What is fiduciary liability insurance coverage? Fiduciary liability insurance coverage protects individuals and organizations responsible for managing employee benefit plans from claims of errors, omissions, or breaches of duty. It’s designed to help plan sponsors, trustees, and administrators handle risks tied to managing retirement, health, or welfare plans.

For example, if an HR executive faces allegations of mishandling a 401(k) plan, this insurance can cover legal fees and damages.

This article explains what fiduciary liability insurance coverage is, who needs it, what it covers and excludes, and why it matters for businesses managing employee benefits. We’ll guide you through the basics and offer practical insights to help you understand this insurance in today’s regulatory environment.

1. What is fiduciary liability insurance coverage?

Fiduciary liability insurance provides protection against claims that arise from alleged breaches of fiduciary duty while managing employee benefit plans. Simply put, it covers mistakes or misconduct related to overseeing retirement or welfare plans.

This insurance typically covers:

-

Breach of fiduciary duty claims

-

Plan mismanagement issues

-

Errors or omissions in plan administration

-

Misleading or negligent advice given to plan participants

-

Legal defense costs and settlements

Most often, fiduciary liability insurance addresses risks created by ERISA fiduciary insurance requirements , the main federal law governing benefit plans.

Real example: If a committee member is sued for making poor investment choices, the insurance can help cover defense costs.

2. Who qualifies as a fiduciary?

A fiduciary is anyone legally responsible for managing or controlling employee benefit plans under ERISA. They are held to a high standard and must act solely in the interest of plan participants.

Common fiduciary roles include:

-

Employers who sponsor benefit plans

-

Plan trustees

-

Plan administrators

-

Board members overseeing plan committees

-

Human resources leaders involved in plan decisions

For example, a retirement plan committee member making investment decisions would qualify as a fiduciary under the law.

Think this piece is helpful? Check out more stuffs below:

- Can a felon buy a house? Rights, rules, and risks [2025]

- How much is gap coverage insurance? Smart buyer tips [2025]

- What is Push and Pull marketing? A simple breakdown [2025]

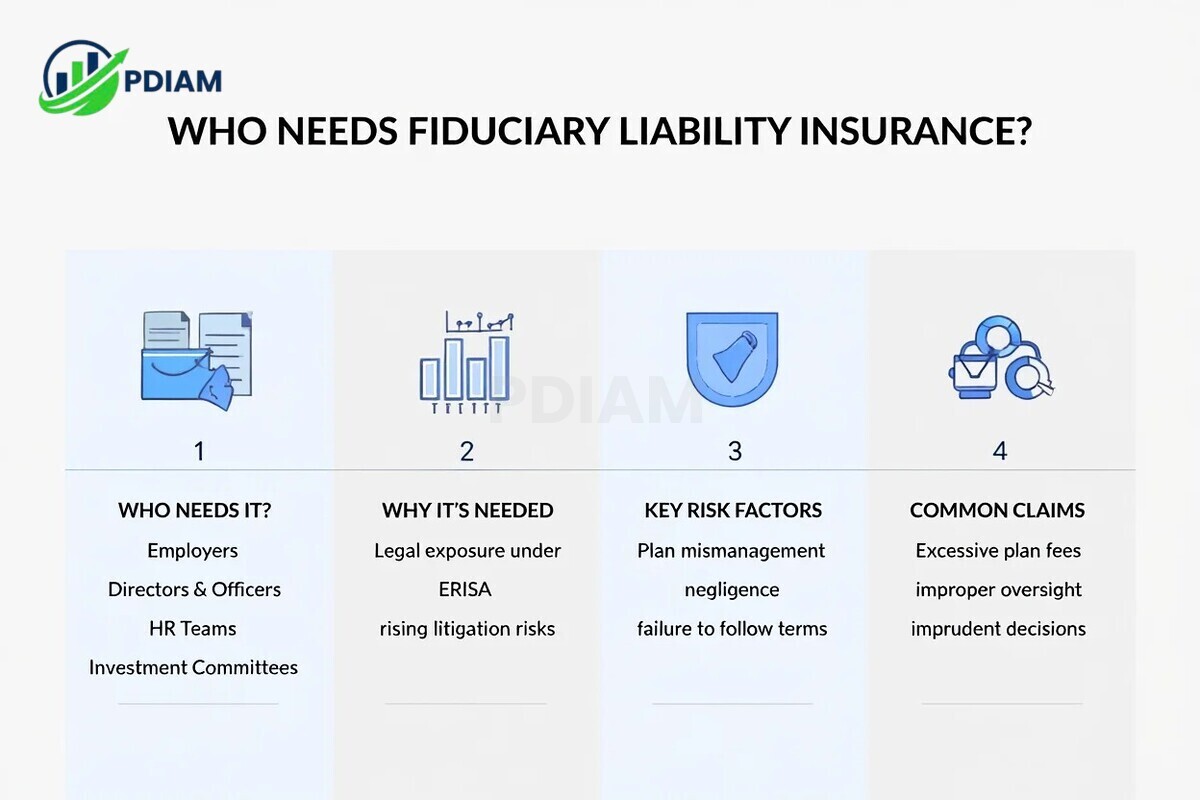

3. Who needs fiduciary liability insurance?

Organizations that sponsor or manage employee benefit plans typically need this coverage.

That includes employers, directors and officers (D&O), HR teams, and investment committees.

Risk factors include:

-

Complex plan administration under ERISA

-

Litigation over plan fees or poor management

-

Failure to act prudently or follow plan terms

-

Wrongful acts or negligence in plan oversight

Fiduciary liability insurance definition: A policy that protects individuals or organizations acting as fiduciaries under ERISA from liability related to plan mismanagement or breach of duty.

Real case: A medium-sized company faced a regulatory probe for excessive 401(k) plan fees. The company’s fiduciary liability insurance helped cover its legal defense.

4. What does fiduciary liability insurance cover?

This insurance covers a wide range of claims related to fiduciary activity. Key covered events include:

-

Breach of fiduciary duty (e.g., acting against participants’ best interest)

-

Mismanagement of plan assets or funds

-

Administrative errors or omissions

-

Misleading or negligent advice

-

Legal defense costs, settlements, and judgments

Pro tip: Many policies include ERISA investigations, but always confirm if this is endorsed in your specific coverage.

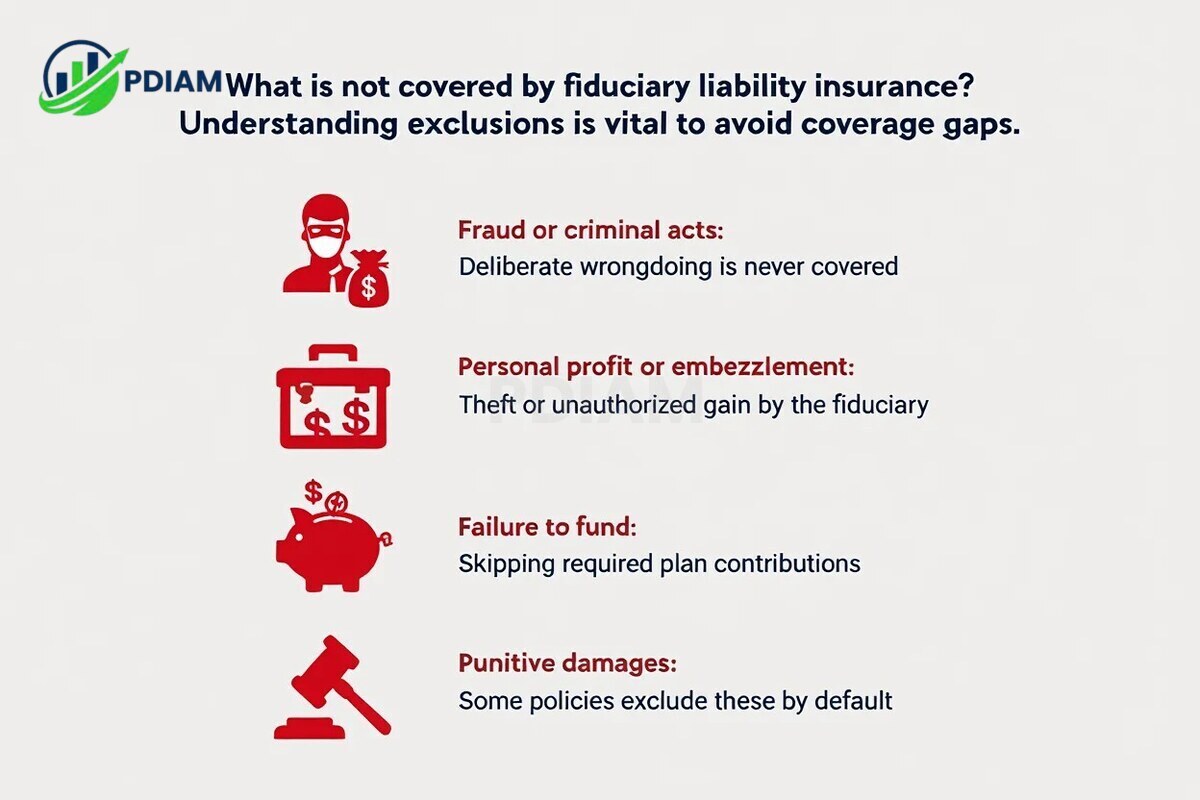

5. What is not covered by fiduciary liability insurance?

Understanding exclusions is vital to avoid coverage gaps. Common exclusions include:

-

Fraud or criminal acts: Deliberate wrongdoing is never covered.

-

Personal profit or embezzlement: Theft or unauthorized gain by the fiduciary.

-

Failure to fund: Skipping required plan contributions.

-

Punitive damages: Some policies exclude these by default.

Example: If a plan administrator embezzles funds, the claim would be denied. That’s where an ERISA fidelity bond steps in, these are legally required for plans handling plan assets.

6. Fiduciary liability insurance vs. other employee benefits insurance

Understanding the difference between related insurance products prevents costly assumptions.

| Coverage Type | What It Protects | Who Needs It | Legally Required? |

|---|---|---|---|

| Fiduciary Liability Insurance | Breach of fiduciary duty, mismanagement | Plan sponsors, trustees | No (but highly recommended) |

| ERISA Fidelity Bond | Theft or fraud involving plan assets | Plan administrators, trustees | Yes (for most plans) |

| Employee Benefits Liability | Errors in benefit plan administration | Employers, HR departments | No |

This chart helps clarify the distinction between fiduciary insurance vs fidelity bond, and why many organizations carry multiple policies.

7. Why is fiduciary liability insurance important?

Fiduciary liability insurance is critical for risk management. Here’s why:

-

Fiduciaries can be personally liable, even for honest mistakes.

-

ERISA-related litigation is rising, including class action lawsuits.

-

Legal costs and settlements can cripple business finances.

-

Insurance protects the organization, its leaders, and plan participants.

A 2025 study revealed a 40% increase in fiduciary-related lawsuits, with most involving retirement plan mismanagement or excessive fees.

View more:

- How to price a business for Sale

- Understand what is meant by real GDP

- Best money management apps for iPhone

8. Factors affecting cost and how to buy fiduciary liability insurance (2025)

Understanding the cost structure of fiduciary liability insurance coverage is essential when budgeting for risk protection. Several key variables influence premiums, policy features, and underwriting decisions in 2025.

8.1. Top cost factors

Here are the main elements that determine your premium:

-

Plan size and participant count: The more participants and assets under management, the higher the exposure, and cost.

-

Industry risk profile: Sectors like healthcare, finance, and education often face greater regulatory scrutiny, driving up premiums.

-

Claims history: Previous lawsuits or investigations against fiduciaries can significantly raise your quote.

-

Policy limits and retention: Higher coverage limits and lower deductibles increase premium costs but offer broader protection.

-

Defense cost handling: Some policies subtract defense expenses from the total coverage limit, reducing what’s available for settlements.

Pro tip: When comparing policies, ask whether legal defense costs are inside or outside policy limits, this can dramatically impact your total protection.

8.2. How to buy fiduciary liability insurance in 2025

Purchasing the right policy requires diligence and an understanding of your organization’s risk exposure. Here’s how to approach the process:

-

Ask about exclusions: Inquire specifically about carve-outs related to cyber risks, ERISA audits, or internal investigations, not all policies cover them by default.

-

Work with a specialized broker: Choose a provider familiar with employee benefit fiduciary liability coverage, ERISA law, and current litigation trends.

-

Review endorsements thoroughly: Don’t assume every policy includes standard protections, read all riders and endorsements line-by-line.

-

Bundle smartly: In some cases, you can pair fiduciary liability insurance with D&O or E&O policies for broader but cost-effective protection.

Buying fiduciary coverage is not just a legal formality, it’s a strategic move to protect your leadership team, HR staff, and plan participants from lawsuits and reputational fallout.

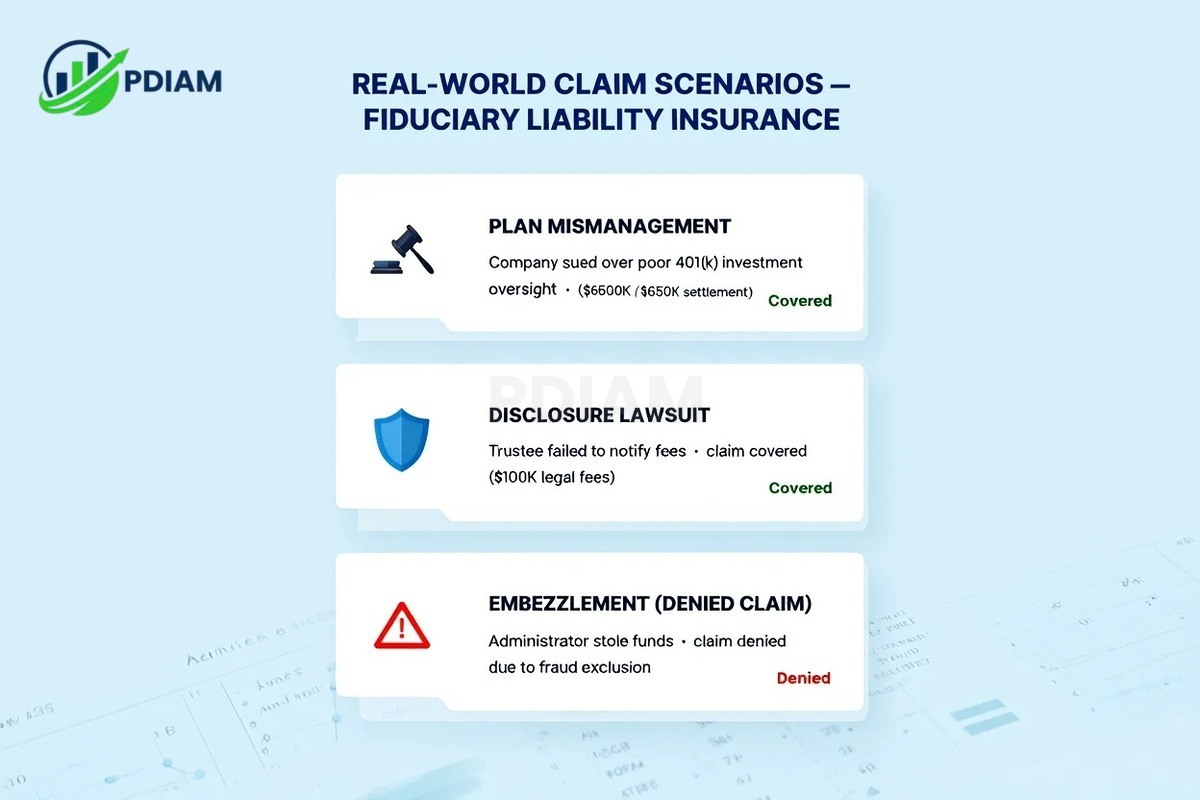

9. Real-world examples and claim scenarios

To better understand how fiduciary liability insurance coverage functions in practice.

Here are anonymized, real-world-inspired examples that illustrate both successful and denied claims:

9.1. Plan mismanagement

A mid-sized tech company faced a class-action lawsuit from former employees who alleged poor investment decisions within the company’s 401(k) plan resulted in significant losses. The fiduciary committee had not reviewed fund performance regularly, violating ERISA standards.

Outcome: The company’s fiduciary liability policy covered legal defense costs and a negotiated settlement of $650,000, protecting both the plan sponsors and individual committee members.

9.2. Disclosure lawsuit

A trustee was accused of failing to properly communicate fee disclosures to participants of a healthcare benefits plan. Although the omission was unintentional, it led to regulatory scrutiny and a civil claim.

Outcome: The fiduciary liability insurance provided a defense attorney and covered over $100,000 in legal fees, helping the trustee avoid personal financial loss.

9.3. Exclusion trigger: Embezzlement

In a different case, a benefits administrator was discovered to have embezzled plan contributions for personal use. The company reported the loss and attempted to claim it under fiduciary liability coverage.

Outcome: The claim was denied because the act involved intentional criminal conduct, fraudulent behavior explicitly excluded under the policy terms. Fortunately, the organization’s ERISA fidelity bond helped recover part of the stolen funds.

Pro tip: Always pair fiduciary liability insurance with an ERISA fidelity bond to protect against both mismanagement and criminal acts.

10. Frequently asked questions about fiduciary liability insurance coverage

10.1. Is fiduciary liability insurance legally required?

No. But it’s strongly recommended for anyone handling benefit plans.

10.2. How is it different from D&O or E&O insurance?

It specifically covers ERISA-related fiduciary errors, not general leadership or service mistakes.

10.3. Who pays legal defense costs?

The insurer generally covers defense costs, subject to policy terms.

10.4. What happens when there’s a claim?

Notify the insurer promptly. They review, assign counsel, and pay if within coverage terms.

10.5. Is fiduciary liability insurance the same as professional liability insurance?

No. Professional liability (E&O) covers service errors. Fiduciary insurance covers ERISA plan oversight.

11. Conclusion

What is fiduciary liability insurance coverage? It’s a vital layer of protection for any entity managing employee benefits. It shields fiduciaries from claims tied to mismanagement, errors, or duty breaches, especially under ERISA regulations.

Recap:

-

It’s not legally required but highly advisable.

-

It differs from ERISA bonds and E&O/D&O insurance.

-

Covers legal defense, settlements, and fiduciary oversight failures.

-

Excludes fraud, embezzlement, and failure to fund.

-

Costs depend on plan size, industry, and policy design.

Without proper insurance, businesses and fiduciaries risk massive financial and reputational loss.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.