If you’ve ever wondered what happens when you decline a Cash App payment, the short answer is that the money never reaches the recipient and is returned to the sender. This can occur when the recipient manually rejects the transfer, or when Cash App’s security system flags the payment as suspicious and blocks it.

From a user’s perspective, declining a payment means no funds permanently leave the sender’s account. However, understanding the full process, refund timelines, and potential security implications is important for managing your Cash App transactions effectively.

1. What happens when you decline a Cash App payment? (Core explanation)

Declining a Cash App payment means the transaction is stopped before funds are deposited into the recipient’s account. The money is sent back to the sender, usually within minutes but sometimes up to 1–3 business days depending on the bank processing times.

Step-by-step from both sides:

-

Recipient – Actively rejects the payment or the system blocks it. The app shows “Declined” and the money is never added to their balance.

-

Sender – Receives an instant notification and sees a status update such as “Refunded” or “Declined” in the transaction history.

Immediate impacts include:

-

No transfer of funds occurs.

-

Refund to the sender without penalty or extra fees.

-

No account restrictions for simply declining.

According to official Cash App support, a decline is simply a transaction reversal, not a penalty.

2. Decline vs. cancel vs. expire

To avoid confusion, it’s important to distinguish between these three statuses.

-

Decline – Recipient rejects the payment or system blocks it; funds return to the sender.

-

Cancel – Sender manually cancels before the recipient accepts; funds return to the sender.

-

Expire – Payment is unclaimed for 14 days, after which funds are automatically returned.

Comparison table:

| Trigger | Who Initiates? | Funds Returned To | Timeline |

|---|---|---|---|

| Decline | Recipient or System | Sender | Instantly to 3 days |

| Cancel | Sender | Sender | Instantly |

| Expire | System after 14 days | Sender | 14 days |

Knowing the difference helps you manage expectations and track payments effectively.

Knowing the difference helps you manage expectations and track payments effectively. Similarly, understanding financial terms in everyday money management can prevent costly mistakes. For example, learning what is a sinking fund will show you how planned savings for future expenses work, helping you stay prepared just like knowing the status of your payments.

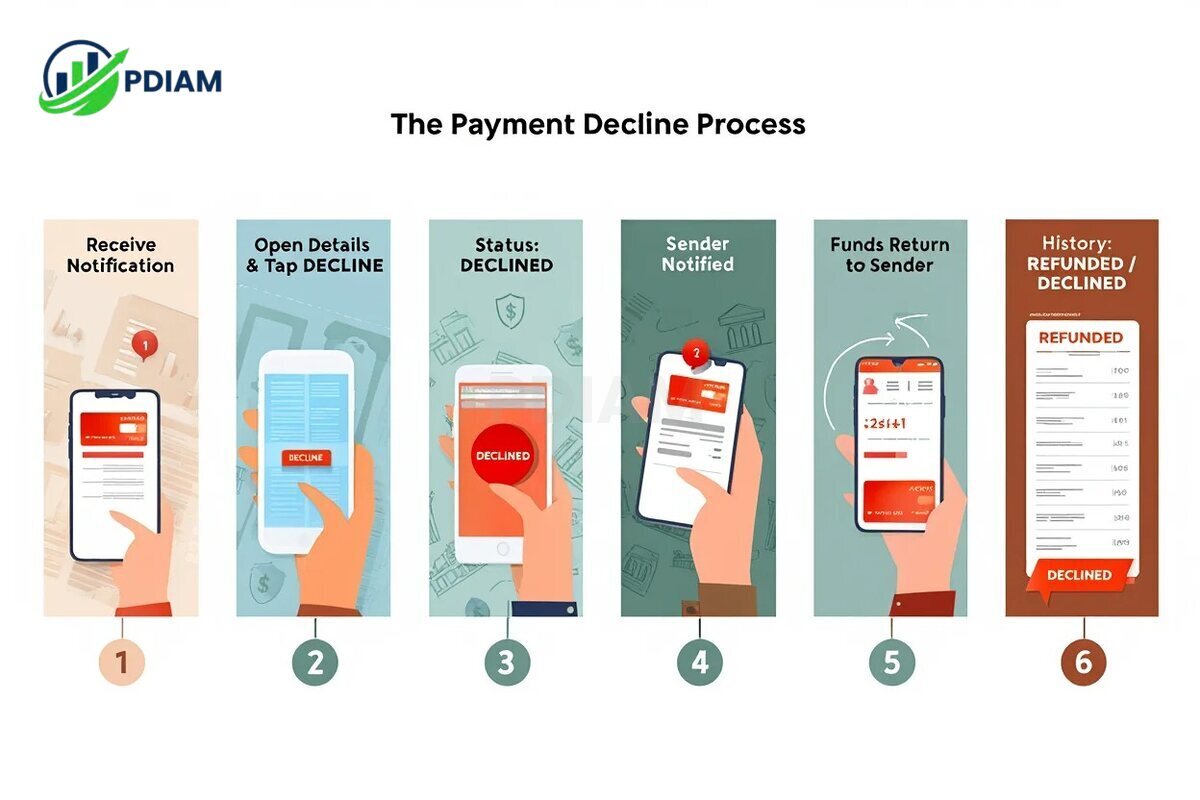

3. Step-by-step: the payment decline process

If you are the recipient and decide to decline:

-

Receive a notification about the pending payment.

-

Open the payment details and tap “Decline” or “Reject.”

-

App updates status to “Declined.”

-

Sender instantly gets a notification.

-

Funds return to the sender’s balance or original payment source.

-

Transaction history updates to “Refunded” or “Declined.”

Pro Tip:

Always verify the sender before accepting or declining. This can protect you from scams.

The process is quick, transparent, and requires no additional action from the sender to get their money back.

View more:

- What is Fiduciary Liability insurance coverage? Must-know facts [2025]

- How many hours in working week? Full breakdown [2025]

- Proven tips to lower average bank charge for a small business [2025]

4. Refund process and money flow after a decline

Refund speed depends on the original funding source.

| Funding Source | Typical Refund Time |

|---|---|

| Cash App Balance | Instant |

| Bank Account | 1–3 Business Days |

| Credit/Debit Card | Up to 3 Business Days |

Real Example:

If John sends $200 from his debit card and it’s declined, the funds may take up to 3 business days to reappear in his bank account, depending on the bank’s processing speed.Tracking the refund through your Cash App history or bank statement ensures you know exactly when the money arrives.

5. Common reasons Cash App payments are declined

Declines fall into two main categories: user actions and system-enforced blocks.

-

User-initiated declines – Recipient chooses not to accept the payment.

-

System security blocks – Cash App flags payments for fraud, unusual activity, or verification issues.

-

Insufficient funds – Sender’s source account lacks enough balance.

-

Account restrictions – Temporary holds or limits on either account.

-

Technical issues – Maintenance, downtime, or connectivity failures.

Identifying the cause of a decline helps in resolving the issue and avoiding future payment problems.

6. How declining impacts sender and recipient

When a payment is declined on Cash App, both the sender and the recipient experience specific outcomes. While the process is generally straightforward and penalty-free, there are certain conditions where repeated declines may trigger additional account scrutiny.

| Sender | Recipient |

|---|---|

| No fees or penalties | No fees or penalties |

| Funds returned in full | No funds received |

| No impact on limits | No impact on limits |

| Can dispute suspicious declines | May need ID verification |

| Possible fraud checks after repeated declines | Possible review after repeated declines |

Declining is generally penalty-free, but repeated declines under suspicious circumstances may trigger account reviews.

7. Security, fraud, and why declines protect users

Declining or blocking payments prevents scams and unauthorized transactions.

Example:

If a payment arrives from an unknown sender with an unusually high amount, Cash App’s system might block it automatically, preventing possible fraud.

Pro Tip:

Always decline and report any suspicious transaction immediately to secure your account.Declines are part of Cash App’s security framework, safeguarding both sender and recipient.

8. What happens if a payment is unclaimed or pending?

If the recipient neither accepts nor declines, the payment remains pending.

Timeline:

-

Day 0 – Payment sent, status “Pending.”

-

Day 14 – Payment expires and funds auto-return to sender.

Unclaimed payments require no action from the sender to be refunded, but tracking them helps avoid confusion.

9. Troubleshooting declines, refunds, and next steps

Steps to verify and resolve:

-

Check transaction history for “Declined” or “Refunded.”

-

Confirm balance in Cash App or linked bank account.

-

Wait the proper refund timeline for your funding source.

-

Contact Cash App support if delays persist.

-

Use dispute tools for suspected errors.

Common issues & solutions:

| Issue | Solution |

|---|---|

| Refund not received | Check funding source; wait appropriate time |

| Unclear status | Verify in transaction history |

| Suspicious decline | Contact support; report fraud |

Prompt action ensures quick resolution of payment issues.

Like this articles? Check out our:

- Understanding what Is a hold harmless agreement clearly [2025]

- Learn What are the Branches of quantitative management easily [2025]

- Sample letter of termination of appointment: Free template [2025]

10. Frequently asked questions

Q1: Do I pay a fee for declining a payment?

No. Declining a payment does not incur fees.

Q2: How do I know if a payment was declined?

You’ll receive a notification and see “Declined” in transaction history.

Q3: Will declining payments lock my account?

Not usually. However, repeated declines flagged for fraud may trigger reviews.

Q4: Can I overturn a decline or challenge a flagged transaction?

Yes, contact Cash App support to discuss and possibly reverse declines.

Q5: Why does my payment keep getting declined?

Possible causes include security blocks, insufficient funds, or account restrictions.

Q6: How does declining differ from canceling?

Declining is recipient rejection; canceling is sender’s action before acceptance.

11. Conclusion

In summary, understanding what happens when you decline a Cash App payment is vital for managing transactions confidently.

Key takeaways:

-

Declines stop the transfer and trigger a refund without penalties.

-

Refund speed depends on the payment source.

-

Differentiating decline, cancel, and expire prevents confusion.

-

Declines can serve as important fraud prevention.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.

H2TFunding.com is a trusted platform that provides strategies, in-depth reviews, and the latest updates on proprietary trading. We provide useful customer analysis, helping traders from beginners to experts make informed choices when looking for the right trading partners. Explore professional articles and reviews at H2TFunding to improve your investment efficiency.

Thanks for sharing accurate health information.