What is a statement of stockholders equity? The statement of stockholders’ equity is a financial report that shows how a company’s ownership value changes over time. It is one of the four primary financial statements, along with the balance sheet, income statement, and cash flow statement.

Investors, analysts, and business owners use this statement to understand how factors like profits, share issuances, and dividends impact a company’s overall equity.

For instance, an investor might refer to this statement to see whether a company’s shareholder value increased after a successful fiscal year. By providing a detailed account of ownership changes, the report enhances understanding of a company’s financial health and long-term stability.

1. What is a statement of stockholders equity?

A statement of stockholders’ equity is a financial statement that summarizes changes in a company’s equity over a defined period, typically a fiscal quarter or year. Stockholders’ equity represents the residual interest in the company’s assets after deducting liabilities.

Unlike the balance sheet, this statement provides detailed information such as new share issuance, dividend payments, and retained earnings adjustments. It serves as a narrative behind the equity figure shown on the balance sheet.

For example, a company may begin the year with $1 million in equity, issue $200,000 in new shares, pay $50,000 in dividends, and end the year with $1.3 million in equity.

Key facts about the statement of stockholders equity:

-

Tracks equity movements over time, not just a point-in-time snapshot.

-

Breaks equity into components like common stock, retained earnings, and treasury stock.

-

Shows how profits, losses, and capital changes affect shareholder value.

This structure allows deeper insight into company behavior and ownership evolution.

2. Why is the statement of stockholders’ equity important?

This financial report is valuable to multiple stakeholders because it highlights:

-

Ownership changes: It shows exactly how shareholder value fluctuates over time.

-

Key financial activities: Events like issuing new shares or paying dividends are clearly documented.

-

Investment performance: Investors can evaluate whether equity growth results from profits or stock sales.

-

Lender risk analysis: Strong equity trends signal lower financial risk.

For instance, if a firm shows growing equity primarily through retained earnings, it signals internal value creation. But if growth stems mostly from issuing shares, it may reflect dilution or capital dependency.

View more:

- Essential Guide: Professional employer organization Pros and Cons [2025]

- Powerful insight: Difference between accounts payable and accounts receivable [2025]

- Definitive guide: Is net income and net profit the same? [2025]

3. Key components of a statement of stockholders’ equity

The statement of stockholders’ equity breaks down total equity into several core components. Each plays a unique role in reflecting how ownership value is built, maintained, or reduced over time.

The table below provides an overview of these components:

| Component | Definition | Role in Equity | Typical Changes |

|---|---|---|---|

| Common Stock | Shares owned by general shareholders | Represents initial ownership investment | Increases with share issuance |

| Preferred Stock | Shares with fixed dividends and priority rights | Equity with higher claim than common stock | Rises when issued to investors |

| Additional Paid-in Capital | Funds paid above the stock’s par value | Captures excess capital from stock sales | Grows with premium-priced shares |

| Retained Earnings | Reinvested cumulative profits | Shows earnings kept within the company | Increases with net income |

| Treasury Stock | Shares repurchased by the company | Reduces total equity | Grows when buybacks occur |

| AOCI | Unrealized gains/losses (e.g., currency, pensions) | Adjusts equity beyond net income | Fluctuates with external market shifts |

These components work together to form a comprehensive view of how a company’s equity evolves over a reporting period.

3.1. Common stock

Common stock reflects the basic ownership interest in a corporation. It’s typically issued at a par or stated value and forms the foundation of the company’s equity.

-

Increases when new shares are issued to raise capital.

-

Remains stable unless additional stock is issued or retired.

-

Unaffected by profits or losses, as it reflects ownership rather than performance.

Common stock is the most widely held type of equity among shareholders.

3.2. Preferred stock

Preferred stock provides holders with dividend preferences and asset priority in liquidation, though often without voting rights.

-

Appeals to investors seeking steady, reliable returns.

-

Adds to equity when new preferred shares are issued.

-

Changes less frequently than common stock due to limited market trading.

Preferred stock often resembles a fixed-income investment in practice.

3.3. Additional paid-in capital (APIC)

APIC represents amounts paid by investors above a stock’s par value during issuance.

-

Increases when stock is sold at a premium, above face value.

-

Does not grow through net income or retained earnings.

-

Enhances capital structure without impacting ownership control.

It reflects investor willingness to pay more for future company value.

3.4. Retained earnings

Retained earnings consist of cumulative net profits that are reinvested in the business rather than distributed as dividends.

-

Rise when net income is earned and retained.

-

Decline when dividends are paid to shareholders.

-

Signal long-term strategy, focusing on growth and reinvestment.

Retained earnings are a key indicator of profitability and company maturity.

3.5. Treasury stock

Treasury stock includes shares previously issued but later repurchased by the company.

-

Reduces total equity as the repurchased shares are no longer outstanding.

-

Used for employee compensation, mergers, or price support.

-

Indicates confidence in undervaluation or strategic restructuring.

Large treasury stock positions may also suggest management’s intent to consolidate ownership.

3.6. Accumulated other comprehensive income (AOCI)

AOCI captures gains or losses excluded from net income but still impact equity, such as:

-

Foreign currency translations

-

Pension plan adjustments

-

Unrealized gains/losses on investments

-

Provides a fuller picture of the company’s financial position.

-

Fluctuates due to external economic or policy shifts.

-

Separate from operating results, yet vital for complete analysis.

AOCI helps stakeholders assess risks and exposures not visible on the income statement.

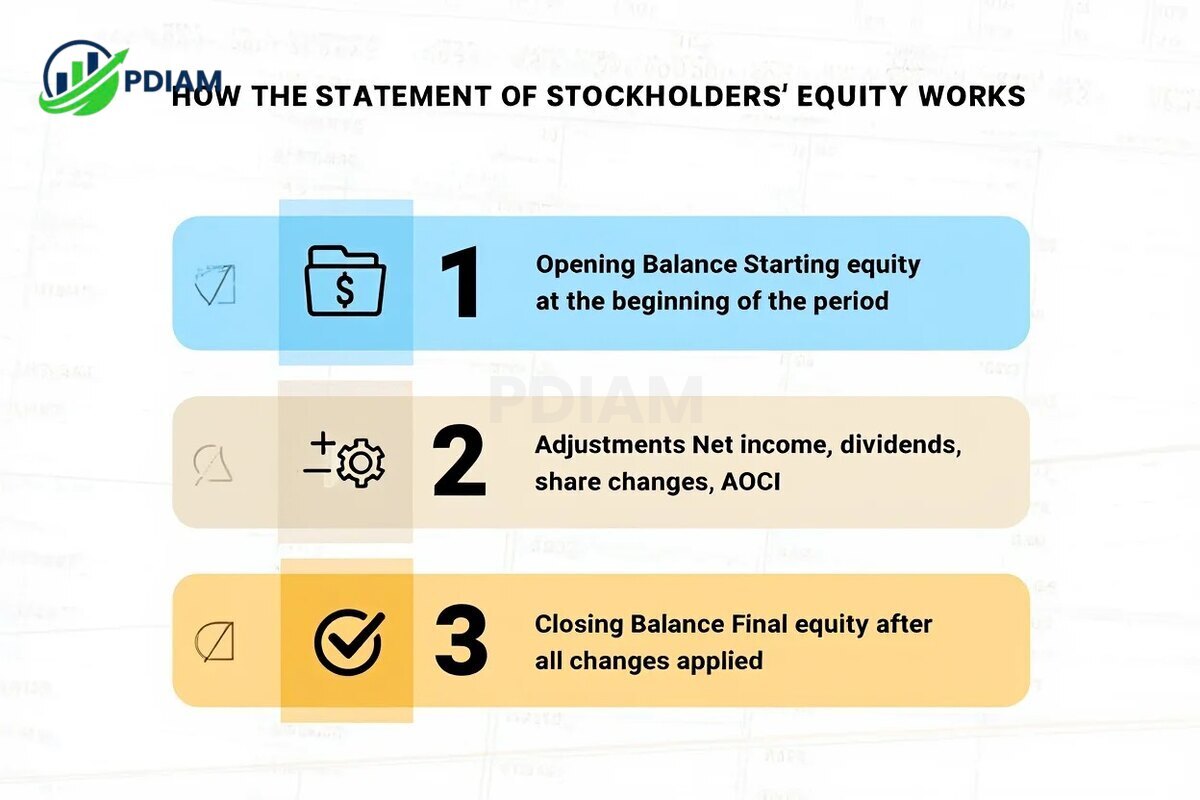

4. How the statement of stockholders’ equity works: Step-by-step walkthrough

This is how the process typically flows:

-

Opening balance: Equity at the start of the reporting period.

-

Adjustments: Add or subtract net income, share issuance, dividend payments, treasury stock, and AOCI.

-

Closing balance: Final equity value after all adjustments.

Real example:

Company X starts with $1,000,000 in equity. During the year:

-

Issues $100,000 in stock

-

Earns $200,000 net income

-

Pays $50,000 in dividends

-

Repurchases $20,000 in shares

Ending equity = $1,000,000 + $100,000 + $200,000 – $50,000 – $20,000 = $1,230,000

5. How to read and interpret a statement of stockholders’ equity

Follow these steps for meaningful analysis:

-

Check beginning and ending balances: Are shareholders gaining or losing value?

-

Identify major changes: Were profits retained, or did the company rely on financing?

-

Watch retained earnings: Growth here indicates strong internal reinvestment.

-

Spot red flags: Excessive treasury stock may suggest manipulation or underperformance.

-

Ask key questions: Is equity growing from business success or dilution?

Pro Tip: Always compare retained earnings across multiple quarters to uncover profitability trends and dividend sustainability.

6. Statement of stockholders’ equity vs. balance sheet

The balance sheet shows a company’s position at a specific point in time, while the stockholders’ equity statement explains how equity got there.

| Feature | Stockholders’ Equity Statement | Balance Sheet |

|---|---|---|

| Time Frame | Tracks changes over a period | Snapshot at a single point in time |

| Focus | Equity movement: income, shares, etc. | Current financial position summary |

| Primary Use | Understand equity evolution | View overall company condition |

Use both together for complete financial insights.

View more:

- How to run a background check on yourself for free in 2025

- What is the Dodd Frank Act? Discover Its role in Financial Stability

- What does rate of inflation mean? A complete guide in 2025

7. Practical uses of the statement of stockholders’ equity

This statement supports informed decisions for various audiences:

-

Investors: Evaluate performance and dividend strategies.

-

Owners: See how retained earnings support expansion.

-

Lenders: Assess stability before approving loans.

For example, an investor noticing consistent equity growth driven by retained earnings might view the company as a sustainable long-term investment.

8. FAQs – Frequently Asked Questions

Q1. What is included in a statement of stockholders’ equity?

A: It includes common stock, preferred stock, paid-in capital, retained earnings, treasury stock, and AOCI.

Q2. Does every company issue this statement?

A: Public companies must include it in financial reporting; private firms may use simpler versions.

Q3. How does it differ from the balance sheet?

A: The balance sheet shows a snapshot; this statement explains how equity changed over time.

Q4. Can this statement reveal shareholder dilution?

A: Yes, it shows new share issuances which can dilute ownership.

Q5. Is retained earnings the same as profit?

A: Not exactly. Retained earnings are accumulated profits after dividends.

Q6. Does buying back stock always lower equity?

A: Yes, treasury stock reduces total equity because the shares are removed from circulation.

Q7. How often is this statement prepared?

A: Usually quarterly and annually, in sync with financial reports.

9. Conclusion

So, what is a statement of stockholders equity? The statement of stockholders’ equity is essential for tracking how ownership value in a business changes over time. It details equity components like common stock, retained earnings, and treasury stock, helping stakeholders assess financial performance and stability.

Summary:

-

Shows changes in equity over a period.

-

Includes new stock, dividends, buybacks, and earnings.

-

Used by investors, lenders, and business owners for decision-making.

Compared to the balance sheet’s snapshot, this statement explains why equity changed, not just how much. Whether you’re analyzing dividends or tracking investor returns, mastering this report is crucial.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.