Professional Employer Organization Pros and Cons? A Professional Employer Organization (PEO) is a company that helps businesses manage their human resources (HR), payroll, benefits, and compliance responsibilities.

Through a process called co-employment, the PEO shares certain employer responsibilities with the client company, allowing businesses to focus more on their core activities while the PEO handles administrative tasks.

Co-employment means the PEO becomes the employer of record for tax and insurance purposes, while the business maintains control over daily operations and employee management.

Businesses often consider using a PEO when they want to reduce HR workload, improve compliance, and offer better employee benefits without building a large internal HR team. Unlike staffing agencies that provide temporary workers, PEOs typically manage long-term employees and offer comprehensive HR services.

They are different from Employers of Record (EOR), which handle employment outsourcing more fully but with less shared control. Compared to in-house HR, PEOs bring expertise and cost efficiency, especially for small to mid-sized companies.

PEO adoption continues to grow, with reports indicating over 25,000 businesses partnered with PEOs in the U.S. This growing trend reflects the appeal of streamlined HR and better benefits at manageable costs.

Understanding what a PEO does lays the foundation for exploring its advantages and disadvantages the key to making informed decisions about HR in 2025.

1. Top 10 professional employer organization pros and cons

Using a PEO can bring significant advantages to growing businesses, but also introduces certain challenges.

This section outlines the ten most common benefits and drawbacks, offering a balanced perspective for decision-makers.

1.1. Pros

Below are ten compelling advantages that businesses often gain from working with a PEO:

-

Access to enterprise-level benefits: Small companies can offer health insurance, retirement plans, and perks similar to those of large corporations. For example, a tech startup saved $20,000 annually by pooling benefits through a PEO.

-

Reduced HR administration workload: PEOs handle complex tasks such as payroll, tax filings, and employee documentation, freeing up internal resources to focus on strategic goals.

-

Legal and compliance support: PEOs remain updated on employment laws and regulations, helping companies avoid fines and lawsuits. A manufacturing firm, for instance, avoided penalties thanks to proactive compliance assistance.

-

Improved payroll accuracy and timeliness: Employees are paid consistently and correctly, reducing the risk of disputes and increasing trust.

-

Risk mitigation through workers’ compensation and safety programs: Businesses gain protection through access to insurance and proactive safety initiatives.

-

Predictable HR costs: PEOs typically offer consolidated pricing, which makes budgeting for HR expenses more transparent and manageable.

-

Recruitment and onboarding assistance: PEOs streamline hiring and help integrate new employees faster, which is especially useful during periods of rapid growth.

-

Enhanced employee retention: Better benefits and structured HR support improve employee satisfaction and reduce turnover.

-

Access to HR technology platforms: Businesses benefit from modern tools for time tracking, reporting, and compliance monitoring.

-

More time for core business growth: With administrative burdens lifted, leadership can focus on product development, customer service, and revenue generation.

These benefits make PEOs particularly attractive for small to medium-sized businesses seeking cost-efficient HR solutions with enterprise-level capabilities.

1.2. Cons

Despite their advantages, PEOs may not be suitable for every organization. Below are ten potential drawbacks that should be carefully considered:

-

Loss of some managerial control: Sharing employment responsibilities can limit direct control over HR decisions and internal policies.

-

Limited benefit customization: Businesses may be restricted to benefit packages offered by the PEO, which might not align perfectly with their workforce needs.

-

Ongoing and sometimes hidden costs: Fees for setup, implementation, or extra services can increase overall expenses if not clearly stated upfront.

-

Minimum employee requirements or contract terms: Some PEOs require a minimum headcount or lock-in periods, making them less ideal for very small teams.

-

Risk of miscommunication or HR errors: Misalignment between the PEO and the client’s internal processes can lead to administrative mistakes.

-

Shared liability in co-employment: Even with a PEO, the client business may still bear legal responsibility for certain compliance failures.

-

Not all PEOs serve every industry equally: Specialized businesses may struggle to find a PEO that understands their sector-specific needs.

-

Potential disruption during transitions: Shifting to or between PEOs can disrupt operations and negatively affect employee morale.

-

Termination penalties or exit complexity: Exiting a PEO agreement may involve fees, loss of data, or delays in regaining HR independence.

-

Potential culture mismatch: For example, a retail chain experienced delays in resolving staff concerns after changing PEO providers, affecting internal trust.

Weighing these pros and cons can help business leaders determine whether partnering with a PEO aligns with their operational needs and company culture.

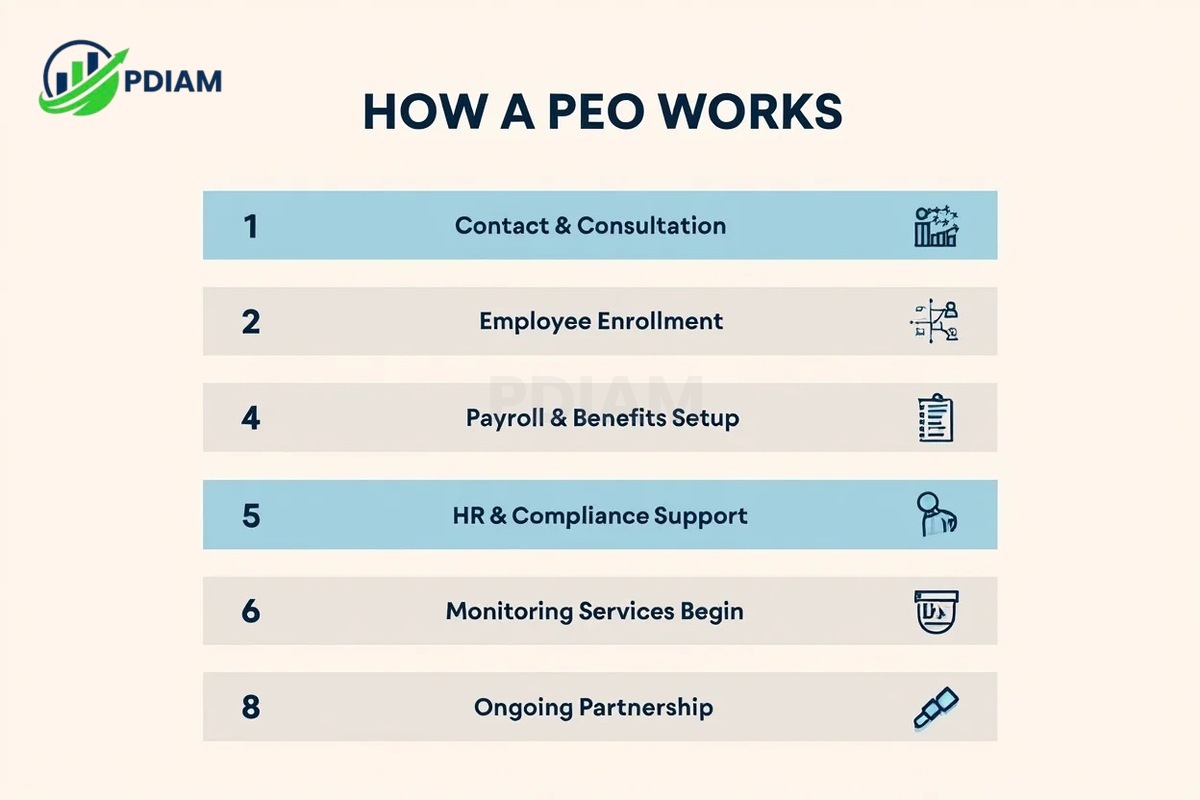

2. How a PEO works: step-by-step process

Before partnering with a PEO, it’s important to understand the workflow. Here’s how the process typically unfolds:

-

Contact and consultation

-

Agreement setup

-

Employee enrollment

-

Payroll and benefits management

-

HR and compliance support

-

Employee services

-

Monitoring and reporting

-

Ongoing partnership

For example, a marketing agency scaling from 10 to 50 employees used a PEO to streamline benefits and comply with multi-state tax laws.

3. Who should use a PEO?

PEOs work well for specific types of businesses. Here are common use cases:

-

Small to mid-sized companies (10–100 employees) wanting enterprise-level HR support

-

Firms experiencing rapid growth needing to scale HR fast

-

Businesses with remote or multi-state workers struggling with compliance

-

Industries such as tech, retail, healthcare, manufacturing, and professional services

For instance, a healthcare clinic expanding to new locations partnered with a PEO to standardize payroll and legal compliance across states.

Check out the Articles below:

- Powerful insight: Difference between accounts payable and accounts receivable [2025]

- Definitive guide: Is net income and net profit the same? [2025]

- How does workers’ comp affect tax return: What’s legal in 2025?

4. Comparison: PEO vs. staffing agency vs. EOR vs. in-house HR

This table breaks down different HR models:

| Model | Role | Employee Relationship | HR Scope | Cost | Customization | Flexibility |

|---|---|---|---|---|---|---|

| PEO | Co-employer sharing HR duties | Shared employer | Payroll, benefits, compliance | Moderate; predictable | Moderate | Medium |

| Staffing Agency | Temporary worker supplier | Employer of temps | Recruiting, temp payroll | High per temp | Low | High |

| EOR | Full employment outsourcing | Employer of record | Payroll, benefits, taxes | Variable; often high | Low | Medium |

| In-House HR | Internal HR team | Employer | Full HR scope | High fixed costs | High | High |

A startup might choose a PEO for scalable HR. A retail chain with seasonal workers might prefer a staffing agency. For international hiring, an EOR provides legal simplicity.

5. Checklist before partnering with a PEO

Before signing with a PEO, review the following:

-

Due diligence: Verify ESAC accreditation, request client references

-

Compliance: Confirm multi-state coverage, legal support

-

Finance: Understand setup fees, monthly costs, potential extras

-

HR services: Clarify payroll, benefits, recruiting scope

-

Technology: Evaluate HR software usability and integrations

-

Support: Ask about customer service availability and response times

-

Exit strategy: Know contract length, penalties, and data ownership

A well-prepared checklist helps ensure the partnership aligns with long-term business goals.

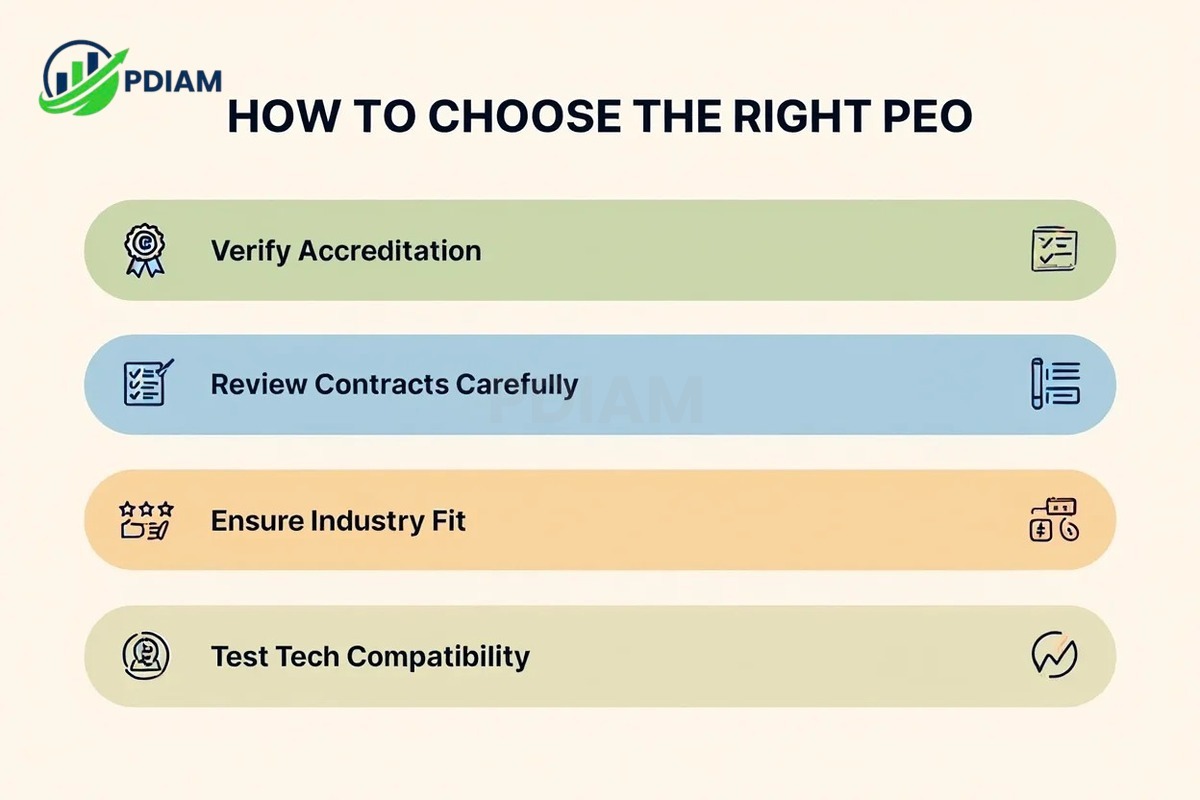

6. How to choose the right PEO

Choosing the right PEO requires research and alignment with your business needs:

-

Look for ESAC and IRS accreditation

-

Avoid vague contracts; insist on clear service-level agreements

-

Read reviews and talk to current clients

-

Ensure industry expertise and compliance coverage

-

Assess software compatibility and integrations

Proper evaluation reduces risk and improves long-term satisfaction with the PEO.

7. Real-world case studies

Understanding how PEOs work in practice can help businesses evaluate their impact more clearly. The following real-world examples illustrate both the benefits and risks associated with partnering with a professional employer organization.

7.1. Success story

A 25-person software company partnered with a PEO to upgrade its employee benefits. By leveraging the PEO’s pooled benefits plans, the company saved 15% annually on healthcare costs.

The partnership also provided reliable compliance support, allowing the business to expand its workforce rapidly without running into legal issues.

This example demonstrates how a well-chosen PEO can enhance competitiveness and streamline HR as a company grows.

7.2. Cautionary tale

A retail chain switched to a new PEO in an effort to reduce operational costs. However, the company encountered miscommunication, unexpected service fees, and poorly managed onboarding. The transition led to payroll delays and reduced employee morale.

This cautionary case highlights the importance of vetting contracts thoroughly and ensuring service alignment before switching PEO providers.

View more:

- Powerful social media for small business marketing: Complete 2025 Expert guide

- How to price a business for Sale: The complete 2025 guide

- Understand what is meant by real GDP fast: Clear Breakdown in 2025

8. FAQs on professional employer organizations

Q1: Do I lose control over my employees with a PEO?

No, you keep operational control. The PEO manages HR and compliance tasks only.

Q2: What’s the difference between a PEO and a staffing agency or EOR?

A PEO co-employs long-term staff, a staffing agency supplies temps, and an EOR legally employs on your behalf.

Q3: How big does my business need to be?

PEOs usually work best for companies with 10 or more employees.

Q4: Can I leave my PEO if my business changes?

Yes, but check the termination clauses and notice period in your contract.

Q5: What should I look for in a PEO contract?

Focus on service scope, hidden fees, exit penalties, and compliance protections.

Q6: What industries are best suited for PEOs?

Tech, healthcare, retail, manufacturing, and professional services.

Q7: Is a PEO the same as outsourcing HR?

Not exactly. A PEO shares legal responsibility through co-employment, while HR outsourcing offers support without shared liability.

9. Conclusion

Understanding the professional employer organization pros and cons helps businesses assess whether a PEO aligns with their needs in 2025. While PEOs offer enterprise-level HR services, improved compliance, and cost predictability, they also come with potential downsides like reduced control and exit complexities.

Summary of key points:

-

Access to better benefits and HR platforms

-

Relief from day-to-day admin burdens

-

Legal compliance support across states

-

Shared risks and potential hidden fees

-

Importance of choosing the right provider

To explore more about HR strategy, visit the Business Operations section on Pdiam and make informed decisions for your team’s success.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.

![Essential Guide: Professional employer organization Pros and Cons [2025]](https://pdiam.com/wp-content/uploads/2025/08/Essential-Guide-Professional-employer-organization-Pros-and-Cons-750x375.jpeg)