As healthcare premiums continue to rise, many Americans ask: What’s the average monthly private health insurance payment in 2025? With household budgets tightening, understanding your real insurance cost has never been more important.

In this comprehensive guide, we’ll break down current national averages, analyze cost drivers like age and plan tier, and provide region-based insights. You’ll also learn practical ways to lower your premium, whether you buy through the Marketplace or get coverage from an employer.

1. What’s the average monthly private health insurance payment?

Understanding the average cost of private health insurance helps you benchmark your own situation and plan your budget accordingly.

For 2025, the national average monthly premium for individual private health insurance is approximately $520. This figure is based on aggregated data from ValuePenguin, the Kaiser Family Foundation (KFF), and the Centers for Medicare & Medicaid Services (CMS).

Each tier under the Affordable Care Act (ACA) offers different cost-benefit tradeoffs. Here’s how the average monthly premiums break down by tier:

| Plan Tier | Average Premium | Ideal For |

|---|---|---|

| Bronze | $400 | Low-cost seekers, rare doctor visits |

| Silver | $520 | Balanced coverage and cost |

| Gold | $680 | Regular care, chronic conditions |

| Platinum | $800 | High care frequency, lowest OOP |

As coverage improves across tiers, premiums increase — but this often reduces other expenses like deductibles and co-pays.

Choosing the right tier depends on your expected medical usage and risk tolerance.

2. Key factors influencing monthly insurance costs

Your monthly health insurance cost isn’t determined by one variable alone.

A combination of personal, plan-related, and geographic factors will shape your premium.

2.1. Personal and household factors

The following personal traits and situations affect how much you’ll pay:

-

Age: Premiums can be up to 3x higher for older adults than for young adults.

-

Tobacco use: Smokers may face 20%–30% higher premiums.

-

Family size: More members mean higher total costs, though the per-person rate may drop.

-

Health history: Chronic illness often leads to choosing higher-cost plans.

These elements make your quote unique — even if the plan name is the same.

2.2. Plan-related decisions

Your choices within the insurance marketplace also influence monthly payments:

-

Coverage tier: Bronze is cheapest, Platinum is most expensive.

-

Deductibles: Lower deductibles usually mean higher premiums.

-

Cost-sharing terms: Plans with lower co-pays or coinsurance tend to cost more upfront.

Plan structure determines whether you’re paying now (higher premium) or later (higher out-of-pocket).

2.3. Geographic and regulatory factors

Where you live significantly shapes your premium, often more than your health status.

-

Location: State and city markets have different cost profiles.

-

Market competition: More insurance carriers mean better pricing.

-

State regulations: Some states require additional benefits, increasing costs.

Local factors may explain cost gaps even among identical plans across states.

3. What is private health insurance?

Understanding what qualifies as “private” health insurance ensures you compare correctly.

| Type | Where Purchased | Notes |

|---|---|---|

| ACA Marketplace Plan | Healthcare.gov or state sites | Subsidies available for most buyers |

| Employer-Sponsored Plan | Through workplace | Employer often pays part of premium |

| Off-Marketplace Plan | Direct from insurer | May lack ACA protections |

| Short-Term Plan | Private brokers | Lower cost, limited coverage |

Private insurance excludes Medicare and Medicaid, which are public programs.

Below are some related articles:

- How to draw up a business Plan in 2025: The complete Guide

- How to make an Email Address for a Business: Ultimate step-by-step guide [2025]

- How can you protect personal information gathered by Legitimate Organizations in 2025

4. Regional cost differences and why your location matters

Your state and city can have a significant impact on your private health insurance premium. This is due to local laws, provider pricing, and population health metrics.

4.1. Average premiums by state in 2025

The following table showcases how much monthly premiums can vary across different U.S. states:

| State | Average Premium |

|---|---|

| Alaska | $670 |

| New York | $665 |

| Massachusetts | $660 |

| Arizona | $450 |

| Nevada | $460 |

| North Carolina | $455 |

As seen above, high-cost or rural states like Alaska tend to have the highest premiums, while competitive markets like Arizona offer more affordable options.

Knowing your state’s average can help you set realistic budget expectations.

4.2. Why your location changes your premium

Several underlying factors explain why your location directly affects your insurance costs:

-

Provider prices: Some hospitals and physicians charge more based on local market rates.

-

State regulations: Certain states require plans to cover more services, raising prices.

-

Population risk pool: States with sicker or older populations often face higher average premiums.

Even if your age and income are the same, your ZIP code alone can shift your premium significantly.

5. Plan tiers and their impact on your insurance costs

The Affordable Care Act (ACA) created tiered plans to give consumers more flexibility based on budget and healthcare needs.

5.1. What each plan tier covers and who it suits

Each tier reflects how costs are split between you and the insurer. Here’s how they compare:

| Tier | Coverage % | Best For |

|---|---|---|

| Bronze | ~60% | Low-usage, budget-conscious users |

| Silver | ~70% | Balanced users; subsidy-eligible |

| Gold | ~80% | Chronic care or ongoing needs |

| Platinum | ~90% | Frequent users; lowest out-of-pocket |

Choosing the right tier means balancing monthly premiums against potential out-of-pocket costs.

Your choice should reflect how often you expect to use healthcare services.

5.2. Real-life case study: Matching plans to user profiles

Understanding how different people choose plans based on their health needs can clarify your decision:

-

A 30-year-old healthy individual picks a Bronze plan for ~$400/month, accepting higher out-of-pocket costs due to rare visits.

-

A 55-year-old managing diabetes selects a Gold plan at ~$680/month, ensuring more covered services and lower extra expenses.

This example shows how age, condition, and usage patterns guide smart plan selection.

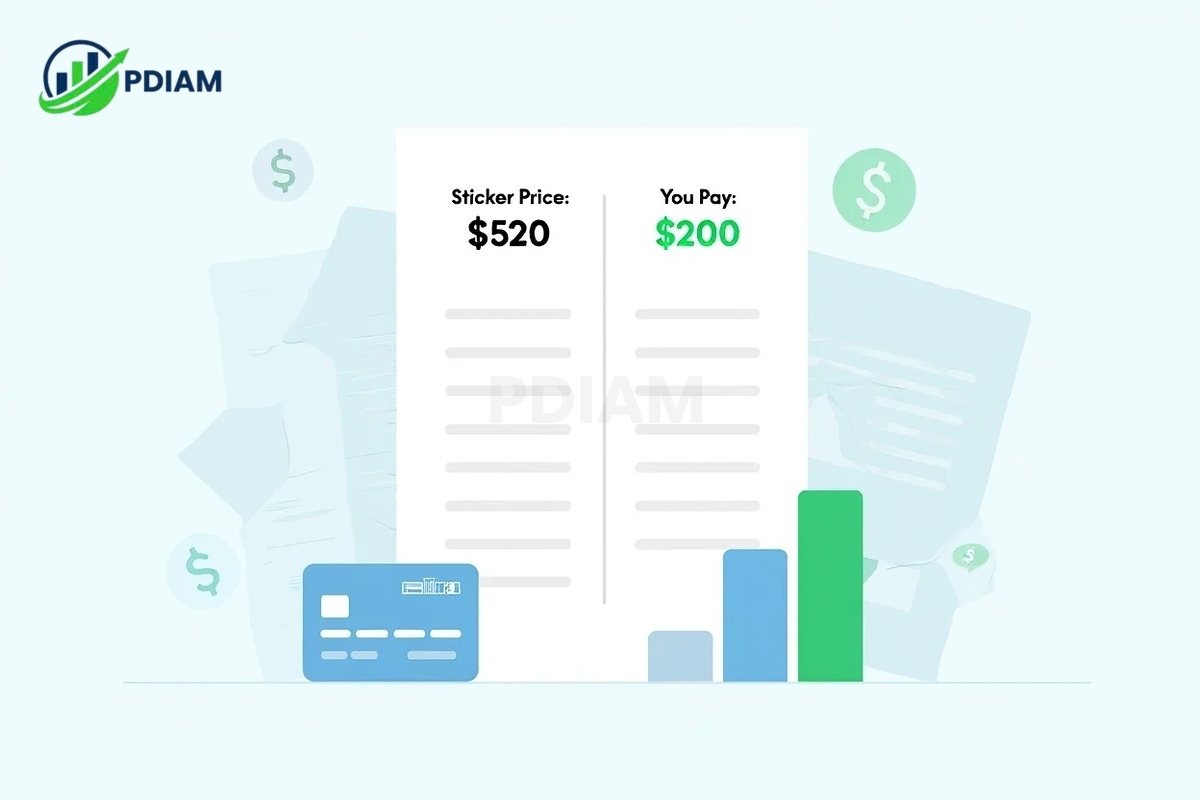

6. What you really pay: Sticker price vs. real cost after subsidies

While premiums may look expensive at first glance, most Americans don’t pay the full listed price thanks to federal subsidies.

Detail below:

6.1. How tax credits reduce monthly payments

The ACA provides premium tax credits based on income and family size. As of 2025, anyone earning up to 400% of the federal poverty level (FPL) may qualify.

| Income Level | Listed Premium | After Subsidy |

|---|---|---|

| $25,000 | $520 | $200 |

| $40,000 | $520 | $300 |

| $60,000 | $520 | $450 |

Even with the same sticker price, lower-income households pay significantly less.

Always check your eligibility to avoid overpaying for the same plan.

6.2. Average vs. median payment in real life

The average full-price premium in 2025 is around $520/month. However, the median payment what most people actually pay after subsidies is closer to $310/month.

This wide gap highlights the real-world impact of government aid.

Don’t base decisions on average costs alone calculate your specific net premium.

7. Understanding out-of-pocket expenses beyond premiums

Monthly premiums aren’t the only cost involved in health insurance. Other expenses can significantly affect your yearly financial burden.

Here are the most common out-of-pocket expenses:

-

Deductibles: Ranges from $1,500 to $7,000, depending on your plan.

-

Co-insurance: Typically 20%–40% of service cost after the deductible.

-

Out-of-pocket maximums: Usually capped between $5,000 and $8,000 per year.

These costs directly impact how much you’ll spend if you have a serious medical event or chronic condition.

When comparing plans, always look beyond the premium to total annual exposure.

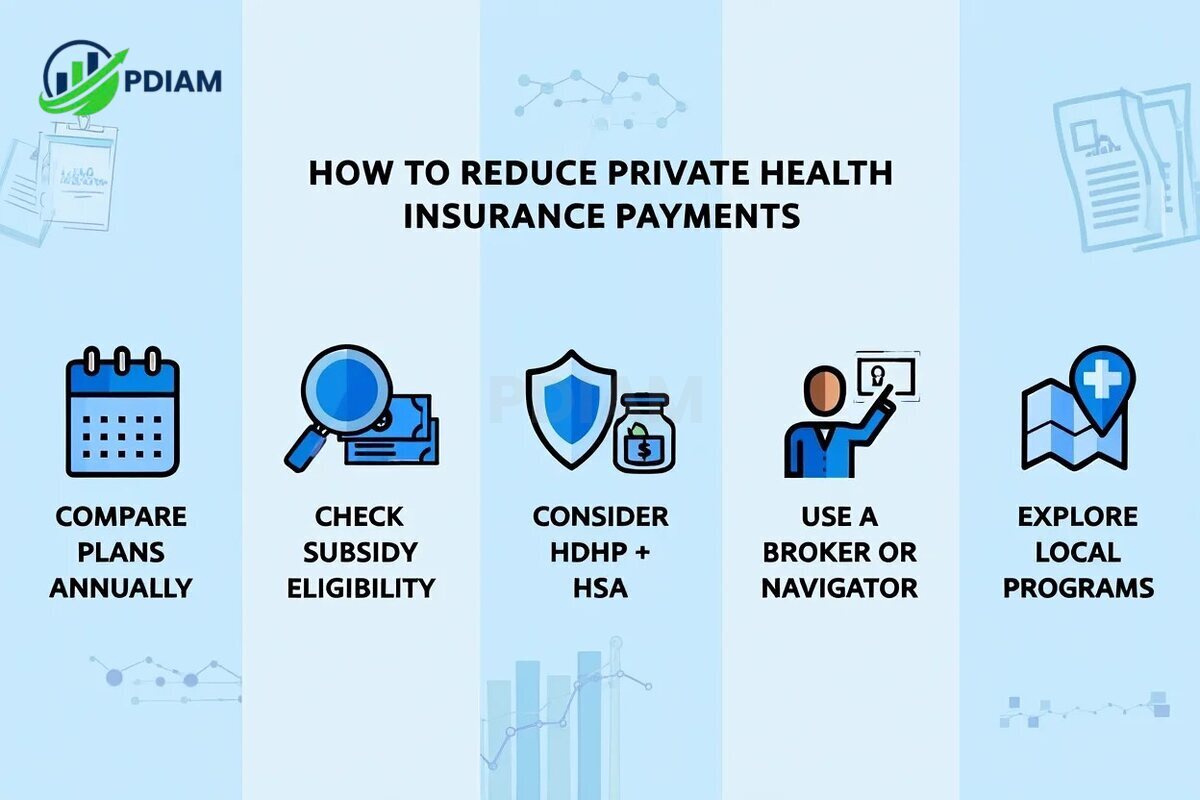

8. How to reduce your private health insurance payments

Even with high sticker prices, there are multiple strategies to lower your health insurance costs legally and effectively.

By being proactive and informed, you can save hundreds per year on insurance:

-

Compare plans annually on Healthcare.gov or your state marketplace.

-

Verify subsidy eligibility regularly, especially if your income or family size changes.

-

Consider high-deductible health plans (HDHPs) paired with Health Savings Accounts (HSAs).

-

Use brokers or navigators to find optimized plans based on your usage.

-

Explore local/state programs, which may offer additional aid or premium support.

Pro tip: An HSA offers triple tax advantages contributions, growth, and withdrawals (for medical expenses) are all tax-free. This can significantly offset your true costs.

Reducing premiums requires action, not luck annual review and right-fit planning are key.

View more:

- What is a good business to start

- How much does health insurance cost per month

- Which statements about the accrual-based method of accounting are true

9. Frequently asked questions (FAQ)

9.1. Do most Americans pay the full $520 per month?

No. Most receive subsidies or get employer contributions that lower their actual payment.

9.2. Does private insurance include Medicare or Medicaid?

No. Private insurance comes from private companies. Medicare and Medicaid are public.

9.3. Are short-term plans worth it?

They can be in specific situations, but they lack full coverage and consumer protections.

9.4. Can I change my plan mid-year?

Only during open enrollment or a qualifying life event (e.g., marriage, job loss).

9.5. What other costs besides the premium should I consider?

Deductibles, co-pays, co-insurance, and uncovered services can add hundreds per month.

9.6. Can I keep my doctor on any plan?

Not always. Check network rules before enrolling.

9.7. Can employer plans be more expensive than Marketplace ones?

Sometimes. If your employer offers minimal coverage, you may still qualify for subsidies through the Marketplace.

10. Conclusion

So, whats the average monthly private health insurance payment in 2025? The national figure is around $520, but what you actually pay depends on your income, location, plan type, and health needs. Thanks to subsidies and smart choices, many pay far less, closer to $310 on average.

To recap:

-

Choose a plan tier based on your usage and budget.

-

Use Marketplace tools to explore subsidy options.

-

Consider regional and personal factors when evaluating costs.

-

Don’t ignore out-of-pocket maxes and deductible structures.

Stay informed, compare yearly, and leverage all options to manage your healthcare costs wisely.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.