What is a professional employee organization? A professional employer organization (PEO) is a service provider that enters into a co-employment relationship with a business, managing key HR functions such as payroll, benefits, and legal compliance.

As companies face rising labor regulations and workforce complexity in 2025, PEOs offer a way to offload administrative burdens and focus on growth.

With the PEO market projected to exceed $100 billion by 2026, more businesses are exploring this solution. Whether you’re a startup or a growing company, understanding what a PEO is and how it works can guide you in making smarter HR decisions.

1. What is a professional employee organization (PEO) do?

A PEO works by entering a co-employment agreement with your business.

This means your employees are legally employed by both your company and the PEO but with distinct responsibilities.

Here’s how responsibilities are typically split:

-

PEO responsibilities:

-

Payroll processing

-

Tax reporting and W-2 filings

-

Employee benefits administration

-

Workers’ compensation and risk management

-

Labor law compliance

-

-

Client company responsibilities:

-

Day-to-day supervision

-

Hiring and firing decisions

-

Culture, leadership, and core operations

-

Your business retains control over its workforce, branding, and strategy. The PEO acts as a behind-the-scenes HR partner, assuming administrative and legal responsibilities.

Pro tip: Choose a certified PEO (CPEO) for IRS-recognized assurance of tax and compliance standards.

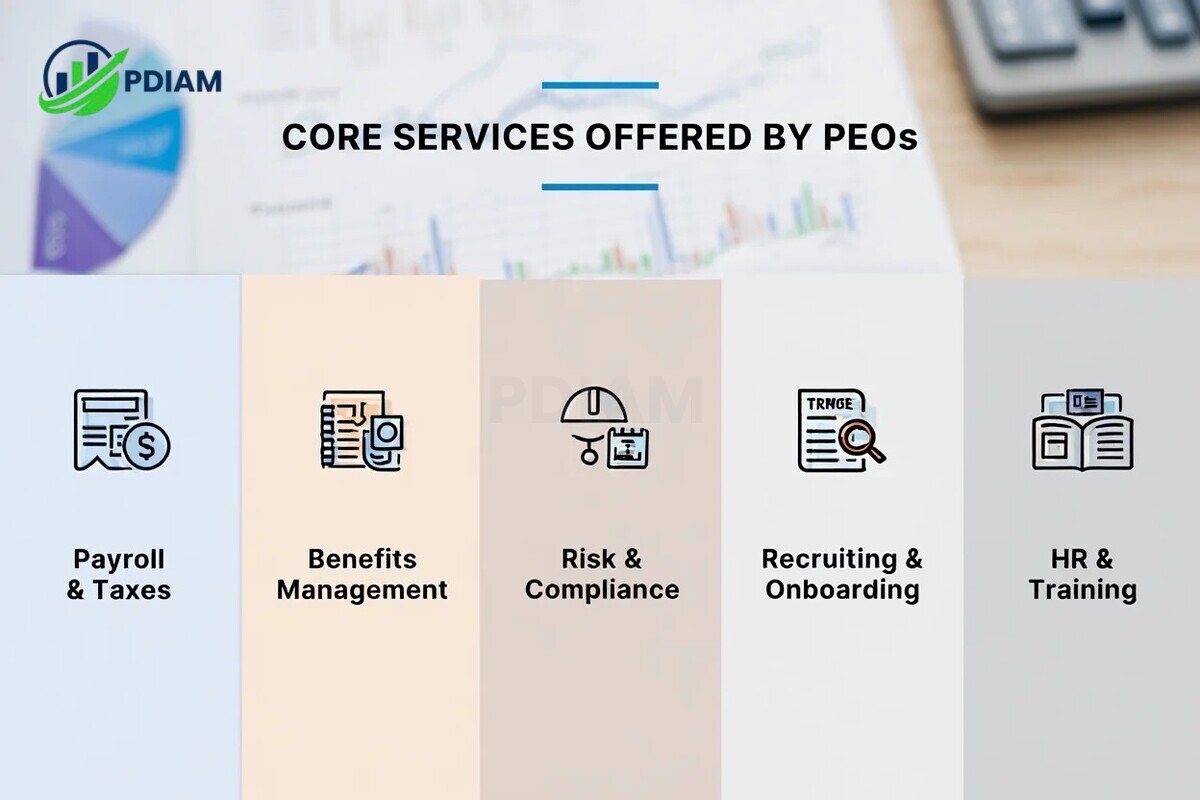

2. Core services offered by professional employer organizations

A professional employer organization typically provides a full suite of HR services.

Below is an overview of the most common:

2.1. Payroll and tax administration

PEOs ensure employees are paid accurately and on time while handling tax filings, W-2s, and compliance with payroll regulations.

2.2. Employee benefits management

They offer access to group health insurance, 401(k) retirement plans, vision, dental, and other perks often at lower rates due to economies of scale.

2.3. Risk management and compliance

PEOs support safety training, workers’ comp claims, and compliance with OSHA and labor laws minimizing legal exposure.

2.4. Recruiting and onboarding

From job postings to I-9 verification, PEOs streamline the hiring process and ensure documentation is in order.

2.5. HR support and employee training

They assist with employee handbooks, conflict resolution, and provide access to digital training and performance management platforms.

Real example: A 40-person software firm in Texas partnered with ADP TotalSource and reduced HR costs by 15% while offering premium benefits to employees.

3. 30+ benefits of using a PEO in 2025

Working with a PEO allows your company to focus on growth while experts handle complex HR, compliance, and operational tasks. The benefits are both wide-ranging and measurable.

Below are more than 30 key advantages categorized into three main areas.

3.1. Operational and cost advantages

Partnering with a PEO creates efficiency in day-to-day HR functions, leading to measurable cost savings and process improvements.

-

Lower HR and payroll overhead through shared technology and support resources

-

Group purchasing power delivers better benefits at reduced premiums

-

Automated payroll processing to prevent errors and delays

-

Scalable HR support that adjusts as your team expands or contracts

-

Predictable budgeting thanks to fixed monthly service costs

-

Improved cash flow through optimized payroll timing

-

Centralized HR systems reduce duplication and increase transparency

-

Reduced administrative workload by outsourcing paperwork and compliance

-

Technology integration with HRIS, ATS, and payroll software

-

Support for multiple locations with a unified system for distributed teams

-

Dedicated account managers for direct, tailored service

-

24/7 customer support to resolve issues any time of day

These operational advantages help small and midsize companies operate like larger enterprises without the overhead.

3.2. Compliance and legal protection

PEOs reduce legal exposure and support your business in meeting fast-changing employment laws.

-

Automatic compliance updates on local, state, and federal laws

-

Accurate tax filings including W-2s, 1099s, and payroll tax submissions

-

Support with audits from tax agencies or labor boards

-

Workers’ compensation insurance management

-

Development of compliant HR policies and handbooks

-

Support during terminations and disciplinary actions

-

EEOC and anti-discrimination policy guidance

-

OSHA reporting and workplace safety programs

-

Data privacy compliance with HIPAA, CCPA, and GDPR

-

Unemployment claim administration to reduce false claims

-

Regulatory document storage for recordkeeping and audit trails

By centralizing legal oversight, businesses can avoid costly lawsuits and reputational damage.

3.3. Talent and employee experience

Beyond compliance and savings, PEOs elevate the employee experience from recruiting to retention.

-

Streamlined hiring with job descriptions, offer letters, and onboarding kits

-

Pre-employment screening including background checks and drug testing

-

Access to high-quality health, dental, vision, and retirement plans

-

Employee self-service tools for checking pay, benefits, and PTO

-

Learning and development platforms to promote upskilling

-

Structured performance review systems

-

Employee satisfaction surveys and engagement tracking

-

Tailored retention strategies to reduce turnover

-

Customizable onboarding flows for new hires

-

Assistance with remote/hybrid team integration

-

Help with promotions and career pathing

-

Confidential HR support for sensitive personnel issues

Pro tip: A better employee experience leads to improved retention and lower hiring costs in the long run.

Together, these benefits make PEOs a powerful partner for long-term workforce stability and growth.

View more:

- How much does the average american make in their lifetime

- Which country markets are highest growing market in the world

- When was the new york stock exchange founded

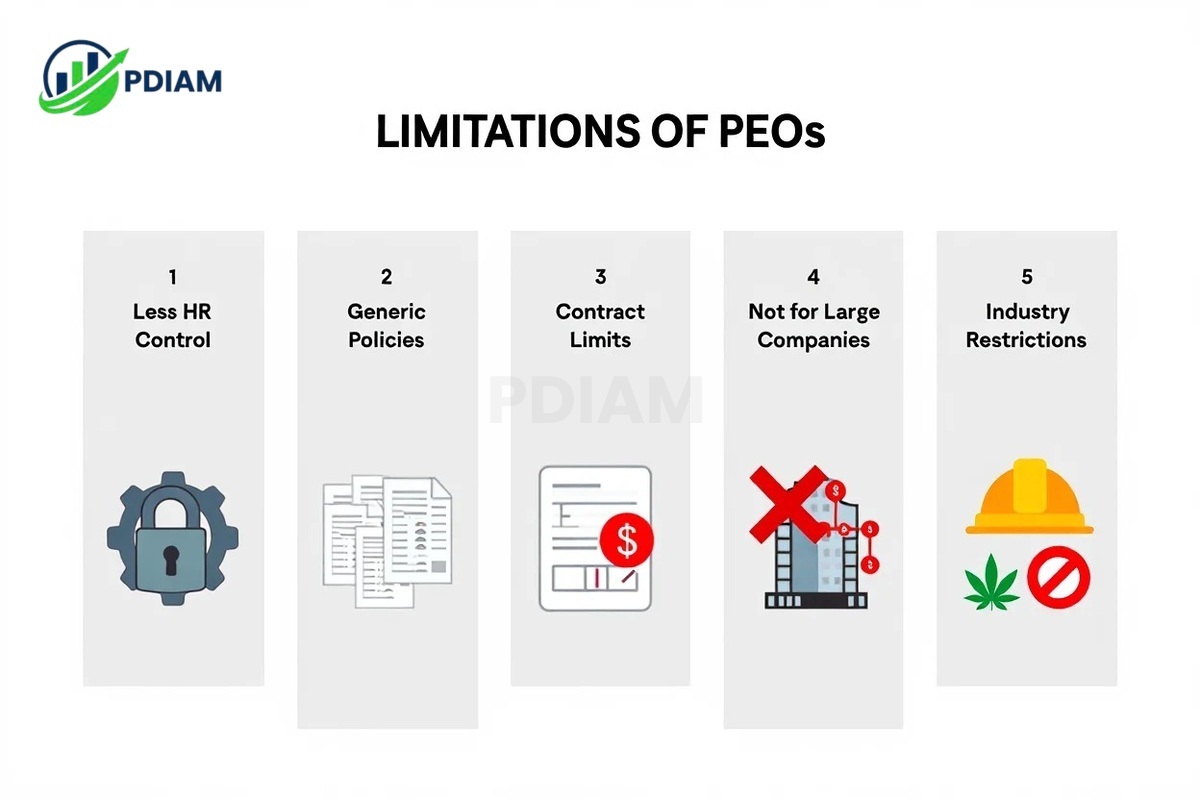

4. Key limitations and drawbacks of PEOs

While PEOs are powerful HR partners, they’re not for every business. Here are some trade-offs to consider:

-

Less control over internal HR: You’ll follow the PEO’s procedures in many HR areas.

-

Generic policies: Customizing policies may be restricted by the provider’s platform.

-

Contract terms: Long-term commitments or exit fees may apply.

-

Not ideal for large corporations: Enterprises with internal HR teams may find PEOs redundant.

-

Industry limitations: Some sectors (e.g., construction, cannabis) may be excluded due to high risk.

Businesses should always review contract terms, pricing models, and service levels carefully before committing.

5. PEOs vs. other HR outsourcing solutions

Choosing the right HR outsourcing approach depends on your company’s size, goals, and legal considerations. Here’s a comparison:

| Model | Co-employment | Handles Benefits | Legal Employer | Best for |

|---|---|---|---|---|

| PEO | Yes | Yes | Shared | SMBs needing full HR support |

| ASO | No | Yes | No | Companies needing admin help |

| Payroll Provider | No | No | No | Firms needing only payroll |

| EOR | Yes | Yes | Yes | Global or remote teams |

Use a PEO if you want a bundled solution with shared liability. Choose an EOR for international hiring. Pick ASO if you want admin support but keep full control.

6. Who should use a PEO?

PEOs are not a one-size-fits-all solution, but they are especially valuable for certain types of businesses. In 2025, companies facing HR complexity, compliance risks, or rapid scaling will find PEOs a strategic partner.

Below are the most common scenarios where partnering with a PEO makes sense.

6.1. Ideal business types and situations

-

Small and mid-sized businesses without internal HR teams

Many SMBs don’t have the resources for full-time HR staff. PEOs fill that gap by offering expert HR services at a fraction of the cost of building an internal department. -

Startups experiencing rapid growth

Fast-growing startups often lack the time and infrastructure to manage hiring, benefits, and compliance. A PEO helps scale operations smoothly while keeping teams focused on innovation. -

Remote-first companies with distributed teams

Businesses with employees in multiple states or countries benefit from a PEO’s ability to manage multi-jurisdiction payroll, tax compliance, and local labor laws. -

Companies in regulated industries

Sectors like healthcare, finance, or education face complex employment laws. PEOs reduce risk by keeping policies up to date and managing compliance with sector-specific regulations. -

Firms expanding across states

Multi-state employers must handle varying employment laws, tax rates, and benefits requirements. PEOs standardize and manage these complexities efficiently.

Choosing the right PEO partner can free businesses from administrative burdens while improving legal compliance and employee satisfaction.

6.2. Use case spotlight

A U.S.-based fintech startup with 60 employees expanded operations across five states. Lacking an HR department, the company partnered with Insperity, a leading PEO, to handle benefits administration, payroll, and legal compliance.

As a result, the startup avoided regulatory penalties, accelerated new hires, and boosted retention all without the overhead of hiring a full in-house HR team.

This real-world example illustrates how a PEO can empower growth while maintaining operational control and reducing HR risks.

Check out below for more contents:

- How to figure out how much a company is worth: The Ultimate 2025 Step-by-Step guide

- What is Code of conduct mean? Avoid these costly mistakes [2025]

- How do I calculate staff turnover like an HR Pro [2025]

7. Regulatory and legal frameworks in 2025

PEOs must comply with various U.S. regulations. Key elements include:

-

IRS certification (CPEO): Recognizes PEOs meeting tax standards.

-

State licensing: Required in many jurisdictions (e.g., Florida, New York).

-

ESAC accreditation: Voluntary quality assurance seal for ethical operations.

-

Liability sharing agreements: Clarify roles for workers’ comp and benefits.

-

Data privacy compliance: PEOs handle employee data under CCPA, GDPR, and more.

Recent updates in 2024–2025 have strengthened disclosure requirements and emphasized clarity in co-employment relationships.

8. Glossary of key PEO terms

To fully understand how professional employer organizations operate, it’s essential to clarify the most common terms used in the PEO industry. Below are the key definitions every business should know:

-

PEO (Professional Employer Organization): A third-party service provider that enters into a co-employment relationship with a business, handling HR, payroll, benefits, and compliance responsibilities on its behalf.

-

CPEO (Certified Professional Employer Organization): A PEO that has been accredited by the Internal Revenue Service (IRS) for meeting strict federal requirements on tax reporting and co-employment practices.

-

Co-employment: A legal employment structure in which both the PEO and the client company share responsibilities for the workforce. The PEO manages back-office HR functions, while the business directs daily work and operations.

-

ASO (Administrative Services Organization): An HR service provider that offers administrative support such as payroll and compliance, without entering into a co-employment relationship with the client.

-

EOR (Employer of Record): A company that becomes the full legal employer of workers on behalf of another business, often used for international or remote hiring where compliance is complex.

-

NAPEO (National Association of Professional Employer Organizations): The leading trade association representing PEOs in the United States, providing education, research, and advocacy for the industry.

-

ESAC (Employer Services Assurance Corporation): An independent organization that certifies and accredits PEOs for financial reliability, compliance practices, and ethical standards.

Understanding these terms is crucial when evaluating HR outsourcing models. Each one plays a role in shaping how services are delivered and what legal responsibilities are shared or retained.

9. Frequently asked questions (FAQ)

9.1. Are employees working for the PEO or the business?

A: Legally, both. The PEO is a co-employer for benefits and tax purposes, but the client manages the employee’s work.

9.2. What’s the difference between a PEO and a staffing agency?

A: Staffing agencies provide temp labor. PEOs manage long-term HR services for your existing team.

9.3. Can PEOs work with unionized workforces?

A: Sometimes. Union contracts may restrict co-employment arrangements, so check carefully.

9.4. What happens if I leave a PEO?

A: You regain full employer responsibility. There may be fees or administrative transitions.

9.5. Do PEOs affect company culture?

A: No. PEOs handle compliance but leave internal culture and leadership to you.

9.6. Are PEOs legal in all 50 U.S. states?

A: Yes, but state registration and licensing vary. Ensure your provider is compliant locally.

9.7. Can a PEO help during a legal dispute or lawsuit?

A: Many provide expert HR support, but you may still need external legal counsel for court matters.

10. Conclusion

Understanding what is a professional employee organization empowers businesses to optimize HR strategy, ensure compliance, and scale sustainably in 2025.

Summary:

-

PEOs provide full HR services under a co-employment model

-

Best suited for small to mid-sized businesses, remote teams, or startups

-

Offer benefits like compliance protection, recruiting support, and cost savings

-

Require careful review of contract terms and industry fit

-

Not ideal for large corporations or heavily unionized environments

As workforce challenges grow in complexity, partnering with a trusted PEO can give your company the operational edge it needs.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.

You’re so awesome! I don’t believe I have read a single thing like that before. So great to find someone with some original thoughts on this topic. Really.. thank you for starting this up. This website is something that is needed on the internet, someone with a little originality!

Good post! We will be linking to this particularly great post on our site. Keep up the great writing

I very delighted to find this internet site on bing, just what I was searching for as well saved to fav