How to accept credit card payments as a Small Business in 2025? Accepting credit card payments is now essential for small businesses to meet customer expectations and stay competitive in 2025.

Consumers increasingly prefer cashless options, with recent data from the Federal Reserve and the Nilson Report showing that over 70% of transactions are made via cards or digital wallets.

This shift means businesses that accept credit cards often see higher sales, improved cash flow, and a stronger reputation. In this article, you’ll learn how to accept credit card payments as a small business through step-by-step guidance, legal compliance, processor selection, and security practices.

Pdiam is committed to providing actionable and reliable financial advice to help small businesses navigate these changes confidently.

1. What does it mean to accept credit card payments as a small business?

Accepting credit card payments means your business can process transactions from major card networks like Visa, Mastercard, American Express, and Discover. This capability allows for flexible payments in-store, online, or via mobile devices.

The payment ecosystem includes the merchant (your business), the acquiring bank, the payment processor, the card networks, and the customer. When a customer initiates a payment, it goes through authorization, settlement, and fund transfer within seconds.

Depending on your business type, the method of acceptance varies:

-

Retail stores often rely on physical POS terminals.

-

Online businesses integrate payment gateways.

-

Mobile businesses use card readers attached to smartphones.

Understanding this foundation is key before moving on to legal and technical requirements.

2. Essential requirements and legal compliance for small businesses

Before accepting credit card payments, you need to ensure legal and regulatory readiness. These steps help protect your business and reassure processors and customers.

Here’s what you’ll need:

-

A valid business license proving your company’s registration status.

-

An Employer Identification Number (EIN) for tax purposes.

-

An active business bank account to receive deposits.

-

Updated contact information and mailing address.

Security-wise, you must comply with the Payment Card Industry Data Security Standard (PCI DSS). While the full standard is complex, small businesses must:

-

Secure customer data.

-

Use strong, regularly updated passwords.

-

Maintain a written privacy and refund policy.

Pro Tip: Begin training staff early on fraud detection and safe payment handling, this reduces chargebacks and protects your reputation.

Required documents and compliance checklist:

To begin accepting credit card payments legally and securely, your business must gather a few essential documents and meet industry compliance standards. These requirements help payment processors verify your legitimacy and ensure you can protect customer payment data.

| Requirement | Purpose |

|---|---|

| Business License | Validates legal operation status |

| EIN | Serves as your federal tax ID |

| Bank Account | Receives payment deposits securely |

| PCI DSS Compliance | Ensures cardholder data is protected |

These items form the baseline for moving forward. Once you’ve completed the documentation and compliance steps, you’re ready to explore available credit card acceptance methods tailored to your business model.

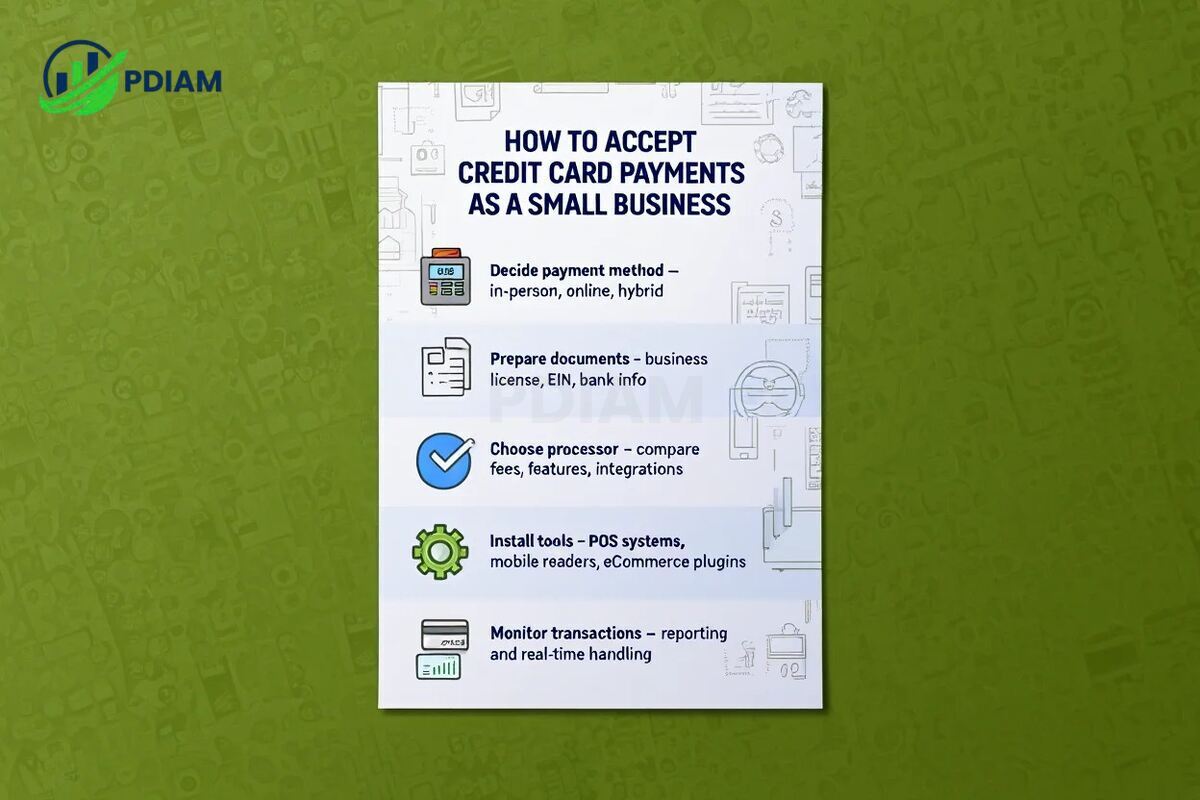

3. How to accept credit card payments as a small business

To help you get started, follow this structured roadmap:

-

Decide your acceptance method: Choose in-person, online, or hybrid options.

-

Gather legal documentation: Have your license, EIN, and bank details ready.

-

Select a payment processor: Compare fees, integrations, and support.

-

Set up hardware/software: Install POS systems, readers, or ecommerce plugins.

-

Train your team: Ensure staff understand fraud prevention and payment flows.

-

Go live and monitor: Track transactions, statements, and processor reports.

Each option has nuances, which we’ll explore in the next sections.

4. Accepting in-person credit card payments

In-person payments are ideal for physical stores and mobile vendors. The most common setup involves:

-

Point-of-Sale (POS) systems with card readers, receipt printers, and touchscreens.

-

Mobile card readers like Square or SumUp attached to smartphones or tablets.

These tools allow support for chip cards, contactless payments (NFC), and mobile wallets like Apple Pay or Google Pay.

Real Example: A local flower shop in Seattle began using Square’s mobile reader for walk-in and pre-order payments. Within two months, card acceptance accounted for 65% of sales, boosting customer satisfaction and streamlining bookkeeping.

Security measures like secure terminals and staff vigilance are essential to prevent theft or skimming.

View more stuff like these:

- Difference between Accrual and Cash basis accounting: Fast breakdown [2025]

- What is Fiduciary Liability insurance coverage? Must-know facts [2025]

- Can a felon buy a house? Rights, rules, and risks [2025]

5. Accepting online credit card payments

For ecommerce and service-based businesses, online credit card payments often serve as the primary revenue stream. The digital checkout experience must be seamless, secure, and scalable.

To accept online payments effectively, your setup should include the following components:

-

Payment gateways

These tools securely transfer payment data between your website and the payment processor. Popular options include Stripe, PayPal, and Square Online. -

Ecommerce platform plugins

Platforms such as Shopify, WooCommerce, and Wix offer built-in integrations with major payment providers. These simplify the process of embedding checkout options into your site. -

Recurring billing tools

For businesses offering subscriptions or retainers, tools like Stripe Billing or PayPal Subscriptions help automate invoices and renewals.

All systems must enforce SSL encryption and tokenization to safeguard sensitive customer data. These measures help you meet PCI DSS requirements and maintain customer trust.

Whether you run a full ecommerce store or a service business with online invoicing, the right payment solution improves both conversion rates and operational efficiency.

The table below highlights three widely used online payment solutions. Each offers distinct advantages based on your technical needs and customer base:

| Platform | Features | Typical Fees |

|---|---|---|

| Stripe | Customizable, API-focused | 2.9% + 30¢ per transaction |

| PayPal | Easy setup, brand recognition | 2.9% + 30¢ |

| Square | In-person & online blend | 2.6% + 10¢ |

Stripe is best for developers seeking full control, PayPal suits businesses that prioritize brand trust and ease of setup, while Square offers a flexible hybrid solution for those selling both online and in person.

Choosing the right platform depends on your checkout design, audience preference, and business growth plans.

6. Other remote credit card payment methods

Not all businesses use traditional terminals or ecommerce. You can also accept payments via:

-

Virtual terminals: Manually enter card info for phone/mail orders.

-

Email invoicing: Send secure links for clients to pay online.

-

Mobile payment links: Ideal for social selling or text-based transactions.

These are common among consultants, event organizers, and service providers who don’t use a full web store.

Pro Tip: When using remote payment methods, implement strict verification procedures to limit fraud exposure.

7. Comparing credit card processors and providers

Selecting the right payment processor is one of the most important decisions for small businesses looking to accept credit card payments. The ideal choice depends on your sales volume, industry, pricing needs, and whether you accept payments online, in person, or both.

7.1. Common processor types

Here are the three most common types of credit card processors available to small businesses:

-

Third-party providers

Services like Square and PayPal offer quick setup and don’t require a dedicated merchant account. These platforms are ideal for startups, freelancers, or pop-up retailers needing flexibility with minimal paperwork. -

Merchant account providers

Banks or specialized providers offer traditional merchant accounts that come with lower per-transaction fees, especially for businesses with higher volumes. However, the approval process involves underwriting and more stringent documentation. -

All-in-one platforms

Platforms like Shopify Payments combine merchant account, payment gateway, and POS features in a single solution. These are great for ecommerce stores looking for an integrated, streamlined approach to handling sales and fulfillment.

Each type has benefits and drawbacks, so it’s critical to align your choice with your business model and growth expectations.

7.2. Quick comparison of popular providers

The table below summarizes the most widely used credit card processors among small businesses, based on factors like use case, fees, and service model.

| Provider | Best Use | Fees | Contract | In-person/Online | Key Perks |

|---|---|---|---|---|---|

| Square | Retail/mobile sellers | 2.6% + 10¢ | No | Both | Free POS app |

| PayPal | Ecommerce & freelancers | 2.9% + 30¢ | No | Both | Buyer protection |

| Stripe | Developers/ecommerce | 2.9% + 30¢ | No | Online | API integration |

| Chase Merchant Services | High-volume retailers | Varies | Yes | Both | Bank integration |

Each provider targets a different type of business. Square is perfect for quick in-person setups, Stripe is developer-friendly for full control, while Chase offers better rates for established retailers.

Carefully read processor agreements before committing, especially terms around cancellation, payout delays, hardware compatibility, and chargeback policies.

View more:

- Financial planning tips for young adults

- Best HR Software for Small Businesses

- What is risk free rate of interest

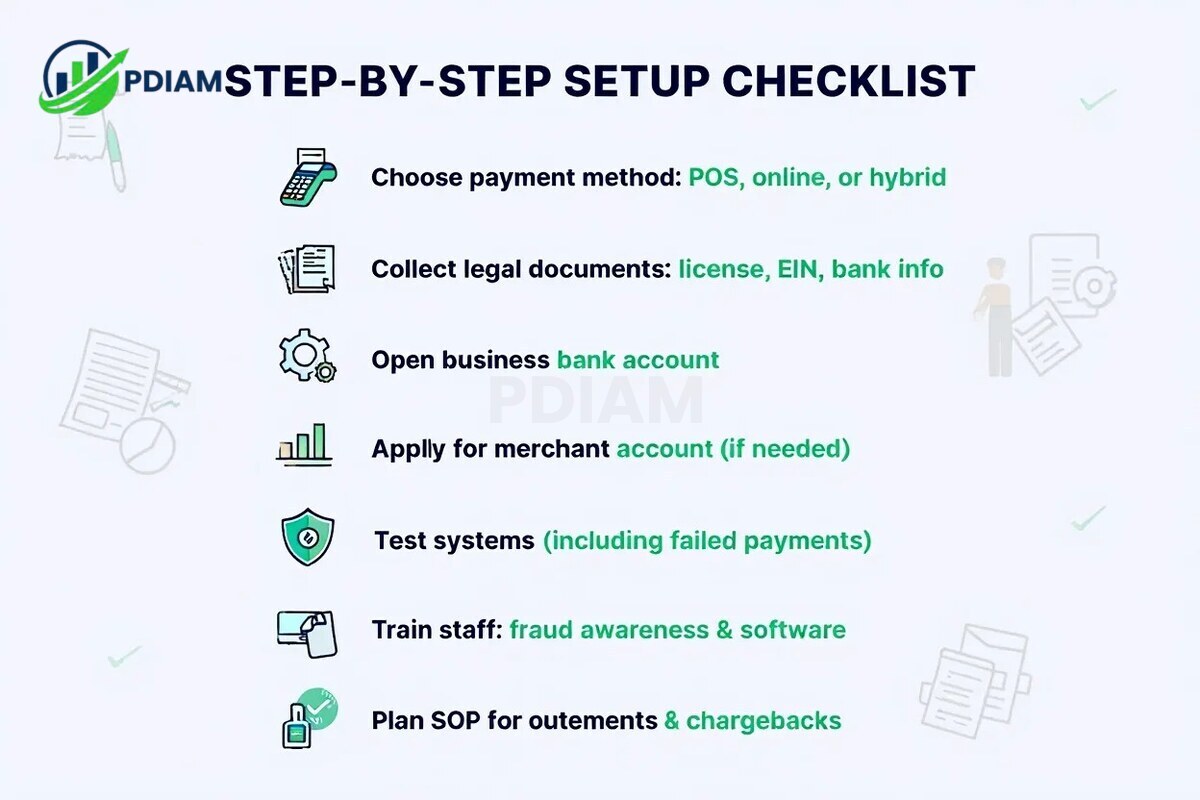

8. Step-by-step setup checklist

Follow this checklist to ensure smooth implementation:

-

Choose your method: POS, online, or hybrid.

-

Collect all documents: License, EIN, bank info.

-

Open a business bank account.

-

Compare payment processors.

-

Apply for a merchant account if necessary.

-

Order hardware or install integrations.

-

Test all systems (including failed transactions).

-

Train staff on fraud awareness and software usage.

-

Monitor all statements and chargebacks.

-

Plan for outages or disputes (build a troubleshooting SOP).

Refer to the compliance table in section 2.1 to stay aligned.

9. Understanding fees, hardware, and cost optimization

Accepting credit card payments involves multiple types of fees, and understanding them is key to managing your expenses effectively. Each payment method, whether in-person or online, has associated costs that impact your bottom line.

Here are the most common types of fees to account for:

-

Transaction fees: These are charged per sale and typically combine a percentage of the sale plus a flat amount. They apply to both in-person and online purchases.

-

Monthly or gateway fees: Some providers charge a fixed monthly fee for access to additional features, reporting tools, or integrations.

-

Chargeback fees: These are incurred when a customer disputes a transaction, and your business must cover investigation or reversal costs.

-

Hardware costs: If you accept payments in person, you’ll need to purchase or rent card readers, POS terminals, or receipt printers.

By understanding these categories, you can better evaluate which provider aligns with your budget and operations.

9.1. Common pricing models

Payment processors use different fee structures depending on your transaction volume, card types, and business model. The most popular pricing models include:

-

Flat-rate pricing: A single percentage + fee per transaction, regardless of card type. Ideal for small or low-volume businesses looking for predictability.

-

Interchange-plus pricing: Separates the card network’s interchange fee from the provider’s markup. Offers transparency and potential savings for high-volume businesses.

-

Tiered pricing: Organizes transactions into “qualified,” “mid-qualified,” and “non-qualified” categories, each with different rates. This model is less transparent and may cost more if you process many non-qualified transactions.

Choosing the right model depends on your average ticket size, monthly volume, and need for fee clarity.

9.2. Sample comparison of payment providers

Below is a simplified comparison of common providers and their typical pricing structures:

| Provider | Fee Structure | Hardware Cost | Other Fees |

|---|---|---|---|

| Square | 2.6% + 10¢ | $49 Reader | No monthly fee |

| PayPal | 2.9% + 30¢ | $79 Optional | Chargeback fees apply |

| Chase | Interchange-plus | $100+ | Monthly fees may vary |

Each provider suits a different type of business. Square works well for pop-ups or mobile vendors, while Chase suits established companies with high processing volume.

Real Example:

A coffee cart that processes $5,000 in monthly sales using Square at a 2.6% rate pays roughly $130/month in transaction fees. By monitoring monthly volume and adjusting providers as the business grows, the owner avoids overspending on unnecessary features or high-tier plans.

10. Security, PCI DSS, and fraud prevention

Compliance with PCI DSS is non-negotiable. Core steps include:

-

Use complex, regularly updated passwords.

-

Never store full card data.

-

Encrypt all card transmissions.

-

Run security patches and software updates.

-

Educate staff on suspicious activity and chargeback prevention.

Pro Tip: Use tokenized payments and auto-fraud detection tools to block high-risk transactions in real time.

11. Integrating payment systems into operations

For smoother operations, connect payment tools with your business systems:

-

Link with accounting software (e.g. QuickBooks, Xero).

-

Automate inventory updates based on sales.

-

Tie payments to your CRM for better customer follow-up.

-

Monitor batch settlements and error logs.

Retailers benefit from real-time inventory tracking, while consultants use CRM-linked invoicing to streamline recurring billing.

12. Use case scenarios

Every small business has unique needs when it comes to accepting credit card payments. Below are real-world examples showing how different business types apply various solutions effectively:

-

Retail:

A pop-up vendor attending weekend craft markets uses Square’s mobile readers to accept contactless payments from shoppers. This setup offers speed, convenience, and a professional checkout experience without bulky equipment. -

Service business:

An independent consultant uses Stripe to send recurring monthly invoices to clients for retainer-based services. The automatic billing streamlines revenue collection and reduces manual follow-ups. -

Ecommerce:

A small Shopify-based online boutique integrates both PayPal and Stripe as checkout options. This allows customers to choose their preferred payment method while ensuring secure, smooth transactions on the site. -

Mobile business:

A local food truck uses Square’s POS system to process orders during lunch rushes. With a wireless reader and digital receipts, the setup supports quick line turnover and builds customer trust.

These examples show that whether stationary or mobile, online or in-person, credit card acceptance can be tailored to fit various sales environments and customer expectations.

13. Frequently asked questions

Q1: Can a business accept credit cards without a POS system?

A: Yes, you can use virtual terminals or online gateways without a traditional POS.

Q2: What’s the difference between Stripe and PayPal?

A: Stripe offers more customization and developer tools, while PayPal is more plug-and-play.

Q3: How long does it take to receive funds?

A: Most processors settle funds in 1–3 business days, though some offer instant payout (with fees).

Q4: Are credit card payments safe for small businesses?

A: Yes, if you follow PCI DSS standards and use encrypted processors.

Q5: How can I reduce chargebacks?

A: Provide clear receipts, refund policies, and fast customer service.

Q6: Is it possible to switch providers later?

A: Yes, but review contract terms, early termination fees, and integration requirements.

Q7: What if my application gets declined?

A: Try a third-party processor like PayPal, or improve your business documents and apply again.

14. Conclusion

Accepting credit card payments is no longer optional, it’s a strategic move to grow and adapt in 2025. By learning how to accept credit card payments as a small business, complying with regulations, and using the right tools, you can streamline operations and deliver better customer experiences.

Key takeaways:

-

Understand the payment ecosystem and choose the right processor.

-

Ensure legal compliance (EIN, business license, PCI DSS).

-

Use secure systems, train staff, and monitor payment activity.

-

Integrate with accounting, inventory, and CRM tools for efficiency.

-

Evaluate fees and pricing models to avoid unnecessary costs.

Careful planning, proactive monitoring, and smart integration will ensure credit card acceptance empowers, not burdens, your business.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.