How does workers’ comp affect tax return? Workers’ compensation provides financial support to employees who get injured or sick because of their job. It covers medical bills, lost wages, and rehabilitation costs to help workers recover.

If you’ve received workers’ comp benefits, you might wonder, How does workers’ comp affect my tax return?

This question is common for injured workers, their families, and even employers who handle payroll and tax documents.

Some common concerns include:

-

Are workers’ comp payments taxable?

-

Do I need to report these benefits on my tax return?

-

How does a settlement affect my taxes?

-

What if I receive both workers’ comp and SSDI?

This article explores these questions clearly and thoroughly.

We will define workers’ compensation, explain tax rules for 2025, cover exceptions, show how to report benefits, and provide practical tips. Real-life examples like lost wages during recovery and lump-sum settlements will illustrate why understanding tax obligations matters.

By the end, you’ll have a complete guide to navigate workers’ comp and tax filing with confidence.

1. What is workers’ compensation? Who qualifies?

Workers’ compensation is insurance that pays employees who are hurt or become ill because of their job. It helps cover medical costs and some income during recovery.

Who qualifies for workers’ comp?

-

Employees injured on the job: An accident like a fall or equipment injury at work.

-

Workers with job-related illnesses: Conditions caused by workplace exposure, like lung disease.

It doesn’t cover injuries unrelated to job duties or self-inflicted harm. Employers usually fund workers’ comp through insurance or, less commonly, by self-insuring.

Workers and families should understand who qualifies before relying on tax-free status.

2. How does workers’ comp affect tax return?

In most cases, workers’ compensation benefits do not affect your federal taxes. The IRS excludes these payments from taxable income because they are meant as compensation for injury, not earnings.

Here is a quick summary:

| Benefit Type | Taxable? | Report on Return? |

|---|---|---|

| Workers’ compensation benefits | No | No |

| Lump-sum settlements for injury | Usually no | Check details |

| Payments for lost wages (non-comp) | Yes | Reported as income |

| SSDI benefits overlapping with comp | Sometimes | May affect taxable income |

According to IRS Publication 525, these benefits are generally tax-free. However, if payments include amounts beyond workers’ comp, taxes may apply. Understanding the purpose of each payment is critical.

Want to learn more about these?

- What is an audited financial statement? Full Breakdown [2025]

- Avoid trouble: New Jersey finance agreement max late fees [2025]

- Useful Guide: Do i need business license for sole proprietorship [2025]

3. Is workers’ compensation taxable income in 2025?

No, workers’ compensation benefits are generally not taxable for 2025. The tax code, specifically IRS guidelines and the Social Security Act, exclude these payments from income that you report on your federal tax return.

The IRS states in Publication 525 that workers’ comp payments for job-related injuries or illnesses are exempt from federal income tax. This helps injured workers focus on recovery without tax stress.

3.1. Exceptions to consider

Although workers’ compensation is typically tax-exempt, there are some important exceptions to keep in mind. These may affect how much of your income is considered taxable if other benefit programs are involved.

-

Workers’ comp + SSDI: If you receive both workers’ comp and Social Security Disability Insurance (SSDI), a portion of your SSDI benefits might become taxable due to federal offset rules.

-

Lost wage replacement outside of comp rules: If your workers’ comp settlement includes amounts meant to replace wages that wouldn’t normally be covered under comp regulations, those portions may be taxable.

Pro Tip: Always ask for a detailed breakdown when receiving a lump-sum settlement. Separating payments by purpose (e.g., injury vs. lost wages) reduces audit risk and clarifies what is taxable.

Even with these exceptions, the majority of injured employees will not owe federal taxes on workers’ comp benefits but being informed helps avoid surprises.

4. How to report workers’ comp on your federal tax return

If your workers’ compensation benefits are not taxable, you generally do not report them on your Form 1040. But here’s what to know:

4.1. Filing guidance

When preparing your tax return, it’s essential to understand how workers’ comp information should or shouldn’t appear in your forms. Below are key points to help ensure accurate filing:

-

Check your tax forms: You typically won’t see workers’ comp reported on a W-2 or 1099 since it’s not taxable.

-

Lump-sum settlements: If you received a settlement, review how the payment was categorized. Sometimes part of it must be reported.

-

If comp is misreported: Contact your employer or insurer to correct any incorrect taxable income reported.

-

Filing tips: Always keep detailed records of your benefits and any related documents to show that payments are workers’ comp.

In most cases, no line on your tax return is needed specifically for workers’ comp. But if you are unsure, consult IRS instructions or a tax professional.

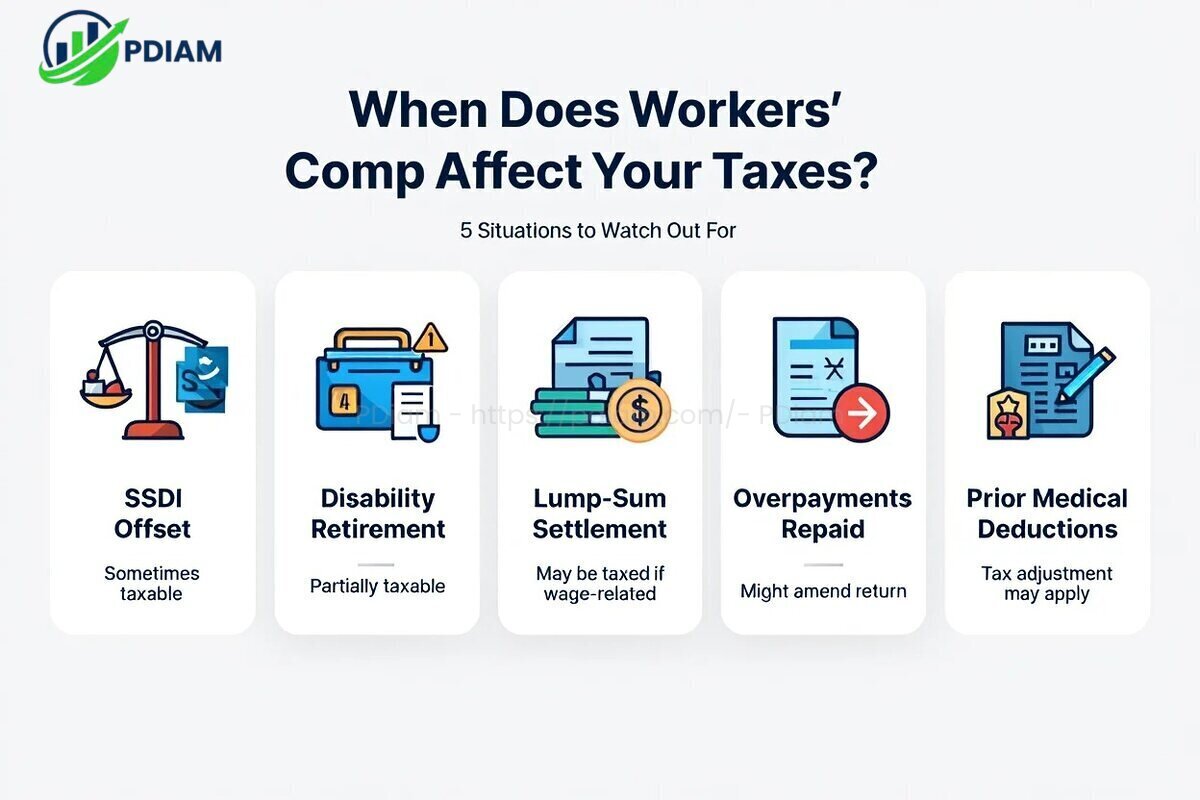

5. When does workers’ comp impact your taxes?

There are situations when workers’ compensation may affect your taxes.

These typically involve combinations with other benefit types or settlement terms that fall outside standard exemptions.

5.1. SSDI/SSI offset

If you receive both workers’ comp and Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), part of the combined benefits may become taxable. This is due to government offsets that limit total disability payments.

5.2. Disability retirement and mixed payments

If you are receiving disability retirement pay from an employer along with workers’ comp, some amounts may count as taxable income.

5.3. Lump-sum settlements

A large, one-time payment to settle a workers’ comp claim can be complex. Usually, the portion that compensates for physical injury is not taxable, but payments for lost wages or punitive damages might be.

5.4. Repayments and overpayments

If you got too much workers’ comp and had to pay some back, the tax rules might require adjustments in your filing.

5.5. Prior medical deductions

If you previously claimed a medical expense deduction for unreimbursed workers’ comp-related costs, receiving compensation later might affect your taxes.

To simplify, here’s a quick reference table showing common exception cases and how the IRS may handle them:

| Situation | Taxable? | IRS Action Needed? |

|---|---|---|

| SSDI offset impact | Sometimes | Report income accordingly |

| Disability retirement payments | Partial | Consult tax guidelines |

| Lump-sum settlements (lost wages) | Yes | Report on return |

| Overpayments repaid | Possible | Amend return if needed |

| Prior medical deductions | Adjust | Document carefully |

While most workers’ comp benefits remain tax-free, these exception cases highlight why personalized guidance is often necessary, especially if your situation involves multiple benefit types or amended returns.

6. State taxes: Does workers’ comp affect your state return?

Most states follow the federal rule that workers’ compensation benefits are not taxable. However, some states have different tax treatments, which may include partial taxation or specific reporting rules for settlements or mixed benefits.

6.1. State-by-state breakdown

The table below outlines how several states handle the taxability of workers’ comp benefits. While this is not exhaustive, it highlights the importance of checking with your local tax authority.

| State | Tax Treatment | Notes |

|---|---|---|

| California | Not taxable | Aligns with federal rules |

| New York | Generally not | Check local exemptions |

| North Dakota | Taxable | State taxes apply |

| New Jersey | Partially taxable | Depends on benefit type |

As the table shows, state-level tax rules may differ significantly, so it’s crucial to verify current guidelines based on your location before filing.

Pro Tip: Always check your state’s department of revenue or tax authority website to confirm the latest rules. Some states require reporting even if the benefits themselves are not taxed.

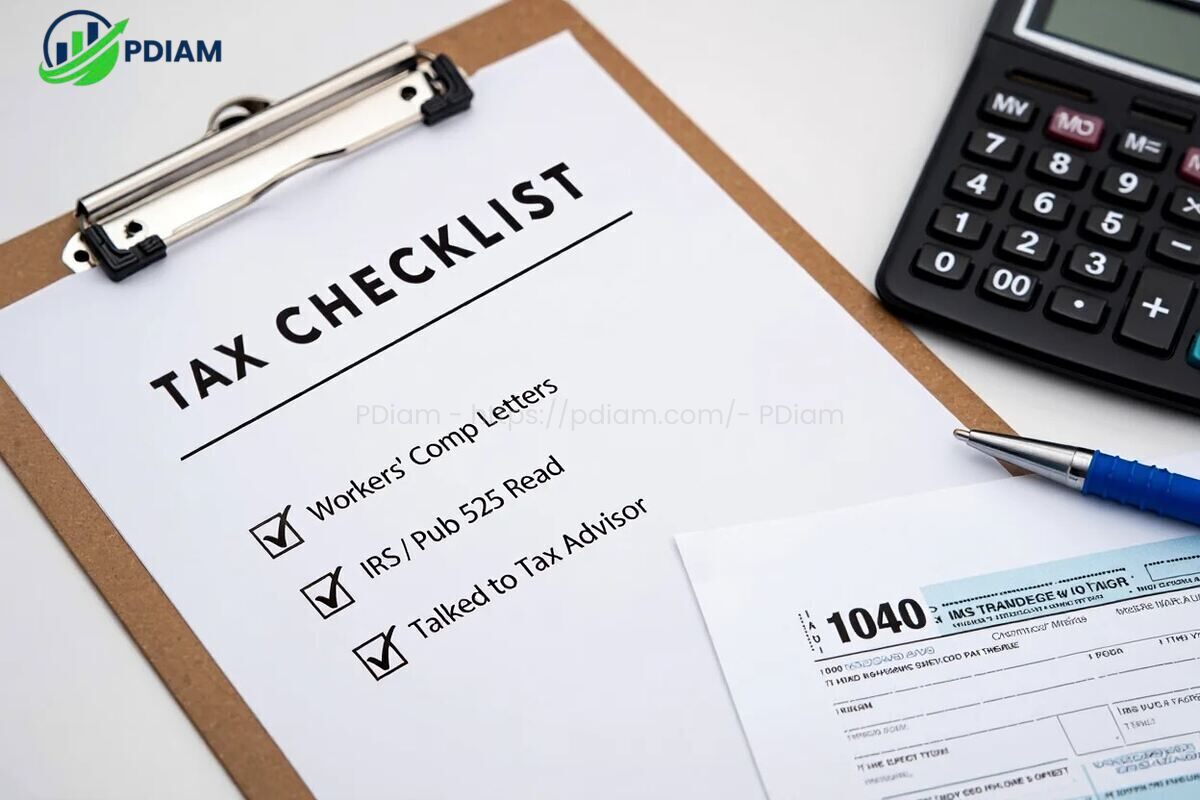

7. Checklist: What to do before filing if you received workers’ comp

Here are key actions to take:

-

Gather all documents related to your workers’ comp payments (settlements, payment letters).

-

Verify if you received any tax forms (W-2, 1099) and check accuracy.

-

Keep records of medical expenses and lost wages if applicable.

-

Review IRS Publication 525 for federal rules.

-

Check your state tax agency’s website for local rules.

-

Consider consulting a tax professional if payments were large or mixed.

-

Be alert to errors like taxable income wrongly assigned to workers’ comp.

Keeping files organized helps avoid mistakes and ensures a smoother tax filing experience.

8. Summary table: Taxability of workers’ comp benefits & common scenarios

To better understand how different types of workers’ comp-related benefits are treated at tax time, refer to the summary table below. It outlines whether each scenario is taxable, how it should be reported, and any important notes to consider.

| Scenario | Taxable? | How to Report | Notes |

|---|---|---|---|

| Standard workers’ comp payments | No | Do not report | Exempt per IRS |

| Lump-sum settlement for injury | Usually no | Review details | Lost wages portion may be taxable |

| SSDI offset cases | Sometimes | Report under SSA rules | Can increase taxable income |

| Disability retirement combined | Partial | Follow employer guide | Depends on benefit type |

| State workers’ comp | Varies | Follow state instructions | Check local tax laws |

As shown above, most workers’ compensation benefits remain tax-free but certain combinations with other benefits or settlement types require careful tax treatment.

View more:

- Critical guide: Is Boss firing someone for violating legal? [2025]

- What is an annual percentage rate? Best expert guide in 2025

- Types of risk in insurance industry: Expert guide 2025

9. FAQs: Workers’ comp and tax returns

9.1. Is a lump sum settlement taxable?

Usually no if for injury, but check if it includes lost wages.

9.2. Do concurrent unemployment benefits affect taxes?

Yes, unemployment is taxable even if combined with workers’ comp.

9.3. What happens if I receive both SSDI and workers’ comp?

Part of SSDI might be taxable due to benefit offsets.

9.4. What if I get a 1099 for workers’ comp?

This may be incorrect; verify with the payer.

9.5. Are tax credits affected?

Workers’ comp won’t reduce Earned Income Tax Credit or Child Tax Credit.

9.6. Filing as a survivor or spouse?

Rules remain similar; ensure all benefits are reported correctly.

9.7. What if I repaid workers’ comp?

Amend your return if you claimed deductions related to the payment.

9.8. Can I deduct medical expenses related to my injury?

Possibly, but only unreimbursed costs.

9.9. Are state workers’ comp payments taxable?

Usually no, but check your state.

9.10. What records should I keep?

Payment statements, settlement documents, and medical bills.

10. Conclusion

How does workers’ comp affect tax return in 2025? For most people, the answer is simple: it doesn’t. Workers’ compensation benefits are not considered taxable income under IRS rules because they compensate for injury or illness on the job.

However, certain exceptions can affect your return. SSDI offsets, mixed payments, and lump-sum settlements may introduce taxable elements. Understanding how each situation applies to you is essential for accurate filing.

Key takeaways:

-

Workers’ comp is generally tax-free under IRS Publication 525.

-

SSDI offsets and mixed payments may result in partial tax liability.

-

Lump-sum settlements must be reviewed carefully especially if lost wages are involved.

-

State tax laws vary, so check with your local tax agency.

-

Maintain detailed records and consult IRS.gov or a tax professional if needed.

Navigating taxes after a workplace injury can be confusing but with the right knowledge, you can file with confidence.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.