How much is gap coverage insurance in 2025? As car loans grow and vehicles lose value faster, understanding the cost of gap insurance has never been more important. Gap coverage insurance helps protect car owners when their vehicle is totaled or stolen.

It pays the difference between the amount you owe on your auto loan and your car’s actual cash value (ACV). For example, if you owe $25,000 on your loan but the car’s value is only $20,000 at the time of loss, gap insurance covers the $5,000 difference.

Many drivers find themselves upside-down, owing more than their car is worth, which increases financial risk. This article breaks down gap insurance costs from different providers, explains what it covers, highlights price factors, compares buying options, and offers tips on saving money.

We’ll also answer common questions to help you make an informed decision about gap insurance this year.

1. How much is gap coverage insurance?

Gap insurance prices can vary significantly depending on where and how you purchase coverage.

Understanding the different cost structures helps you plan more effectively and avoid unnecessary overpayment.

1.1. Understanding cost ranges

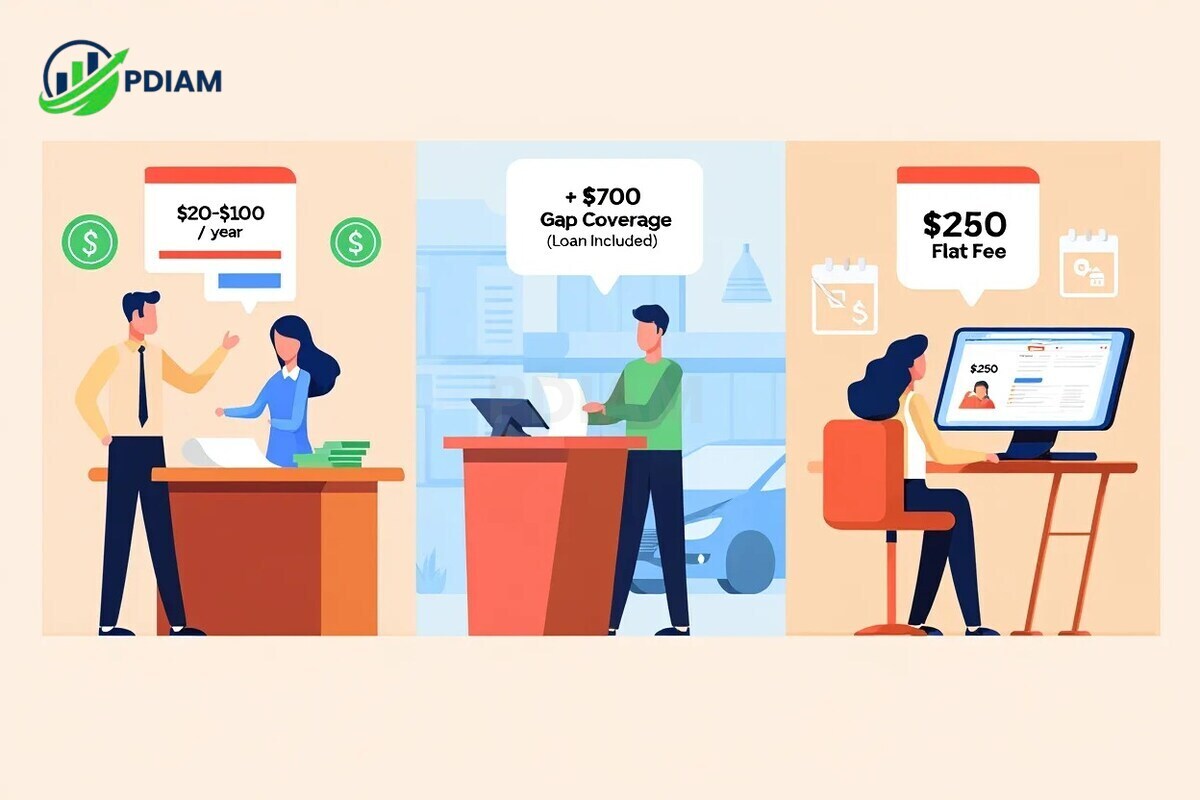

On average, gap insurance costs between $20 and $100 per year when purchased through an insurance company. In contrast, dealerships or lenders typically offer gap insurance as a one-time fee, ranging from $400 to $1,500, often rolled into your auto loan. Third-party providers charge a flat payment between $200 and $300.

Below is a comparison of typical costs by provider type:

| Provider Type | Typical Cost (USD) | Payment Structure |

|---|---|---|

| Insurance Company | $20–$100/year | Annual premium add-on |

| Dealership/Lender | $400–$700 (up to $1,500) | One-time, rolled into loan |

| Third-Party | $200–$300 | One-time, standalone payment |

The price differences often stem from how the cost is applied. Dealerships tend to bundle it into the loan, which means you may also pay interest on the fee. By contrast, insurance companies usually add it as a separate annual charge.

Understanding these pricing models allows you to choose the option that fits your budget while avoiding inflated long-term costs.

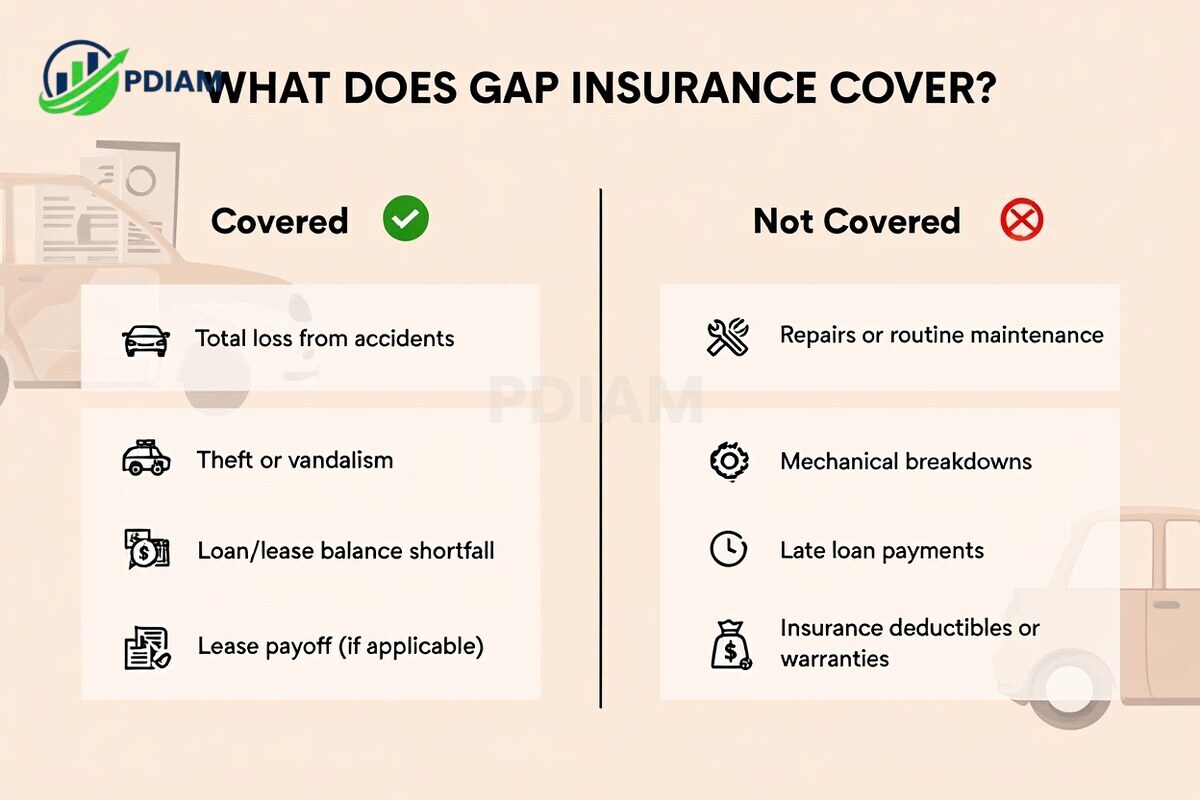

2. What does gap coverage insurance cover?

Gap insurance covers the gap between what your car is worth and what you still owe on your loan if the car is stolen or declared a total loss.

Gap insurance does not cover routine costs. It’s designed to protect you financially during major loss events.

Want to learn more stuffs like this? Check out our related articles:

- What is Push and Pull marketing? A simple breakdown [2025]

- The ugly shocking truth: Can you pay DoorDash with Cash? [2025]

- Is business credit card interest tax deductible? Comprehensive 2025 Guide

3. Why do gap insurance costs vary?

Several factors affect gap insurance pricing. The main reasons include the provider type, the size of your loan or lease, your vehicle’s value, and how fast the car depreciates. State laws and policy terms also play roles.

3.1. Key factors influencing price

-

Source/provider of insurance

-

Loan or lease amount

-

Vehicle type and price

-

Rate of depreciation

-

State insurance regulations

-

Policy duration and coverage limits

-

Requirement of a primary auto insurance policy

Understanding these factors helps you choose the right provider and avoid inflated fees.

4. Where to buy gap coverage insurance

You can buy gap insurance from insurance companies, dealerships, or third-party providers. Each source has pros and cons:

| Source | Pros | Cons |

|---|---|---|

| Insurance Company | Lower yearly cost, bundling options | May require existing auto policy |

| Dealership/Lender | Convenient during car purchase | Higher cost, rolled into loan |

| Third-Party | One-time payment, often cheaper | Limited cancellation flexibility |

Consumer experts recommend buying from your auto insurer to reduce costs and improve cancellation options.

5. When and for how long should you have gap coverage?

Gap insurance provides the most value during the early stages of a vehicle loan or lease, when you’re most at risk of being upside-down—owing more than the car is worth.

During the first few years, depreciation occurs quickly while the loan balance remains high. That’s why gap coverage is typically useful within the first 2 to 3 years of financing or leasing.

5.1. Ideal scenarios for gap insurance

Gap coverage is especially recommended in the following situations:

-

Small or no down payment: You’re more likely to owe more than the car’s value early on.

-

High depreciation vehicles: Some cars lose value faster than others.

-

Long loan or lease terms: Extended financing increases the time you’re vulnerable.

-

Leasing a vehicle: Lease agreements often include gap coverage, but it’s worth verifying.

Once your loan balance is equal to or less than your car’s actual cash value (ACV), gap insurance becomes unnecessary and can be canceled to save on premiums.

6. How to save on gap coverage insurance

Saving money on gap insurance starts with being an informed shopper. The provider you choose and when you cancel your policy can make a big difference in total cost.

Here are effective ways to reduce the cost of gap insurance:

-

Shop around and get multiple quotes: Don’t accept the first offer, especially from dealerships.

-

Buy from your insurer, not the dealership: Insurers often offer better annual rates and cancellation flexibility.

-

Bundle with your auto insurance if possible: This can unlock additional discounts.

-

Cancel gap coverage when equity surpasses loan: Don’t keep paying when you no longer need it.

-

Read your policy terms carefully before signing: Know the limits, exclusions, and refund options.

These actions not only lower your premiums but also give you more flexibility if your financial situation or vehicle changes over time.

7. Real-world scenarios: Gap insurance in practice

To better understand how gap insurance plays out in real life, consider these 2025 case studies of everyday drivers who used (or misused) gap coverage.

7.1. Case studies & common mistakes

-

Jane bought gap insurance through her insurer for $40/year. When her car was totaled in an accident, her policy paid off a $5,000 loan gap—preventing major financial loss.

-

Mark purchased gap coverage from the dealership for $600. After comparing options later, he realized he could have saved hundreds by going through his insurance company.

-

Lisa canceled her gap insurance after three years, once her loan balance matched her vehicle’s value. She avoided unnecessary premium payments moving forward.

Common mistakes include:

-

Overpaying at the dealership without researching alternatives

-

Failing to cancel gap coverage once it’s no longer needed

-

Not understanding what the policy actually covers

Learning from real cases like these helps you avoid costly mistakes and make smarter financial decisions about gap insurance.

View more:

- Best HR Software for Small Businesses in 2025

- How to price a business for Sale: The complete 2025 guide

- Essential Guide: Professional employer organization Pros and Cons [2025]

8. Frequently asked questions (FAQs)

Q1: Can I buy gap insurance after purchasing my car?

A1: Yes. Most insurers allow you to purchase gap coverage within the first 12 months after buying the vehicle.

Q2: Does gap insurance apply to used vehicles?

A2: Yes, especially if you owe more on the loan than the car’s current value.

Q3: Can I cancel gap insurance and get a refund?

A3: Usually yes. Most policies offer a prorated refund if canceled early, depending on provider terms.

Q4: Is gap insurance required by law?

A4: No. However, some lenders or lease companies may require it as part of the loan or lease agreement.

Q5: Can gap insurance transfer to a new car?

A5: Typically not. Most policies are tied to a specific vehicle and must be reissued if you change cars.

Q6: Is gap insurance more important for leased cars?

A6: Yes. Leased vehicles usually have high depreciation and little equity, making gap coverage essential.

Q7: Do state rules affect gap insurance availability?

A7: Yes. Availability and terms may vary depending on state insurance regulations.

9. Conclusion

So, how much is gap coverage insurance? Gap coverage insurance protects you from owing more than your car’s value if it’s totaled or stolen. In 2025, rising loan balances and faster vehicle depreciation make gap insurance more relevant than ever. Costs vary depending on the provider, payment method, and vehicle type.

To recap:

-

Average cost ranges from $20/year to $1,500 (one-time)

-

Best to buy from insurers for flexibility and savings

-

Cancel when your loan balance no longer exceeds car value

-

Understand what’s covered and compare multiple options

-

Follow a checklist before committing to any policy

Ready to save? Compare gap insurance quotes today through your auto insurer or state insurance department to get the best deal possible.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.

I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.