What is a Section 125 Cafeteria plan? A Section 125 cafeteria plan is a special type of employee benefit program in the U.S. tax system. It lets employees choose from different benefits offered by their employer, like health insurance or flexible spending accounts, and pay for them with pre-tax dollars.

This means workers can save money by reducing their taxable income, and employers can also lower payroll taxes.

These plans are popular because they offer flexibility and tax savings, making them a win-win for both sides. In fact, over 70% of midsize U.S. employers offer some form of cafeteria plan, according to the Society for Human Resource Management (SHRM).

But what does Section 125 really mean, and how exactly do these plans work? Let’s explore that next.

1. What is a Section 125 cafeteria plan?

A Section 125 cafeteria plan is a special type of employer-sponsored benefit plan in the U.S. tax code. These plans allow employees to choose from a variety of benefits and pay for selected options using pre-tax dollars.

The name cafeteria refers to the flexibility employees have, just like picking items from a menu, workers can assemble a benefits package that best suits their needs.

These plans are attractive because they reduce employees’ taxable income, increase take-home pay, and offer employers payroll tax savings. However, they must comply with IRS regulations to maintain their favorable tax status.

To be valid under the law, a Section 125 plan must offer at least one benefit that is provided pre-tax and at least one that is taxable if chosen.

1.1. Key features include

Section 125 cafeteria plans come with specific legal and operational characteristics that define how they work and why they are beneficial.

-

Pre-tax payments allow employees to lower their taxable income. This means they owe less in federal income and FICA taxes.

-

Employers also save by paying lower payroll taxes on reduced employee wages.

-

The plan cannot be used to offer cash in lieu of benefits or cover nonqualified perks like gym memberships or certain fringe benefits.

-

The IRS enforces strict documentation, testing, and compliance requirements to preserve the plan’s tax-exempt status.

Here’s a simplified example of benefits and whether they qualify for pre-tax treatment:

| Benefit | Pre-Tax? |

|---|---|

| Health Insurance Premiums | Yes |

| Dependent Care Assistance | Yes |

| Group Term Life Insurance (> $50K) | No |

| Cash Bonuses | No |

Employers use this framework to construct a customized menu of benefits, allowing for a tailored approach to compensation. Understanding these core features lays the foundation for exploring how these plans operate in practice through payroll deductions and annual elections.

2. How does a Section 125 cafeteria plan work?

A Section 125 cafeteria plan allows employees to choose benefits during specific enrollment periods and pay for them using pre-tax deductions. This process lowers their taxable income and results in meaningful tax savings for both employees and employers.

Understanding how the plan functions step by step helps ensure successful participation and compliance.

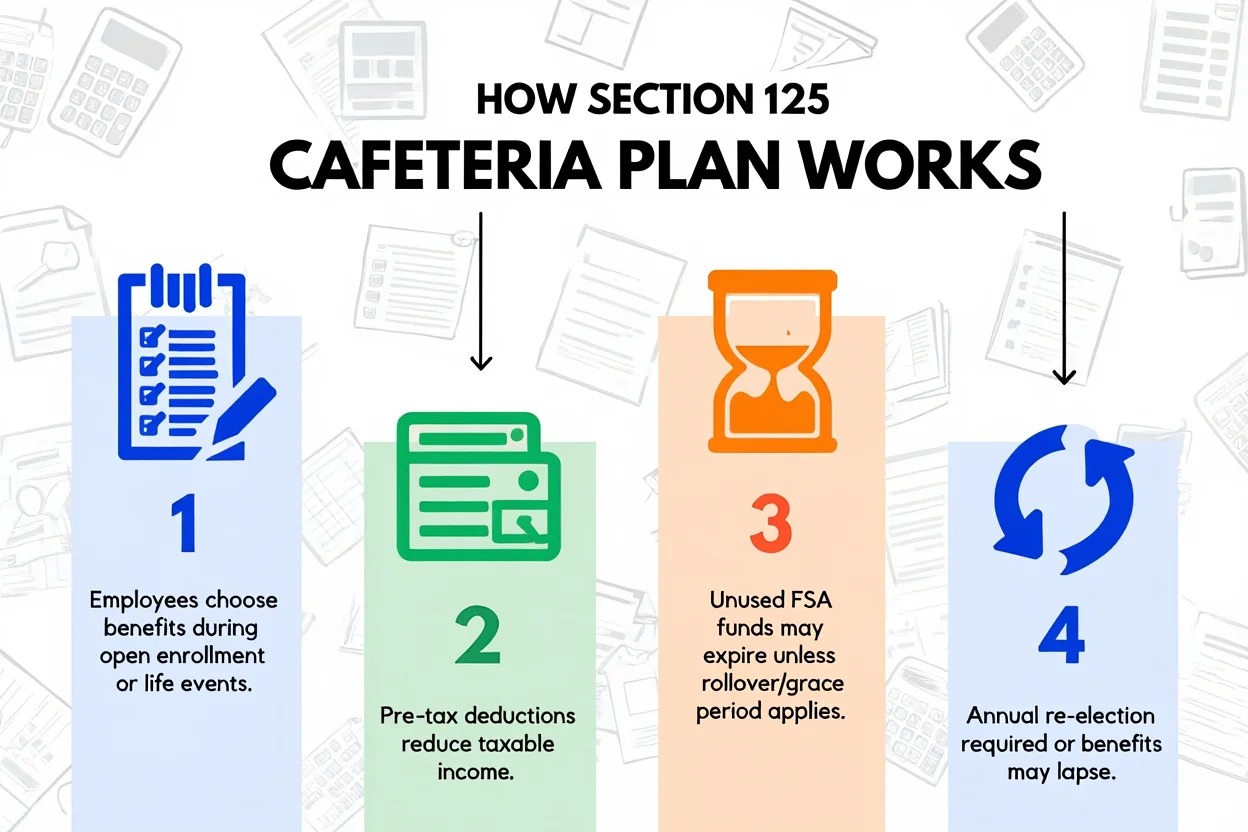

2.1. Step-by-step process

The following outlines how Section 125 plans typically operate within an organization.

-

Enrollment: Employees select their preferred benefits and contribution amounts during open enrollment or after qualifying life events such as marriage, birth, or adoption. This selection sets the foundation for the year’s benefit deductions.

-

Payroll deductions: Once enrolled, the selected benefit contributions are deducted from employees’ paychecks before taxes are calculated. This reduces taxable wages and increases net take-home pay.

-

Use-it-or-lose-it rules: Certain benefits like Flexible Spending Accounts (FSAs) come with strict usage timelines. If funds are not used by the end of the plan year, they may be forfeited unless the plan allows a limited rollover or grace period.

-

Reenrollment: Employees must reelect benefits annually or when a life event allows a mid-year change. If no changes are made, they may lose access to certain benefits or default to prior elections.

For example, consider an employee earning $50,000 who elects to contribute $2,000 to a health FSA. This reduces their taxable income to $48,000.

| Description | With Section 125 | Without Section 125 |

|---|---|---|

| Gross Pay | $50,000 | $50,000 |

| FSA Contribution | -$2,000 (pre-tax) | $0 |

| Taxable Income | $48,000 | $50,000 |

| Estimated Taxes (25%) | $12,000 | $12,500 |

The example above highlights a clear tax savings of $500 for the employee. Employers also benefit by paying less in payroll taxes due to the reduced taxable income.

Understanding these mechanics is essential for both HR administrators and employees to get the full financial benefit of participating in a Section 125 cafeteria plan.

3. Types of Section 125 cafeteria plans

Section 125 plans aren’t one-size-fits-all. The IRS allows for multiple structures to fit various employer needs, based on company size, benefit goals, and administrative capacity. Choosing the right type of plan is key to achieving both compliance and employee satisfaction.

Each type of cafeteria plan offers a different level of flexibility and complexity.

Below are the four most common types of Section 125 plans, with a breakdown of how they work and who they’re best suited for.

-

Premium Only Plans (POPs):

These plans are the simplest form of cafeteria plans. They allow employees to pay for health insurance premiums using pre-tax dollars. Employers like them because they’re easy to set up and maintain, with minimal documentation. POPs are suitable for companies of any size. -

Flexible Spending Arrangements (FSAs):

FSAs let employees set aside funds to pay for medical, dental, vision, or dependent care expenses. These are use it or lose it accounts, employees must spend the money within the plan year or forfeit the balance. FSAs offer excellent tax savings but require careful planning. -

Full (Full-Flex) Cafeteria Plans:

This is the most comprehensive option. It includes POPs, FSAs, and additional benefits like group term life insurance, accident coverage, or wellness programs. Though flexible, these plans are complex to administer and typically used by large organizations. -

Simple Cafeteria Plans:

Designed for small businesses with fewer than 100 employees, these plans reduce administrative requirements and bypass certain nondiscrimination tests. They provide a streamlined path for small employers to offer pre-tax benefits without excessive paperwork.

These plan types give employers a range of options depending on their size, resources, and desired benefit offerings.

Here’s a quick comparison of key features across all four plan types:

| Plan Type | Features | Pros | Cons | Ideal Employer Size |

|---|---|---|---|---|

| Premium Only | Only health premiums | Simple, cost-effective | Limited choices | All sizes |

| FSA | Health/dependent care expenses | Tax savings, flexible | Use-it-or-lose-it rule | Medium to large |

| Full-Flex Plan | Multiple benefit types | Variety, employee choice | More complex administration | Large |

| Simple Plan | Basic benefits, fewer rules | Easy setup, small biz-friendly | Fewer benefit options | Small |

Pro Tip: If you’re a small business looking for minimal overhead, a Simple Cafeteria Plan offers flexibility and avoids complex compliance hurdles, making it a smart starting point.

Choosing the right plan structure is essential for maximizing participation, minimizing compliance risk, and aligning benefit offerings with organizational goals.

Think this is an interesting topic? Check out our related post:

- Critical guide: Is Boss firing someone for violating legal? [2025]

- Best HR Software for Small Businesses in 2025

- Types of risk in insurance industry: Expert guide 2025

4. What benefits and expenses can Section 125 plans cover?

While Section 125 cafeteria plans offer a wide array of benefit options, not every type of expense qualifies for tax-advantaged treatment. Understanding which benefits are eligible, and which are not, is essential to stay compliant and maximize savings.

These benefits are divided into two main groups: qualified (allowed under IRS rules) and non-qualified (excluded from Section 125 tax treatment).

4.1. Qualified benefits often include:

The IRS allows a number of specific benefits to be included in Section 125 plans. These benefits provide significant tax savings and help employers build attractive compensation packages.

-

Health, dental, and vision insurance premiums: Employees can pay premiums with pre-tax dollars, lowering their taxable income.

-

Flexible Spending Accounts (FSAs): Both health care and dependent care FSAs qualify, offering upfront tax savings for out-of-pocket expenses.

-

Health Savings Accounts (HSAs): While not always included directly, certain limited-purpose FSAs can coordinate with HSAs under IRS rules.

-

Group term life insurance (up to $50,000): Premiums for coverage below this threshold are eligible for pre-tax treatment.

Employers commonly include these benefits to give workers more control over how their compensation is structured.

4.2. Benefits that cannot be covered include:

Certain items are explicitly disqualified from Section 125 treatment, even if they seem like logical additions. Offering these through a cafeteria plan could trigger IRS penalties.

-

Cash or cash equivalents: Direct cash payments, gift cards, or other monetary incentives are never eligible under Section 125.

-

Voluntary benefit premiums not meeting IRS rules: Some accident or supplemental insurance plans may not qualify, especially if they lack clear tax-exempt status.

-

Benefits exceeding legal limits: For example, life insurance over $50,000 becomes partially taxable.

-

Other excluded categories: This includes gym memberships, non-medical commuter benefits, or anything outside IRS-defined guidelines.

Here’s a side-by-side comparison of what’s allowed vs. disallowed:

| Qualified Benefits | Non-Qualified Benefits |

|---|---|

| Health insurance premiums | Cash payouts |

| Dental and vision plans | Life insurance over $50,000 |

| Dependent care FSAs | Gym memberships |

| Health FSAs | Commuter benefits (separate regs) |

Pro Tip: Always verify with a tax advisor or third-party administrator before adding new benefits to your Section 125 plan. Even well-intentioned offerings can disqualify the plan if they don’t meet IRS guidelines.

For 2025, the IRS sets contribution limits such as $3,050 for health FSAs and $5,000 for dependent care FSAs. Most plans still follow use it or lose it rules, although some may allow limited rollovers or grace periods.

Employers should communicate these limits clearly during enrollment and help employees plan spending to avoid forfeitures.

5. Who can participate in a Section 125 cafeteria plan?

Understanding who is eligible for a Section 125 plan is essential for proper plan administration and employee communication. While most full-time workers qualify, employers must also consider timing, employment status, and dependent eligibility.

To ensure compliance and fairness, employers typically follow a set of guidelines when determining eligibility.

-

Employment status: Full-time employees are usually eligible to enroll in Section 125 plans. However, part-time or temporary employees may be excluded depending on company policy and plan structure.

-

Waiting periods: Many employers impose a waiting period, commonly up to 90 days after hire, before employees can begin participating. This helps employers manage benefit timelines and budget forecasts.

-

Dependents and spouses: While spouses and dependents can receive coverage under the employee’s elected benefits, they cannot independently make elections or participate directly in the plan.

-

Former employees: Individuals who leave the company mid-year generally lose their benefits, but COBRA coverage may allow them to continue receiving certain eligible benefits temporarily.

Consider this example timeline:

Employee hired → Completes 90-day wait → Eligible for plan → Elects benefits during enrollment → Coverage begins.

In case of employment termination, benefits typically end at the time of separation. However, through COBRA continuation, some benefits may be extended temporarily if the former employee qualifies.

Understanding these eligibility rules helps employers maintain legal compliance while offering benefits that employees can plan around with confidence.

6. Tax advantages and compliance for Section 125 plans

One of the most compelling reasons employers adopt a Section 125 cafeteria plan is the potential for tax savings.

Both employers and employees benefit financially, but only when the plan is set up and maintained in full compliance with IRS regulations.

6.1. Tax advantages

Section 125 plans provide tax relief that supports both sides of the employment relationship.

-

Employees: Contributions made to benefits like FSAs are deducted pre-tax, which reduces their taxable income. This lowers federal income taxes and FICA obligations, allowing more take-home pay.

-

Employers: By reducing employees’ taxable income, companies also lower their payroll tax burden. Additionally, offering pre-tax benefits helps attract and retain top talent.

Example: An employee earning $50,000 contributes $2,000 pre-tax to an FSA.

-

Their taxable income drops to $48,000.

-

Assuming a 25% tax rate, the employee saves $500.

-

The employer saves roughly $153 in payroll taxes.

These savings add up quickly across an entire workforce, improving the overall efficiency of the compensation package.

6.2. Key compliance requirements

To preserve the tax-advantaged status of a Section 125 plan, employers must follow strict IRS requirements.

-

Nondiscrimination testing: Plans must pass annual tests to ensure they do not disproportionately benefit highly compensated or key employees. This maintains fairness and tax qualification.

-

Written plan documents: A formal written plan must outline all policies, benefits, and eligibility rules. Without this, the plan fails IRS scrutiny.

-

Employee notices: Employers must provide clear information about benefit choices, deadlines, and rights. Transparency ensures employees can make informed decisions.

-

Accurate IRS reporting: Employers are responsible for filing necessary documentation each year. Errors or omissions can lead to penalties or even disqualification of the plan.

Failure to comply with these standards can result in loss of tax benefits and retroactive taxation. Fortunately, the IRS publishes an annual compliance checklist, such as the 2025 version, to help employers stay on track.

By maintaining clear records and updating plan documents regularly, companies can confidently reap the rewards of Section 125 participation without falling into noncompliance.

7. Is a Section 125 cafeteria plan right for your business?

Before adopting a Section 125 cafeteria plan, employers need to consider their company size, employee preferences, and administrative capacity. While these plans offer clear tax benefits, they also come with compliance responsibilities that may not suit every organization.

Understanding the potential advantages and challenges helps businesses decide whether a Section 125 plan aligns with their goals and resources.

| Pros | Cons |

|---|---|

| Tax savings for employee and employer | Administrative complexity |

| Improves employee satisfaction | Use it or lose it forfeiture rules |

| Flexible benefit choices | Requirements for nondiscrimination testing |

| Competitive recruiting advantage | Potential penalties for non-compliance |

While the tax advantages and flexible benefits are compelling, employers must be prepared to handle annual testing, communication, and reporting to maintain compliance.

In practical terms, if your workforce values health benefits and you want payroll tax relief, a cafeteria plan is worth considering.

8. How to set up a Section 125 cafeteria plan for your company

Setting up a Section 125 cafeteria plan may seem complex, but the process is straightforward when broken down into specific steps. Employers need to follow IRS rules closely and provide clear communication to their employees from the start.

Before launching your plan, it’s important to prepare all foundational elements required by the IRS and ensure that administrative systems are in place.

| Requirement | Description |

|---|---|

| Plan Document | Legal framework outlining benefits and rules |

| Enrollment Notices | Employee communication on options and deadlines |

| Payroll Setup | Systems adjusted for pre-tax deductions |

| Compliance Review | Annual testing and reporting |

These steps help employers avoid costly compliance mistakes while making the plan accessible and effective for employees.

Resources such as IRS templates and the Pdiam Knowledge Base provide helpful tools to guide businesses through the process smoothly.

View more:

- Which country markets are highest growing market in the world

- 2025’s Ten top Billionaires in the World ranked

- Saving money on a low income

9. Best practices for administering Section 125 plans

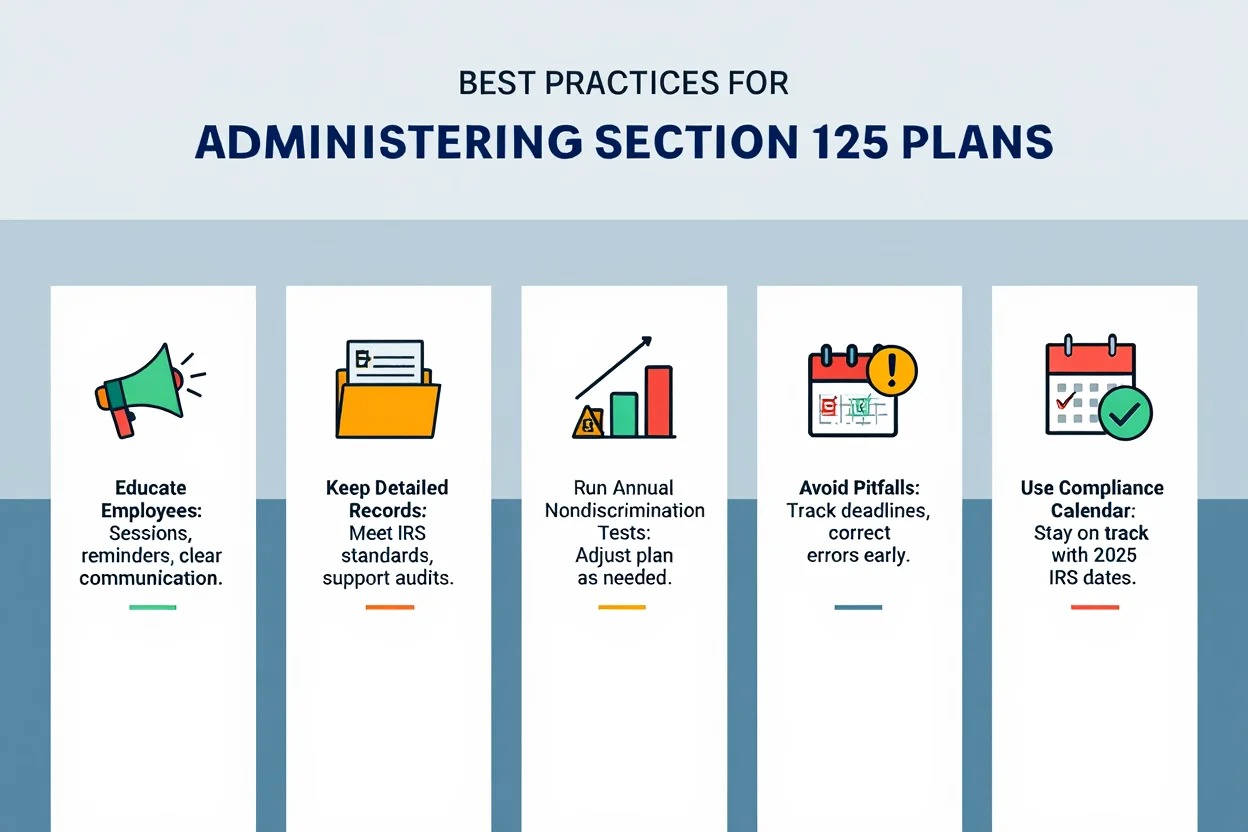

Effective administration of Section 125 cafeteria plans is crucial to ensure compliance, employee satisfaction, and long-term program sustainability. Employers who follow structured processes and clear communication often see significantly better results.

To manage a Section 125 plan successfully, employers need to follow several essential practices. These actions help maintain IRS compliance and ensure that employees take full advantage of available benefits.

-

Educate employees regularly about plan benefits and deadlines.

Hosting onboarding sessions and sending reminders before open enrollment helps ensure employees fully understand their benefit options, reducing confusion and improving participation. -

Keep detailed records that meet IRS documentation standards.

Accurate and well-organized documentation is essential for audits and annual reporting. This includes plan documents, enrollment forms, payroll records, and communication logs. -

Conduct yearly nondiscrimination testing and adjust plans if needed.

IRS requires testing to confirm benefits are not disproportionately favoring highly compensated employees. Adjusting elections or eligibility may be necessary to stay compliant. -

Watch for common pitfalls like missed enrollment deadlines or incomplete reporting.

A missed form or incorrect deduction can jeopardize the plan’s tax-advantaged status. Assign responsibility clearly and audit regularly. -

Use a compliance calendar, 2025 IRS dates are available to stay on track.

Keeping a shared calendar with all key compliance milestones helps HR and finance teams avoid costly oversights throughout the year.

Pro Tip: Assign a dedicated plan coordinator or benefits consultant to oversee your Section 125 plan. Businesses that designate ownership often experience fewer compliance issues and smoother communication with employees.

By following these best practices, employers can protect the tax advantages of their Section 125 plans while maximizing employee engagement and operational efficiency.

10. Section 125 cafeteria plan FAQs & common myths

Q1: Does participation affect Social Security credits?

A: No. Contributions reduce taxable wages but not earnings counted toward Social Security.

Q2: Can employees change elections mid-year?

A: Generally no, except for qualifying life events like marriage, birth, or job loss.

Q3: What happens if you leave your job?

A: Benefits end unless COBRA continuation applies.

Q4: Can you use an FSA with an HSA?

A: You can use limited-purpose FSAs with HSAs, but full FSAs might disqualify you from HSA eligibility.

Q5: Do small businesses qualify?

A: Yes, with options like Simple Cafeteria Plans that fit smaller workplaces.

Q6: Myth – Only large companies can offer these plans.

A: False. Small businesses can adopt tailored Section 125 plans.

Q7: Myth – You lose all unused benefits at year-end.

A: Some plans allow small rollovers or grace periods.

11. Conclusion: Is a Section 125 cafeteria plan worth it?

Understanding what is A Section 125 cafeteria plan can offer great benefits for both employees and employers, from tax savings to flexible benefit choices.

Key takeaways:

-

Reduce taxable income through pre-tax contributions.

-

Lower payroll taxes for employers.

-

Wide range of eligible benefits under IRS rules.

-

Simple and complex plan options available for all business sizes.

Ultimately, Section 125 cafeteria plans serve as a powerful tool for both financial efficiency and employee satisfaction. Whether you’re a small business or a large enterprise, implementing a compliant and well-communicated plan can bring long-term value.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.