If you’ve been exploring health insurance options, you might have come across the term PPO. So, what does PPO stand for in health insurance?

PPO means Preferred Provider Organization. It’s a type of health plan known for giving you flexibility in choosing doctors and specialists without needing a referral.

Typically, PPO plans benefit those who want more control over their provider choices and seek coverage that supports both in-network and out-of-network care. Major insurers and HealthCare.gov highlight PPO plans for their wide provider networks and ease of access.

This guide will walk you through the PPO meaning, its features, how it works, and how it compares to other plans. Whether you’re new to health insurance or looking to switch plans, understanding PPOs will help you make informed choices.

1. What does PPO stand for in health insurance?

PPO stands for Preferred Provider Organization. This term comes from the way the insurance plan prefers a network of doctors and hospitals but still allows access to providers outside the network, usually at a higher cost.

PPOs are common in the U.S. health insurance market because they balance choice and cost.

PPO plans are built around flexibility. Below are the core characteristics that define them:

-

Members receive the best coverage when using preferred or in-network providers.

-

They can also see out-of-network providers but often pay more out-of-pocket.

-

Referrals from a primary care doctor are not required to see specialists.

-

They are widely offered in employer plans and individual marketplaces.

These features make PPO plans attractive to individuals who value autonomy in their healthcare decisions.

2. Understanding PPO plans: Definition, purpose, and target users

Let’s dig deeper into what a PPO is, what it’s designed to do, and who benefits most from it.

2.1. PPO plan meaning and purpose

A PPO plan is a type of health insurance designed to give members the freedom to choose health care providers. Unlike plans that require strict network use and referrals, PPOs allow visits to specialists directly and out-of-network care at higher costs.

The main purpose of PPOs is to offer flexibility while still managing care costs.

2.2. Who typically chooses PPO plans?

Here’s a quick breakdown of user types and why PPOs are a good fit:

| User Type | Why PPO Works for Them |

|---|---|

| Frequent travelers | Access doctors nationwide, including out-of-network |

| Patients needing specialists | Direct access without referrals |

| Self-employed or freelancers | Flexible care options not tied to employer networks |

| Families with diverse needs | Variety of providers and locations available |

If your health needs require freedom of choice and nationwide access, a PPO plan might be ideal.

3. Key features of a PPO health insurance plan

To better understand why many people prefer PPOs, it’s essential to explore the distinct features that set them apart from other health insurance options.

PPO health plans offer a combination of flexibility, accessibility, and expansive provider networks. Here are the key features you should know:

-

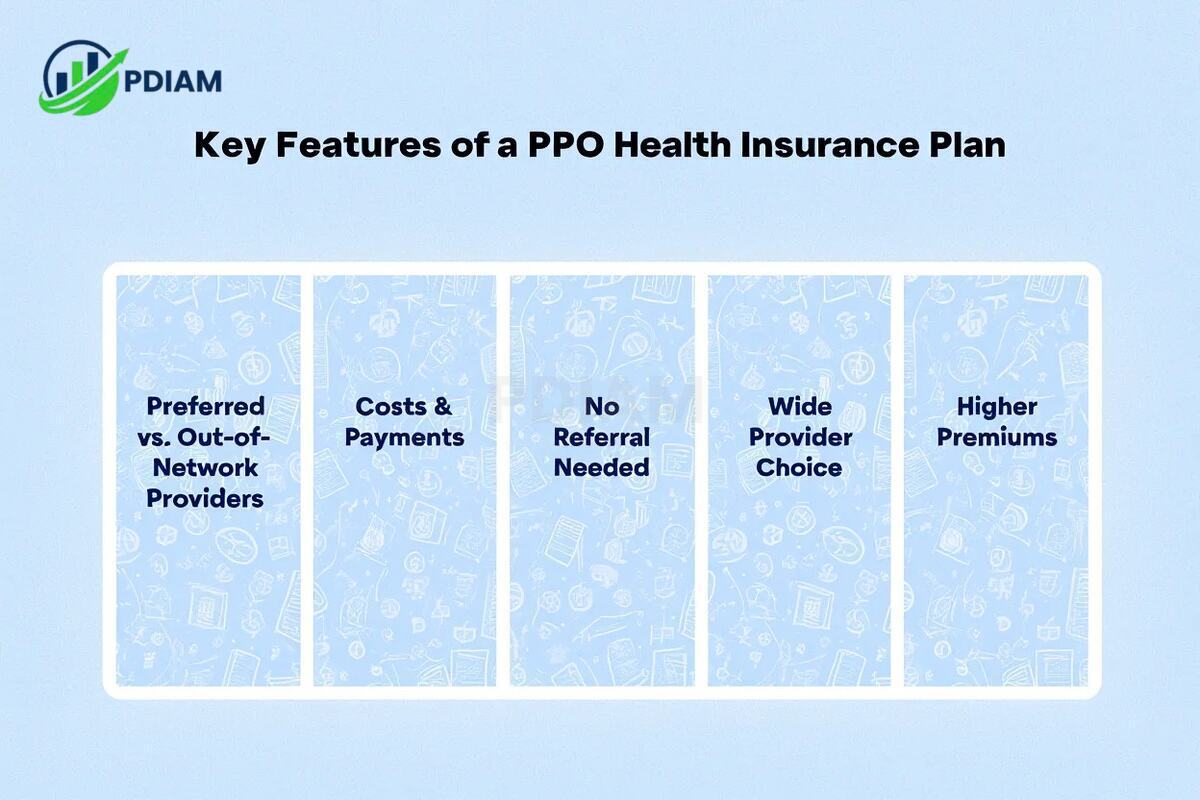

Preferred vs. Out-of-Network Providers

PPOs maintain a preferred or in-network group of providers that offer services at lower negotiated rates. You still have the freedom to see out-of-network providers, but you’ll pay more out-of-pocket when doing so. -

Costs & Payments

In-network services often come with lower co-pays and coinsurance. When you go out-of-network, your deductible and coinsurance tend to be higher, increasing your overall healthcare costs. -

No Referral Needed

One of the biggest advantages is that PPOs don’t require you to obtain a referral from a primary care provider to see a specialist. This streamlines access to specialized treatment when you need it. -

Wide Provider Choice

PPOs typically include a large network of doctors and hospitals across the country. This makes them an excellent choice for people who travel frequently or have providers in different locations. -

Higher Premiums

Due to the added convenience and broader access, PPO plans often carry higher monthly premiums compared to more restrictive plans like HMOs or EPOs.

Pro Tip: On average, PPO premiums are 15–20% higher than HMO plans. However, that cost buys you the ability to see specialists directly and avoid referral delays, saving time and hassle, especially for complex care needs.

These features make PPOs ideal for individuals and families who value provider choice, nationwide flexibility, and fewer administrative barriers, even if it means paying more.

For more stuffs like this, check out our:

- What is a Mission Statement in Business? Complete guide and 30+ benefits

- What is NFC and contactless payments? Everything you need to know in 2025

- What is excess liability insurance coverage? Must-know 10+ tips and facts

4. How does a PPO work? Step-by-step example

To understand the functionality of a PPO, let’s walk through a typical user journey.

4.1. PPO in action: What the process looks like

Here’s a step-by-step example of how patients interact with PPO health insurance:

-

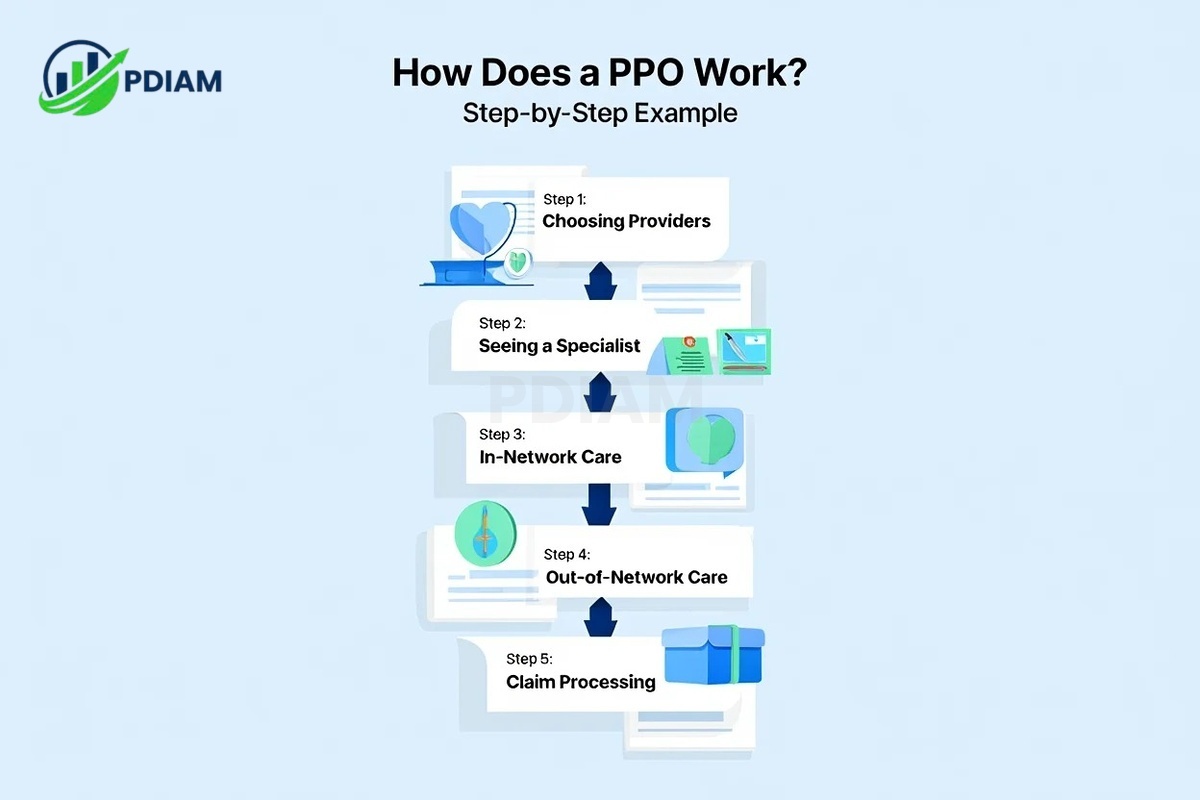

Step 1: Choosing Providers

You begin by selecting a primary care doctor or specialist from within your PPO’s preferred network. These in-network providers have pre-negotiated rates, helping reduce your medical expenses from the start. -

Step 2: Seeing a Specialist

One major advantage of PPOs is that you can go directly to a specialist without needing a referral from a primary care physician. This simplifies and speeds up access to specialized care. -

Step 3: In-Network Care

When you choose providers within the network, your insurer covers a larger share of the cost. You pay lower co-pays and coinsurance, making routine visits and checkups more affordable. -

Step 4: Out-of-Network Care

PPOs still allow visits to doctors outside the network. However, these visits usually come with higher deductibles, co-insurance rates, and more paperwork. -

Step 5: Claim Processing

In-network providers typically submit claims to the insurance company on your behalf. For out-of-network visits, you may need to pay upfront and file claims yourself for reimbursement.

Each of these steps highlights the trade-off between flexibility and cost within PPO plans.

4.2. PPO patient cost comparison

The following table illustrates a typical cost scenario for in-network versus out-of-network care under a PPO plan:

| Scenario | In-Network Visit | Out-of-Network Visit |

|---|---|---|

| Doctor Visit Cost | $150 | $150 |

| Co-Pay/Coinsurance | $20 co-pay | $50 coinsurance |

| Insurance Covers | $130 | $80 |

| Out-of-Pocket Total | $20 | $70 |

Real Example: In 2024, a PPO member in California paid just $25 for an in-network cardiology consultation, compared to $85 for a similar visit with an out-of-network specialist.

This comparison shows how PPOs reward patients for using in-network care while still preserving access to broader options when needed.

5. PPO vs. HMO, EPO, and POS: Comparison table

When evaluating health insurance plans, it helps to compare the main types side by side. This section outlines the key differences between PPO, HMO, EPO, and POS plans.

The table below highlights the most important features to consider when comparing these plan types:

| Feature | PPO | HMO | EPO | POS |

|---|---|---|---|---|

| Network Size | Large | Small | Large | Moderate |

| Out-of-Network Coverage | Yes (costly) | No | No | Yes (with referral) |

| Specialist Referral Required | No | Yes | No | Yes |

| Monthly Premiums | High | Low | Medium | Medium |

| Flexibility | High | Low | Medium | Medium |

Real Example: According to HealthCare.gov 2024 data, over 40% of individual market enrollees selected PPO plans despite higher premiums, favoring the flexibility in specialist access.

This comparison helps clarify why many people choose PPOs when freedom to choose providers and ease of access to specialists are top priorities, even if it means paying more.

6. Pros and cons of PPO health insurance plans

Let’s evaluate the pros and cons of PPOs to help you weigh your options.

| Pros | Cons |

|---|---|

| Wide choice of providers nationwide | Higher premiums than HMOs or EPOs |

| No need for specialist referrals | More complex billing, especially out-of-network |

| Coverage for out-of-network services | Higher out-of-pocket costs possible |

| Flexibility for travelers and freelancers | May require submitting claims manually |

While PPOs offer excellent flexibility, they may not suit those looking for the most affordable premiums.

7. When should you choose a PPO plan?

Choosing a health plan depends heavily on your lifestyle, preferences, and how you access care.

This section outlines when a Preferred Provider Organization (PPO) might be the right fit for you.

7.1. Common situations where PPOs make sense

Below are several real-life situations where PPO plans offer clear advantages:

-

You travel frequently: If you’re often on the move across states or regions, PPOs provide access to a broader range of providers, even out-of-network, making it easier to receive care wherever you are.

-

You need regular specialist care: For individuals managing chronic conditions or ongoing treatments, PPOs allow direct access to specialists without the need for time-consuming referrals.

-

You’re self-employed or freelance: Without employer-tied options, PPOs offer flexibility in selecting your providers and care facilities.

-

Your household has varied medical needs: Families with diverse health requirements benefit from PPOs due to their wide provider networks and fewer access restrictions.

These examples illustrate how PPOs adapt to complex, dynamic healthcare needs.

7.2. Quick decision checklist

To further evaluate if a PPO plan aligns with your needs, consider these questions:

-

Do I want direct access to specialists without referrals?

-

Am I okay paying higher premiums for more provider choice?

-

Will I use out-of-network doctors occasionally?

-

Do I value flexibility more than the lowest possible cost?

Pro Tip: If you answered yes to most of these, a PPO plan likely offers the coverage and convenience you’re seeking.

This checklist helps you align your expectations with what PPO plans deliver.

View more:

- Is net income and net profit the same

- Difference between accounts payable and accounts receivable

- Professional employer organization pros and cons

8. Glossary: PPO & health insurance key terms

To make informed decisions, it’s crucial to understand the basic terminology used in PPO and health insurance discussions.

-

Network: A group of doctors and hospitals that have agreed to provide medical services at negotiated rates with the insurer.

-

Deductible: The amount you must pay out-of-pocket for services before your insurance coverage kicks in.

-

Premium: The monthly fee you pay to keep your health insurance active.

-

Co-pay: A fixed dollar amount you pay for covered services, such as doctor visits or prescriptions.

-

Co-insurance: The percentage of medical costs you share with your insurer after meeting your deductible.

-

Referral: A formal recommendation from your primary care physician (PCP) required by some plans before you can see a specialist.

-

Primary Care Physician (PCP): Your main doctor who provides routine care and manages your overall health needs.

These definitions serve as a foundation for navigating your PPO options with clarity and confidence.

9. Frequently asked questions about PPOs

Q1. Do I need a referral with a PPO?

A: No. PPOs let you see specialists without a referral from your PCP.

Q2. What if I see an out-of-network doctor?

A: You can, but expect higher out-of-pocket costs. You may need to submit your own claim.

Q3. Are PPOs available through employer plans, ACA, or Medicare Advantage?

A: Yes. PPOs are offered in all three: employer-sponsored, ACA marketplace, and some Medicare Advantage plans.

Q4. How do I check if my provider is in the PPO network?

A: Use your insurer’s website or contact customer service to confirm provider status.

Q5. How are claims handled differently with a PPO?

A: In-network claims are typically filed for you. Out-of-network claims may require self-submission.

Q6. Do PPOs cost more than HMOs?

A: Generally, yes. PPOs usually come with higher premiums due to their flexibility and broader access.

Q7. Can I switch from an HMO to a PPO mid-year?

A: Only if you experience a qualifying life event or your employer allows mid-year plan changes.

10. Conclusion

Understanding what does PPO stand for in health insurance empowers you to make smarter health care decisions.

PPO means Preferred Provider Organization, and it delivers flexibility by:

-

Offering wide provider access, in- and out-of-network

-

Allowing direct specialist visits without referrals

-

Covering services nationwide for frequent travelers

-

Providing better autonomy in managing your health

If you value flexibility, freedom of choice, and convenience over the lowest monthly cost, a PPO plan is likely worth it.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.