $50 each under Goods & Services could be paying over $1,500 in fees per month. Negotiating rates or shifting some payments to fee-free methods could cut this significantly.

Breaking down fees by scenario highlights why it’s essential to factor payment costs into your pricing and transaction strategy.

7. Recent PayPal fee policy changes (2024–2025)

PayPal periodically updates its fee structure to reflect operational costs, market conditions, and regional requirements. Being aware of these changes can help you adjust your payment strategies in time.

Notable changes:

-

2024: Introduction of tiered fees for high-volume sellers, offering reduced rates to businesses that process above certain thresholds.

-

Q3 2024: Adjustments to cross-border fee percentages in specific regions.

-

Early 2025: Updates to fixed fees to account for currency fluctuations and inflation.

Since PayPal’s fee schedule can change with little notice, reviewing the official PayPal fees page regularly is essential for accurate financial planning.

8. Supplemental: advanced user questions

Beyond standard FAQs, certain advanced considerations may impact how you approach PayPal’s credit card fees.

-

Business account effect? Business accounts may qualify for lower rates, particularly with consistent sales volume.

-

Tax deductible? Merchant fees are generally considered deductible business expenses in many jurisdictions.

-

Nonprofit rates? Registered nonprofits may access discounted transaction rates through PayPal’s charity program.

-

High-volume discount? Merchants processing large transaction totals can request custom rates, pending approval from PayPal.

Understanding these advanced factors can unlock opportunities to reduce costs and optimize payment handling for specific business models or organizational types.

View more:

- How can a company improve its organisational performance?

- Critical guide: Is Boss firing someone for violating legal? [2025]

- Difference between Accrual and Cash basis accounting: Fast breakdown [2025]

9. Frequently asked questions

Q1: Can I send money with a credit card for free?

No. Using a credit card almost always incurs fees unless you use a bank account or PayPal balance.

Q2: Are debit card fees different?

Usually slightly lower, but depend on transaction type.

Q3: Are there hidden charges?

No hidden charges, but cross-border & currency fees add up.

Q4: What about refunds or chargebacks?

Fixed fee may not be refunded.

Q5: Does sending abroad cost more?

Yes, due to cross-border + currency fees.

Q6: How are fees shown?

They’re itemized in transaction details.

10. Conclusion

In summary, understanding does PayPal charge a fee for credit cards is essential for managing your transactions wisely and avoiding unexpected costs. By knowing exactly when and how these fees apply, you can plan payments more strategically, choose the best funding methods, and compare alternatives to minimize expenses.

Key takeaways:

-

PayPal charges vary by transaction type, funding method, and currency.

-

Friends & Family payments with credit cards always incur fees, while Goods & Services fees are typically paid by sellers.

-

International transactions add cross-border charges and currency conversion costs.

-

Comparing PayPal’s fees with other processors can reveal cheaper or more suitable options for your needs.

A well-informed approach to PayPal’s credit card fees helps you control costs and make smarter payment choices.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.