Understanding the types of risk in insurance industry is crucial for professionals, students, investors, and business owners. Insurance is built on managing uncertainty, so recognizing different risks helps ensure profitability, compliance, and business continuity. Recent events, such as global climate disasters and cyberattacks, highlight how quickly risks can impact insurers worldwide.

This guide explores all major risk categories insurers face today, emerging risks shaping 2025, and practical ways to manage them effectively.

1. What is risk in the insurance industry?

In the context of insurance, risk refers to the possibility of loss or adverse events that may impact individuals, businesses, or insurers.

It involves uncertainty about future outcomes, often leading to financial consequences if the event occurs.

1.1. Pure risk vs. speculative risk

In the insurance industry, risks are generally divided into two main categories:

-

Pure risk: Situations where there is only a chance of loss or no loss, without any potential for gain. Examples include property damage, illness, or theft.

-

Speculative risk: Scenarios that involve the possibility of either loss or gain, such as business ventures or investment activities.

Table: Examples of Risk Types

| Risk Type | Description | Examples |

|---|---|---|

| Pure Risk | Only chance of loss or no loss | Fire damage, health issues |

| Speculative Risk | Chance of loss or gain | Investment losses, new ventures |

Classifying risks into pure and speculative categories allows insurers to design products and set premiums more accurately, forming the foundation of effective risk management strategies.

2. Types of risk in insurance industry

Insurance companies must navigate various risks that impact their ability to pay claims, maintain solvency, and ensure long-term stability.

These risks are often interrelated, and effective management is essential for protecting both the company and its policyholders.

2.1. Market risk

Market risk arises from fluctuations in interest rates, stock prices, or currency values. For instance, a sharp decline in investment markets can reduce an insurer’s asset values and overall profitability.

2.2. Underwriting risk

Underwriting risk occurs when claims exceed expectations due to poor risk assessment or unforeseen events, such as a sudden surge in natural disaster-related claims.

2.3. Operational risk

Operational risk stems from internal failures like system breakdowns, fraud, or human error. For example, a significant software outage in claims processing can delay payouts and damage customer trust.

2.4. Credit risk

Credit risk involves the possibility of a counterparty, such as a reinsurer or policyholder, defaulting on their obligations. A reinsurer’s bankruptcy can cause major financial setbacks.

2.5. Liquidity risk

Liquidity risk arises when an insurer cannot convert assets into cash quickly enough to pay claims, especially during catastrophic events when there is a surge in payouts.

2.6. Legal and regulatory risk

Given the highly regulated nature of insurance, changes in laws or non-compliance can lead to fines, increased costs, or operational constraints that affect business performance.

2.7. Reputational risk

Reputational risk occurs when negative publicity, claims disputes, or compliance issues harm the insurer’s brand, leading to reduced customer trust and lost business.

Each of these risks can significantly affect an insurer’s financial stability. For example, the 2021 Texas winter storm highlighted how underwriting and liquidity risks can overwhelm even well-prepared insurers.

3. Emerging and evolving risks in 2025

The insurance industry is facing new and rapidly evolving risks that require adaptive strategies and advanced modeling techniques. These factors are reshaping how insurers operate and plan for the future.

Key emerging risks include:

-

Cyber risk: Cyberattacks, ransomware, and data breaches are increasing, leading to severe financial losses and operational disruptions.

-

Climate and catastrophe risk: More frequent and intense weather events such as floods, wildfires, and hurricanes are driving higher claim volumes.

-

Pandemic and biological risk: The COVID-19 pandemic revealed how global health crises can disrupt claims, reserves, and business operations.

-

Talent risk: A shortage of skilled professionals affects underwriting, claims management, and innovation in the insurance sector.

-

ESG risk: Environmental, social, and governance factors are becoming critical, with stricter compliance requirements from regulators and investors.

-

Long-tail or latent risk: Risks like asbestos exposure or pollution liabilities may result in claims decades later, complicating pricing and reserving.

Example:

The 2022 hurricane season led to record claims exceeding $30 billion, underlining the importance of climate risk modeling.

View more stuffs like this:

- How to run a background check on yourself for free in 2025

- Best Telephone system for small business on a budget [2025]

- What’s the cheapest franchise to open for maxium profit right now? [2025]

4. Risk classification table

To summarize, here’s a table highlighting the key types of risk:

| Name | Description | Key Example |

|---|---|---|

| Market Risk | Financial market fluctuations | Interest rate changes |

| Underwriting Risk | Unexpected claim losses | Spike in storm claims |

| Operational Risk | Failures in processes or systems | IT outage in claims system |

| Credit Risk | Counterparty default | Reinsurer insolvency |

| Liquidity Risk | Lack of cash for obligations | Delay in paying claims |

| Legal & Regulatory Risk | Compliance and legal challenges | New privacy laws |

| Reputational Risk | Brand damage and loss of trust | Media disputes over claims |

| Cyber Risk | Data breaches and cyberattacks | Ransomware attack |

| Climate Risk | Extreme weather and catastrophes | Flood damage |

| Pandemic Risk | Health crises | COVID-19 claims surge |

| Talent Risk | Workforce shortages | Loss of skilled underwriters |

| ESG Risk | Sustainability and governance issues | ESG non-compliance |

| Long-Tail Risk | Claims emerging years later | Asbestos claims |

5. What makes a risk insurable?

Not every risk can be covered by insurance. To be considered insurable, a risk must meet specific conditions that allow insurers to accurately assess and price it, while maintaining financial stability.

Key conditions include:

-

Randomness: Events must be uncertain and outside the insured’s control.

-

Calculability: The probability and potential cost of the event must be estimable.

-

Financial impact: The risk must cause a measurable financial consequence.

-

Legal soundness: The risk must be legal and aligned with public policy.

-

Large pool: There must be enough similar risks to spread the cost effectively.

For instance, fire damage to a home, car accidents, or health-related issues are insurable, while losses from poor business decisions or speculative investments are not. Understanding these criteria helps insurers and customers set realistic expectations about coverage.

6. How insurance companies manage risks

Insurance companies must manage a wide range of risks to maintain stability, profitability, and customer trust. Effective risk management involves proactive strategies, data-driven decisions, and compliance with regulations.

Key methods include:

-

Risk identification: Using data analytics and modeling to detect potential risks early.

-

Risk pricing: Setting premiums that accurately reflect the probability and severity of claims.

-

Risk transfer: Sharing risk through reinsurance agreements to minimize exposure.

-

Operational controls: Enhancing internal processes, upgrading technology, and improving staff training to reduce human error.

-

Compliance: Ensuring strict adherence to legal and regulatory requirements to avoid fines and legal complications.

-

Crisis management: Developing contingency plans for major events like natural disasters or cyberattacks.

By leveraging artificial intelligence, many insurers reduced claims processing times by 30% in 2023, boosting both efficiency and customer satisfaction.

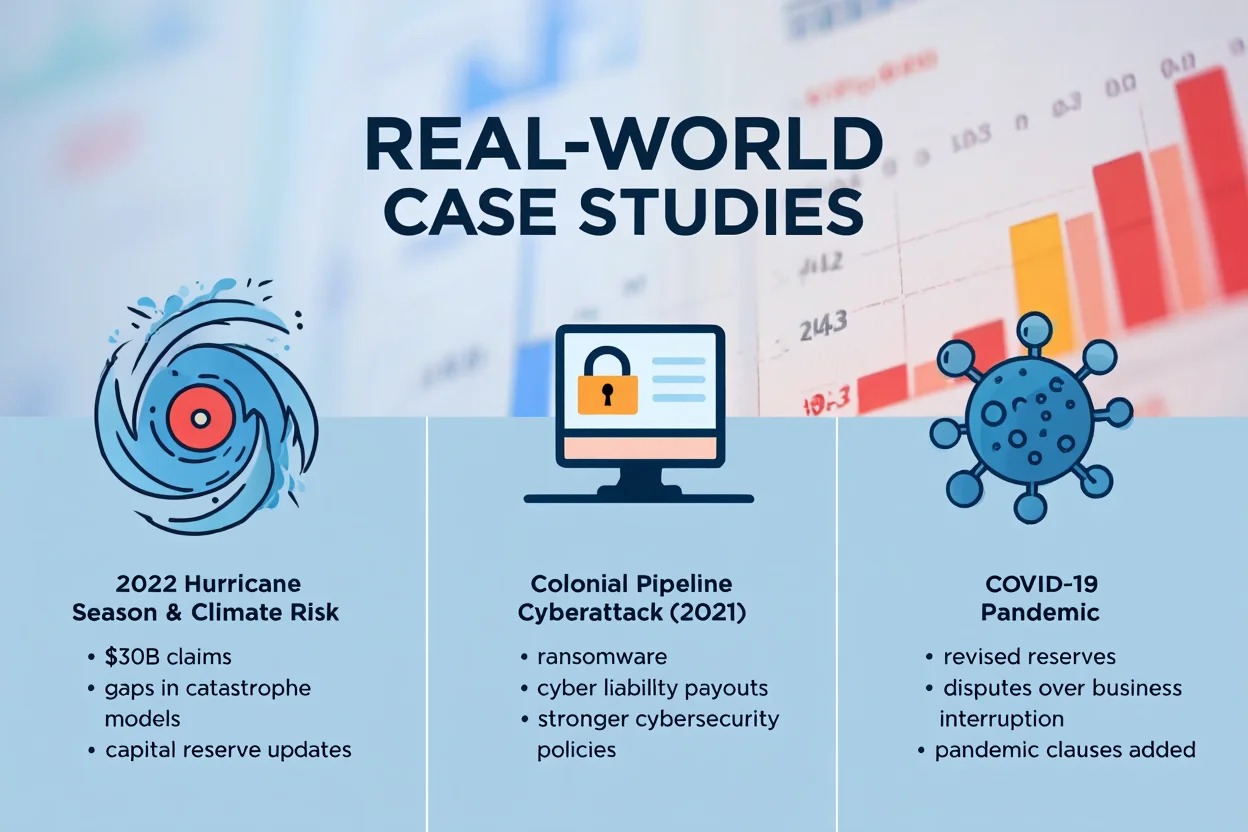

7. Real-world case studies

Examining real-world events provides valuable lessons on how different types of risk in insurance industry manifest and impact insurers.

These examples highlight the need for stronger risk models, better preparedness, and adaptive strategies.

7.1. 2022 hurricane season and climate risk

The 2022 Atlantic hurricane season caused over $30 billion in claims, revealing significant gaps in underwriting models and liquidity planning. Many insurers were forced to re-evaluate catastrophe risk models and improve capital reserves to handle extreme weather events.

7.2. Colonial Pipeline cyberattack (2021)

A major ransomware attack on Colonial Pipeline resulted in severe operational disruptions and significant payouts for cyber liability insurers. This incident emphasized the growing threat of cyber risk and led insurers to enhance cybersecurity requirements and client risk assessments.

7.3. COVID-19 pandemic

The global pandemic forced life and health insurers to revise reserves due to unexpected claims. It also sparked disputes over business interruption policies, prompting insurers to add pandemic-specific clauses and develop stronger crisis response strategies.

These case studies underscore how both core and emerging risks, such as climate change, cyberattacks, and pandemics, can severely impact insurers’ financial stability and operations. Learning from these events helps companies refine risk models and prepare for future challenges.

8. Future trends shaping insurance risks (2025+)

The insurance industry is undergoing rapid transformation as technology, environmental factors, and regulations continue to evolve. Understanding these trends helps insurers stay ahead of potential risks and maintain competitive advantage.

Key future trends include:

-

Digitalization and AI: Advanced technologies enhance risk modeling, improve fraud detection, and speed up claims processing.

-

Geopolitical uncertainty: Increasing global tensions introduce new risks, requiring insurers to adopt proactive monitoring and contingency planning.

-

ESG and data privacy regulations: Stricter compliance requirements, particularly around environmental, social, and governance standards, are driving insurers to adapt their operational and reporting frameworks.

Insurers that invest in advanced risk models, cutting-edge technology, and continuous innovation will remain resilient and better prepared for emerging challenges.

View more:

- What does it mean to be underbanked? Better options [2025]

- 2025’s Ten top Billionaires in the World ranked

9. FAQs: Types of risk in insurance industry

Q1: What is the most common risk in insurance?

A: Underwriting risk, as it directly involves unexpected claim losses.

Q2: Can all risks be insured?

A: No. Only risks meeting criteria like randomness and calculability are insurable.

Q3: How do insurers manage emerging risks?

A: Through updated models, analytics, and reinsurance.

Q4: What is operational risk?

A: Risks arising from process failures, fraud, or system breakdowns.

Q5: How does climate risk affect insurers?

A: It increases claims from natural disasters and impacts premium pricing.

Q6: What role does AI play in risk management?

A: AI improves fraud detection, claims efficiency, and predictive analysis.

Q7: Why is reputational risk significant?

A: It erodes customer trust, leading to reduced revenue and brand value.

10. Conclusion

Understanding the types of risk in insurance industry is crucial for insurers and businesses aiming to manage uncertainty and build resilience. Throughout this guide, we explored both core risks, such as market, underwriting, and operational risks, and emerging threats like cyber risk, climate risk, and ESG challenges. Insurers that invest in advanced analytics, robust operational controls, and innovation will be best prepared for future challenges.

Key takeaways:

-

Core risks (market, underwriting, credit, operational) directly affect financial stability.

-

Emerging risks (cyber, climate, pandemic, ESG) require adaptive strategies and updated models.

-

Technology, AI, and strong compliance frameworks enhance risk mitigation.

-

Real-world case studies highlight the impact of climate events, cyberattacks, and pandemics.

To stay competitive in 2025 and beyond, insurers must prioritize proactive risk management, leverage data-driven tools, and continuously refine their risk assessment models.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.

I appreciate you sharing this blog post. Thanks Again. Cool.