A business plan is a written document outlining your company’s goals, strategies, and how you will achieve them. In 2025, learning how to draw up a business plan is essential for navigating a volatile and highly competitive market.

Whether you’re launching a startup or running an established company, having a clear roadmap is more important than ever.

1. Why you need a business plan and who it’s for

Creating a business plan offers more than just structure it increases your odds of success.

-

Funding: Investors and lenders require a detailed plan before offering capital.

-

Roadmap: It defines your goals and outlines strategies to stay focused.

-

Risk management: Anticipates challenges and outlines contingency actions.

-

Adaptability: Helps adjust to changing market conditions and new opportunities.

This guide is ideal for entrepreneurs, SMEs, solo founders, and corporate strategists. Research by the SBA and Harvard shows that businesses with written plans are more likely to thrive.

View more:

- How to make an Email Address for a Business: Ultimate step-by-step guide [2025]

- How can you protect personal information gathered by Legitimate Organizations in 2025

- Do we need save previous Companies Paystubs? Must-Know Tips

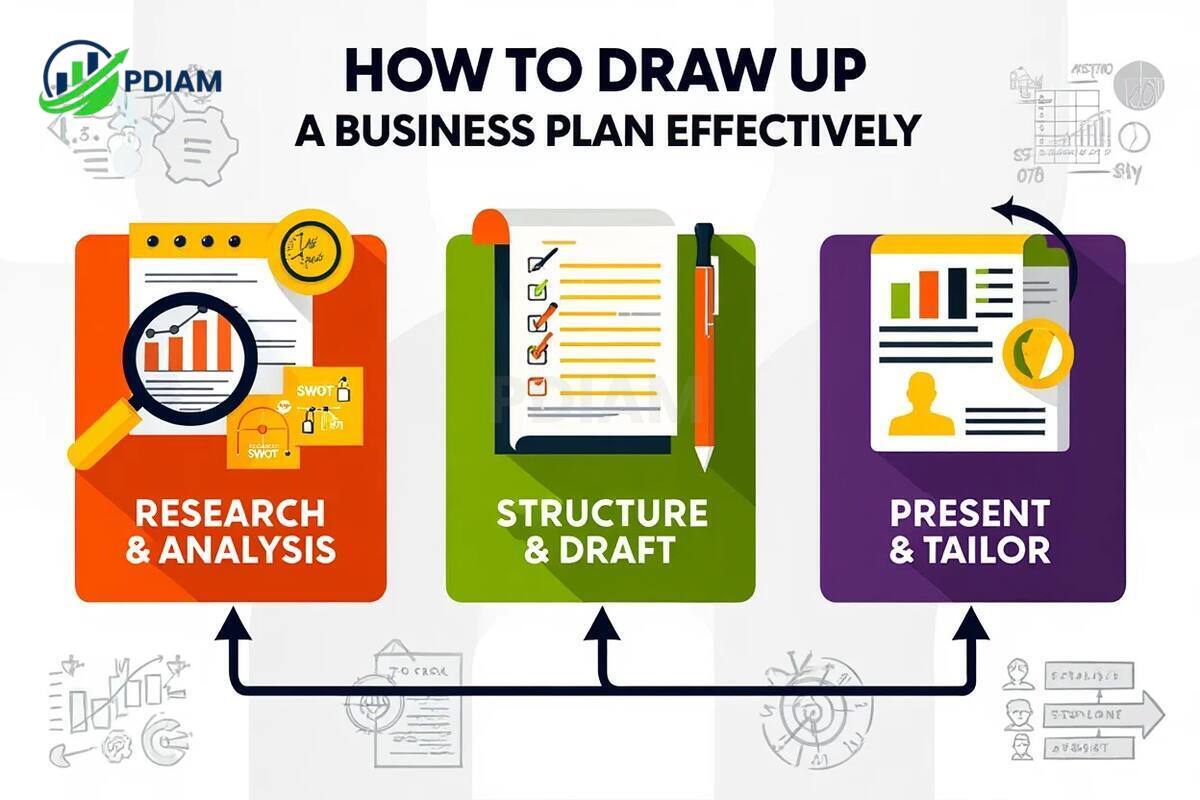

2. Steps of how to draw up a business plan effectively

To understand how to draw up a business plan that is both strategic and actionable, you must follow a step-by-step process.

The planning process should be flexible and iterative as you gather insights and adapt your direction.

2.1. Research and analysis

Start with deep research to understand your market and competitive landscape.

-

Use reliable sources like the SBA, Statista, and industry-specific reports.

-

Identify trends, customer behavior, and gaps your business can fill.

-

Conduct SWOT analysis to assess your internal and external position.

Real example: A boutique fitness startup analyzed three competitors and found demand for early-morning classes this led to a unique offering that drove their differentiation.

This research-driven approach lays the foundation for all other parts of your plan.

2.2. Structuring and drafting

Organizing your content clearly improves both writing and presentation.

-

Use a standard structure: executive summary, company, market, product, marketing, operations, and financials.

-

Write in simple, direct language. Avoid buzzwords and complex jargon.

-

Get early feedback from advisors or peers and revise accordingly.

Clarity and iteration are key when learning how to draw up a business plan that others can trust.

2.3. Presenting and tailoring

Adapting your plan to its audience maximizes its impact.

-

Design your plan to look professional with headings, spacing, and charts.

-

Create tailored versions depending on use: investor decks, bank loans, or internal strategy.

Customizing for your reader increases clarity and approval rates.

3. Key components of a successful business plan

Every effective business plan includes a set of essential components. These core sections allow stakeholders to evaluate your idea, operations, and growth potential with confidence.

3.1. Executive summary

This is the most important page many stakeholders won’t read beyond it.

-

Describe your business mission, current status, and goals.

-

Include your funding request and specify how the funds will be used.

Startup example:

GreenTech seeks $500,000 to launch solar solutions targeting urban homeowners, with a focus on affordable clean energy.

A compelling summary invites deeper reading and investor interest.

3.2. Company overview

This section defines your business identity and structure.

-

Outline your legal status (LLC, sole proprietorship, etc.).

-

Share your origin story, founder background, and mission.

-

Highlight what sets your business apart.

Template:

[Company Name] is a [business structure] established in [year], focused on [core mission or value proposition].

This establishes trust and vision early in your plan.

3.3. Market analysis

You must prove there’s a real market and that you understand it.

-

Present relevant market data and customer segmentation.

-

Profile competitors and industry leaders.

-

Use a SWOT table to summarize positioning.

SWOT Table Example:

| Strengths | Weaknesses |

|---|---|

| Innovative product | Limited reach |

| Opportunities | Threats |

|---|---|

| Growing demand | Big-name rivals |

Back your insights with sources and keep analysis concise but insightful.

3.4. Products and services

This section explains what you offer and why it matters.

-

Describe your main offerings and how they solve user pain points.

-

Share your roadmap or lifecycle if products are evolving.

SaaS example:

A real-time dashboard helps small businesses analyze performance. AI insights are planned for year two.

Clarifying your solution adds credibility to your value proposition.

3.5. Marketing and sales strategy

Show how you’ll attract, convert, and retain customers.

-

Define buyer personas and their behaviors.

-

Outline acquisition channels: digital, offline, partnerships.

-

Include pricing models, upselling strategies, and retention plans.

Online example:

Use Instagram ads targeting Gen Z homeowners interested in sustainability.

Offline example:

Host local events with free samples to build loyalty.

Marketing plans reflect your understanding of customer behavior and revenue strategy.

3.6. Team and operations

A great plan includes who’s in charge and how the business works daily.

-

Detail leadership, ownership, and advisor involvement.

-

Explain logistics, tools, vendors, and daily workflows.

Pro tip: Show your system maturity by listing platforms (e.g., QuickBooks, Trello) used to streamline operations.

This section shows you’re ready to execute, not just plan.

3.7. Financial plan

Your financials must be realistic, backed by assumptions, and visually clear.

-

Project startup costs, monthly expenses, and revenue over 1–3 years.

-

Include a funding request and its intended use.

-

Present break-even analysis and cash flow forecast.

Sample table:

| Year | Revenue | Expenses | Profit |

|---|---|---|---|

| 2025 | $200K | $150K | $50K |

| 2026 | $350K | $250K | $100K |

Show your math and provide footnotes for assumptions. This improves transparency and investor trust.

4. Tools, formats, and customization tips

Selecting the right structure and tools ensures your business plan is both efficient and compelling.

4.1. Choosing the right format

Your plan’s structure should match your stage and audience.

-

Traditional format: 15–30 pages with full details ideal for investors and banks.

-

Lean startup format: 1–5 pages focusing on key hypotheses perfect for agile startups.

Pick one based on whether you’re proving potential or refining your strategy.

4.2. Tailoring based on purpose

Adapt your plan for different goals. Here’s how to emphasize the right parts:

| Purpose | Focus | Key Inclusions |

|---|---|---|

| Investor pitch | Growth and scalability | Milestones, ROI, funding breakdown |

| Bank loan | Stability and repayment | Cash flow, collateral, revenue history |

| Non-profit | Mission and impact | Programs, beneficiaries, fundraising |

Customizing your content shows you’re serious about who you’re presenting to.

4.3. Useful templates and tools

These tools help speed up the creation process:

-

SBA Business Plan Template standardized structure

-

OECD Planning Toolkit international alignment

-

Business Model Canvas great for brainstorming

-

SWOT generators visual tools for quick insights

Pro tip: Start with a template but rewrite in your own words. Authenticity improves clarity and impact.

5. Mistakes to avoid when drawing up your plan

Learn from common errors that weaken business plans:

-

Over-optimism: Use conservative forecasts.

-

Missing financials: Back up all claims with numbers.

-

Lack of research: Never base decisions on assumptions.

-

Jargon overload: Write for clarity.

-

Skipping risk analysis: Always address potential obstacles.

-

Forgetting to update: Revisit your plan annually or after big changes.

A good plan is realistic, data-driven, and clearly organized.

6. 30-point checklist: Business plan essentials (2025 edition)

This updated checklist helps you review every critical detail in your business plan before presenting it to investors, lenders, or partners. Use it to ensure your plan is thorough, professional, and ready for action.

6.1. Foundation and content

Start with the essential building blocks of your plan. These items form the core structure that every stakeholder expects.

-

Cover page with company name, tagline, and date of creation

-

Confidentiality disclaimer to protect sensitive information

-

Table of contents for easier navigation

-

Executive summary that captures your vision and funding needs

-

Company description outlining your mission and structure

-

Market analysis supported by real data and charts

-

SWOT analysis to highlight your strategic position

-

Products & services overview showing unique value

-

Marketing plan with defined audience and acquisition channels

-

Sales strategy including conversion funnel and pricing

-

Organizational chart with team bios and responsibilities

-

Operations plan for logistics, tools, and workflows

-

Financial projections covering 1–3 years with charts

-

Funding request with exact amount and use of funds

-

Break-even analysis to show profit point

-

Milestones & KPIs with expected timelines

-

Exit strategy for investors or business succession

-

Contact information with phone, email, and address

This section ensures that your content is complete, strategic, and clearly structured.

6.2. Supporting documents and validation

These supporting materials reinforce your credibility and prepare your plan for external scrutiny.

-

Legal registrations (business license, tax ID, etc.)

-

Patents and intellectual property filings

-

Partnership agreements with co-founders or collaborators

-

Testimonials or letters of intent from customers or clients

-

Technology stack including software, platforms, or tools

-

Appendices with extra data, market charts, or bios

-

CRM and automation integrations for sales/marketing systems

-

Updated competitor analysis reflecting recent trends

-

Assumptions for financials with notes and justifications

-

Data sources and citations to support claims

-

Risk mitigation plans outlining what happens if goals slip

-

Contingency plan for crisis or market downturns

-

Version control and backup systems for managing plan updates

-

Compliance documentation (GDPR, industry-specific regulations)

Reviewing this full 32-point checklist ensures your business plan is not only complete, but compelling, data-backed, and ready for real-world execution.

View more:

- How might a company reduce its variable expenses

- What is gap medical insurance coverage

- Grants for women to start a business

7. FAQs about how to draw up a business plan

Q1: Do I really need a business plan for a small business?

A: Yes. Even small businesses benefit from written plans for growth, funding, and focus.

Q2: How often should I update my plan?

A: At least once a year or after any major pivot or market change.

Q3: What’s the best format for startups?

A: A lean business plan works for early stages, with a traditional format used for funding rounds.

Q4: What’s the difference between a plan and a canvas?

A: A business plan is more detailed; a canvas is visual and concise useful for brainstorming.

Q5: Can I use AI tools to write my plan?

A: Yes but review everything for accuracy, tone, and customization.

Q6: What tools are best for financial forecasting?

A: Google Sheets, Excel, LivePlan, and Xero all offer great forecasting modules.

Q7: Should I share my full plan with employees?

A: Share key parts like vision, milestones, and roles not sensitive financials or IP.

8. Conclusion

Knowing how to draw up a business plan is no longer just a formality it’s your foundation for strategic action in 2025.

Key takeaways:

-

Business plans improve clarity, funding access, and decision-making.

-

A structured plan includes research, goals, market data, and financials.

-

Use templates, but customize every section to your needs.

-

Tailor versions based on audience investor, bank, or internal.

-

Update regularly and treat your plan as a living document.

A strong business plan sets you up for resilience, agility, and sustainable growth.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.