Is net income and net profit the same? This is a common question among investors, business owners, and students of finance. In simple terms, both net income and net profit refer to the amount of money a company keeps after subtracting all expenses, including taxes and interest, from its total revenue.

While accounting standards such as US GAAP and IFRS often use these terms interchangeably, understanding any subtle differences can help you interpret financial reports more accurately and make better financial decisions.

In this guide, we’ll clarify the definitions of net income and net profit, explain how they are calculated, explore their usage in different contexts, and highlight common misconceptions. By the end, you’ll have a clear understanding of these essential financial terms and how to spot them in company statements.

1. Quick answer: Is net income and net profit the same?

Yes, in nearly all practical contexts, net income and net profit are the same. Both represent the final profit a business retains after deducting all expenses, including taxes and interest.

For most companies, accounting systems, and financial reports, the two terms are interchangeable. However, slight distinctions may arise in niche industries, regional regulations, or reporting frameworks that apply specific terminology.

2. Definitions and terminology

Although net income and net profit are often used interchangeably, it’s important to understand their definitions, how they are used in different contexts, and what other terms may appear in financial statements as synonyms.

A strong grasp of terminology helps avoid confusion, especially when comparing reports across regions, standards, or industries.

2.1. What is net income?

Net income is the final profit a business retains after subtracting all operating costs, financing charges, taxes, depreciation, and other expenses from total revenue. It reflects the company’s comprehensive performance over a specific period and is often referred to as the bottom line because it appears on the last row of the income statement.

Net income is used in formal reporting, particularly in GAAP-based financial statements, and is a key figure for investors and analysts tracking company performance over time.

2.2. What is net profit?

Net profit refers to the same final profit figure as net income, but the term is used more frequently in informal or regional contexts. It represents the amount left after all business-related costs have been deducted from revenue, including production, operating, interest, and tax expenses.

In practice, companies might choose to use net profit in internal reports or software interfaces, while using net income in external filings. Despite the difference in terminology, the two terms convey the same core meaning.

Pro Tip: In most cases, the choice between net income and net profit is one of style, not substance, focus on the calculation, not the label.

2.3. Synonyms and usage in reporting

Several related terms appear alongside net income/net profit in various business reports. Below are the most common:

-

Net earnings: Often used in public company reports, this can refer to profit attributable to shareholders, especially after minority interest adjustments.

-

Profit after tax (PAT): Common in UK and IFRS-based systems; emphasizes that tax has already been deducted.

-

Bottom line: A generic term used to denote the final profit figure in any statement format.

While these terms are largely interchangeable, their nuance may depend on context. Overall, both US GAAP and IFRS treat net income and net profit as equivalent when calculating a business’s bottom-line profitability.

Understanding these labels ensures accurate interpretation regardless of jurisdiction or financial software.

View more:

- Do i need business license for sole proprietorship

- New jersey finance agreement max late fees

- What is an audited financial statement

3. How are net income and net profit calculated?

To understand the meaning of net income and net profit, it’s essential to see how they are calculated in the context of a company’s income statement. These final profit figures are the result of a sequential process where each financial metric builds on the previous one.

3.1. Standard income statement layout

An income statement follows a logical order, starting from total revenue and subtracting various costs step-by-step until reaching net income or net profit. Here’s the typical flow:

-

Revenue (Sales) – Total income from products or services sold

-

Cost of Goods Sold (COGS) – Direct production costs like materials or labor

-

Gross Profit = Revenue − COGS

-

Operating Expenses – Selling, General, and Administrative costs (SG&A)

-

Operating Profit (EBIT) = Gross Profit − Operating Expenses

-

Interest and Taxes – Financing and tax obligations

-

Net Income / Net Profit – Final profit after all expenses

This structure ensures each profitability layer is visible and logically derived from the one above it.

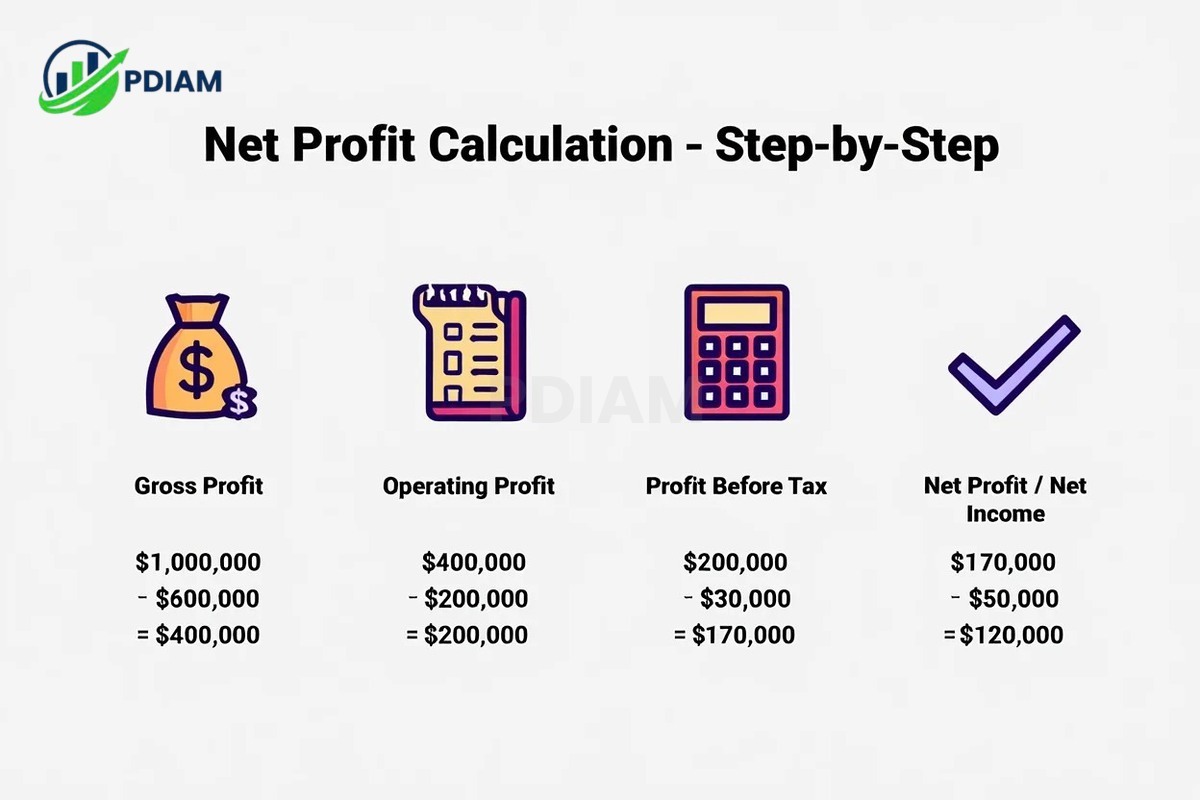

3.2. Step-by-step calculation (with example)

Let’s consider a sample company with the following annual figures:

-

Revenue: $1,000,000

-

COGS: $600,000

-

Operating Expenses: $200,000

-

Interest Expense: $30,000

-

Taxes: $50,000

We can calculate the profit layers step by step:

-

Gross Profit = $1,000,000 − $600,000 = $400,000

-

Operating Profit = $400,000 − $200,000 = $200,000

-

Profit Before Tax = $200,000 − $30,000 = $170,000

-

Net Income / Net Profit = $170,000 − $50,000 = $120,000

This final amount, $120,000, is what both net income and net profit refer to, confirming they are functionally identical in financial reporting.

Pro Tip: Always analyze each layer, gross, operating, and net, to understand where profits are shrinking and whether cost structures are sustainable.

3.3. Visual breakdown

The table below summarizes each profit stage to show how net income is derived:

| Stage | Amount | Description |

|---|---|---|

| Revenue | $1,000,000 | Total sales generated |

| Gross Profit | $400,000 | Revenue minus cost of goods sold (COGS) |

| Operating Profit (EBIT) | $200,000 | After subtracting operating expenses |

| Net Income / Net Profit | $120,000 | Final profit after deducting interest and taxes |

This structured view reinforces how each figure flows into the next, with net profit sitting at the bottom of the hierarchy.

4. Is there a difference between net income and net profit?

In 99% of cases, there is no meaningful difference between net income and net profit. Both terms refer to the final amount a company retains after accounting for all expenses, taxes, and interest.

However, in rare situations, specific contexts, such as legal, regional, or software conventions, may apply slightly different meanings. Understanding these edge cases helps prevent misinterpretation when reviewing global financial reports.

4.1. Contexts where minor differences may arise

There are a few specialized cases where these two terms may diverge in use or implication. Let’s take a closer look:

-

Legal or tax frameworks: Certain countries or jurisdictions may define net profit differently from net income for compliance or reporting purposes. These definitions might affect how taxable profit is calculated under local law.

-

Reporting convention: In UK-based systems, small business dashboards, or IFRS-driven reports, net profit may be the more common label, even though it refers to the same bottom-line number as net income under GAAP.

-

Accounting preference: Occasionally, companies might use net profit to denote earnings before one-time or extraordinary items, while net income includes those items to reflect a comprehensive bottom line.

These differences are subtle and rarely cause confusion for everyday investors or readers of standard financial statements.

Pro Tip: Always read the income statement footnotes or accounting policy notes to confirm how a business defines and calculates its final profit figure, especially when comparing reports across countries or systems.

In practice, these distinctions are semantic and rarely impact interpretation for investors or analysts.

5. Where are these terms used?

Net income and net profit are used in a wide range of financial and business contexts. Although the terms may differ depending on geography or audience, they convey the same underlying meaning: final profitability after all deductions.

These terms commonly appear in the following places:

-

Financial statements: Both terms appear on the income statement’s bottom line, showing the company’s final earnings for the period.

-

Investor reports and press releases: Public companies frequently highlight net income in quarterly earnings calls or financial disclosures. Depending on the region, you may see either term used.

-

Accounting software and dashboards: Business platforms like QuickBooks or Xero may label the final profit field as either Net Profit or Net Income, depending on settings or regional defaults.

-

Tax filings and budget planning documents: Small businesses and tax advisors use both terms when preparing returns or forecasts. Accuracy and consistency are more important than the term used.

Whether you’re reading a 10-K filing or using a bookkeeping tool, understanding that both terms represent final earnings helps avoid confusion.

5.1. Global usage comparison

The table below highlights how the terms are used across different accounting standards and business environments:

| Term | Region / Standard | Usage Context |

|---|---|---|

| Net Income | US, GAAP, formal financials | SEC filings, 10-Ks, investor presentations |

| Net Profit | UK, IFRS, small businesses | Informal business reporting, tax filings |

| Net Earnings | Global | Used interchangeably; sometimes shareholder-specific |

Despite these variations in language, the final profit amount remains consistent across systems and statements. The key is to focus on placement within the income statement and understand how the company defines the term in footnotes or disclosures.

6. Net income vs. net profit vs. other profit terms

Many readers confuse net profit with other profit-related terms.

The table below clarifies their differences.

6.1. Comparison table

To clarify the distinctions between profit-related terms, the table below breaks down how each term is defined, where it appears on the financial statement, and its common synonyms.

| Term | Definition | Common Synonyms | Statement Location |

|---|---|---|---|

| Net Income | Final profit after all costs, interest, and taxes | Net Profit, Bottom Line | Bottom of income statement |

| Net Profit | Same as net income | Net Income, PAT | Bottom of income statement |

| Gross Profit | Profit before expenses, only subtracts COGS | Gross Margin | Upper portion |

| Operating Profit | Profit after operating expenses, before tax & interest | EBIT, Operating Income | Middle section |

Each of these terms serves a specific role in assessing profitability. Understanding where they sit within the income statement helps avoid misinterpretation when comparing companies or periods.

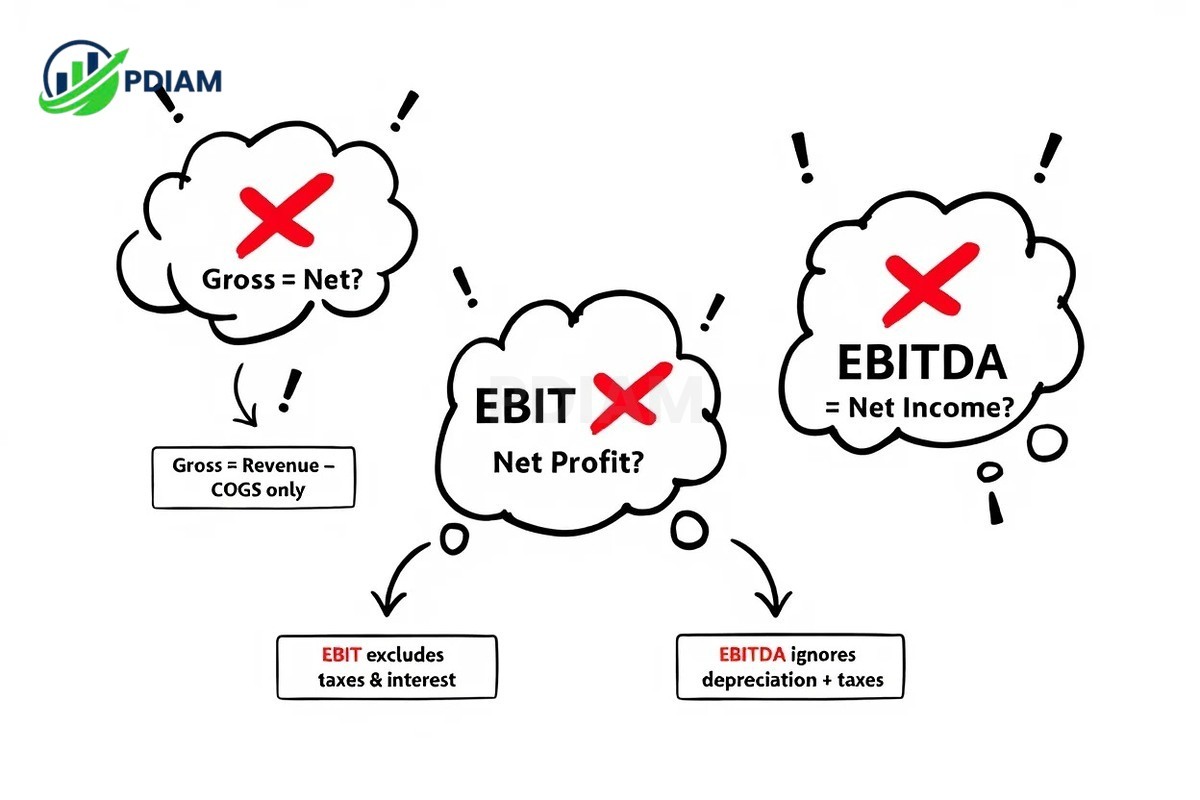

6.2. Common misconceptions

Many people confuse net profit with other profitability metrics because the terms sound similar. Below are three common misunderstandings to watch out for:

-

Gross profit ≠ net profit: Gross profit only subtracts the cost of goods sold (COGS) from revenue. It does not include operating expenses, taxes, or interest, so it can give a misleading picture of profitability if viewed in isolation.

-

Operating profit excludes financing and tax effects: Operating profit, also called EBIT, shows earnings before interest and taxes. It reflects the company’s core operational performance, but it doesn’t capture full profitability the way net profit does.

-

EBITDA is not the same as net income: EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It measures operational cash flow potential but ignores non-cash expenses and tax obligations, making it unsuitable for understanding actual net results.

These distinctions are essential when analyzing a company’s performance across reports or industries.

Pro Tip: Use each term strictly in its proper context. Never substitute gross profit, operating profit, or EBITDA for net income unless you’re certain about the reporting standard and what the number truly represents.

Think this one is an interesting topic? Check out our related articles:

- How does workers’ comp affect tax return: What’s legal in 2025?

- What is an audited financial statement? Full Breakdown [2025]

- Avoid trouble: New Jersey finance agreement max late fees [2025]

7. Real example from business reporting

Consider Apple Inc.’s 2022 10-K filing:

-

Revenue: $394.3 billion

-

Net income: $99.8 billion

Apple uses net income in line with GAAP, but financial news often calls this net profit. Both refer to the same figure: bottom-line profit after all costs.

Real Example: In their Q4 earnings call, Apple’s CFO referred to record quarterly net income , while several financial media outlets called it record net profit.

This shows how the terms are used interchangeably across professional settings.

8. FAQs: Is net income and net profit the same?

8.1. Is net profit always the same as net income?

Yes, in nearly all cases. Any minor variations are definitional, not financial.

8.2. Why do some reports use one term over the other?

Terminology may depend on regional standards (GAAP vs IFRS), audience, or software design.

8.3. Can gross profit be high while net profit is low?

Yes. High expenses, taxes, or interest can reduce final profit even if gross profit is strong.

8.4. Are earnings and profit the same?

Often yes, but earnings may refer specifically to profit available to shareholders.

8.5. Which term should small businesses use?

Either is fine. Consistency across all reports is more important than term selection.

8.6. Where do I find net profit on financial reports?

It’s typically the last line on the income statement , labeled as Net Income, Profit After Tax, or Net Earnings.

8.7. Can net profit be higher than net income?

No. If both are defined correctly, they are the same. Differences may suggest mislabeling.

9. Conclusion

Is net income and net profit the same? In virtually all accounting standards and business contexts, yes , they represent the same final measure of profitability. Both indicate how much money a company keeps after subtracting all operating costs, interest, and taxes.

Key takeaways:

-

Net income = Net profit = Bottom-line earnings

-

Terms vary slightly by region and reporting system

-

Always check footnotes for definition clarity

-

Understanding these terms helps you read statements confidently

-

Apple, Amazon, and most Fortune 500 companies use both interchangeably

Mastering basic terms like net income and net profit gives you a stronger grasp of how companies report and grow profit.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.