Is business credit card interest tax deductible? Yes, business credit card interest is generally tax deductible in 2025 when it relates directly to business expenses.

The IRS allows interest deductions if the charges are for ordinary and necessary business costs. This means the expenses must be common and accepted in your industry and essential to your business operations.

Importantly, only interest tied exclusively to business use qualifies. Personal expenses on the same card are not deductible. This distinction is crucial for tax planning, cash flow management, and compliance with IRS rules.

Since the Tax Reform Act of 1986, these guidelines have remained largely consistent, supported today by IRS Publication 535 and the latest 2025 IRS updates.

Throughout this guide, you’ll learn how to identify deductible interest, manage mixed-use credit cards, keep proper records, and claim deductions correctly on your tax forms. Whether you’re a sole proprietor or operate a corporation, this article will clarify the key rules and steps to maximize your eligible deductions confidently.

1. What does tax deductible mean? (Definition & practical impact)

A tax deduction reduces your taxable income, which means you pay less in taxes overall. When business credit card interest is deductible, it directly lowers your tax burden.

Here’s how it works:

-

Tax deductible means an expense lowers taxable income.

-

Lower taxable income means less tax to pay.

-

A $1,000 deduction saves $210 at a 21% tax rate.

-

Recognizing deductions improves tax planning and cash flow.

Understanding what qualifies as a deduction helps you plan more efficiently and avoid surprises during tax season.

2. IRS rules 2025: Is business credit card interest tax deductible?

In 2025, the IRS continues to allow deductions for interest paid on business credit cards, but only when the charges are strictly tied to ordinary and necessary business expenses.

This standard, defined in IRS Publication 535, serves as the foundation for determining whether credit card interest qualifies as a deductible business cost.

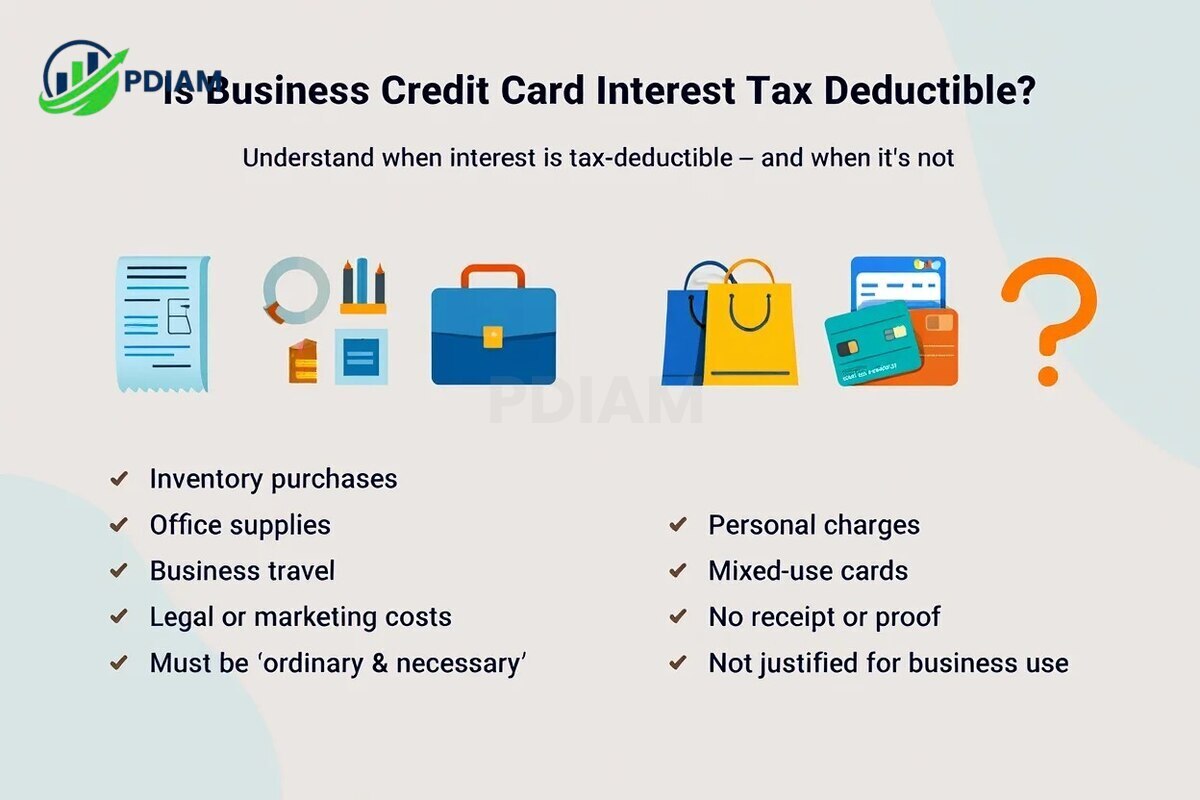

2.1. What qualifies as ordinary and necessary?

Before claiming the deduction, it’s important to understand how the IRS defines the criteria:

-

Ordinary: The expense must be common and widely accepted in your industry.

-

Necessary: The cost must be helpful and appropriate for operating your business, even if not indispensable.

These two qualifiers must both be satisfied.

Common examples of deductible interest-bearing business expenses include:

-

Inventory purchases: Buying goods for resale or production

-

Office supplies: Paper, printers, desks, or software subscriptions

-

Business travel and lodging: Flights, hotels, or transportation for work trips

-

Professional services: Legal, accounting, or consulting fees

-

Marketing and advertising: Paid ads, promotional printing, branding campaigns

These categories typically meet IRS standards, making interest on such purchases deductible.

2.2. What doesn’t qualify?

The IRS disallows deductions in the following cases:

-

Interest on personal purchases, even if charged on a business credit card

-

Interest from mixed-use cards where business and personal spending aren’t clearly separated

-

Charges that lack receipts, business justification, or audit-ready documentation

Pro tip: If you’re ever unsure whether a charge is deductible, ask yourself: Would I make this purchase if I didn’t run this business? If the answer is no, the expense—and its interest—is likely valid.

The IRS expects a strict separation between personal and business finances. Failing to provide adequate documentation or mixing expenses can result in your deduction being denied during an audit.

View more:

- Is Boss firing someone for violating legal

- Which country markets are highest growing market in the world

- How much does the average American make in their lifetime

3. What types of expenses qualify?

Here’s a list of business-related expenses where credit card interest may be deductible:

-

Inventory: Goods purchased for resale or production

-

Supplies: Daily use office or operational materials

-

Utilities and rent: Facility-related costs

-

Software subscriptions: Tools essential for operations

-

Business meals: Meals during client meetings or business travel

-

Transportation: Travel expenses tied to business trips

-

Client meetings: Costs from hosting or traveling to clients

-

Advertising: Paid promotions, online ads, etc.

-

Professional fees: Payments to accountants, consultants, or lawyers

These categories typically meet the IRS ordinary and necessary criteria, making associated interest deductible.

4. Business vs. personal credit card interest: What’s deductible?

To clarify common scenarios, refer to this table:

| Scenario | Interest Deductible? | Reason |

|---|---|---|

| Business card used for business expenses | Yes | Interest tied to business use |

| Business card used for personal expenses | No | Personal expenses are never deductible |

| Personal card used for business expenses | Yes (with documentation) | Interest allowed if business charges are tracked |

| Personal card used for personal expenses | No | Not related to business |

Using a personal card for business can still qualify, but documentation must be meticulous.

5. How to handle mixed-use credit cards

If you use one card for both business and personal charges, take extra care:

-

Track each transaction’s purpose and date

-

Use expense tracking software or spreadsheets

-

Calculate the percentage of business spending

-

Apply the same percentage to total interest

-

Keep all statements and receipts

Example:

If 70% of monthly charges are business-related, then 70% of the interest is deductible. But you must prove this with documentation.

Pro tip: Use a dedicated business credit card to simplify accounting and reduce audit risk.

6. How to claim the interest deduction (forms & steps)

Depending on your business type, interest expenses are reported differently:

| Entity Type | Tax Form | Where to Deduct |

|---|---|---|

| Sole Proprietor | Schedule C (Form 1040) | Line 16 (Interest) |

| Partnership | Form 1065 | Schedule K-1 (distributed to partners) |

| C-Corporation | Form 1120 | Deduct as ordinary business expense |

| S-Corporation | Form 1120S | Flows through to shareholders via Schedule K-1 |

| LLC | Varies | Based on election (Sole prop, partnership, or corp) |

Always attach statements and receipts that show the interest charged and its business purpose. A CPA or tax preparer can help determine where and how to enter the expense properly.

7. Record-keeping, documentation & IRS compliance

To defend your deductions, you’ll need proper records:

-

Credit card statements showing interest

-

Receipts and invoices tied to the charges

-

Logs or spreadsheets for mixed-use cards

-

Documentation kept 3–7 years per IRS audit windows

-

Digital backups using software like QuickBooks, Xero, or Wave

Real example: A consultant audited in 2023 lost $3,400 in deductions because she didn’t keep credit card statements tied to business travel charges. The IRS disallowed them all.

Well-organized records help you pass audits and claim deductions without stress.

8. 2025 IRS updates on credit card interest deductibility

According to IRS Publication 535 (2025):

-

The ordinary and necessary standard still applies

-

No new limits have been added this year

-

Mixed-use documentation requirements tightened

-

Form instructions now clarify deduction reporting by business type

-

Taxpayers are advised to check for late-year bulletins or changes

Stay updated via irs.gov and consult a professional annually.

Think this is an interesting topic? Why not checking out our related Articles:

- Useful Information: What is a statement of stockholders equity? [2025]

- Essential Guide: Professional employer organization Pros and Cons [2025]

- Powerful insight: Difference between accounts payable and accounts receivable [2025]

9. Expert tips to maximize your deduction

To make the most of your deduction and stay compliant:

-

Use a dedicated business credit card

-

Review charges monthly and categorize them

-

Automate reporting via apps (e.g., Expensify, QuickBooks)

-

Keep business and personal spending strictly separate

-

Consult a tax pro for multi-entity or high-volume businesses

-

Bookmark and read IRS Publication 535 each tax season

These steps reduce errors and ensure you get every dollar of deduction available.

10. Frequently asked questions (FAQ)

Q1: Is interest on a business cash advance deductible?

A: Yes, if the advance is used solely for business purposes.

Q2: What if a trip is partly business and partly personal?

A: Only the interest on charges related to the business portion is deductible.

Q3: Can I deduct interest from a personal card used for business?

A: Yes, if the charges are well documented and clearly for business.

Q4: Can I deduct credit card annual fees?

A: Yes, if they relate to business operations.

Q5: What happens if business interest exceeds gross income?

A: Interest limits may apply—review IRS passive activity rules.

Q6: Do I need to amend returns if I find errors?

A: Yes. Correcting past filings early helps avoid penalties.

Q7: Are rewards or cashback taxable?

A: Generally not, unless redeemed as cash or linked to personal spending.

11. Conclusion

So, is business credit card interest tax deductible? In 2025, business credit card interest remains tax deductible when used for ordinary and necessary business purposes under IRS guidelines.

Summary:

-

Deduct only interest tied to business expenses

-

Use the right IRS forms based on your business type

-

Keep all supporting documents for 3–7 years

-

Avoid mixed-use confusion by separating cards

-

Consult a tax pro to ensure full compliance

Apply the strategies in this guide to reduce your tax burden and keep your business financially optimized.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.