How might a company reduce its variable expenses in 2025? Understanding and managing variable expenses has become crucial for businesses in 2025. Variable expenses are costs that change in direct proportion to business activity, affecting profitability, cash flow, and overall resilience.

With recent economic uncertainties, supply chain disruptions, and shifting consumer behaviors, companies face increased pressure to control these costs.

According to a 2024 survey by the Financial Management Association, over 65% of businesses reported that managing variable expenses was key to maintaining competitive margins this year.

This guide explains what variable expenses are, why they matter, and offers practical strategies to reduce them effectively. Whether you run a startup, mid-sized company, or a large corporation, trimming variable costs can fuel growth and improve stability.

Backed by expert insights and real-world examples, this article will help you apply proven financial approaches to reduce spending wisely in today’s dynamic market.

1. What are variable expenses? (Definition, examples, and 2025 insights)

Before exploring how to reduce them, it’s essential to understand what variable expenses are, how they differ from fixed costs, and why they are so influential in financial management.

By showing the below:

1.1. Definition

Variable expenses are costs that rise or fall depending on how much a company produces or sells. Unlike fixed expenses, which remain constant regardless of activity, variable costs move directly with business volume.

1.2. Examples and comparison table

Here’s a simple comparison table:

| Variable Expenses | Fixed Expenses |

|---|---|

| Materials and supplies | Rent and lease payments |

| Direct labor costs | Salaries of permanent staff |

| Sales commissions | Insurance premiums |

| Shipping fees | Property taxes |

| Utility costs tied to production | Office depreciation |

Common variable expenses across industries include:

-

Raw materials and packaging (fluctuate with production)

-

Hourly labor wages (rise in busy seasons)

-

Sales commissions (proportional to sales volume)

-

Shipping and freight fees (increase with orders)

-

Credit card transaction fees (linked to sales)

-

Utilities linked to production (usage-based)

-

Marketing campaign costs based on volume

-

Seasonal inventory purchases

For example, a manufacturer’s use of raw materials and production labor varies with output. In retail, shipping and packaging costs increase with order volume. SaaS companies may see higher cloud usage and customer support costs as subscriptions grow.

Because these expenses directly relate to activity, businesses can adjust them to optimize costs more readily than fixed expenses.

1.3. 2025 insights

In 2025’s environment, variable expenses offer both risk and opportunity. Firms that track and control these costs can react faster to market changes and improve profitability.

2. How to identify and track variable expenses effectively

To reduce variable expenses, businesses must first identify and monitor them accurately. The following five-step process is a proven method for clarity and control:

-

Gather all company expenses for recent months and segment them into categories.

-

Separate fixed costs from variable ones, noting semi-variable costs carefully.

-

Use digital tools or templates to track expenses regularly, ensuring clear records.

-

Analyze monthly and quarterly fluctuations to spot patterns or unexpected spikes.

-

Benchmark your variable costs against industry averages to understand where you stand.

Popular expense-tracking tools include QuickBooks, Expensify, and cloud-based ERP modules tailored for finance teams. Templates for Excel or Google Sheets can be effective for smaller businesses.

Pro Tip: Avoid misclassifying semi-variable costs, such as utility bills that have both a fixed base and usage-based portion. Accurate classification ensures better decision-making.

Regular audits and clear reporting help you “know the numbers” and act quickly when needed.

View more:

- How long do you have to pay back a business loan

- Do i need business license for sole proprietorship

- New Jersey finance agreement max late fees

3. Core strategies: How might a company reduce its variable expenses?

Reducing variable expenses requires a structured, multi-pronged approach.

The strategies below are tailored for 2025 and backed by data and real-world results.

3.1. Supplier & vendor negotiation (2025 tactics)

One of the most direct ways to cut variable costs is through supplier negotiation:

-

Conduct annual contract reviews to ensure competitive pricing.

-

Negotiate volume discounts based on purchase forecasts.

-

Join group purchasing organizations for better rates.

-

Solicit bids from multiple vendors to create leverage.

Real example: A mid-sized manufacturer renegotiated supply contracts and achieved a 12% reduction in raw material costs within six months.

Negotiating smartly can yield immediate and measurable savings without compromising quality.

3.2. Workforce optimization & smart labor management

Labor costs often form a significant portion of variable expenses. Strategies include:

-

Employ on-demand or temporary staffing to handle peak workloads.

-

Automate repetitive tasks to decrease direct labor needs.

-

Cross-train employees to improve flexibility.

-

Use freelance or remote workers where feasible.

-

Manage hybrid work setups to reduce facility-related costs.

Real example: Automation projects introduced by several firms in 2024 showed ROI within 9 months, boosting efficiency and lowering overtime expenses.

Flexible labor strategies align resources with demand while keeping costs in check.

3.3. Inventory & process streamlining

Reducing inventory holding and streamlining production reduces waste and variable costs:

-

Adopt just-in-time (JIT) inventory to minimize stock.

-

Optimize batch sizes for efficient manufacturing.

-

Set minimum order quantities aligned with demand.

-

Implement lean manufacturing principles to reduce waste.

Real example: A logistics company’s application of JIT cut storage costs by 18% while improving delivery speed.

Efficient processes reduce both waste and unnecessary expenses.

3.4. Technology & automation for expense reduction

Using technology is key to modern cost control:

-

Automate workflows such as accounts payable/receivable, HR, and procurement.

-

Use AI-driven forecasting tools to optimize purchasing.

-

Migrate IT infrastructure to cloud platforms for scalability.

-

Implement digital contract management to avoid missed savings.

-

Adopt utility monitoring systems to track and reduce energy costs.

Real example: Studies show average technology investments return savings within 12 months through reduced manual errors and improved efficiency.

The right tech reduces hidden costs and enhances operational agility.

3.5. Contract, subscription, and service audit

Review all service-related expenses regularly:

-

Conduct quarterly reviews of software licenses and subscriptions.

-

Eliminate unused or redundant services.

-

Renegotiate contracts for better terms.

-

Look for bundled deals or consolidated service rates.

Real example: A tech firm saved $1,500 monthly after auditing its SaaS subscriptions.

Regular service audits ensure you only pay for what you truly use.

3.6. Employee engagement for cost-saving ideas

Employees often have valuable insights into variable cost drivers:

-

Create incentives for staff to suggest cost-saving initiatives.

-

Establish suggestion programs that reward practical ideas.

-

Involve teams in process redesigns to identify inefficiencies.

Real example: A retail chain’s staff-led waste reduction effort cut packaging costs by 9% within one quarter.

Engaging employees builds a culture of cost-awareness and innovation.

3.7. Outsourcing, shared services & partnerships

Outsourcing non-core activities can lower variable costs effectively:

-

Outsource administrative or back-office functions.

-

Use shared business services to aggregate demand.

-

Consider offshoring for specific functions, ensuring compliance and ethics.

Real example: An accounting department’s outsourcing saved 15% annually compared to in-house costs.

Strategic outsourcing frees resources for core business growth.

4. 30+ checklist: How to reduce variable expenses (practical actions for any business)

To make cost-cutting more actionable, here’s a checklist every business can apply.

.1. Supplier & vendor

-

Review supplier contracts annually to ensure competitive pricing and terms.

-

Negotiate bulk purchase discounts based on reliable demand forecasts.

-

Use group purchasing organizations to access lower rates.

-

Invite competitive bids from multiple vendors for leverage.

-

Consolidate suppliers where feasible to improve terms.

-

Monitor supplier performance to prevent overruns and delays.

4.2. Labor & staffing

-

Use temporary staff during seasonal peaks to avoid overstaffing year-round.

-

Automate repetitive, low-value tasks to cut direct labor hours.

-

Cross-train employees to increase operational flexibility.

-

Hire freelancers for specialized tasks instead of full-time hires.

-

Optimize hybrid work policies to reduce facility-related costs.

4.3. Inventory & operations

-

Adopt just-in-time inventory to reduce holding costs.

-

Optimize order quantities to balance storage and supply needs.

-

Apply lean manufacturing to minimize waste.

-

Reduce storage expenses through efficient warehouse management.

-

Improve demand forecasting to avoid overproduction.

-

Streamline production batches to lower per-unit costs.

4.4. Technology & automation

-

Automate accounts payable/receivable processes to cut admin costs.

-

Use AI for demand and inventory forecasting.

-

Move IT systems to cloud platforms for scalability.

-

Implement energy monitoring tools to track and reduce usage.

-

Automate contract renewals to avoid missed opportunities.

4.5. Contracts & subscriptions

-

Audit software usage quarterly to identify unused licenses.

-

Eliminate duplicate subscriptions across teams.

-

Renegotiate service agreements to improve rates.

-

Bundle services where possible for discounts.

4.6. Energy & utilities

-

Upgrade to energy-efficient equipment to lower consumption.

-

Monitor usage patterns to identify and eliminate waste.

4.7. Employee engagement

-

Run cost-reduction suggestion programs with rewards.

-

Recognize and incentivize process improvement ideas.

4.8. Outsourcing & partnerships

-

Outsource non-core functions to specialist providers.

-

Share services with partners to benefit from economies of scale.

Using a structured checklist keeps cost-cutting systematic and sustainable rather than reactive.

5. Ongoing measurement & sustaining reductions

Cutting costs is not a one-off project. Ongoing measurement ensures savings are maintained:

Key KPIs:

-

Variable Cost Ratio: Variable costs / total sales.

-

Cost Per Unit: Average variable expense per product/service.

-

Margin Improvement: Profitability changes post-cost-cutting.

-

Variance Reporting: Budget vs. actual cost differences.

Tools like Google Sheets can handle basics, while ERP dashboards provide real-time tracking. Zero-based budgeting, starting each budget cycle from zero, keeps expenses under control.

Sustained savings come from discipline, visibility, and a company-wide cost-conscious culture.

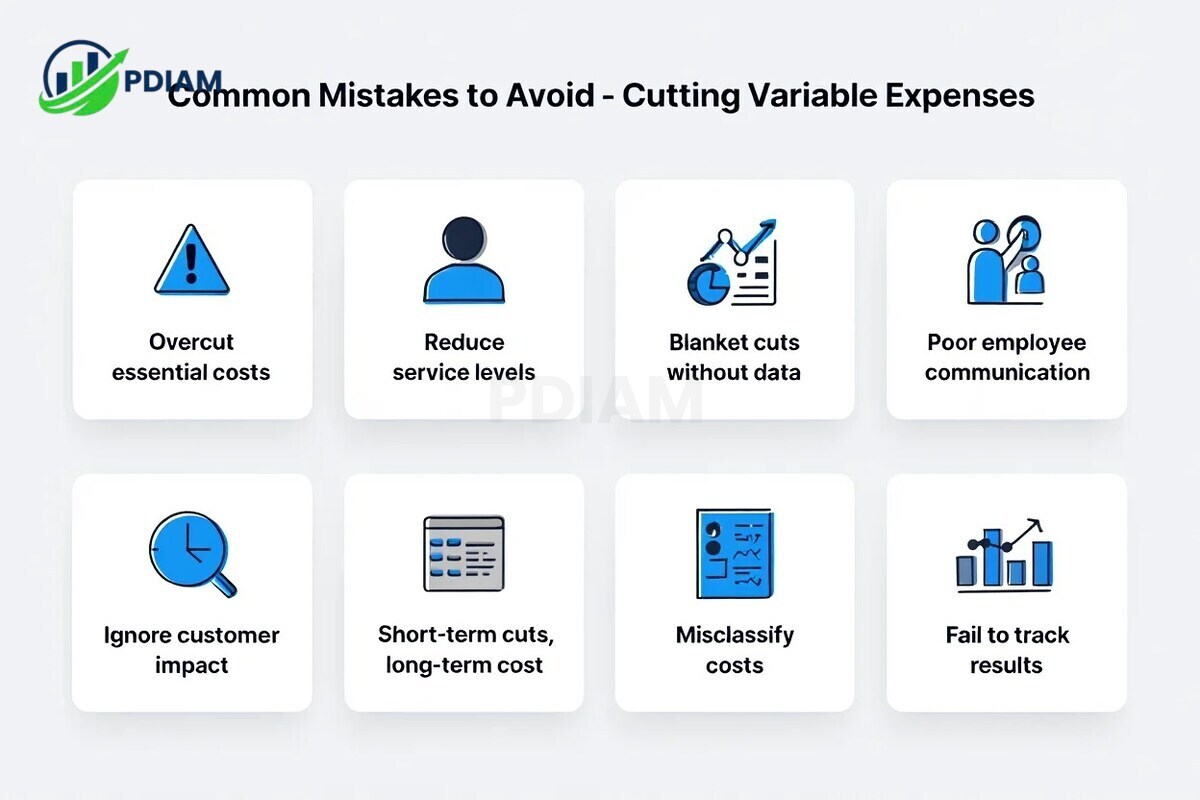

6. Common mistakes to avoid

Cutting variable expenses can backfire if approached without careful planning. The following are common mistakes that can undermine savings and harm operations.

-

Overcutting essential costs that affect quality.

-

Reducing service levels, harming customer experience.

-

Blanket cuts without data analysis.

-

Poor communication with employees about changes.

-

Ignoring customer impact, risking lost sales.

-

Short-term cuts that increase long-term costs.

-

Misclassifying costs, leading to poor decisions.

-

Failing to track results post-implementation.

Avoiding these pitfalls ensures savings don’t come at the expense of growth or quality. By learning from these mistakes, companies can pursue cost reductions more strategically.

If you want more stuffs like these, check out our:

- What is a high turnover rate? Full HR Breakdown [2025]

- What is a private label product? Smart seller’s guide [2025]

- What are the assets of a business? Explained simply [2025]

7. Real-world examples & 2025 industry benchmarks

Looking at real-world cases and industry benchmarks can help businesses set realistic cost-reduction targets and identify proven strategies that work.

| Sector | Typical Variable Expense (% of revenue) |

|---|---|

| Manufacturing | 25–35% |

| Retail/E-commerce | 30–40% |

| SaaS/Tech | 20–30% |

| Logistics | 35–45% |

| Professional Svcs | 40–50% |

Example 1: A manufacturer reduced costs by 14% in 12 months via supplier renegotiation and JIT inventory.

Example 2: An e-commerce brand cut shipping/packaging costs by 10% by redesigning packaging and adopting hybrid staffing.

Example 3: A professional services firm lowered labor expenses 8% using part-time contractors and billing automation.

Benchmarks and case studies help set realistic goals and inspire action. Learning from industry data ensures that cost-reduction plans remain both competitive and achievable.

8. FAQs

8.1. Q: Should my business outsource variable functions?

A: Yes, if the tasks are non-core, outsourcing can be more cost-effective without affecting quality.

8.2. Q: What’s the difference between variable and semi-variable costs?

A: Variable costs change directly with volume; semi-variable costs have both fixed and variable components.

8.3. Q: Which variable costs are easiest to cut in SaaS businesses?

A: Cloud usage fees, third-party service licenses, and customer support labor.

8.4. Q: Is zero-based budgeting better than traditional budgeting?

A: Zero-based budgeting forces justification for every cost, offering tighter control.

8.5. Q: How can I engage staff in cost-saving without hurting morale?

A: Involve them in problem-solving, reward ideas, and explain benefits clearly.

8.6. Q: How often should we review contracts and subscriptions?

A: At least quarterly to identify unused services and renegotiate terms.

8.7. Q: Can technology investments really pay for themselves?

A: Yes, many firms see payback in under a year through reduced errors and increased efficiency.

9. Conclusion

So, how might a company reduce its variable expenses? Reducing variable expenses in 2025 is essential for improving profitability, resilience, and growth potential.

Key takeaways:

-

Identify and track costs accurately.

-

Apply multi-faceted strategies: supplier negotiation, labor optimization, inventory streamlining, tech adoption, service audits, employee engagement, and outsourcing.

-

Use structured checklists and KPIs to sustain savings.

-

Avoid common mistakes that harm quality or long-term performance.

By taking a disciplined, data-driven approach, companies of all sizes can control variable expenses while preserving service quality and employee morale.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.