How long do you have to pay back a business loan? When businesses take out loans, understanding how long they have to repay them is essential. The repayment period, or term, determines how payments are spread out and affects cash flow and planning.

For business owners in 2025, knowing these terms helps avoid surprises and supports strategic financial decisions.

Loan lengths vary widely from a few months to over 20 years depending on the type of loan and lender policies. This article will guide you through typical repayment durations, explain key concepts, show real examples, and help you decide which term fits your business needs in today’s market conditions.

1. What does it mean to pay back a business loan?

Paying back a business loan means returning the borrowed money, plus interest, to the lender over an agreed time frame. The repayment term is the total length set to complete this process. Typically, repayment happens through scheduled payments that combine part of the loan amount and interest.

Here are common repayment methods:

-

Monthly payments spread evenly over several years

Most traditional loans use this structure for simplicity and predictability. -

One-time lump sum payment at the term’s end

Common in short-term loans or bridge financing. -

Balloon payments

Regular smaller payments followed by a large final payment.

These methods vary in structure but all aim to repay principal plus interest effectively.

Example: Borrowing $100,000 to be repaid over five years at a fixed interest rate means dividing the total owed into manageable monthly amounts until fully paid.

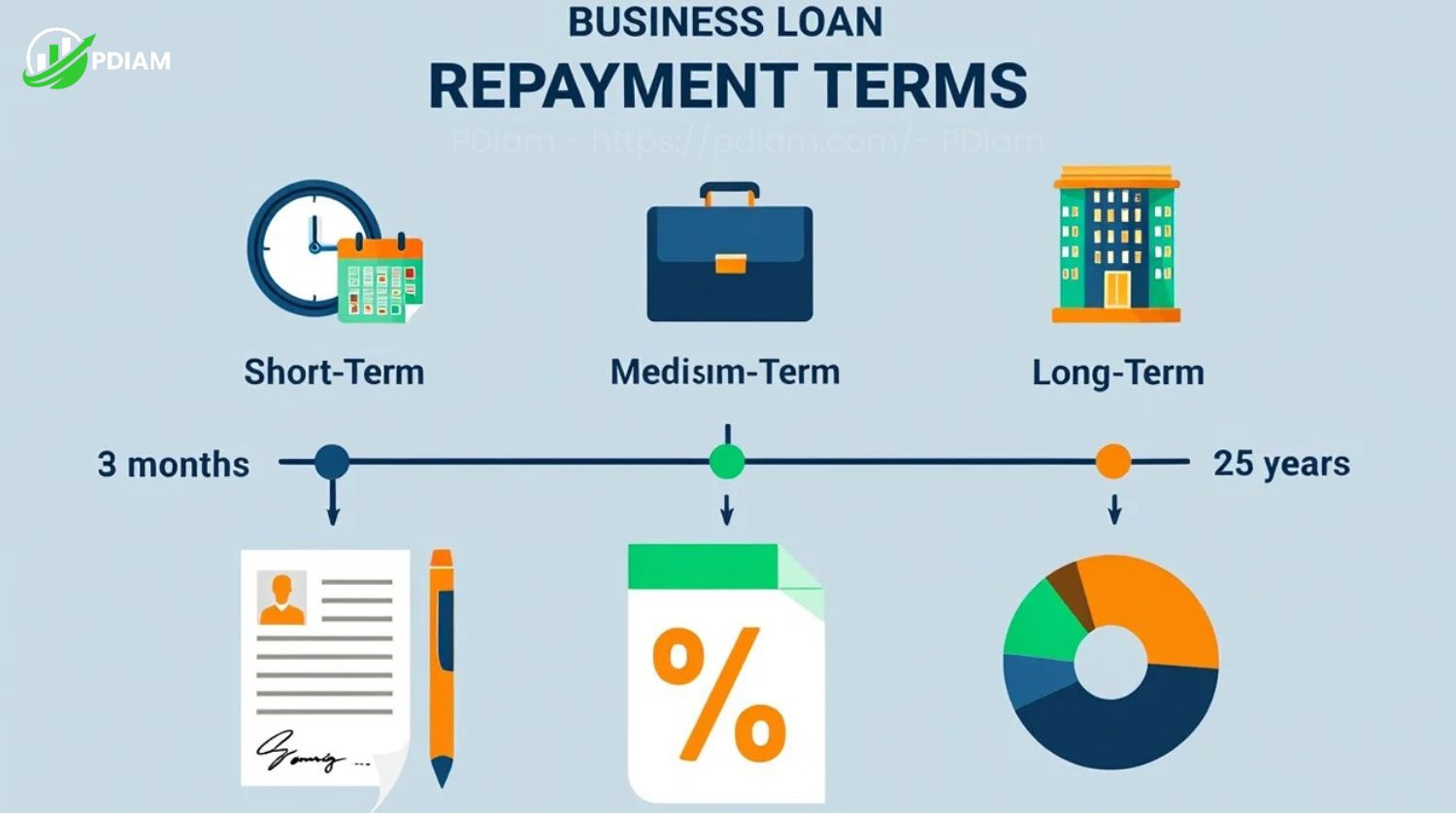

2. How long do you have to pay back a business loan?

The length of time you have to repay a business loan varies widely based on several key factors including the loan type, the lender’s risk appetite, and your intended use of funds.

Some loans are designed for short-term needs and are repaid in a matter of months, while others particularly those for real estate or large investments can span up to 25 years.

Understanding typical repayment durations is critical for choosing a loan that aligns with your cash flow and growth plans.

2.1. Comparison of business loan types and terms

The table below outlines common business loan products, their standard repayment terms, best-use cases, and example lenders.

| Loan Type | Typical Repayment Term | Best For | Example Lenders |

|---|---|---|---|

| SBA 7(a) Loan | 7–25 years | Real estate, expansion | SBA lenders, banks |

| SBA Microloan | Up to 6 years | Startups | Nonprofits, microlenders |

| Traditional Term Loan | 1–10 years | Equipment, working capital | Banks, credit unions |

| Equipment Financing | 1–10 years | Equipment purchase | Banks, fintech |

| Line of Credit | 6 months–5 years (revolving) | Cash flow flexibility | Banks, fintech |

| Merchant Cash Advance | 3–24 months | Quick funding | Online lenders |

| Invoice Financing | Up to 1 year | Bridging invoice gaps | Specialty lenders |

This comparison gives you a clearer view of how different loan types match specific needs helping you narrow down the best option for your business situation.

View more:

- Saving money on a low income: A comprehensive 2025 Expert guide

- Best money management apps for iPhone: Complete guide in 2025

- Is the Bank of Dave a True Story? The complete impact revealed in 2025

3. Business loan repayment terms by loan type

Each type of business loan offers different repayment terms based on its structure, purpose, and risk profile. Understanding how each works will help you choose a financing option that aligns with your business goals and cash flow capacity.

3.1. SBA 7(a) loans

The SBA 7(a) loan is one of the most popular government-backed options for small businesses. Repayment terms range from 7 to 25 years, depending on how the funds are used with real estate typically qualifying for the maximum term.

Monthly payments are usually fixed and include both principal and interest. Approval is based on your business’s creditworthiness and financials.

Example: A $250,000 loan repaid over 20 years at a 6% interest rate would result in monthly payments of approximately $1,800.

This loan type suits businesses seeking long-term financing with predictable costs.

3.2. SBA microloans

These loans are designed for startups and very small businesses, offering up to $50,000 in funding with repayment terms of up to 6 years. They’re issued through nonprofit lenders and are ideal for businesses needing smaller amounts to get started or cover operating expenses.

Payments are generally monthly, and interest rates are slightly higher than 7(a) loans due to the smaller size and risk level.

Example: A $30,000 microloan at 8% interest over 5 years would cost around $610 per month.

This option provides manageable terms for new ventures still building credit.

3.3. SBA 504 loans

SBA 504 loans are intended for long-term fixed assets like equipment or commercial real estate. Repayment terms typically range from 10 to 20 years, depending on the asset’s nature and expected lifespan.

They are structured with two components one from a Certified Development Company (CDC) and one from a bank and both require fixed monthly payments.

These loans work well for businesses expanding physical operations or acquiring high-value assets.

3.4. Traditional bank loans

Conventional term loans from banks or credit unions usually carry repayment periods between 1 and 10 years. They’re commonly used for working capital, expansion, or equipment purchases.

Interest rates and schedules may vary depending on the lender, but monthly payments are often fixed.

Example: A $100,000 bank loan at 7% interest repaid over 5 years would have monthly payments of roughly $1,980.

These loans are best for businesses with established credit and predictable revenue.

3.5. Online and flexible loans

Online lenders offer fast and flexible financing options, typically with shorter terms of 3 months to 5 years. These loans are easier to qualify for and may include daily or weekly payment schedules instead of monthly.

They often come with higher interest rates, but the quick turnaround and less stringent requirements appeal to many small businesses.

This type is well-suited for urgent needs like inventory purchases or covering short-term gaps.

3.6. Equipment financing

This loan is used to purchase machinery, vehicles, or tools and is often secured by the equipment itself. Repayment terms usually match the expected useful life of the asset typically 1 to 10 years.

Payments are fixed, and approval may be easier since the asset serves as collateral.

Equipment financing is a smart way to acquire essential tools without depleting cash reserves.

3.7. Business line of credit

A business line of credit offers revolving access to capital, with terms ranging from 6 months to 5 years. You draw only what you need and pay interest only on the used amount.

Payments are flexible and depend on how much you borrow and how quickly you repay it.

This option is ideal for managing cash flow swings, seasonal expenses, or unexpected costs.

3.8. Merchant cash advance

Merchant cash advances (MCAs) are short-term financing tools with repayment periods between 3 and 24 months. Rather than fixed payments, MCAs are repaid as a percentage of your daily credit card sales.

They are easy to obtain but usually come with high effective interest rates.

Businesses needing fast cash and with strong card sales may benefit, but should weigh the cost carefully.

3.9. Invoice financing

Invoice financing helps bridge cash flow gaps between issuing invoices and receiving payments. These are short-term arrangements, usually lasting less than 12 months.

The lender advances a portion of the invoice amount, and repayment occurs when your customer pays.

This financing method works well for B2B businesses with slow-paying clients and predictable receivables.

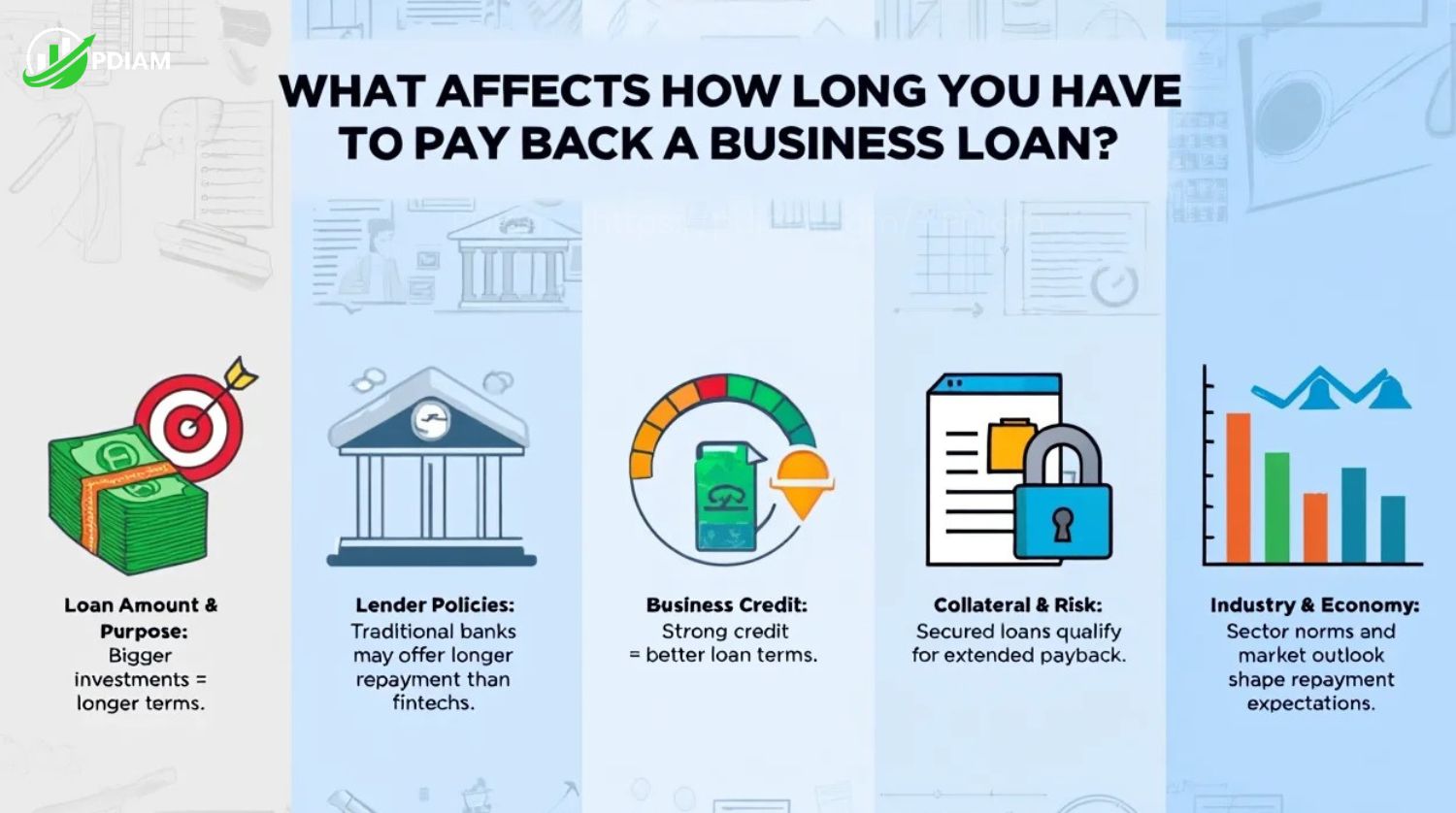

4. What affects how long you have to pay back a business loan?

Several key factors determine your repayment term:

-

Loan amount and purpose

Larger, long-term investments justify longer terms. -

Lender policies

Banks may offer longer terms than fintech startups. -

Business credit and financial health

Strong credit opens doors to extended terms. -

Collateral and risk

Loans secured by assets often qualify for longer repayment. -

Industry standards and economy

Some industries expect faster payoffs; economic outlook affects loan lengths.

Example: Equipment loans are often matched to asset lifespan for financial efficiency.

Think this topic is an interesting one? Check out our related Articles below for more stuffs like:

- Proven tips to lower average bank charge for a small business [2025]

- How many hours in working week? Full breakdown [2025]

- The Ultimate guide: What is A section 125 Cafeteria plans and benefits

5. How repayment term length affects your business

The repayment length significantly affects your business’s finances:

| Term | Monthly Payment | Total Interest Paid |

|---|---|---|

| 3 years | $3,042 | $9,512 |

| 5 years | $1,933 | $16,007 |

| 10 years | $1,110 | $33,227 |

Pros and cons

Short-term loans:

-

Higher monthly payments

-

Less interest overall

-

Faster payoff

-

Tighter cash flow

Long-term loans:

-

Lower monthly payments

-

More total interest

-

More cash flow flexibility

-

Longer debt exposure

Choosing wisely helps maintain balance between affordability and cost.

6. Can you pay back a business loan early?

Paying off a business loan ahead of schedule can help reduce interest costs and free up cash flow but it’s not always as straightforward as it seems. While most lenders allow early repayment, the terms and conditions can vary significantly.

6.1. Early repayment tips

Before deciding to repay a loan early, it’s important to evaluate both the financial benefits and potential drawbacks. Here are a few practical steps to follow:

-

Read the loan agreement thoroughly

Many lenders include clauses about prepayment penalties or minimum interest requirements. Knowing these terms upfront prevents unexpected charges later. -

Ask about early payment fees

Some lenders charge a flat fee or a percentage of the remaining balance if you repay ahead of schedule. Understanding this helps you calculate whether early payment is worth it. -

Consider refinancing if penalties are high

If early repayment triggers substantial fees, refinancing with a more flexible lender could be a better strategy to reduce overall interest while avoiding penalties.

These steps ensure that early repayment actually benefits your business in the long run.

Real example: A lender may charge 2% of the remaining loan balance if the borrower repays within the first 24 months turning a smart move into a costly mistake if not anticipated.

Early repayment can be an excellent strategy, but only when done with a full understanding of the costs and benefits involved.

7. How to choose the best business loan repayment term

Picking the right term aligns with your business’s goals and cash flow.

Follow these 11 steps:

-

Analyze your revenue and cash flow patterns.

-

Define your purpose for the loan.

-

Assess how much monthly payment is feasible.

-

Match the loan to your business cycle.

-

Consider future revenue or expansion plans.

-

Review prepayment penalties.

-

Compare total interest costs by term.

-

Ask about payment flexibility.

-

Understand your credit profile.

-

Talk to business advisors (SBDC, SCORE).

-

Fit the loan into your financial strategy.

Following these steps leads to an informed decision that supports long-term success.

8. Tools & resources for repayment planning

Selecting the right repayment term requires careful analysis and having the right tools makes that process much easier. Below are key resources that can help you evaluate your options and stay on track throughout your loan lifecycle:

-

SBA loan calculator

This official tool from the U.S. Small Business Administration helps estimate your monthly payment based on loan amount, interest rate, and term length. It’s a valuable starting point for evaluating affordability. -

Business loan repayment planner

These spreadsheets or software tools allow you to visualize your entire repayment schedule. You can input custom variables and adjust for early payments or interest changes. -

Cash flow guides

Educational guides on managing business cash flow help ensure that loan repayments don’t strain your operations. They often include forecasting templates and seasonal budgeting strategies. -

SCORE and SBDC resources

Free government-backed counseling services like SCORE and the Small Business Development Centers (SBDC) provide access to expert advice, workshops, and personalized loan consultations. -

Loan comparison tools

Online platforms like Fundera or NerdWallet let you compare interest rates, terms, fees, and lender requirements side by side. These are ideal for exploring your options before applying. -

Accounting software integration

Tools like QuickBooks and Xero now offer loan tracking features, syncing payments with your bookkeeping system for better visibility and compliance. -

Credit monitoring services

Maintaining a strong credit profile is key to securing better loan terms. Services like Nav or Experian help track business credit scores and send alerts on changes that may impact eligibility.

These tools make it easier to understand the full cost of a loan, plan your cash flow, and avoid surprises giving you more control over your financial future.

9. FAQs on business loan repayment terms

Q1: Can I extend or restructure my loan if I’m struggling?

A: Yes. Contact your lender early. Options vary by lender and loan type.

Q2: Can I refinance a business loan to change the term?

A: Refinancing is a common way to adjust repayment schedules.

Q3: Will early repayment improve my credit?

A: It may help if the loan is paid in full without default.

Q4: What are deferred or interest-only payment periods?

A: Some loans offer these during early months to ease startup costs.

Q5: What happens if I default on my loan?

A: Default may result in penalties, damaged credit, or legal action.

Q6: Are repayment terms negotiable?

A: Sometimes especially with strong collateral or business history.

Q7: Which business loan is fastest to pay off?

A: Merchant cash advances and invoice financing have the shortest terms.

10. Conclusion

Understanding how long do you have to pay back a business loan empowers business owners to make smarter financial decisions and plan more confidently for growth. Repayment terms differ based on loan type, lender, and your business’s specific financial needs.

Key takeaways:

-

SBA and traditional loans usually come with long repayment periods; short-term financing provides faster access but shorter terms.

-

Your credit history, loan amount, and cash flow play key roles in determining available term lengths.

-

Paying off a loan early can reduce total interest, but check for prepayment penalties.

-

Choosing a term aligned with your revenue cycle helps avoid financial strain.

-

Use loan calculators, expert advisors, and comparison tools to evaluate the best option.

With the right information, you can select a repayment term that supports both stability and strategic growth.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.