What is an audited financial statement? An audited financial statement is a vital tool that shows a company’s financial health, verified by an independent expert. Think of it as a trusted report card that helps investors, owners, and stakeholders understand how well a business is performing.

In 2025, with rising regulatory demands and complex markets, having audited financial statements is more important than ever for building trust and transparency.

Whether you are a business owner planning growth, an investor assessing risk, or a student learning finance, this guide will walk you through everything you need to know about audited financial statements today, using current examples and standards.

The American Institute of CPAs (AICPA) emphasizes that audited statements provide reliable and objective information that supports sound financial decisions.

This article covers definitions, components, the audit process, benefits, and practical advice to help you navigate the evolving financial landscape confidently.

1. What is an audited financial statement?

An audited financial statement is a financial report that has been reviewed by an independent third party , typically a certified public accountant (CPA) or external auditor , to confirm its accuracy and compliance with applicable accounting standards.

Unlike unaudited or compiled statements, audited reports come with an auditor’s opinion, stating whether the financial statements present a true and fair view, free from material misstatement.

The audit process involves detailed checks, including assessing internal controls, verifying transactions, and reviewing accounting policies.

In 2025, these audits may incorporate advanced technologies like data analytics and remote verification methods to enhance thoroughness and efficiency.

Depending on the country or type of organization, requirements can vary; for example, public companies often must provide audited reports under IFRS or GAAP rules, while smaller private firms might have more flexible standards.

A typical audited statement includes an Opinion paragraph, where the auditor states whether the financial information presents a true and fair view. This section is crucial for users seeking assurance about the company’s financial position.

2. Key components of audited financial statements

An audited financial statement includes several essential documents that work together to tell the company’s financial story.

- Balance Sheet: Shows a company’s assets, liabilities, and equity at a specific date, helping assess financial strength.

- Income Statement (Profit & Loss): Details revenues, expenses, and profit over a period, reflecting business performance.

- Cash Flow Statement: Tracks the flow of cash in and out, highlighting liquidity and operational health.

- Statement of Changes in Equity: Shows changes in ownership interest, including retained earnings and dividends.

- Notes to Financial Statements: Provide explanations and additional details about accounting methods and specific items.

- Auditor’s Report: Contains the auditor’s opinion and summary of the audit process.

Below is a simple overview mapping these components to their purposes:

| Document | Purpose |

|---|---|

| Balance Sheet | Snapshot of financial position |

| Income Statement (P&L) | Tracks profitability |

| Cash Flow Statement | Measures liquidity and cash activity |

| Statement of Changes in Equity | Shows ownership changes |

| Notes to Financial Statements | Provides context and explanation |

| Auditor’s Report | Confirms reliability of the above |

Each part helps investors, analysts, lenders, and stakeholders understand different facets of the business.

Understanding these parts helps investors and professionals make better financial decisions by seeing the full picture.

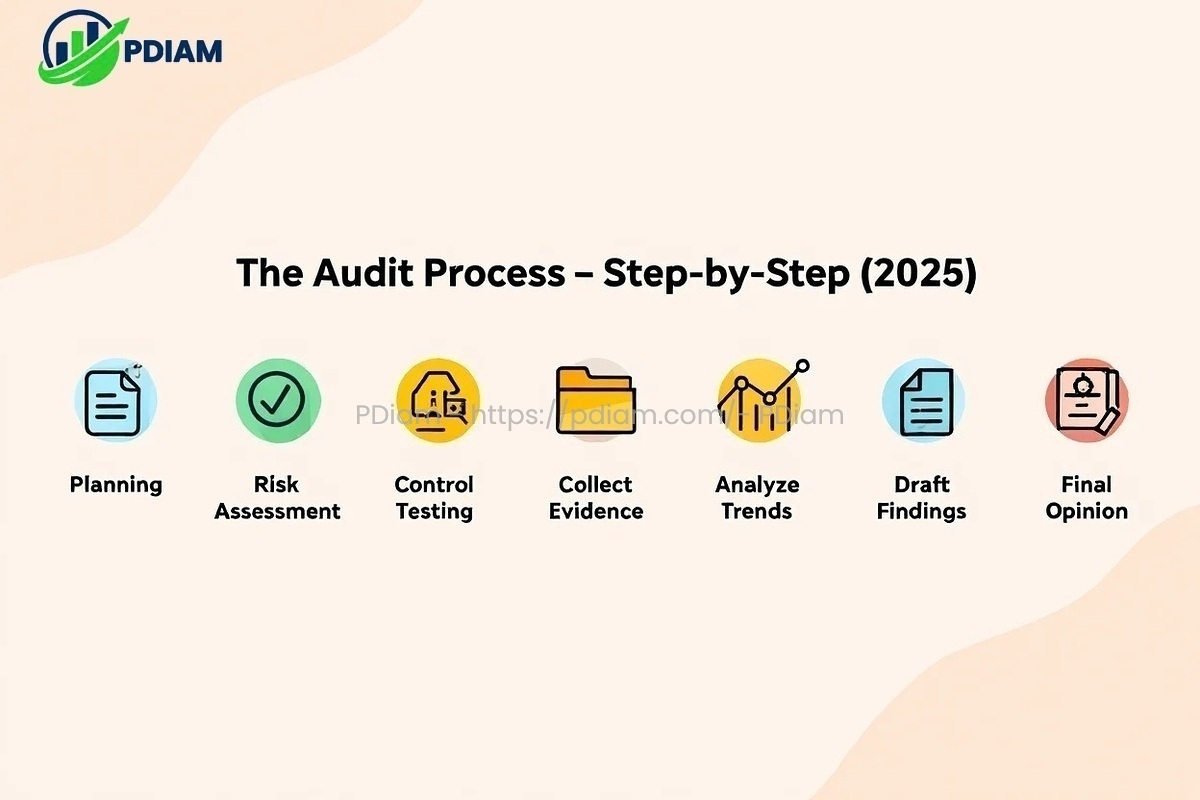

3. The audit process explained step-by-step

Audits are performed by independent auditors whose role is to remain objective and impartial throughout the process. Here’s an overview of the typical audit steps in 2025:

- Engagement & Planning: The auditor and company agree on the scope, timeline, and key risks.

- Risk Assessment: Auditors identify areas with higher chances of error or fraud.

- Internal Controls Testing: Check if company procedures effectively prevent mistakes.

- Evidence Collection: Gather documents, confirmations, and examine transactions.

- Analytical Procedures: Evaluate trends and ratios for unusual patterns.

- Drafting & Reviewing Findings: Prepare reports, discuss findings with management.

- Auditor Opinion & Reporting: Issue final opinion , unqualified, qualified, adverse, or disclaimer.

In 2025, audits increasingly use technology like AI and data analytics to enhance accuracy. Remote auditing also allows more flexibility, especially for companies with global operations. Regulatory updates stress stronger documentation and transparency, raising audit quality across markets.

Understanding these steps helps stakeholders trust the process and grasp what an auditor’s opinion means for a company’s financial health.

View more:

- What’s the cheapest franchise to open for maxium profit right now?

- How much does the average American make in their lifetime?

- Best Telephone system for small business on a budget

4. Why audited financial statements are important

Audited financial statements offer many benefits to different users. Here are key reasons why they matter:

- Increase Trust: Verified data builds user confidence in financial reports.

- Detect Fraud: Audits reveal irregularities and help prevent misconduct.

- Ensure Compliance: Meet regulatory and tax reporting requirements.

- Support Funding: Lenders and investors rely on audits to assess risk.

- Facilitate Mergers & Acquisitions: Provide transparent information for deals.

- Enable Public Offerings: Audited statements are required for IPOs.

- Improve Transparency: Detailed disclosures help stakeholders understand the business.

- Boost Stakeholder Confidence: Employees, suppliers, and customers feel reassured.

- Help Risk Management: Insights from audits guide better decisions.

- Allow Global Comparability: Especially important with IFRS adoption worldwide.

For example, a well-known 2024 case showed how an audit uncovered financial irregularities early, helping the company avoid bigger losses. In 2025, the pressure to include ESG (Environmental, Social, and Governance) factors in audits adds a new layer of importance.

5. Sample audit report & real-world scenarios

Here is a simplified extract from a fictitious audited financial statement’s auditor report section:

In our opinion, the financial statements present fairly, in all material respects, the financial position of XYZ Corporation as of December 31, 2024, in accordance with IFRS.

Two common scenarios when audits are required include:

- Initial Public Offering (IPO): Companies must provide audited reports to show financial reliability to potential investors.

- Bank Loans: Lenders require audits to assess creditworthiness before approving funds.

Investors focus on the auditor’s opinion and notes, while management uses the findings to improve processes.

6. How to choose an auditor in 2025

Selecting the right auditor is critical. Here are key points to consider:

- Credentials: Look for recognized certifications like CPA or ACCA.

- Industry Experience: Auditors familiar with your sector understand key risks better.

- Independence: Ensure no conflicts of interest exist.

- Reputation: Check track records and client reviews.

- Scalability: Choose firms that can handle your future growth.

- Technology Adoption: Firms using AI and data analytics offer more efficient audits.

- Cross-Border Capability: Important for multinational companies.

Watch out for red flags like auditors with financial ties to management or failure to update skills as regulations evolve.

7. Red flags & best practices when reading audit reports

Audited financial statements offer assurance but not all audits are created equal. Some reports may still raise concerns if warning signs appear. Recognizing these red flags and following proven practices can help you interpret statements accurately and prepare your own audits effectively.

7.1. 5 red flags to look out for

To ensure high-quality audited statements, companies should adopt strong internal practices that support transparency and audit readiness:

-

Manipulative reporting

Signs include aggressive revenue recognition (e.g., recording future sales today), inflated asset valuations, or shifting expenses off the books. These tactics often distort the company’s true financial position and should be investigated. -

Internal control failures

Lack of segregation of duties, override of key controls by senior staff, or inconsistent reconciliation processes signal a weak financial system. These vulnerabilities increase the risk of errors or intentional misstatements. -

Auditor rotation or frequent changes

Switching auditors repeatedly especially before major disclosures may suggest disagreements or attempts to avoid scrutiny. Stakeholders should question the reason for such turnover. -

Late financial reporting

Delays in publishing audited reports can be a red flag for underlying financial issues, poor recordkeeping, or disputes during the audit process. Timely reporting reflects operational control. -

Going concern warnings

If the auditor highlights doubt about the company’s ability to continue operating, it could indicate cash flow issues, debt defaults, or broader financial instability. This is a serious alert for investors and creditors.

These indicators don’t always confirm fraud or failure but they warrant deeper investigation before making financial decisions.

7.2. Best practices for businesses

To ensure high-quality audited statements, companies should adopt strong internal practices that support transparency and audit readiness:

-

Maintain clear documentation and organized records

Auditors rely on evidence. Well-maintained ledgers, contracts, and supporting schedules streamline audit fieldwork and reduce back-and-forth delays. -

Address auditor concerns early

Don’t wait for year-end. If auditors raise questions during planning or interim reviews, resolve them proactively to avoid surprises during final reporting. -

Be transparent about estimates and assumptions

Subjective inputs like asset impairments or provisions should be well-justified and consistent with historical patterns. Vague or inconsistent assumptions may attract audit adjustments or concern. -

Conduct internal reviews before the audit starts

Internal audits or pre-close reviews help identify anomalies early. This reduces audit findings, enhances credibility, and reflects sound governance.

These practices not only improve audit outcomes but also strengthen trust with investors, lenders, and regulators.

View more:

- Useful Guide: Do i need business license for sole proprietorship [2025]

- Avoid trouble: New Jersey finance agreement max late fees [2025]

- Ultimate Guide: How long do you have to pay back a business loan? [2025]

8. FAQs & common misconceptions

Q1: Can an audit guarantee a company is fraud-free?

A: No. While audits reduce fraud risk, they cannot eliminate it entirely.

Q2: Are all companies required to have audited financial statements?

A: No. It depends on company size, jurisdiction, and industry.

Q3: What’s the difference between audit, review, and compilation?

A: Audit = highest assurance; Review = limited review; Compilation = no assurance.

Q4: What are the four types of audit opinions?

A: Unqualified (clean), qualified, adverse, and disclaimer of opinion.

Q5: Can internal staff conduct audits?

A: Only external audits are considered independent and reliable for stakeholders.

Q6: Are ESG factors part of audits in 2025?

A: Increasingly yes , especially in public or international reporting standards.

9. Conclusion

Understanding what is an audited financial statement is crucial for making informed financial decisions and ensuring regulatory compliance in 2025.

Key takeaways:

-

Audited reports offer verified, independent insights into company performance.

-

The audit process includes planning, risk assessment, testing, and formal opinion.

-

Stakeholders rely on audit outcomes for investment, lending, compliance, and growth.

-

Red flags should not be ignored , they may signal deeper problems.

-

Choosing the right auditor boosts both credibility and efficiency.

Get audit-ready, reduce risks, and enhance your financial credibility today.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.