This guide explains how New Jersey finance agreement max late fees work in 2025 across mortgages, auto loans, consumer credit, and more.Late fees are charges applied when borrowers fail to make payments on time under finance agreements.

In New Jersey, understanding these fees is vital for both consumers and lenders to ensure fairness and compliance with state laws.

The New Jersey statutes, particularly N.J.S.A. 46:10B-25, and oversight by the New Jersey Department of Banking and Insurance (NJDOBI) set clear guidelines on how these fees can be imposed.

This guide covers various types of finance agreements, including mortgages, auto loans, and consumer credit, providing a comprehensive overview of late fee limits in 2025.

1. What are new jersey finance agreement max late fees?

Finance agreement late fees are penalties charged when a payment is overdue. They serve as an incentive for timely payment and help lenders cover costs associated with late collections.

- Late fees typically trigger after a missed or delayed payment beyond a set grace period.

- They apply to mortgages, auto loans, consumer credit agreements, and some business loans.

- Consumer agreements often have stricter limits than commercial or business loans.

- Some rental agreements may also impose late fees but follow different rules.

Knowing which agreements fall under these rules helps borrowers and lenders manage expectations and avoid surprises when payments are late.

2. Max late fees: New Jersey rules and limits (2025)

For 2025, New Jersey law caps late fees on finance agreements at 5% of the overdue payment amount. Before a lender can charge this fee, a 15-day grace period must pass after the payment due date. Only one late fee can be charged per missed payment, and fees cannot be compounded on the same overdue amount.

Lenders must also notify borrowers about late fees within 45 days to remain compliant and transparent. These rules are set under N.J.S.A. 46:10B-25, which saw no major changes entering 2025, reinforcing consistent protection for consumers.

| Limit Type | Rule/Amount | Statute/Authority |

|---|---|---|

| Max Fee | 5% of overdue amount | N.J.S.A. 46:10B-25 |

| Grace Period | 15 days | |

| Notice Period | 45 days to notify | |

| Fee Frequency | Once per missed payment |

These regulations ensure that borrowers are treated fairly and lenders can recover reasonable costs from late payments.

3. How to calculate late fees under New Jersey finance law

Calculating the maximum late fee is straightforward. Multiply the overdue payment by 5%.

For example, if a payment of $1,200 is late beyond the 15-day grace period, the max late fee allowed is $60.

| Payment Due | Days Late | Late Fee | Explanation |

|---|---|---|---|

| $1,200 | 16 | $60 | Over grace period, 5% of $1,200 |

| $500 | 10 | $0 | Within grace period, no fee |

Remember, lenders cannot charge multiple late fees on the same missed payment, preventing fee stacking.

Check out our related posts for more stuffs like this:

- Useful Guide: Do i need business license for sole proprietorship [2025]

- Ultimate Guide: How long do you have to pay back a business loan? [2025]

- Proven tips to lower average bank charge for a small business [2025]

4. Special cases, exemptions, and protections

Some agreements have different rules or additional protections:

- Rental agreements may allow late fees but often follow different caps or conditions.

- Commercial or business loans might have less restrictive limits, depending on contract terms.

- Homeowners sometimes benefit from extra protections under local laws or mortgage-specific regulations.

- Auto loans may include specific clauses on late fees but generally adhere to the 5% cap.

| Agreement Type | Late Fee Rules |

|---|---|

| Consumer Finance | Max 5%; 15-day grace |

| Business/Commercial | Varies; often higher or negotiated |

| Rental Agreements | Different caps; state/local rules apply |

Pro Tip: Always check your contract. Some business or auto loan agreements may include clauses that exceed consumer finance protections—but must still comply with NJ statutes unless exempt.

5. Borrower rights and lender responsibilities

Lenders must clearly disclose late fee policies and notify borrowers within 45 days of a missed payment. Transparency helps avoid disputes and promotes fair treatment.

Borrowers who believe late fees are unfair or improperly charged can take steps to dispute them. The New Jersey Department of Banking & Insurance (NJDOBI) and Consumer Affairs provide support for resolving such issues.

Here is a checklist for borrowers disputing a fee:

- Review your finance agreement’s terms carefully.

- Check if the late fee exceeds 5% or was charged before the 15-day grace period.

- Contact your lender in writing to dispute the charge.

- If unresolved, reach out to NJDOBI or Consumer Affairs for guidance.

Borrowers have the right to dispute unfair or improperly applied fees.

6. Legal precedents and case law

Recent case law in New Jersey continues to reinforce statutory protections for consumers.

- Court rulings generally uphold the 5% cap as reasonable and protect consumer interests.

- In 2024, a notable case confirmed that fees above statutory limits are unenforceable, reinforcing protections.

- Judges have emphasized the need for lenders to provide timely notice, aligning with 45-day disclosure rules.

These decisions strengthen enforcement and create a fair playing field for all parties.

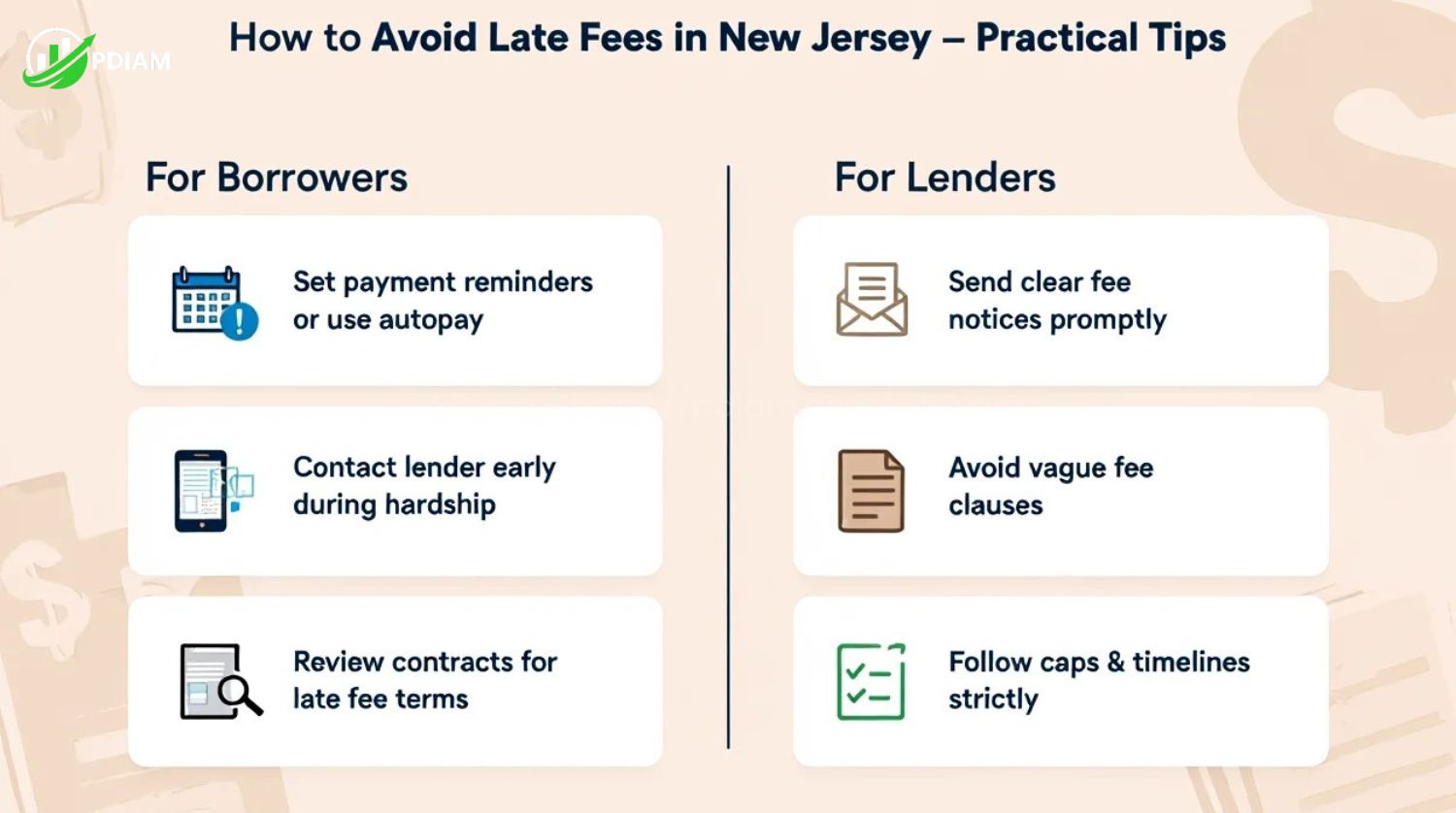

7. Practical tips to avoid late fees in New Jersey

Whether you’re a borrower or lender, late fees can often be avoided with proactive planning:

-

Borrowers:

-

Set payment reminders or use autopay

-

Reach out early to renegotiate due dates during hardship

-

Review contracts before signing for fee-related terms

-

-

Lenders:

-

Provide written notice of fees promptly

-

Avoid ambiguity in fee clauses

-

Adhere strictly to caps and notification timelines

-

Real example: A borrower facing hardship in Newark requested a payment extension before day 15 and avoided the $75 late fee. Clear communication with the lender helped prevent penalties.

View more:

- How to run a background check on yourself for free in 2025

- Saving money on a low income: A comprehensive 2025 Expert guide

- Best Telephone system for small business on a budget [2025]

8. FAQs on New Jersey finance late fees

Q1: Can a lender charge more than 5% if the borrower agrees?

A: No. The 5% cap is statutory and cannot be waived, even by contract.

Q2: Does the 5% limit apply to business loans?

A: Not always. Business loans are often exempt unless stated otherwise in the agreement.

Q3: What happens if a lender fails to give 45-day notice?

A: The fee may be voided. Borrowers can dispute it through NJDOBI.

Q4: Is there a dollar cap on top of the 5% rule?

A: No fixed dollar cap—only the percentage-based maximum applies.

Q5: How can I check if a late fee is legal?

A: Compare it to 5% of the overdue amount and check the timing. Contact NJDOBI or a lawyer if unsure.

Q6: Can I be charged more than one fee for the same missed payment?

A: No. Only one late fee is allowed per missed payment, regardless of how long it remains unpaid.

Q7: Are rental agreements covered by these same rules?

A: Not exactly. Rental fees follow different housing laws and often city-specific caps.

9. Conclusion

Understanding the New Jersey finance agreement max late fees is essential for protecting your rights and ensuring lenders follow the law. With a 5% cap, 15-day grace period, and mandatory 45-day notice, the state provides clear limits that safeguard both parties.

Key takeaways:

-

Fees cannot exceed 5% of the overdue payment

-

Lenders must wait 15 days before charging

-

Only one fee per missed payment is allowed

-

Borrowers can dispute unlawful or excessive charges

By knowing these rules, borrowers can better manage payments, avoid unnecessary fees, and exercise their rights. Lenders benefit from following these regulations to maintain compliance and foster trust.

For any uncertainties, official resources offer guidance and support to ensure financial agreements remain fair and transparent in 2025 and beyond.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.