Starting a business can be one of the most rewarding decisions in a woman’s career, but it requires resources and the right funding can make all the difference. While loans and investments have their place, business grants provide a unique opportunity: free funding with no repayment and no equity loss.

Unfortunately, women entrepreneurs face unique challenges in accessing capital. Research from Babson College and the U.S. Small Business Administration (SBA) shows that women-led startups receive far less venture capital and bank financing than their male counterparts.

Factors like systemic bias, smaller professional networks, and societal expectations contribute to this gap.

To level the playing field, dedicated grants for women to start a business have been created. These programs are designed to offer not just funding, but also mentorship, networking, and visibility.

Whether you’re launching your first venture, expanding a side hustle, or scaling an established business, understanding these grants and how to secure them is critical to success.

1. What are business grants and how do they work for women?

Business grants are non-repayable funds provided by government agencies, corporations, nonprofits, or private organizations to support specific business activities. Unlike loans, grants do not require repayment. Unlike investments, they do not involve giving up equity or profit shares.

Grants for women often have clear eligibility requirements and competitive application processes. Many focus on industries or missions where women are underrepresented, from technology to green energy, and from creative industries to social enterprises.

Comparison table of funding options

Before exploring your options, it’s useful to understand how grants differ from other funding sources:

| Funding Type | Description | Pros | Cons |

|---|---|---|---|

| Grants | Free funding with specific eligibility; no repayment required | No debt, no equity loss; credibility boost | Competitive; strict application requirements |

| Loans | Borrowed money to be repaid with interest | Immediate funding; flexible use | Debt risk; credit score impact |

| Investments | Capital from investors in exchange for equity or profits | Large funding potential; mentorship | Loss of ownership; investor influence |

Real example: The Amber Grant offers monthly awards for startups, including women-led ventures. Other examples include SBIR grants for science and tech projects, and SBA Women’s Business Centers that provide both funding and resources.

Pro Tip: Always track grant cycles. Some opportunities are annual, others are rollingapply early to stand out in competitive pools.

2. Why women need specific grants to start a business

While both men and women face challenges in entrepreneurship, certain barriers disproportionately affect women. Recognizing these barriers is the first step to understanding why grants for women to start a business are so important.

Key barriers:

-

Limited access to venture capital: According to SBA data, women founders receive only 2–3% of all VC funding.

-

Systemic discrimination: Lending and investment bias can make financing more difficult to secure.

-

Networking gaps: Women often have fewer industry connections, making it harder to access opportunities.

-

Confidence and perception gaps: Research suggests women may request smaller amounts of funding or avoid applying altogether.

Real example: Jane, a sustainable fashion entrepreneur, was rejected by three banks before winning the Amber Grant. This funding allowed her to purchase equipment, hire staff, and launch her brand successfully.

Best to know about these articles belows too:

- What is gap medical insurance coverage? Must-know facts

- Effective tips about how might a company reduce its variable expenses [2025]

- What is a high turnover rate? Full HR Breakdown [2025]

3. Current grants for women to start a business in 2025

For 2025, several major grant programs are open to women entrepreneurs, offering a range of funding levels, focus areas, and application deadlines.

| Grant Name | Max Amount | Focus/Type | Deadline |

|---|---|---|---|

| Amber Grant | $10,000+ | Startups/All industries | Monthly |

| Cartier Women’s Initiative | $100,000 | Global/Impact-driven | Annual |

| Tory Burch Foundation Fellowship | $10,000 | Women Entrepreneurs | Annual |

| SBA Growth Accelerator Fund | $50,000 | Accelerators/Startups | Rolling |

| Girlboss Foundation Grant | $15,000 | Creative Women | Biannual |

| InnovateHER Challenge | $40,000 | Tech/Social Impact | Annual |

| Women Who Tech Grant | $50,000 | Tech Startups | Annual |

| Black Girl Ventures | $10,000 | Minority Women | Rolling |

| NASE Growth Grants | $4,000 | Small Business | Monthly |

| VWISE | $20,000 | Veteran Women | Annual |

Applying to these programs requires understanding their eligibility criteria, aligning your business goals with their mission, and preparing strong documentation to improve your chances of success.

4. National grants

National grants often provide higher funding amounts and broader eligibility compared to local programs, but they also attract more applicants, making the competition intense. These grants are ideal for women-led businesses that have a well-defined mission, measurable impact, and a strong track record.

Programs like the Amber Grant and Cartier Women’s Initiative have helped thousands of women launch and scale their businesses by offering not only financial support but also global recognition and networking opportunities.

Winning a national grant can open doors to partnerships, media coverage, and further investment opportunities.

Pro Tip: National grants may also bring significant media exposure. If your brand story is compelling and aligns with the grant’s mission, this visibility can be as valuable as the funding itself, helping to build credibility in your industry.

5. State and local grant programs

State and local grant programs are often less competitive due to their limited geographical scope, making them more accessible to early-stage entrepreneurs. These grants aim to stimulate local economic growth and support small business development, particularly among underrepresented groups like women-owned enterprises.

Steps to find them:

-

Visit your state’s economic development website: Most states list active grant programs, eligibility criteria, and deadlines on their official portals.

-

Connect with local Small Business Development Centers (SBDCs): These centers provide free or low-cost assistance, including grant application guidance.

-

Join local chambers of commerce: Membership can give you early access to grant announcements and networking events.

-

Attend community business networking events: These events often feature guest speakers or panels that share grant opportunities and tips.

These state and local programs can serve as stepping stones to larger national opportunities, helping you gain experience in the grant application process while building a foundation for future growth.

6. Industry, mission, and niche-focused grants

Many grants are designed to support specific industries or causes, which can significantly narrow the competition. If your business operates in a targeted sector, applying for an industry-specific grant can increase your chances of success.

Example: The InnovateHER Challenge funds women-led tech solutions that address critical community issues, such as healthcare access or educational inequality. Similarly, Women Who Tech supports early-stage female founders in technology, providing not just funding but also mentorship and access to investor networks.

Aligning your business with a grant’s specific mission can make your application stand out, especially when you can demonstrate clear, measurable outcomes that match the funder’s objectives.

7. Minority, LGBTQ+, veteran, and mom-focused grants

Certain grants are tailored to meet the needs of underrepresented groups within the entrepreneurial ecosystem. These programs recognize that women who are also part of minority communities, the LGBTQ+ population, veteran groups, or mothers may face additional barriers to funding and resources.

For example, Black Girl Ventures funds Black and Brown women founders, focusing on businesses that create community impact. The VWISE (Veteran Women Igniting the Spirit of Entrepreneurship) program supports veteran women in launching and growing their businesses through both funding and specialized training.

Such grants often provide more than just capitalthey include mentorship, networking opportunities, and community support that can be instrumental in building a sustainable business.

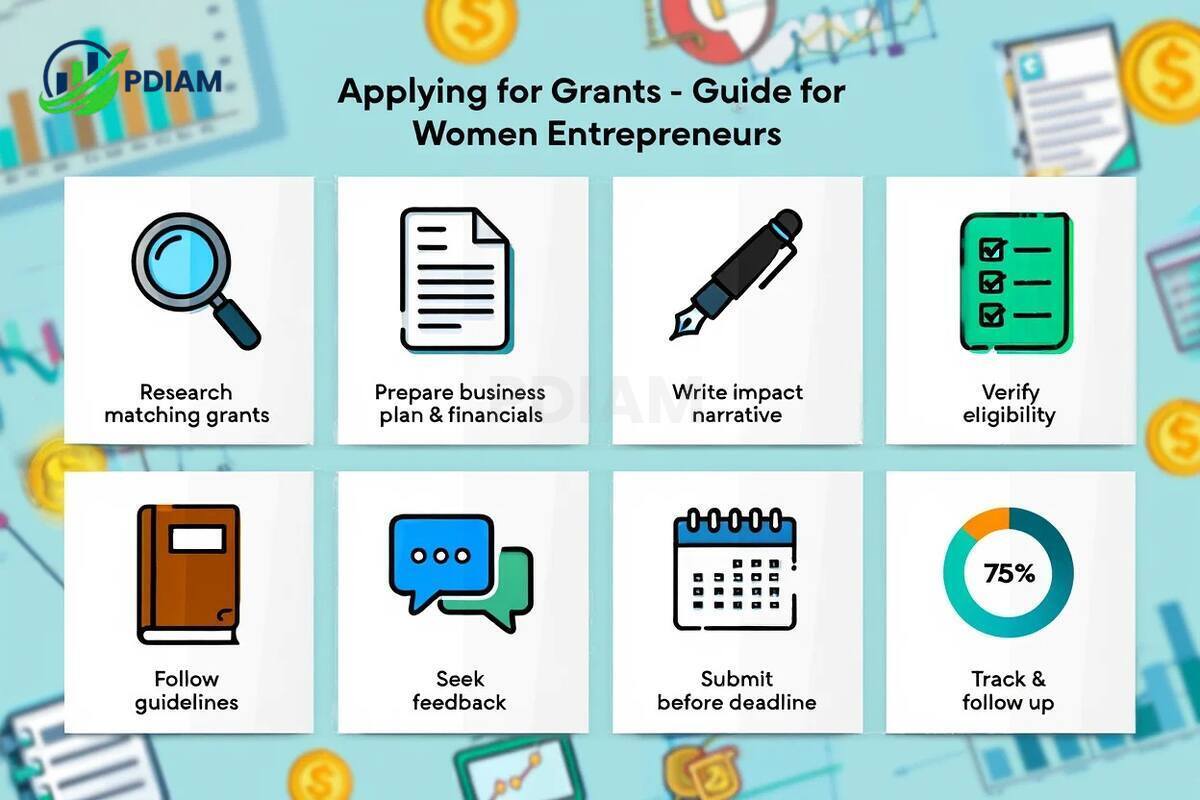

8. Step-by-step guide to applying for grants for women to start a business

Applying for grants requires preparation:

-

Research grants that fit your stage and industry.

-

Prepare essential documents like your business plan and financials.

-

Write a compelling narrative showing your impact.

-

Verify eligibility criteria.

-

Follow application guidelines exactly.

-

Seek feedback before submission.

-

Submit before the deadline.

-

Track progress and follow up.

Pro Tip: Use a spreadsheet to manage deadlines and requirements for multiple grants.

9. Grant application checklist

Before applying, ensure you have:

-

Business plan and strategy.

-

Proof of registration and ownership.

-

Financial statements or projections.

-

Team member bios.

-

Letters of recommendation.

This preparation streamlines the process and increases your odds of success.

10. Choosing the right grant for your business

When selecting a grant, consider funding amount, fit with your mission, and application complexity.

| Program | Amount | Odds | Complexity | Frequency |

|---|---|---|---|---|

| Amber Grant | $10,000+ | Moderate | Low | Monthly |

| Cartier Women’s Initiative | $100,000 | Low | High | Annual |

| Tory Burch Foundation | $10,000 | Moderate | Medium | Annual |

Small grants can serve as stepping stones to larger awards.

11. Additional resources beyond grants

In addition to grants, there are many other resources that women entrepreneurs can leverage to grow their businesses. These options can complement grant funding and provide valuable expertise, networking, and ongoing support.

-

Mentorship programs like SCORE: SCORE connects entrepreneurs with experienced mentors who offer guidance on business planning, marketing, and growth strategies. Having a mentor can help avoid costly mistakes and accelerate decision-making.

-

Accelerator programs: These programs offer structured training, funding opportunities, and networking in exchange for a small equity stake or a set participation fee. They often include pitch events to connect with investors.

-

Government loan options: Beyond grants, government-backed loans (such as SBA loans) can provide low-interest capital for expansion, equipment purchases, or working capital needs.

-

Women’s chambers of commerce: These organizations focus on promoting women-owned businesses through advocacy, education, and events that foster collaboration and partnerships.

By combining grants with these additional resources, women entrepreneurs can build a stronger foundation for sustainable growth and long-term success.

12. Real women, real success

Examples of successful women entrepreneurs who have won grants can offer both inspiration and practical lessons for new applicants. Here are three real-life cases that highlight the power of combining preparation, alignment with grant goals, and persistence:

-

Maria’s Consulting Firm: Maria applied for the Amber Grant to expand her business services and hire additional staff. She focused her application on the clear market need for her consulting services and backed her case with strong financial projections. W

-

Leah’s Green Tech Startup: Leah’s company won the prestigious Cartier Women’s Initiative grant by showcasing measurable environmental impact in the renewable energy sector. Her success underscores the importance of aligning your business with the specific mission of the grant provider.

-

Angela’s Bakery: Angela leveraged the Tory Burch Foundation grant to modernize her bakery’s equipment, improve production capacity, and expand into online sales. Her authentic storytelling and demonstration of community benefit resonated with the grant reviewers.

These examples illustrate that securing a grant is not just about the money it’s also about gaining credibility, building networks, and creating momentum for future growth.

View more:

- How much does the average American make in their lifetime? Comprehensive 2025 Guide

- What’s the cheapest franchise to open for maxium profit right now? [2025]

- Best Telephone system for small business on a budget [2025]

13. FAQs: Grants for women to start a business in 2025

Q1: What grants are easiest for new founders?

A: Programs like the Amber Grant and NASE Growth Grants are known for simpler application processes and monthly award cycles. These grants are ideal for women launching their first business, as they require fewer documents and have straightforward eligibility requirements.

Q2: Are grants taxable?

A: In most cases, grant funds are considered taxable income. This means you may need to report them on your business or personal tax return. Consulting a tax professional ensures you understand any obligations and can plan for potential liabilities.

Q3: Can solopreneurs apply?

A: Yes. Many grant programs welcome applications from sole proprietors and single-member LLCs, provided they meet other eligibility criteria such as ownership percentage, residency, and industry focus.

Q4: Can non-US women apply?

A: Some global grants, such as the Cartier Women’s Initiative, accept applications from women entrepreneurs worldwide. However, many U.S.-based grants require citizenship or permanent residency, so always check eligibility guidelines before applying.

Q5: How often can I apply?

A: This varies by program. Some allow multiple applications throughout the year, while others limit submissions to once annually or once per lifetime. Reviewing each grant’s rules prevents wasting time on ineligible reapplications.

Q6: Where can I find local grant alerts?

A: State government websites, Women’s Business Centers (WBCs), and local business networks are reliable sources. Subscribing to newsletters or following social media pages of these organizations can help you stay updated.

Q7: What is the typical timeline from application to award?

A: Most grant programs take 2–6 months to review applications and announce winners. Timelines depend on factors such as application volume, review processes, and whether interviews or presentations are required.

Q8: Do grants require matching funds?

A: Some grants require recipients to contribute their own funds or secure matching amounts from other sources. This is more common in government grants, so it’s important to verify financial commitments before applying.

Q9: Can I use grant money for any business expense?

A: Not always. Some grants restrict spending to specific uses like equipment, marketing, or research and development. Misuse of funds can lead to repayment obligations or disqualification from future funding.

14. Conclusion

Accessing the right grants for women to start a business in 2025 can greatly improve your chances of building a sustainable and thriving company. Whether you pursue national, local, or niche grant opportunities, the combination of preparation and persistence is essential for success.

Key takeaways:

-

Target grants that match your current business stage and long-term mission.

-

Prepare complete documentation and a compelling, impact-driven narrative.

-

Use smaller or local grants as stepping stones toward larger funding sources.

-

Leverage extra support channels such as mentorship, accelerators, and industry networks.

By following these strategies, you position your business to stand out in competitive grant processes and secure the resources needed to grow.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.