How much does health insurance cost per month? Knowing how much health insurance costs per month is essential for budgeting, comparing plans, and avoiding unexpected bills. In 2025, prices vary significantly based on location, age, plan type, and eligibility for subsidies.

Whether you’re exploring options through the ACA marketplace, an employer, or federal programs, understanding average costs and key variables can help you make informed decisions.

This guide breaks down average monthly premiums by plan type, explains how personal factors affect pricing, and provides tips to reduce your costs this year.

1. Average monthly health insurance costs in 2025

Monthly health insurance premiums depend on several factors, but we can begin with a general benchmark.

In 2025, the average monthly premium for an ACA Silver plan (used as the standard benchmark) is about $550 for a 40-year-old individual. However, this number fluctuates based on age, location, and plan tier.

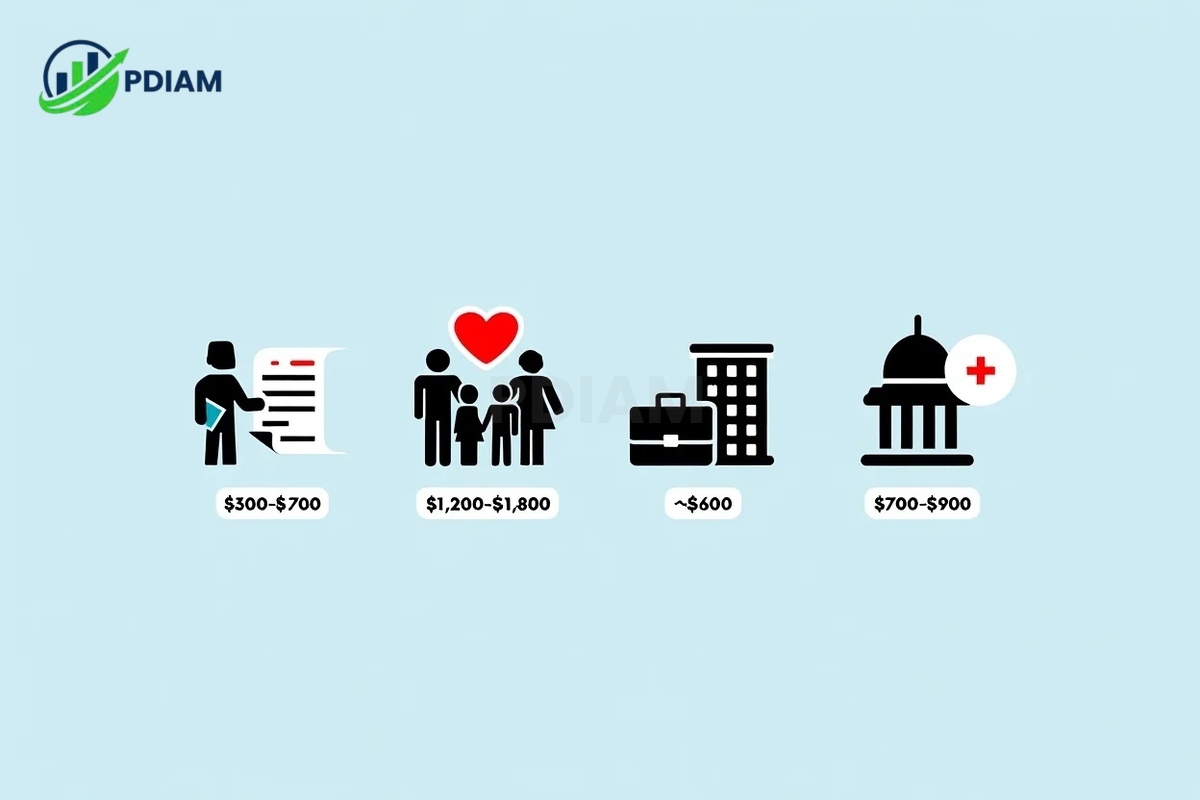

Here’s a breakdown of average monthly premiums:

-

Individual ACA plans: $300–$700/month

-

Family ACA plans: $1,200–$1,800/month

-

Employer-sponsored plans (individual): ~$600/month

-

Federal employee health benefits (FEHB): $700–$900/month

Average premiums by metal tier

Metal tiers affect how much you pay each month and how much coverage you receive:

| Plan Tier | Average Monthly Premium (Individual) |

|---|---|

| Bronze | $400 |

| Silver | $550 |

| Gold | $700 |

| Platinum | $850 |

These averages are a good starting point, but your actual cost depends on multiple personal factors, explored next.

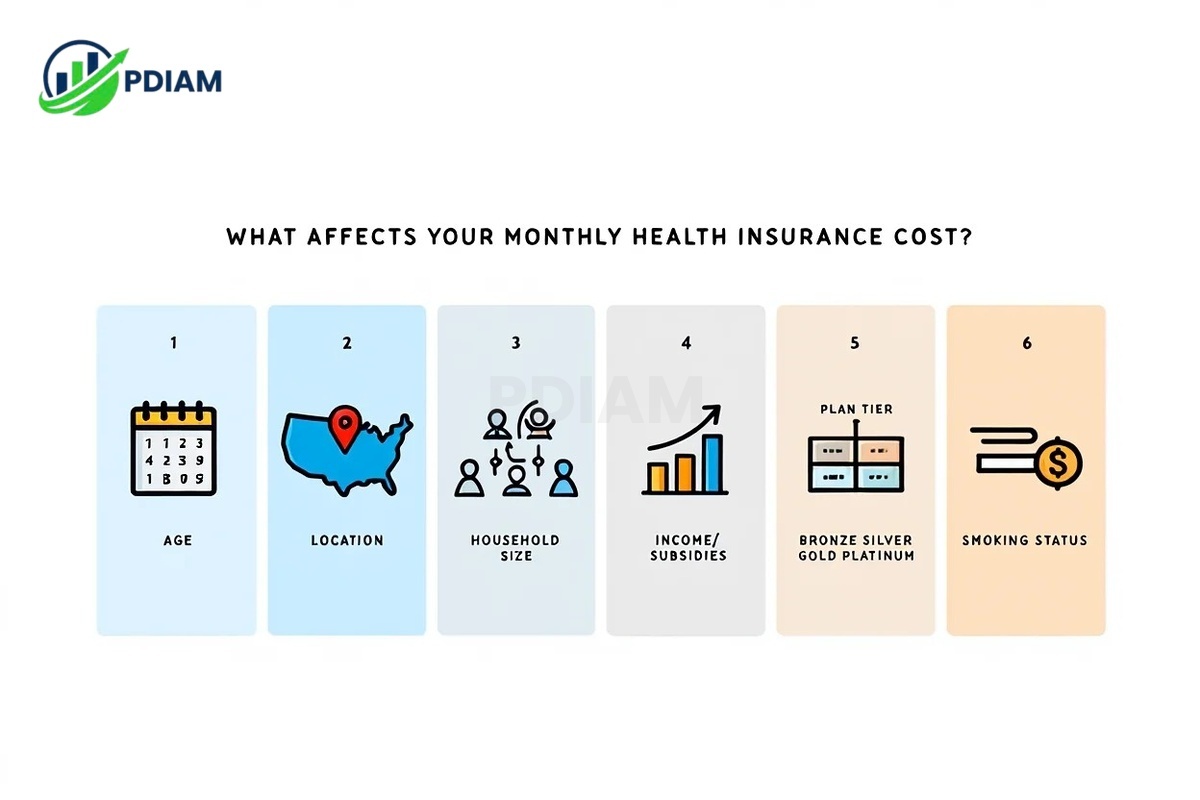

2. What affects how much does health insurance cost per month?

Understanding what drives premium pricing can help you plan effectively.

The following are the key factors influencing monthly health insurance costs.

2.1. Age

Premiums increase with age. On average, each year after age 18 adds 3%–5% to your premium. A 21-year-old might pay half as much as someone aged 60.

2.2. Location

State and even county-level differences in healthcare costs affect premiums. Urban areas typically have higher premiums due to denser hospital networks and higher costs of living.

2.3. Household size

Adding dependents raises your premium, but family plans often offer better value per person compared to individual coverage.

2.4. Income and subsidy eligibility

If your income falls within a certain range (usually 100%–400% of the federal poverty level), you may qualify for Advanced Premium Tax Credits (APTC) that reduce monthly premiums significantly.

2.5. Plan tier

Lower-tier plans like Bronze cost less but come with higher deductibles and out-of-pocket expenses. Platinum plans are costlier monthly but provide better coverage and lower deductibles.

2.6. Smoking status

Smokers may pay up to 50% more in premiums compared to non-smokers.

Real Example: A 21-year-old non-smoker in Arkansas might pay around $250 for a Silver plan, while a 60-year-old smoker in Alaska could face premiums over $1,200.

View more:

- How does workers’ comp affect tax return

- Difference between accounts payable and accounts receivable

- Professional employer organization pros and cons

3. How subsidies reduce your monthly premium

The average premium doesn’t tell the full story. Thanks to subsidies, more than 80% of ACA marketplace enrollees pay significantly less than the listed premium.

Subsidies are based on income and household size, and are applied directly to your monthly bill.

How a subsidy works (example):

-

Silver plan base premium: $550/month

-

Subsidy based on income: $400/month

-

Your actual premium: $150/month

Some low-income households may qualify for $0 premiums or Medicaid.

Pro Tip: Use official tools like Healthcare.gov’s subsidy calculator to estimate your potential savings before choosing a plan.

4. Why are premiums changing in 2025?

Health insurance costs continue to rise due to several market and regulatory forces.

Key reasons for premium increases

-

Medical inflation: The overall cost of care has risen ~4% annually over the past five years.

-

Higher drug prices: New medications and rising prescription costs increase insurer spending.

-

Regulatory changes: Updates to essential benefit coverage and administrative rules affect plan pricing.

-

Increased healthcare usage: Post-pandemic care catch-up continues to drive claims upward.

Despite these challenges, competition between insurers and more efficient digital healthcare delivery are helping keep some premiums in check.

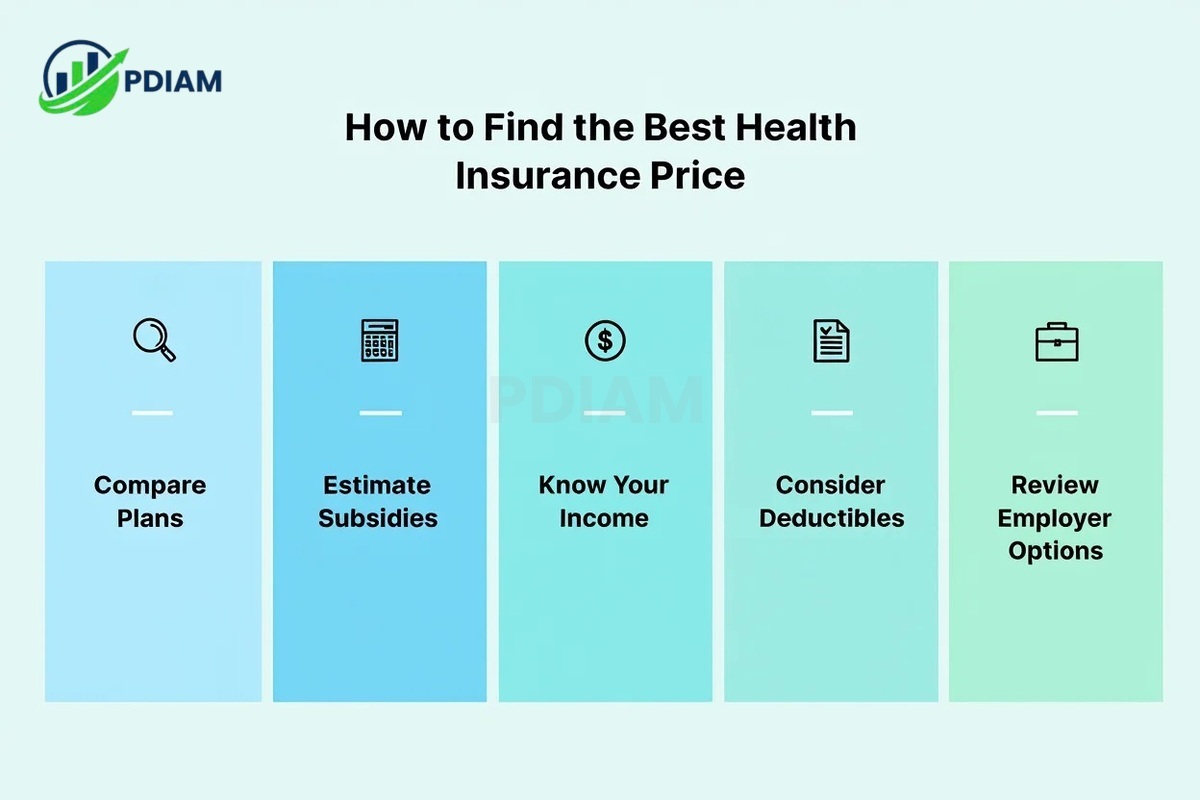

5. How to find the best health insurance price

Finding affordable coverage means more than picking the cheapest monthly premium.

Consider total value, coverage, and eligibility.

Steps to get your best price:

-

Compare plans on Healthcare.gov or your state exchange.

-

Use calculators like the KFF or Healthcare.gov tools to estimate subsidies.

-

Know your income and household size for accurate quotes.

-

Factor in deductibles and copays, not just monthly cost.

-

Check employer plans, but don’t assume they’re always cheaper.

By shopping smart and using available tools, you can save hundreds per month.

6. State-by-state health insurance costs in 2025

Where you live plays a major role in determining how much health insurance costs per month. Prices vary widely between states due to differences in local healthcare markets, regulations, and insurer competition.

The tables below show the five states with the highest and lowest average monthly health insurance premiums in 2025.

6.1. Top 5 most expensive states for monthly premiums

These states top the list for health insurance costs in 2025, largely due to higher healthcare costs, rural geography, and limited insurer competition.

| Rank | State | Avg. Monthly Premium |

|---|---|---|

| 1 | Alaska | $800 |

| 2 | Maryland | $750 |

| 3 | Connecticut | $730 |

| 4 | New York | $700 |

| 5 | New Jersey | $690 |

These high premiums are typically driven by factors like limited provider networks and above-average service costs.

6.2. Top 5 least expensive states for monthly premiums

In contrast, the following states offer the lowest health insurance premiums, thanks to strong marketplace competition and effective state-level healthcare policies.

| Rank | State | Avg. Monthly Premium |

|---|---|---|

| 1 | Arkansas | $350 |

| 2 | Wyoming | $370 |

| 3 | Hawaii | $390 |

| 4 | Montana | $400 |

| 5 | Idaho | $420 |

These states demonstrate how local policy and infrastructure can significantly lower the cost of coverage.

7. Special scenarios: different groups, different prices

While average premiums provide a baseline, your situation can significantly affect what you pay for coverage.

Belows showing it:

7.1. Self-employed and gig workers

Freelancers, contractors, and small business owners often turn to the ACA marketplace for flexible plans.

Many qualify for substantial subsidies based on fluctuating incomes.

Pro Tip: If you’re self-employed, keep accurate income records. This helps ensure correct subsidy calculations and avoid repayment during tax season.

7.2. Students and young adults

Young adults under 30 may qualify for catastrophic or Bronze plans, which offer low premiums but higher deductibles.

College students may also stay on a parent’s plan until age 26 or use school-sponsored options.

7.3. Seniors (65+)

Most seniors are covered by Medicare, which operates separately from the ACA.

While this article focuses on ACA and private plans, Medicare costs are set by federal guidelines and depend on income and enrollment timing.

7.4. Low-income and uninsured individuals

In Medicaid expansion states, individuals earning below 138% of the federal poverty level often qualify for $0-premium plans.

Those in non-expansion states may face coverage gaps but can still access subsidized marketplace plans in many cases.

These scenarios emphasize that personal circumstances play a big role in determining your real monthly cost, far beyond general averages.

Belows might worth your time:

- What is a Good Business to start in 2025? Top picks

- What is a Professional Employee organization? 30+ Key Benefits

- How to figure out how much a company is worth: The Ultimate 2025 Step-by-Step guide

8. Frequently asked questions (FAQs)

8.1. What is the average monthly cost of health insurance in 2025?

The average monthly cost for a Silver plan is about $550, but actual costs vary depending on location, age, and subsidy eligibility.

8.2. What does the monthly premium include?

It covers only the cost of having insurance—not deductibles, copays, or coinsurance.

8.3. Can I qualify for subsidies?

Yes, if your household earns between 100% and 400% of the federal poverty level. In 2025, eligibility was expanded slightly.

8.4. Are cheaper plans better?

Not always. Cheaper premiums often come with higher deductibles and limited networks.

8.5. How do short-term plans compare?

They cost less monthly but offer limited coverage and don’t meet ACA requirements.

8.6. What if I miss open enrollment?

You may still qualify for a Special Enrollment Period after major life events like job loss, marriage, or childbirth.

8.7. Is employer-sponsored insurance always the cheapest?

Not necessarily. It depends on how much your employer contributes and what alternatives are available in the marketplace.

9. Conclusion

Understanding how much health insurance costs per month is crucial to making the best financial and medical decisions in 2025. While premiums may seem high at first glance, most Americans pay far less thanks to subsidies and competitive plan offerings.

Key takeaways:

-

Average ACA Silver premium: $550/month

-

Factors like age, location, and smoking impact price

-

Subsidies can reduce costs to $0 for eligible households

-

Employer and federal employee plans remain strong options

-

State and personal scenarios greatly influence pricing

Take the time to compare options, check subsidy eligibility and secure the best plan you need.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.

![How much does Health insurance cost per month? Avoid overpaying [2025]](https://pdiam.com/wp-content/uploads/2025/08/How-much-does-Health-insurance-cost-per-month-thumbnail-750x375.jpeg)