Understanding which statements about the accrual-based method of accounting are true is essential for anyone involved in finance, accounting, or business management. In 2025, this method remains the gold standard for accurate financial reporting under both GAAP and IFRS.

Whether you’re a student preparing for exams or a business owner aiming for compliance, mastering the core truths of accrual accounting helps ensure better decisions and honest financial practices.

This guide breaks down the verified facts, corrects common myths, and shows practical examples. You’ll also find tables, journal entries, and FAQs to deepen your understanding of how accrual accounting works in today’s regulatory landscape.

1. What is accrual-based accounting?

Accrual-based accounting is a system where income and expenses are recorded when they are earned or incurred, not when the cash is received or paid. This approach provides a more complete and timely view of a company’s financial performance.

It contrasts with cash-based accounting, where transactions are recorded only when money physically moves. Accrual accounting better aligns with how businesses operate and helps users of financial statements make informed decisions.

2. Which statements about the accrual-based method of accounting are true?

Understanding the foundational truths of accrual accounting is critical for compliance, financial clarity, and long-term planning.

These principles are recognized in both academic and professional environments and form the basis of how most businesses report their financial results.

The following points summarize widely accepted truths about the accrual-based method of accounting. Each statement aligns with established accounting frameworks and is fundamental to accurate financial reporting.

-

Revenues are recorded when earned, even if not yet received in cash

Under the accrual method, income is recognized when a product or service is delivered, not when payment is made. This approach aligns with the revenue recognition principle and ensures that revenue is properly tied to business activity. -

Expenses are recorded when incurred, regardless of when payment is made

The matching principle requires that costs be matched with the revenues they help generate. Even if payment is delayed, expenses must be reflected in the same period the benefit was realized. -

Accrual accounting includes accounts receivable and accounts payable

These accounts represent amounts owed by or to the business and are essential for tracking financial obligations and claims. They ensure that outstanding transactions are reflected in the books. -

It is required under GAAP and IFRS for most medium and large businesses

Both U.S. Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) mandate the accrual method for public companies and many private ones, promoting standardization and comparability. -

Non-cash events such as credit sales and accrued wages are included

Transactions that do not involve immediate cash, such as sales on credit or unpaid salaries, are captured under accrual accounting. This gives a more complete view of a company’s financial activity during a period. -

Financial statements under accrual basis reflect a business’s true financial condition

Because transactions are recorded when they occur economically, not when cash moves, accrual-based reports provide a more accurate snapshot of profitability and liabilities. -

The matching principle ensures that revenues and related expenses are recognized in the same period

This principle improves the quality of financial data by linking costs directly to the revenues they help generate, reducing distortion in reported net income. -

Adjusting entries are required at the end of each period

Adjusting entries ensure that all accrued revenues and expenses are accounted for in the correct period. This is essential for producing timely and accurate financial reports. -

Accrual accounting enhances transparency and reduces manipulation risk

By disconnecting financial reporting from cash flow timing, the accrual method reduces opportunities for income or expense manipulation through delayed billing or premature payments. -

Prepaid expenses and unearned revenues are included to reflect economic reality

These accounts help businesses recognize future obligations and entitlements, offering a realistic view of current and deferred performance. -

Forecasting and budgeting benefit from the time-based alignment of income and expenses

When revenue and costs are recognized in the periods they relate to, it becomes easier to build accurate budgets and financial models.

Each of these statements reflects principles found in the Accounting Standards Codification (ASC) and the IFRS Conceptual Framework, reinforcing their credibility and universal applicability.

View more:

- How to accept credit card payments as a small business

- How to come up with a name for a brand

- How can a company improve its organisational performance

3. Summary table of true statements

The table below summarizes the key features of accrual accounting that have been confirmed as true.

| Statement | True/False | Explanation |

|---|---|---|

| Revenues are recognized when earned | True | Reflects delivery of goods/services, not cash timing |

| Expenses are recognized when incurred | True | Uses the matching principle |

| Includes receivables and payables | True | Tracks outstanding obligations |

| Required under GAAP/IFRS | True | Mandated for consistent financial reporting |

| Records non-cash events | True | Includes credit sales, accrued liabilities |

| Improves financial clarity | True | Shows actual operational performance |

| Requires end-of-period adjustments | True | Maintains timing accuracy |

| Covers prepaid and unearned items | True | Captures future rights and obligations |

These components work together to create a clear, standardized, and regulation-compliant accounting system.

4. Common false beliefs about accrual accounting

Misconceptions about accrual accounting can lead to reporting errors, failed audits, and poor decisions. Below are some widely held false beliefs, along with accurate corrections.

| False Statement | Correction |

|---|---|

| Revenue is only recognized when cash is received | Revenue is recognized when earned, even without cash |

| Expenses are recorded only when paid | Expenses are recorded when the obligation is created |

| Accrual ignores cash completely | Cash is tracked separately through the statement of cash flows |

| Accrual is optional for all businesses | Many entities are required to use it under GAAP/IFRS |

| Prepaid and unearned items are excluded | They are key parts of the method, ensuring timing accuracy |

| Small businesses can’t use accrual | They can choose to adopt it, and many benefit from doing so |

| It delays recognition of transactions | It records transactions as they occur, not later or earlier |

Understanding these clarifications helps reduce errors and align with accepted standards.

Understanding these clarifications helps reduce errors and align with accepted standards. But accounting accuracy is only one side of financial management individuals and businesses also need to monitor spending carefully. If you want a practical guide, check out our article on how to track expenses to build stronger money habits and keep your finances under control.

5. Accrual vs. cash-based accounting: comparison

A direct comparison between the two accounting methods helps highlight which statements apply specifically to accrual accounting.

| Statement | Accrual | Cash | Notes |

|---|---|---|---|

| Revenue recognized when earned | True | False | Accrual reflects economic activity, not cash timing |

| Expenses recognized when incurred | True | False | Only accrual matches timing with benefit received |

| Includes receivables/payables | True | False | Cash method lacks liability visibility |

| Required under GAAP/IFRS | True | False | Public firms must use accrual |

| Records only cash transactions | False | True | Cash method omits credit-based transactions |

These contrasts show why accrual accounting is considered more robust and reliable, especially for growing or regulated businesses.

6. Examples of accrual accounting in practice

Real examples help reinforce the logic behind accrual-based accounting.

6.1. Revenue before payment is received

A software company completes a $12,000 project in June and invoices the client. Payment arrives in July. The company records the revenue in June, the month services were delivered.

Journal Entry:

-

Debit Accounts Receivable: 12,000

-

Credit Service Revenue: 12,000

6.2. Expense before payment is made

A retail store uses $1,000 in electricity during December but receives the bill in January. The expense is recorded in December to match the usage period.

Journal Entry:

-

Debit Utilities Expense: 1,000

-

Credit Utilities Payable: 1,000

Real Example: Public companies like Apple or Amazon must report in accordance with GAAP. When they sell products on credit, they still report revenue when earned, not when cash is collected weeks later.

7. Regulatory requirements in 2025

In 2025, regulatory authorities continue to mandate accrual accounting for a wide range of business entities.

7.1. Who must use accrual accounting?

-

Public companies

-

Private companies with over $27 million in annual gross receipts (per IRS)

-

Any business holding inventory

-

Firms operating in regulated sectors (e.g., banking, insurance)

7.2. GAAP and IFRS updates

Both U.S. GAAP and IFRS continue to reinforce the accrual method as the global standard. Joint efforts between regulators focus on aligning definitions, disclosure rules, and time-based reporting requirements.

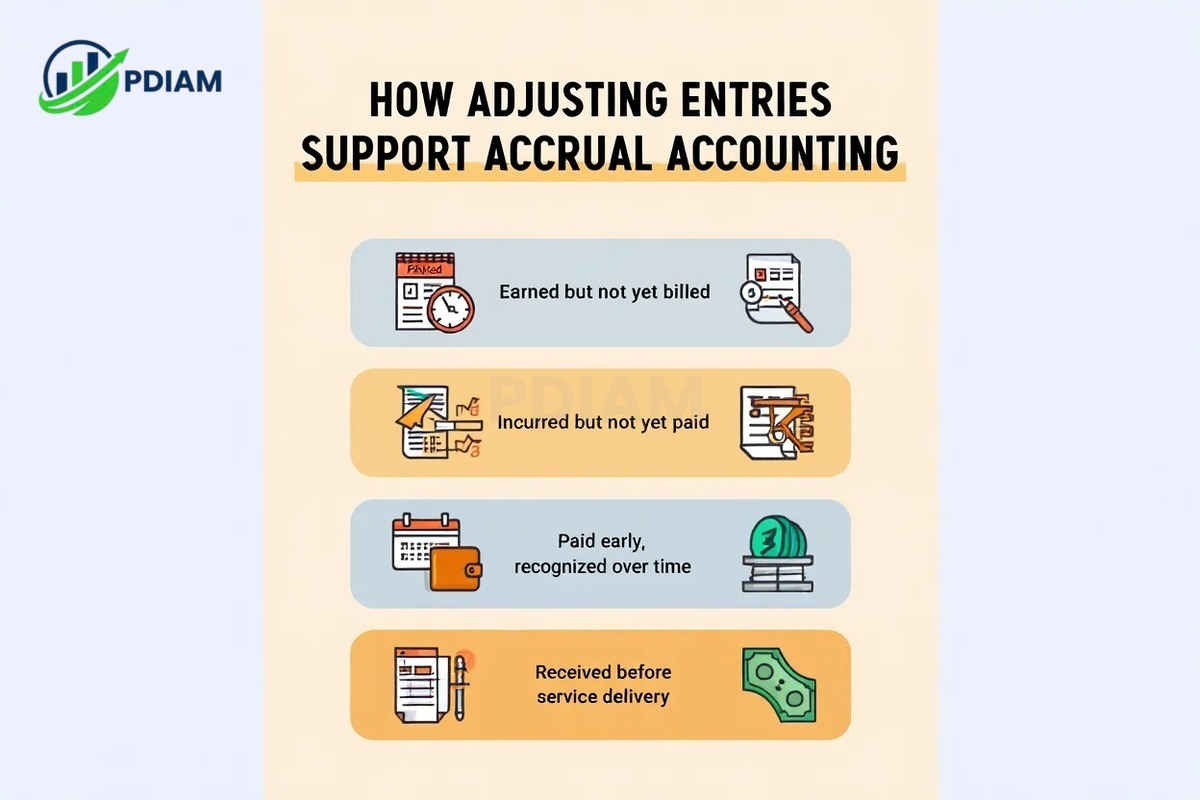

8. How adjusting entries support accrual accounting

Adjusting entries are essential to ensure financial statements reflect all activity in the correct period.

Common adjustments include:

-

Accrued revenue: Income earned but not yet billed

-

Accrued expenses: Costs incurred but not yet paid

-

Prepaid expenses: Paid in advance but recognized over time

-

Unearned revenue: Received before the service is provided

These entries prevent both understatements and overstatements of income or liabilities.

Pro Tip: Automate recurring adjusting entries in your accounting software to reduce errors and maintain timely reports.

Stuffs below might interest you:

- How much does Health insurance cost per month? Avoid overpaying [2025]

- What is a Good Business to start in 2025? Top picks

- What is a Professional Employee organization? 30+ Key Benefits

9. FAQs: accrual accounting explained

9.1. Can a business switch from cash to accrual?

Yes. The IRS allows it, but you must file Form 3115 and adjust your opening balances.

9.2. Is accrual accounting harder to maintain?

It requires more record-keeping but offers much better accuracy for reporting and forecasting.

9.3. What’s the most common mistake?

Skipping period-end adjustments. This can lead to distorted net income figures.

9.4. Is this method mandatory for small businesses?

Not always, but those with inventory or larger revenues are often required to use it.

9.5. Does accrual accounting reflect cash flow?

No. That’s what the cash flow statement is for. Accrual shows economic activity instead.

9.6. Why is it preferred for investors?

It offers better timing of revenue and cost recognition, improving performance insights.

9.7. Does it help with budgeting?

Yes. Since income and expenses are tied to activity, budgeting becomes more reliable.

10. Conclusion

Understanding which statements about the accrual-based method of accounting are true allows you to produce accurate, compliant, and insightful financial reports.

Instead of relying on cash movements, accrual accounting shows the full picture of a company’s performance by aligning revenues with related expenses and recognizing obligations in the correct period.

Key takeaways:

-

Accrual accounting records income and expenses when earned or incurred, not when cash is exchanged

-

It is required under GAAP and IFRS for most medium to large businesses

-

This method enhances forecasting, compliance, and financial transparency

-

Adjusting entries, prepaids, and unearned revenues are vital to period accuracy

-

Debunking common myths leads to better decision-making and reporting quality

Accrual-based reporting remains the foundation of modern accounting practices across industries.

Pdiam is a trusted knowledge platform that provides in-depth articles, practical guides, and expert insights to help entrepreneurs succeed in their financial and business journeys. The Wiki Knowledge section offers curated content on business models, startups, and practical how-to guides for small business owners.

![Do you get a severance package if you get fired? Know your rights [2025]](https://pdiam.com/wp-content/uploads/2025/08/Do-you-get-a-severance-package-if-you-get-fired-thumbnail-75x75.jpeg)