Knowing how to figure out how much a company is worth is essential in many situations. Whether you’re selling a business, attracting investors, merging with another company, resolving legal matters, or handling estate planning, business valuation is key to making informed decisions.

Using the right valuation method helps avoid costly mistakes and ensures fairness. This guide will walk you through key valuation concepts, explore different approaches with examples, and provide step-by-step instructions for calculating company value in 2025.

1. Why understanding company value matters

Knowing the value of a business impacts financial strategy, risk management, negotiations, and growth decisions. It allows stakeholders to approach partnerships, funding, or exits with realistic expectations.

For example, a small business owner planning to sell needs a clear estimate to negotiate the best price. Investors use valuation to determine potential returns. Legal professionals rely on valuation during divorce settlements or shareholder disputes.

Grasping valuation fundamentals helps you confidently navigate critical business milestones.

2. Business valuation basics: Key concepts and essential principles

Business valuation estimates what a company is worth based on several measurable and qualitative factors. It essentially answers the question: “If this business were sold today, how much would it be worth?”

The most influential factors include:

-

Financial performance: Revenue, profits, and cash flow.

-

Growth potential: Market trends, expansion plans, and customer acquisition.

-

Assets: Both tangible (property, equipment) and intangible (brands, IP).

-

Industry and market conditions: Competition and broader economic health.

-

Leadership: Strength and track record of the management team.

Valuing public companies is generally easier due to real-time stock prices and financial disclosures. Private businesses and startups are more complex, especially if they lack profits but have high growth potential.

Understanding these elements creates a strong foundation for choosing the right valuation method.

3. How to figure out how much a company is worth: Main approaches explained

There are three major approaches to determine company value, each suited for different business types and goals:

-

Asset-Based Methods: Focus on what the company owns (assets) minus what it owes (liabilities).

-

Income-Based Methods: Estimate the present value of future profits.

-

Market-Based Methods: Compare to similar businesses or past transactions.

To help you choose the right method, here’s a comparison table summarizing key valuation approaches, their ideal use cases, input requirements, and pros/cons:

Comparison Table: Business Valuation Methods:

| Approach | Method | Best For | Key Inputs | Pros | Cons |

|---|---|---|---|---|---|

| Asset-Based | Book Value | Asset-heavy firms (e.g., real estate, manufacturing) | Balance sheet assets and liabilities | Simple; based on accounting data | Ignores future earning potential |

| Adjusted Net Assets | Firms with valuable tangible/intangible assets | Fair market value of assets and liabilities | More accurate than book value | May be difficult to assess intangible assets | |

| Income-Based | Discounted Cash Flow (DCF) | Profitable or high-growth businesses | Forecasted cash flow, discount rate | Accounts for future potential | Sensitive to assumptions and forecasting errors |

| Earnings Multiples | Stable firms with historical earnings | Net income, industry P/E or EV/EBITDA ratio | Fast and market-accepted method | May not reflect unique business risks | |

| Market-Based | Comparable Company Analysis (CCA) | Businesses in mature or public markets | Financial metrics of peer companies | Real-world benchmarks | Hard to find perfect comparables |

| Precedent Transactions | M&A scenarios, sale preparation | Actual sale prices of similar companies | Reflects actual market behavior | Data may be private or outdated |

Choosing the right approach depends on the company’s industry, maturity, available data, and valuation purpose.

Combining methods often results in a more accurate, balanced picture of worth.

3.1. Asset-based valuation methods

Asset-based valuation calculates the business’s net asset value (NAV) by subtracting total liabilities from total assets.

Popular methods include:

-

Book Value: Based on accounting records from the balance sheet.

-

Net Asset Value: Adjusts book value to current market rates.

-

Adjusted Net Asset: Includes fair value estimates and corrections.

Formula:Value = Total Assets – Total Liabilities

Example:

Assets = $1,000,000

Liabilities = $400,000

NAV = $600,000

This method works best for asset-heavy companies like manufacturing or real estate businesses.

3.2. Income-based valuation methods

Income-based valuation projects future earnings and discounts them to their present value. It’s effective for profitable or fast-growing companies.

Two primary methods:

-

Discounted Cash Flow (DCF): Calculates present value of projected cash flows using a discount rate to reflect risk.

-

Earnings Multiples: Applies industry multiples (P/E, EV/EBITDA) to current earnings.

Example (DCF):

Next year’s cash flow: $100,000

Discount rate: 10%

Present value = $90,909

Example (P/E):

Earnings = $200,000

Industry P/E = 15

Value = $3 million

These methods reflect profitability and investor expectations but require accurate forecasts.

3.3. Market-based valuation methods

Market-based valuation relies on real-world data from similar businesses.

Common approaches:

-

Comparable Company Analysis (CCA): Use financial multiples from similar public companies.

-

Precedent Transactions: Analyze actual sale prices of comparable businesses.

Example:

If similar firms sell at 2× revenue and your company earns $5M in revenue, value = $10M.

This approach is strong when robust market data is available but weaker for unique or early-stage companies.

View more:

- How to price a business for Sale: The complete 2025 guide

- Financial goal setting examples

- Best money management apps for iPhone

4. Step-by-step guide: How to calculate a company’s worth in 2025

Follow these steps to assess your company’s value accurately:

-

Collect financial statements: Income statement, balance sheet, and cash flow statements.

-

Review assets and liabilities: Update figures to reflect current market values.

-

Analyze business trends: Look at past performance, industry growth, and customer behavior.

-

Select valuation methods: Choose based on business model and purpose.

-

Apply asset-based method: Use adjusted net assets if physical value is key.

-

Run DCF analysis: Forecast future cash flows and choose a discount rate.

-

Calculate earnings multiples: Use industry standards or peer data.

-

Use market data: Apply ratios from similar businesses or transactions.

-

Compare outcomes: Cross-check different methods for consistency.

-

Document assumptions: Clearly state how values and projections were calculated.

-

Factor in external risks: Include legal, regulatory, or economic influences.

Example:

-

Net Assets = $1M

-

Earnings = $150,000

-

P/E = 10 → $1.5M

-

Market multiple = 12 → $1.8M

A balanced valuation would consider all three outcomes.

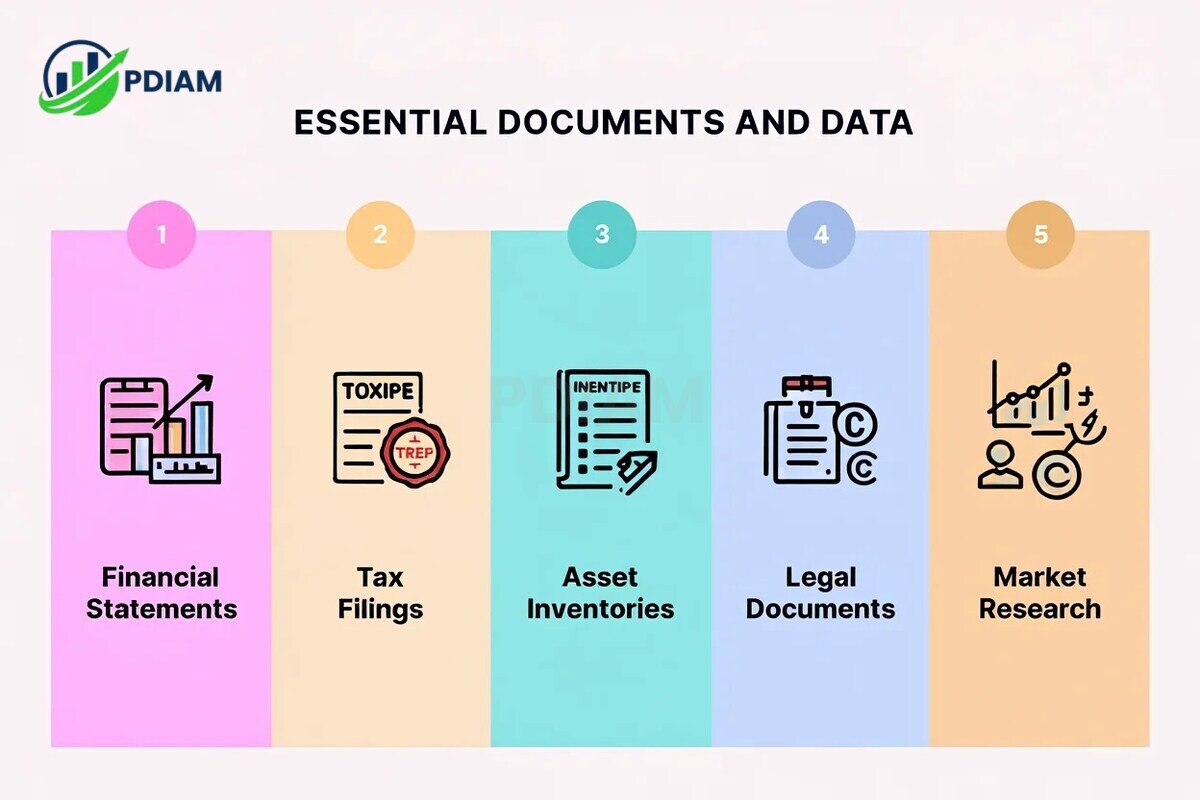

5. Essential documents and data

To ensure accuracy and credibility, prepare these key resources:

-

Financial statements: Income statement, balance sheet, and cash flow reports.

-

Tax filings: Confirm income and verify consistency.

-

Asset inventories: Detailed list of physical and intangible assets.

-

Legal documents: Contracts, patents, trademarks, or litigation records.

-

Market research: Industry reports, customer data, and competitor analysis.

Having a complete documentation set helps avoid errors and supports decision-making.

6. How to choose the right valuation method for your company

Choosing the best valuation method depends on the company’s structure, data availability, and the reason for the valuation.

Consider the following:

-

Business type: Asset-heavy vs. service-oriented vs. tech startup.

-

Stage: Mature business vs. early-stage company.

-

Data access: Public financials vs. private books.

-

Goal: Sale, fundraising, legal, tax, or internal strategy.

Examples:

-

A consulting firm with low assets might use earnings multiples.

-

A manufacturer may apply adjusted NAV and DCF.

-

A tech startup may use recent fundraising comparables or market data.

Using more than one method strengthens the valuation and gives stakeholders a clearer picture.

Want to learn more stuffs like this? Check the following below:

- What is Code of conduct mean? Avoid these costly mistakes [2025]

- How do I calculate staff turnover like an HR Pro [2025]

- Learn Does PayPal charge a fee for Credit Cards clearly [2025]

7. Top tools & online calculators for business valuation (2025 updated)

Digital tools can speed up valuation while improving objectivity and consistency. Here are top-rated options:

-

BizEquity: Ideal for SMBs, automated reports based on financials.

-

Equidam: Designed for startups, incorporates five methods.

-

ValuAdder: In-depth tool for experienced analysts.

-

SCORE Valuation Calculator: Free, user-friendly for small business owners.

-

ValuationResources.com: Central hub for guides, templates, and industry ratios.

-

CalcXML: Simplified calculator with instant outputs.

-

MoneySoft: Advanced scenario modeling for larger firms.

-

EquityNet: Combines valuation with crowdfunding tools.

These tools support fast analysis but rely heavily on accurate data input and assumptions.

8. 30+ business valuation pitfalls & mistakes (checklist for 2025)

Valuing a business may seem straightforward, but even seasoned professionals can fall into traps that skew results. Below is a comprehensive list of common errors, financial, methodological, and psychological, that can distort your estimate of how much a company is worth.

-

Overestimating intangible assets: Valuing a brand, software, or customer loyalty without supporting data often leads to inflated numbers. Intangibles should only be valued if backed by market comparisons or proven cash flow impact.

-

Using outdated comparables: Benchmarks from five years ago may no longer reflect your industry’s current landscape. Always use recent and relevant market data for comparison.

-

Inconsistent financial statements: Mismatched revenue, unclear COGS, or irregular cash flow entries break valuation models. Clean, reconciled statements are essential before using any method.

-

Choosing the wrong valuation method: A growing tech startup shouldn’t be valued using book value alone. Similarly, DCF doesn’t work for unpredictable or early-stage companies. Method fit is key.

-

Ignoring off-balance-sheet liabilities: Lease obligations, legal settlements, or hidden debts can reduce value dramatically. Make sure to include them when calculating net assets or adjusting risk.

-

Neglecting working capital needs: Assuming all cash is available for distribution overlooks the capital needed to run daily operations. Overlooking this results in overstated equity value.

-

Failure to normalize earnings: One-time events like lawsuits, asset sales, or bonuses should be adjusted out. Not normalizing leads to misleading EBITDA or net income figures.

-

Overreliance on projections: Forecasts that are too optimistic or based on flawed assumptions can skew DCF results. Always stress-test multiple scenarios to check sensitivity.

-

Misjudging risk premium: Using a discount rate that’s too low ignores business risk. It results in an overly high valuation, especially in volatile industries or early-stage ventures.

-

Overapplying industry multiples: Blindly applying P/E or EV/EBITDA ratios from large public companies to small private ones is misleading. Adjust for size, liquidity, and business model differences.

-

Excluding customer concentration risks: A business that relies on 1–2 major clients is riskier than one with a diverse customer base. If ignored, it inflates perceived stability.

-

Ignoring employee dependency: If a founder or one key employee drives most revenue, their departure would significantly affect future cash flow. This should factor into risk assessments.

-

Misunderstanding goodwill: Goodwill should only be recognized when justified by real transaction value or proven market premium, not estimated by guessing brand value.

-

Forgetting about deferred taxes: Ignoring deferred tax liabilities or assets can result in valuation gaps between book and market value. Always adjust for tax timing differences.

-

Disregarding industry cycles: Valuing a construction firm during a housing boom without adjusting for cycle risk will likely overstate value. Understand where you are in the macro cycle.

-

Overestimating synergy value in M&A: Anticipated benefits from mergers may not materialize. Never bake in full synergy value unless it’s backed by operational plans.

-

Improper use of terminal value in DCF: Overweighting terminal value (e.g. 70%+ of total value) based on unrealistic perpetual growth distorts results. Always keep assumptions conservative.

-

Failing to adjust for economic environment: Inflation, interest rates, and political instability all affect discount rates, market sentiment, and asset prices.

-

Using “rules of thumb” blindly: Quick rules like “2× revenue” vary greatly by industry. Always validate rules of thumb with real data.

-

Valuing at the wrong time: Conducting valuation during a temporary downturn, crisis, or high season can skew numbers. Choose neutral periods if possible.

-

Ignoring minority discounts: If selling a partial stake, value should reflect lack of control. A 30% holding is not worth 30% of full equity in many private firms.

-

Overlooking liquidity discounts: Private companies are harder to sell than public ones. Failing to apply an illiquidity discount overstates value.

-

Mixing book and market values: Combining historical balance sheet values with market comps creates inconsistency. Choose one basis and stick with it.

-

Assuming linear growth: Most businesses don’t grow steadily every year. Overly straight-line projections ignore seasonality and market volatility.

-

Not factoring in competitive threats: New entrants, tech disruption, or regulation can reduce future profitability. These should affect risk premiums or growth forecasts.

-

Skipping documentation of assumptions: Failure to clearly record assumptions and sources makes the valuation hard to defend or update later.

-

Overlooking IP ownership issues: Valuing software or content-based companies without verifying IP rights can cause legal complications later.

-

Not validating internal data: Trusting internal forecasts or budgets without verifying them independently risks overconfidence bias.

-

Omitting geographic or political risks: Businesses with foreign operations may face currency volatility or regulatory changes. Include these in the discount rate or scenario planning.

-

Underestimating cost of capital: Using WACC that’s too low inflates valuations. Be realistic with inputs like debt cost and equity risk premium.

-

Disregarding inventory obsolescence: For retail or manufacturing firms, stale or unsellable inventory should be written down or excluded.

-

Failing to reconcile multiple methods: When asset-based, income-based, and market-based valuations differ widely, ignoring discrepancies creates a false sense of precision.

-

Overlooking ESG risks: Environmental, social, or governance issues, like labor disputes or sustainability violations, can impact brand and value significantly.

-

Lack of professional review: DIY valuation without review from an advisor, CPA, or legal counsel may result in technical errors, especially in legal or M&A settings.

Avoiding these 30+ pitfalls requires a disciplined process, a deep understanding of both numbers and context, and a willingness to challenge assumptions. A credible valuation doesn’t just use math, it applies judgment.

9. FAQs: Common questions about figuring out company value

Q1. Can I value a pre-revenue startup?

Yes, but it requires estimating growth and using comparables or future cash flow.

Q2. How often should I update valuation?

Annually or after major business changes like funding rounds or expansions.

Q3. Can I do it myself?

For small businesses, yes. For complex firms, professionals are recommended.

Q4. How does valuation affect sale price?

It sets realistic expectations and supports negotiation with data.

Q5. When should I get expert help?

During legal disputes, M&A, fundraising, or when ownership is shared.

11. Conclusion

Understanding how to figure out how much a company is worth gives you the clarity to negotiate deals, raise capital, and make strategic decisions with confidence. Whether you’re a founder, investor, or advisor, mastering valuation fundamentals is a valuable skill in 2025 and beyond.

-

Understand the three core approaches: asset-based, income-based, and market-based.

-

Choose methods based on business type, data availability, and the reason for valuation.

-

Use valuation calculators and real-world examples to guide your estimates.

-

Avoid common mistakes like misusing comparables or ignoring liabilities.

By following these principles, you’ll gain a realistic picture of company value and reduce the risk of costly errors.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.