In today’s increasingly litigious world, having the right amount of liability insurance is not optional, it’s essential. Businesses and individuals alike face growing legal risks, with average settlement amounts rising by over 10% annually across industries like construction, healthcare, and professional services.

This environment has created a serious coverage gap, where primary liability policies may no longer offer sufficient protection against large claims. That’s exactly where excess liability insurance coverage steps in. It acts as a safety net, providing additional protection when your main policies hit their limits.

Let’s explore what excess liability insurance coverage is, how it works, why you might need it, and how to make sure you’re covered.

1. What is excess liability insurance coverage?

Excess liability insurance coverage is a secondary insurance policy that kicks in when the limits of your underlying liability insurance are exhausted.

It does not introduce new types of coverage, instead, it extends the financial limits of existing policies like general liability, commercial auto, or employers’ liability insurance.

Here’s what makes excess liability coverage unique:

-

Acts as a backup once your primary policy is maxed out.

-

Follows the “follow-form” structure, meaning it mirrors the terms and conditions of the underlying policy.

-

Applies to specific base policies, extending their coverage amount but not expanding their scope.

This ensures that your legal protection continues even when a claim exceeds your base policy limits.

Real Example: A tech company with a $2 million general liability policy faced a $3.5 million lawsuit over a data breach. Its excess policy absorbed the $1.5 million difference, saving the business from financial disaster.

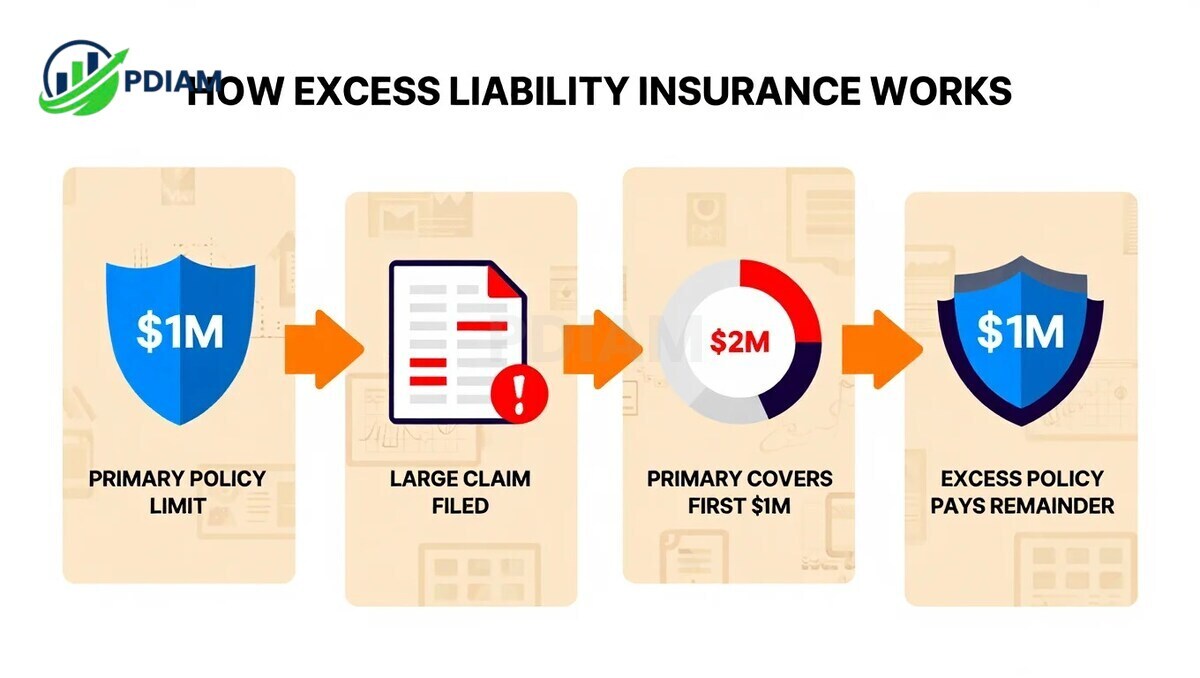

2. How does excess liability insurance work?

To understand the process, here’s a simplified step-by-step:

-

You hold a base liability policy, such as general liability, with set limits.

-

A large claim is filed, perhaps $2 million, exceeding your $1 million primary coverage.

-

Your primary insurer pays the first $1 million.

-

Your excess liability policy then covers the remaining $1 million.

This model is widely used across:

-

General liability

-

Auto liability

-

Employers’ liability

-

Errors and omissions (E&O)

Industries with high exposure to lawsuits, construction, transportation, and professional services, often rely on this protection.

3. What does excess liability insurance cover (and not cover)?

Understanding the scope and limitations of excess liability insurance coverage is essential to avoid costly misconceptions. This section outlines what is typically covered, and what isn’t.

3.1. Coverage provided

Excess liability insurance generally mirrors your underlying liability policies, offering extended protection for the same types of risks.

-

Bodily injury: Includes serious physical harm resulting from accidents, product defects, or negligence, often a major source of large claims in healthcare and construction sectors.

-

Property damage: Covers high-cost repair or replacement of damaged third-party property that exceeds your primary policy limits.

-

Legal defense expenses: Helps pay legal fees and court costs when lawsuits continue beyond the original policy limits, often critical in long-term litigation.

-

Certain personal injury claims: May include slander, libel, or invasion of privacy, if already covered in the underlying policy.

This coverage serves as a financial buffer that increases your total liability limit, not the types of risks insured.

Pro Tip: If you rely on excess liability insurance for legal protection, ensure your base policy already includes the exact type of incident you want extended.

3.2. What it doesn’t cover

While excess insurance offers substantial financial extension, it comes with clear limitations you must be aware of.

-

No new coverage types: It will not protect you against risks not already covered by your base policies, such as cyberattacks or employee discrimination unless specifically endorsed.

-

Excludes intentional or high-risk acts: Claims resulting from deliberate harm, criminal activity, war, terrorism, asbestos, or pollution are typically not covered unless special riders are in place.

Pro Tip: Always review the “exclusion” sections in both your primary and excess policies. Your protection is only as strong as the policy it extends from.

By knowing what’s excluded, you can plan for additional endorsements or specialty coverage where needed.

View more:

- What are the branches of quantitative management

- What is a hold harmless agreement

- What happens when you decline a cash app payment

4. Why is excess liability insurance needed?

In today’s high-stakes legal environment, excess liability insurance coverage is more than a financial product, it’s a strategic necessity. Let’s look at the most compelling reasons why.

4.1. Rising legal costs

Lawsuit payouts have escalated significantly. Even a single claim can exceed $1 million in damages, particularly in sectors like construction, transportation, or medical services. Without excess coverage, businesses and individuals are forced to cover the excess cost themselves, often leading to bankruptcy or asset liquidation.

4.2. Contractual obligations

Many contractual relationships now require extended liability limits. Whether you’re bidding on a government contract, leasing commercial property, or partnering with enterprise clients, showing proof of high-limit coverage often determines eligibility. Excess insurance ensures that you remain compliant and competitive.

4.3. Asset protection

Your assets, both personal and business, are on the line in a major liability lawsuit. Without adequate coverage, even a successful company could face devastating losses. Excess liability insurance acts as a safeguard, allowing you to continue operating without fear of losing your financial foundation.

These reasons make excess liability insurance an indispensable component of modern risk management, especially for those operating in high-risk industries or possessing valuable assets.

5. How does excess liability insurance differ from umbrella insurance?

While both provide additional protection beyond primary coverage, they differ in scope and purpose.

Here’s a comparison:

| Feature | Excess Liability | Umbrella Insurance |

|---|---|---|

| Scope | Extends limits only | Extends and broadens coverage |

| Follows base policy? | Yes (follow-form) | Not necessarily |

| Adds new risks? | No | Yes (e.g., slander, libel) |

| Best for | High-risk businesses | Broader personal/business needs |

This comparison highlights how umbrella policies may cover scenarios not addressed by your base or excess policies.

6. Who should consider excess liability insurance coverage?

Excess liability coverage is ideal for:

-

Businesses with significant exposure to lawsuits

-

High-net-worth individuals needing to protect personal assets

-

Companies required by law or contract to carry higher liability limits

-

Industries like healthcare, construction, logistics, or tech

If your operations involve public-facing risk, third-party property, or professional liability, this coverage is a smart investment.

7. How much excess liability coverage do you need?

There’s no one-size-fits-all answer, but key considerations include:

-

Industry standards: High-risk sectors may need $5M–$10M.

-

Asset value: The more you have to lose, the more coverage you need.

-

Legal environment: Operating in litigation-heavy areas like California or New York?

-

Contractual needs: Check agreements for minimum limits.

Consulting with an insurance advisor helps tailor coverage to your actual risk.

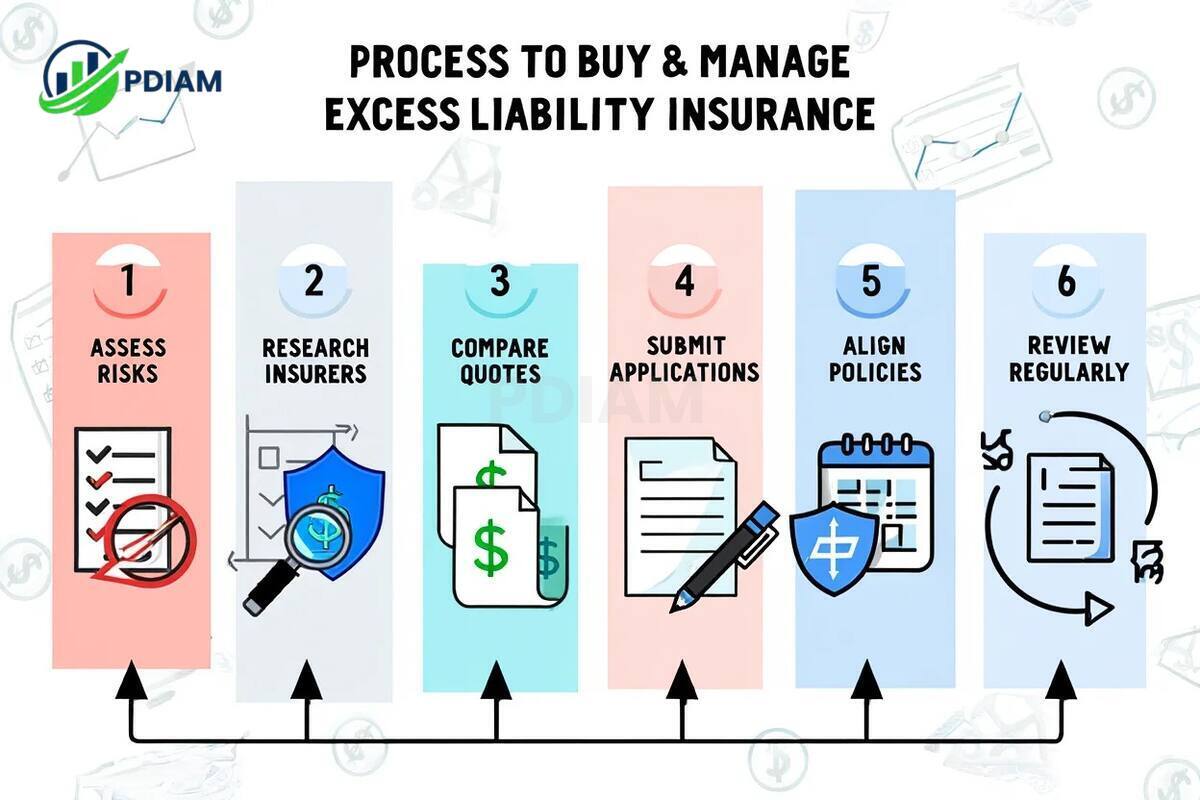

8. What is the process for buying and managing excess liability insurance?

Getting started is straightforward if approached methodically:

-

Assess risks: List potential exposures not covered by base limits.

-

Research insurers: Focus on providers experienced in your sector.

-

Compare quotes: Look at premiums, policy limits, and exclusions.

-

Submit applications: Ensure accurate and consistent data across policies.

-

Align policies: Match policy periods and coverage triggers.

-

Review regularly: Annual reviews ensure limits keep pace with your risk growth.

Maintaining a coordinated insurance structure avoids gaps that could jeopardize coverage when you need it most.

9. 10+ Key benefits of having excess liability insurance coverage

Here are over 30 reasons why this coverage should be in your insurance portfolio:

-

Adds a critical layer of protection for large claims.

-

Shields business or personal assets from legal risk.

-

Meets contract requirements in regulated industries.

-

Helps avoid out-of-pocket expenses beyond base policy.

-

Covers defense costs that exceed limits.

-

Provides peace of mind amid rising litigation.

-

Allows firms to bid on larger projects confidently.

-

Enhances credibility with clients and investors.

-

Can be tailored to specific risk profiles.

-

Ensures compliance with regulations.

-

Available to both individuals and businesses.

-

Improves financial planning through liability caps.

-

Reduces premium cost volatility.

-

Aligns with corporate governance standards.

-

Minimizes claims disputes with clearly layered policies.

-

Boosts negotiation power with clients or partners.

-

Facilitates continuity after catastrophic claims.

-

Offers flexible coverage amounts.

-

Maintains policy consistency via follow-form structure.

-

Supports long-term operational strategy.

-

Helps secure business loans or bonding.

-

Backstops high-profile risk scenarios.

-

Enables growth with manageable legal exposure.

-

Often more affordable than raising base limits.

-

Covers multi-location or international exposures.

-

Compatible with risk transfer plans.

-

May offer higher limits at group discounts.

-

Offers protection from “shock losses”.

-

Forms the basis for layered insurance towers.

-

Trusted by large enterprises and small businesses alike.

These benefits highlight the strategic value of excess liability insurance coverage in today’s legal and financial landscape.

Check aritcles below for more stuffs:

- What’s the average monthly private Health Insurance payment? Complete 2025 U.S. Cost

- How to draw up a business Plan in 2025: The complete Guide

- How to make an Email Address for a Business: Ultimate step-by-step guide [2025]

10. Frequently asked questions about excess liability insurance coverage

10.1. Is excess liability insurance available to individuals or only businesses?

A: It’s available to both. Many high-net-worth individuals buy excess policies to protect personal assets from lawsuits.

10.2. What is the difference between “follow-form” and “stand-alone” excess insurance?

A: Follow-form mirrors the terms of the underlying policy, while stand-alone may have different conditions and exclusions.

10.3. Does excess liability insurance cover new or emerging risks?

A: No. It only extends the limits of coverage types already included in your base policy, cyber, pollution, and other emerging risks typically require specific add-ons.

10.4. Is this coverage cost-effective for small businesses?

A: Yes, especially in high-risk industries. It often provides significant financial protection at a modest cost.

10.5. How are claims handled with excess insurance?

A: Your primary insurer pays first. Once their limits are exhausted, your excess policy covers the remainder.

10.6. Can you stack or layer multiple excess policies?

A: Yes. This is common in large corporations. However, coordination across policies is essential to avoid conflicts.

10.7. Does excess liability replace the need for umbrella insurance?

A: No. They serve different roles. Excess insurance boosts limits; umbrella insurance can also broaden scope.

11. Conclusion

What is excess liability insurance coverage? It’s a powerful tool to expand your protection against large, potentially devastating claims.

To recap:

-

Extends liability limits when base policies fall short

-

Supports compliance with legal or contractual demands

-

Shields assets and operations from financial ruin

-

Helps manage risk in a cost-effective way

-

Essential for industries and individuals facing high exposures

Choosing the right insurance structure is key to navigating 2025’s legal and financial risks. Don’t leave your future to chance, consult your insurance advisor today.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.